3 IPOs We're Watching Closely For 2024

Large-cap potential offerings from areas ranging from food to finance make our hitlist.

In a variety of bank quarterly earnings last month, most shared a cautiously optimistic view of a rebound in capital market activity for 2024. Part of this segment includes initial public offerings (IPO’s), which refers to the process of taking a company from being privately held to being listed on the stock market.

The IPO market has been very subdued for the past couple of years. Below shows the US market, but this is reflective of the broader global scene:

Why has the IPO market been so quiet?

The bulk of the problem can be put down to poor market conditions. At any stage over the past two years, there have been any number of challenging social, economic or political issues that have capped stock market gains.

Rising interest rates has been a key factor, with the rising opportunity cost of investing weighing on investors minds. The higher cost of issuing new debt for large corporates has eaten into net profits.

We’ve also had the presence of wars in Ukraine (and more recently Gaza) along with heightened tensions between the West and China.

This all matters for the IPO market because the success of an offering very much depends on how buoyant the market is and how optimistic key stakeholders are.

Why would a CEO that has spent his life building a private company risk any possibility of a flop in the market unless he/she is convinced that things will go well?

A changing tide

Granted, we doubt the floodgates of IPO’s will open in 2024. But there is the potential for interest rate volatility to be dubbed ‘the new normal’. Further, some companies that have been holding off for a while can’t hang around forever, with a needed capital injection or exit opportunity for the founders pressing.

Here are our three current favourite private companies that we’d look to get involved in should the IPO happen soon…

Klarna is a Swedish FinTech firm setup back in 2005. It’s a ‘buy now, pay later’ (BNPL) firm, partnering with companies as an ecommerce provider that allows flexibility in short term credit agreements with customers.

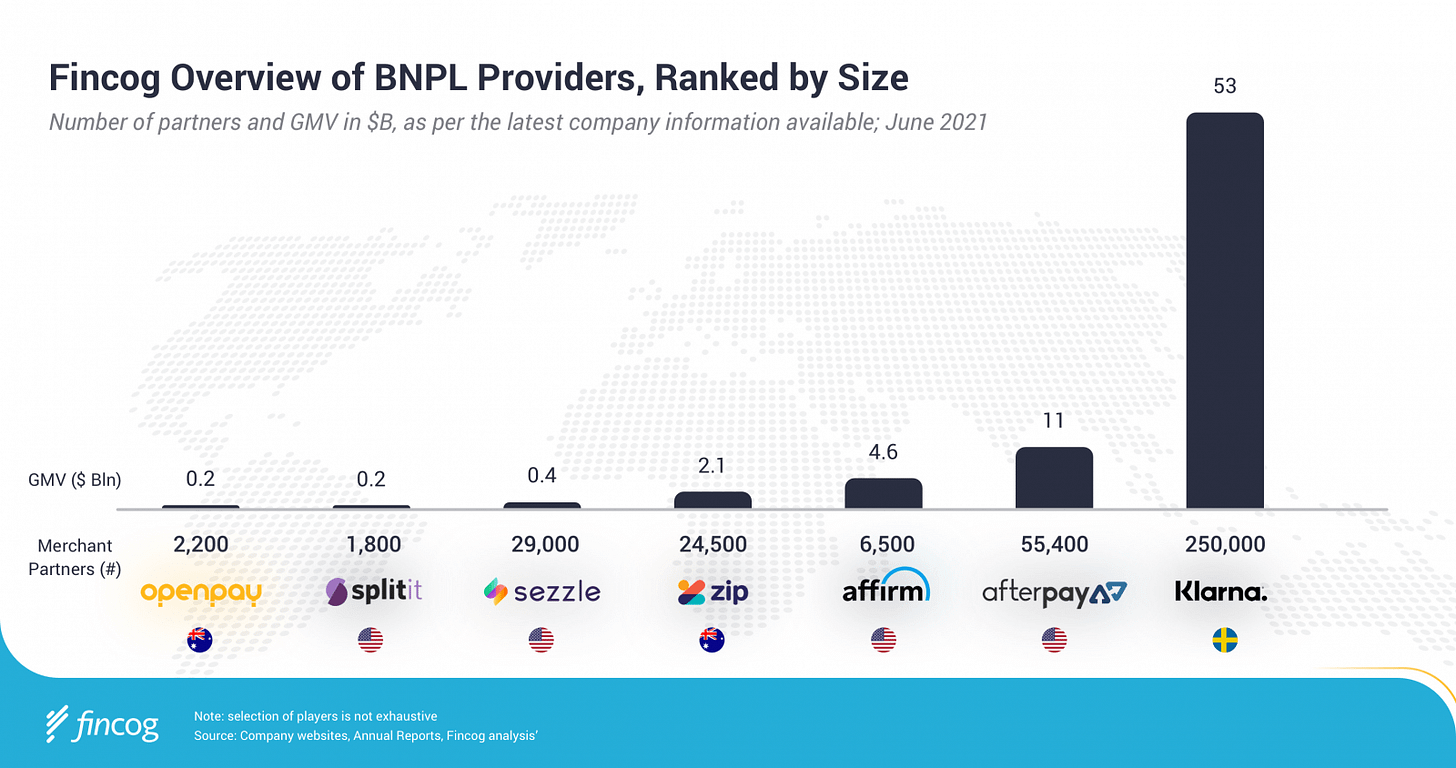

It has broadened it’s offering over time, and pushes users to it’s K App with the aim of being a more holistic financial services operator. Even so, it’s a dominant player in the BNPL space:

The firm has been chatting about going public for some time, but was hit in July of last year when it had to raise $600m with a valuation of $6.5bn. This was a large haircut from the $46.5bn valuation that it was given in 2021.

The business is profitable, with a Q3 profit of $11.9m. Yet the firm is stuck between being valued for an IPO along more traditional banking metrics, versus a more lucrative growth FinTech stock.

Whatever happens, we feel the IPO price will be on the conservative side, which is why we’re interested. The issue with how you define the stock is one reason, but the other is the current caution around BNPL firms.

For example, here in the UK (where Klarna recently setup a legal entity - for a listing on the LSE???) there is intense scrutiny over regulations in this sector. If we get a clamp down before the IPO, we feel this will dampen short-term demand for the IPO.

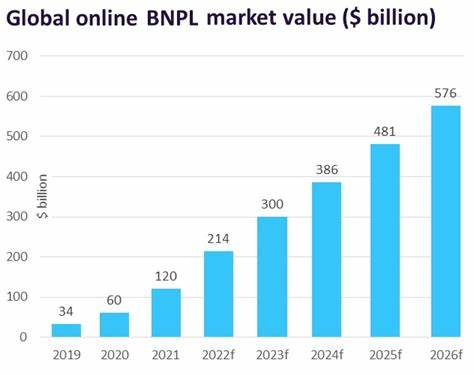

Looking to the long-term, we feel that the firm has large potential. The BNPL sector is exploding, but when you consider the size of the market that Klarna has tapped into, there’s a huge market potential for growth.

Next up we consider Impossible Foods. It was founded back in 2011, and as the name suggests, focuses on meat alternative food compounds.