5 Elections That Will Move Markets In 2024

With the largest election year on record upon us, we cut through the noise and provide the detail.

2024 is going to be a unique year for many reasons. Yet a very valid one is the fact that over 40% of the globe will have the opportunity to vote in an election.

Eight of the top ten most populous countries in the world will go to the polls. Aside from the size of the countries going to vote, there are some smaller nations that still carry a punch in terms of the wider importance of who gets elected. Below is a snapshot of the key elections that we’re watching out for:

What makes an election noteworthy for investors?

There are three main factors that we look for to assign importance (from a market perspective) to an election:

Absolute Vote Size - for countries like the United States and India, market participants will pay attention simply due to the size of the turnout involved. The elections of just those two nations will impact over a billion people. The knock-on impact on companies will be felt.

Political Ideology Shifts - another key factor is if there’s the potential for a large shift on the political scale. This is especially true in Europe, where the rise of far-right-leaning parties could win in some countries.

Indirect Influence - finally, we flag up the fact that in some cases, the winning candidate could have leanings towards either China or the West. This global power struggle will also make investors sit up and take note.

How do markets usually react?

As with any kind of generalisation like that above question, elections in the past were notoriously hard to trade around.

One point we do flag is that the markets don’t like uncertainty. Therefore, volatility around election day will be higher if the race is very tight. Once a clear winner is established, a relief rally in stocks can often be seen, unless it’s a real surprise outcome.

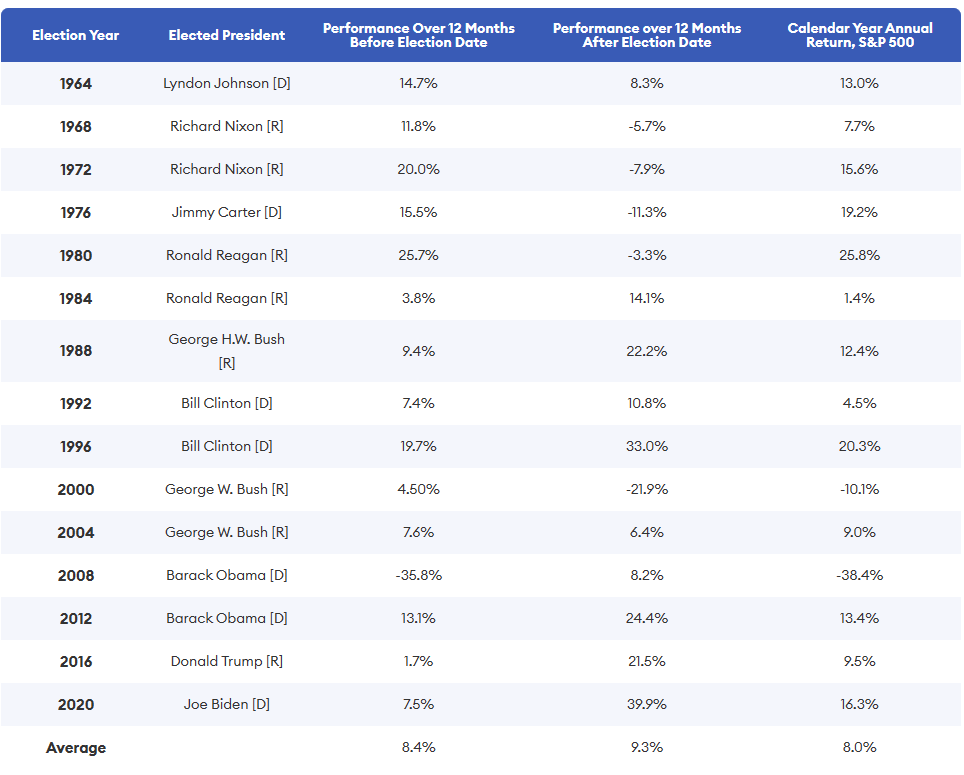

In terms of political leaning, there doesn’t really appear to be any clear favourite for the market (again, excluding extreme outliers). For example, the below chart shows the S&P 500 returns for the US elections, with no clear pattern for a Democrat or Republican victor:

For the rest of the article, we’ll run through our top 5 elections to keep an eye on, as well as sharing our favourite trade ideas (volatility spreads) for trying to profit from them.

Key Elections To Note

Taiwan - 13th January

The year kicks off fast with the Taiwan presidential race coming to a close next week. This is important because of the escalation in tensions with China, with the US looking on as well.

It looks likely that the current Democratic Progressive Party (DPP) will win a third term, which isn’t great news for China. After all, official dialogue between Taipei and Beijing stopped after the DPP took power in 2016.

Lai Ching-te would be the candidate here, who China views as dangerous. More pro-China candidates are also running, which could throw a spanner in the works for a surprise victory.

Should Lai and the DPP win and push on with the aim of independence, this could pull both the US and China directly into the picture.

As for markets, the key stock in focus would be TSMC, which accounts for 30% of global semiconductor sales and is listed in Taiwan.

South Africa - Q1 (exact date TBC)

Nelson Mandela’s African National Congress (ANC) party has held a majority in South Africa since 1994. This looks like it could change this year thanks to the rise of support for The Democratic Alliance (a more centre leaning party).

Polls show that currently no party has enough votes to secure a majority, which will likely see a messy coalition put through. This isn’t really good news for anyone, including those interested in SA related assets.