5 Iconic Finance Movie Quotes

From the likes of Rogue Trader in the late 90's to Margin Call in 2011, here are some of our favourite lines.

Finance and trading films are a niche category, but then again our subscriber base is full of investors, analysts and fund managers. For our weekend piece this week, we thought we’d share some of our favourite snippets loosely related to finance. Enjoy.

A Good Year (2006)

"You'll come to see that a man learns nothing from winning. The act of losing, however, can elicit great wisdom. Not least of which is, uh... how much more enjoyable it is to win. It's inevitable to lose now and again."

The quote here comes from Max Skinner’s (Russel Crowe) uncle, Henry. Sat around the dinner table, a young Max is reminded that more can be gained from losing than winning, and that we all do lose on occasion.

Skinner applies this in various aspects of his life, from his bond trading job in the city down to his quest to win the heart of a local French girl.

For investors and traders alike, it’s a great quote to measure up to, given that any trading strategy won’t yield a 100% win rate. Taking losses is par for the course, but learning how to deal with losses is what can separate good traders from the great.

Wall Street 2 (2010)

“Good day - I’m okay, bad day - I’m okay. What’s the difference?”

Louis Zabel moans the above line to a junior prop trader (played by Shia LaBeouf) in the follow up film from the original Wall Street classic.

It comes at a bad time, with CEO Zabel struggling to keep his investment bank afloat. As the bank stock loses value, bad days increase, with a consortium setup to rescue the bank.

We like the point that comes through here in the quote that controlling your emotions through good times and bad is incredible powerful, especially as an investor. If you can maintain the same attitude (what’s the difference? ) when you have a profitable or a losing day, you’re halfway to success already.

Margin Call (2011)

“There are three ways to make a living in this business: be first, be smarter, or cheat.”

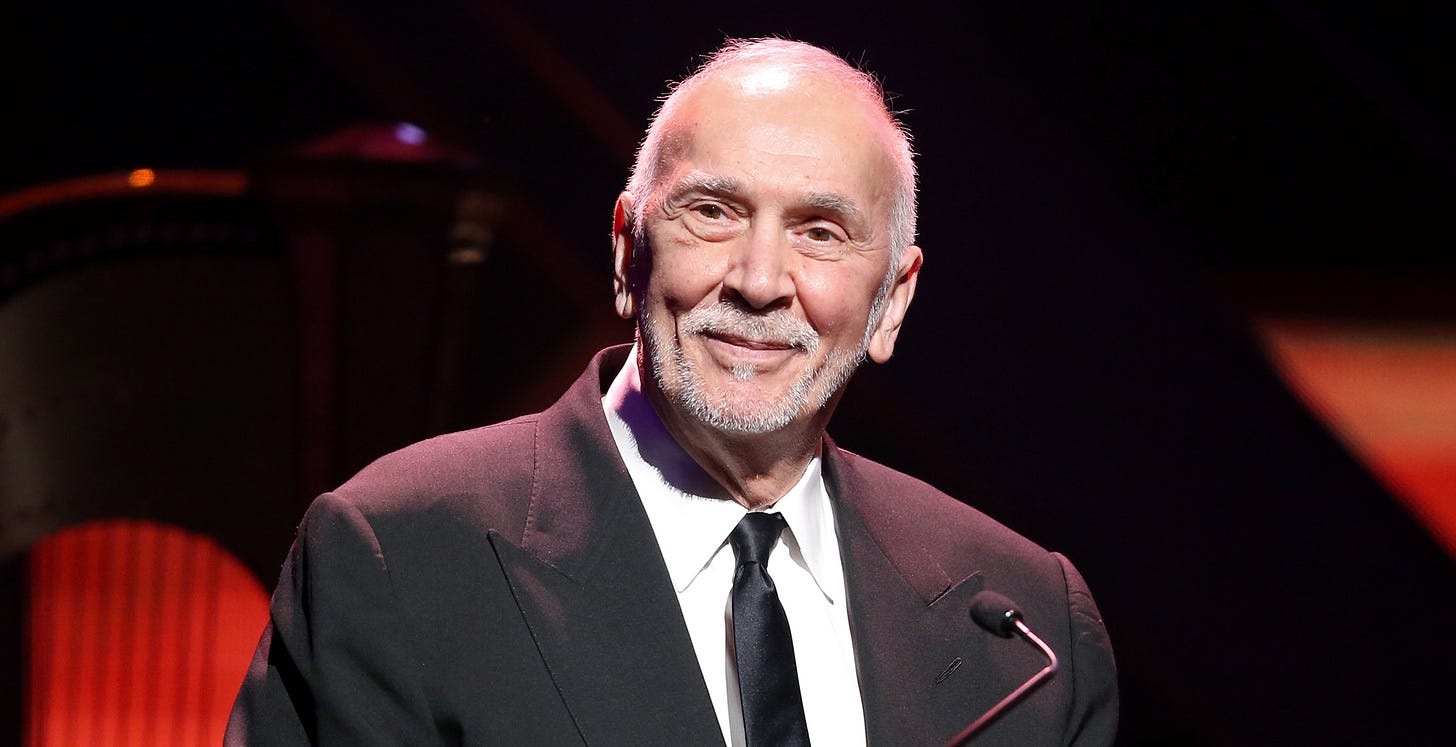

Jeremy Irons is pretty iconic in whatever role he assumes, but his epic boardroom speech as John Tuld is one well worth watching.

Faced with a mountain of MBS which he fears will be worthless in a matter of days, he utters the above line to the rest of the room.

He follows it up be saying that he doesn’t cheat, and although he has some pretty smart people in the room, it’s sure easier just to be first (i.e sell it all ASAP).

When it comes to generating returns from the markets, it is a case of being first or being smarter. Smart is great, but spotting an opportunity and being the first in often can yield the greatest results.

Good Will Hunting (1998)

Clark: There's no problem. I was just hoping you could give me some insight into the evolution of the market economy in the southern colonies. My contention is that prior to the Revolutionary War, the economic modalities—especially in the southern colonies—could most aptly be characterized as agrarian pre-capital—

Will: [interrupting] Of course that's your contention. You're a first year grad student. You just got finished reading some Marxian historian, Pete Garrison probably, you’re gonna be convinced of that until next month when you get to James Lemon, then you’re gonna be talking about how the economies of Virginia and Pennsylvania were entrepreneurial and capitalist way back in 1740. That's gonna last until next year, you’re gonna be in here regurgitating Gordon Wood, talkin’ about, you know, the Pre-revolutionary utopia and the capital-forming effects of military mobilization.

Good Will Hunting isn’t a finance movie by any stretch, but we love the interaction between Will (Matt Damon) and a random Uni student at the bar. Clark tries to impress the girls by calling out Will and his friends for a lack of education in economics.

Little does he know that Will is one of the smartest guys period, who proceeds to give Clark a taste of his own medicine with some US economic history.

The bottom line here is that it’s good to be the smartest guy in the room, but using such information simply to impress others is a quick recipe for disaster.

Rogue Trader (1999)

McGregor: "All right, um -- it's like if I agree to sell you this cup of cappuccino, which I don't yet own, at 45 cents a month from now, if I can buy the cappuccino at say, 43 cents, I make a profit. If the price goes the other way, I have to pay more and I lose. It's timing, it's buying and selling at the right moment. Sometimes expresso might be the best deal, or salt or pepper."

Seow: "So, we're running a supermarket, huh?"

A very fresh faced Ewan McGregor appears in Rogue Trader, depicting the true story of Nick Leeson at Barings Bank.

It’s far from a glamorous portrayal of being a trader, yet quite rightly so given the illegal actions he took as a result of his own bad decision making.

Yet before things really take a spiral lower, Nick is a great trader and goes to expand the desk in Asia. With one of his new recruits (Seow), he tries to explain the process of shorting an asset.

In fairness, it’s a good explanation, but for some people understanding financial concepts simply isn’t their thing.

The bottom line; if you can’t explain something complicated in a simple way, you don’t understand it well enough.

"Show me the MONEY" Jerry Maguire 1996 :-)

A good year is in my top 10 fav movies period