Eight Key Takeaways From A Big Week

Everything from the US to China, Germany to the UK.

It has been a big week in markets and one that will be spoken about for a long time. We appreciate that there’s a plethora of great quality commentary on the wires at the moment, so we don’t want to go over common ground.

Rather, to finish the working week, we wanted to provide our favourite takeaways and soundbites from the U.S. election, FOMC meeting and everything else in between as an easy-to-digest Friday summary.

Enjoy.

S&P 500 Top Gainers Is Telling

In trading on Wednesday, Discover Financial Services was the top performer, with the share price gaining 20.2%. Not far behind was Capital One, up 15%.

What’s interesting to note here is that this can mostly explained by the Trump victory. At the moment, Capital One is looking to take over Discover in a deal worth $35bn that would see the combined force be the largest credit-card issuer in the country.

It’s being held up, needing Governmental approval. With Trump now in power, it’s seen as a likely done deal, given his stance on getting America moving and pushing ahead with his pro-business agenda. The jump in the respective share prices reflects the optimism by investors that this deal can now be finished, fuelling the day’s gain.

Banks and other financial institutions were among the top performers, with Goldman Sachs up over 10%. This relates to the inflationary potential in the economy following a Trump victory and how this could lead to higher yields and, therefore, higher net interest income for the banking giants.

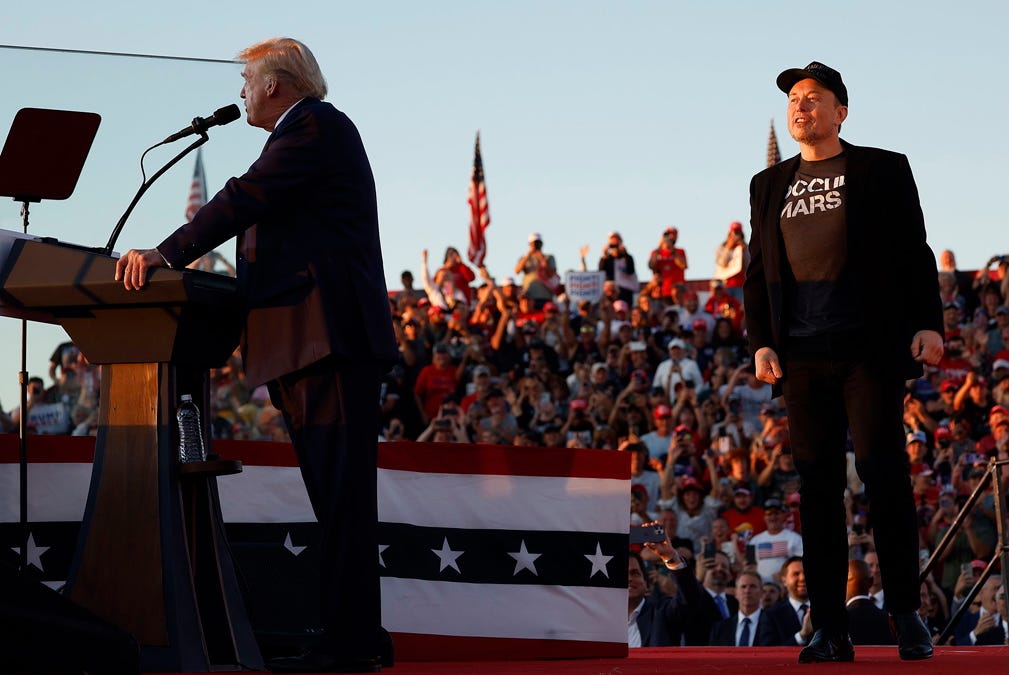

Musk & Tesla

Tesla shares are up 17.7% over the past week, spiking particularly with the confirmation of Trump taking power. Trump and Musk have come together in recent months, fuelling an interesting relationship, to say the least!

Yet now that Musk has a direct line through to the White House, we feel Tesla shares could be off to the races. Trump’s victory should benefit Tesla’s stock by prioritising U.S.-based manufacturing, with Tesla having such facilities already. On the flip side, Trump’s approach to foreign competitors in the EV space should act as a favourable tailwind for Tesla, making them more price competitive in the domestic market.

Let’s also not forget the favourable tax policies and deregulation that Trump wants to bring in. This aligns well with Musk’s goals of expanding Tesla's domestic production and reducing regulatory hurdles.

Also, we don’t feel it’s inappropriate to mention that Musk will probably get some form of special treatment, given his support for Trump in recent months.

Of course, there’s the risk that Tesla shares turn into a proxy for playing the overall state of Trump’s presidency. But for the moment, we feel it’s got room to run.

Watch Out For USD/CNY

Tariffs are coming. In fact, Trump likely gets going on this shortly after taking office, unlike the delay from the first term.

We expect him to start by imposing 60% tariffs on some Chinese products with exemptions but threaten more. His targeted tariffs on selective products or industries will be used as a key negotiation tool, but we fully anticipate him pulling the trigger on this.

We see this having a material medium term impact on CNY. In a report we’ve seen from MUFG, a 60% tariff “would require a 10%-12% depreciation of CNY to offset the negative impact of tariffs, keeping everything else unchanged. A potential less strong Dollar from now till the end of 2025 compared with 2018-2019 trade war time, makes the required 10%-12% CNY depreciation much more significant than what it appears.”

This, in turn, leads us to our next takeaway…