A Break Of The Balance

Low volatility today does not mean low volatility tomorrow.

A quiet month… so far.

Earnings rundown.

What the smart money is doing.

Our bull and bear case.

Before we get started, we value all of our readers and have appreciated the support so far this year. The growth since we moved over to Substack has been unexpected. If you are a new reader, we are sure you will enjoy our work as others do, so please sign up below to be the first to read our content. We publish a weekly plan on Monday, deep-dives into equities and FX on Wednesdays and Fridays, as well as some light but interesting reads on Sundays.

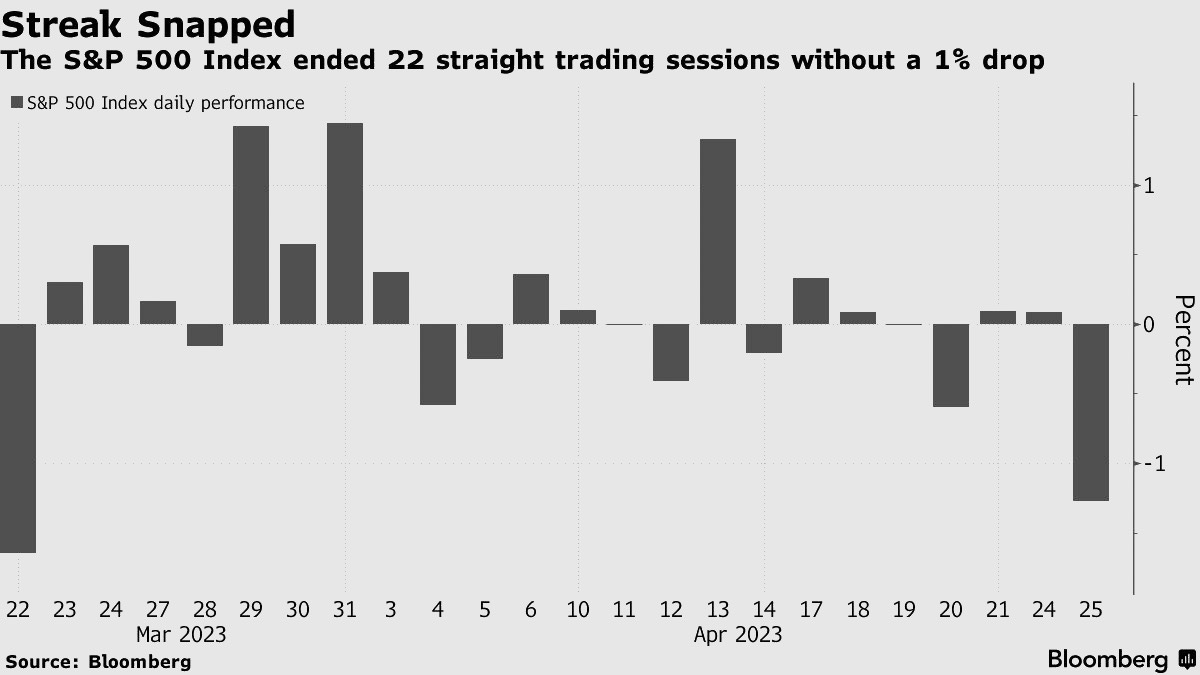

April has proved to be a tame month for both the S&P 500 and the NASDAQ 100. S&P futures have traded in a range of about 100 points, between 4100 and 4200. NASDAQ futures have been in a relatively similar range of roughly 400 points, excluding yesterday's sell-off.

In fact, yesterday was the first time in 22 trading sessions that the S&P 500 made a loss of more than 1%.

This decline, likely not coincidently, came as a major week of earnings kicked off, especially for tech names.

A quick rundown of earnings

To start the week on Monday, two bank names reported. Two names that have both been in the spotlight over the last two months.

Credit Suisse lost more than $2 billion from its businesses in the first quarter, and customers withdrew around $75 billion in deposits.

First Republic also reported earnings after close on Monday. The stock fell sharply on Tuesday in the wake of depositors withdrawing more than $100 billion during last month's crisis. The share price hit a $7.92 low, down from a $222 high in November 2021 and $122 at the start of March.

Microsoft was the headline Tuesday night. The stock is up a hefty 7.5% after a 9.45% EPS and a 3.6% revenue beat.

After close today, Mark Zuckerberg and Meta step under the spotlight.

Amazon and Snap are due for Thursday after-hours reporting, with a major oil name, Exxon Mobil, closing the week out on Friday before the US market opens.

Will earnings break a careful balance?

Low volume and volatility has been noticed by many. The Volatility Index (VIX) saw 52-week lows last week as it traded down to 16.17.

Swing traders and day traders have been impacted. Less movement in the markets offers less opportunity.

But this earnings week could finally bring some volatility back. The VIX had a nice push upwards yesterday as the markets took a step back, narrowly missing a 20 break.

“The sugar high from the Covid stimulus has ended. Now companies are having to contend with a more challenging economic environment following a big batch of Fed rate hikes,” Kelly Bogdanova, vice president and portfolio analyst at RBC Wealth Management, said in an interview. “From our perspective, we’re staring an earnings recession in the face.”

Another fact that may not be on the side of the bulls is quants.

“Out of ammo”

That’s the warning from Goldman Sachs Group Inc.’s Scott Rubner, whose data show systematic money managers have loaded up on more than $170 billion worth of global shares in the past month, driving the funds’ exposure to the highest level since early 2022.

The group is more likely to be sellers in the upcoming weeks, given their posture, which is close to a peak right now, according to the market veteran who has monitored fund movement for two decades.

If the market declines in the coming month, quant funds would be compelled to unwind as much as $276 billion of shares, according to Goldman's model.

However, if a significant rally occurs during the same time period, they would only need to buy up to $25 billion due to their increased exposure.

Big systemic traders are only one force in the market, albeit a large one. Tracking and predicting their impact on supply and demand dynamics is fertile ground for Wall Street analysis but is, by its nature, an imprecise science.

Our bull and bear case for the S&P 500

We are paying close attention to some key levels, and they might be playing out very soon…