A Cape Of Good Hope

Markets cheer South African stocks as new coalition forms.

Emerging markets have offered many opportunities in recent months. Javier Milei’s election to President in November saw an economic turnaround in Argentina, driving its stock index (MERVAL) up 150% since. With the India elections done and dusted, the Sensex is back at ATHs and driving higher. Now, we have South African markets rallying, along with the SA Rand.

Political driving force

Investors cheered an agreement between rival political parties to back the reelection of Cyril Ramaphosa as president. This agreement paves the way for a broad government coalition led by the African National Congress and the business-friendly Democratic Alliance. This marks the first election in which the ANC lost its outright majority since 1994.

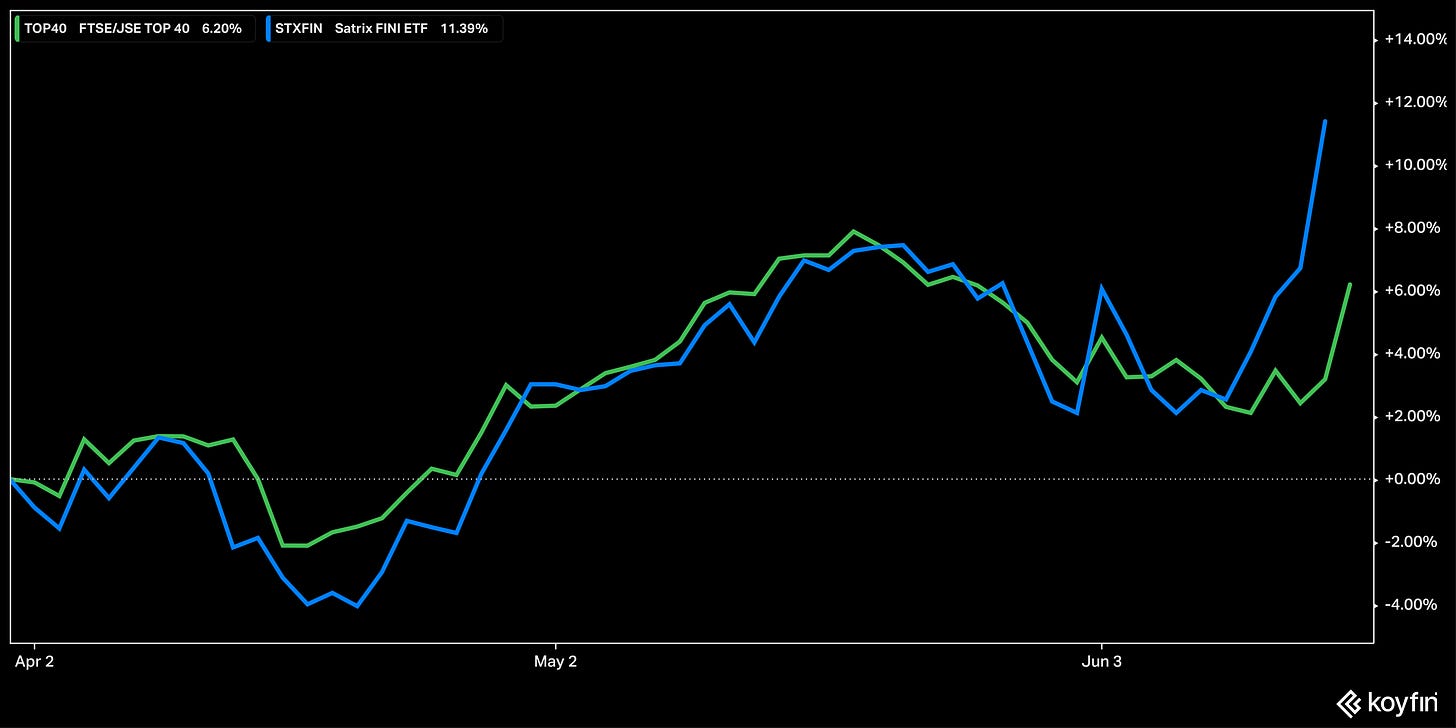

This new coalition is positive for markets and the local currency, as seen by the initial reaction to the news. The South Africa Top 40 Index is up 3.3% this week, while the Satrix Fini Portfolio (a South Africa financial sector ETF) is up over 6%.

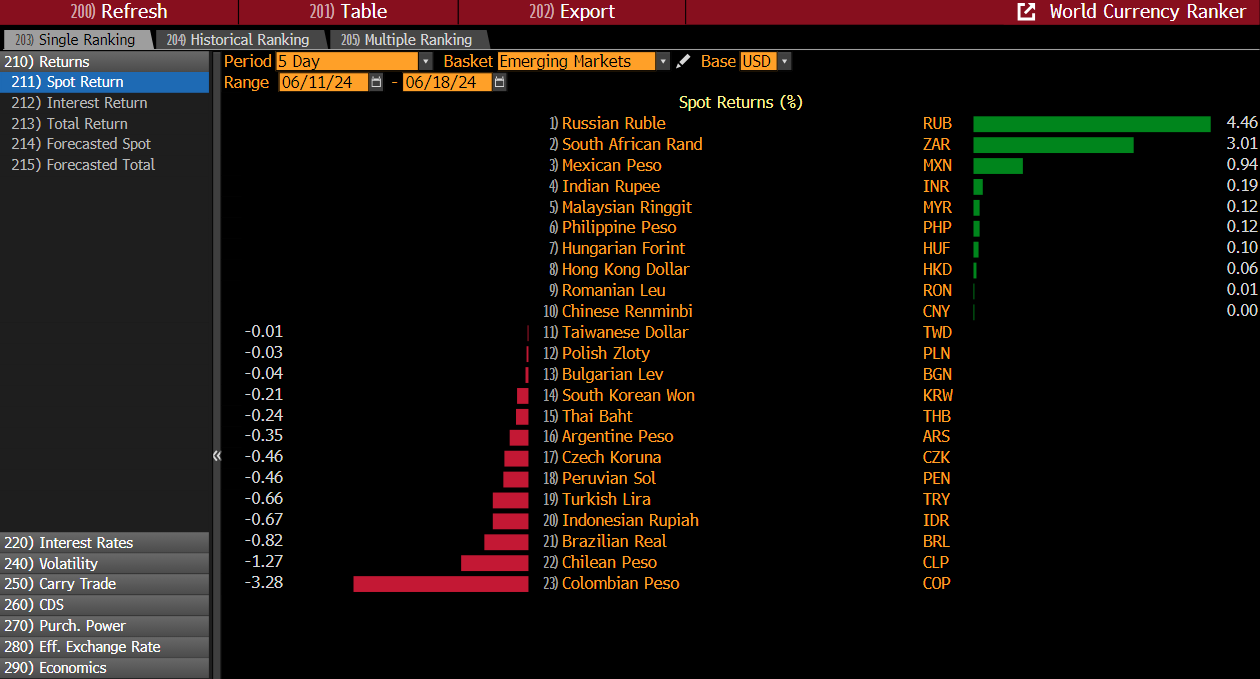

The South African Rand has strengthened and looks set to break out of range against multiple pairings. The Rand gained 1.3% this week to 18.077 per dollar as of the time of writing,

Among emerging-market currencies, the Rand is the second best performer over the last week, behind only the Russian Ruble.

The country’s so-called Government of National Unity (GNU) has boosted confidence by promising to accelerate reform efforts. These measures include controlling state debt and addressing power shortages and logistical challenges that have been hindering Africa’s largest economy for too long. Investor sentiment was reinforced by the exclusion of parties that advocate for land expropriation and the nationalisation of mines and banks.

The best bet

“This is the best-case scenario for South African politics — the DA’s active participation in a GNU — and South African stocks should rally further,” JPMorgan wrote in a note on Tuesday. They raised the country to overweight from underweight in their asset allocation for Central and Eastern Europe, Middle East and Africa. South Africa is becoming the best bet in EMs.

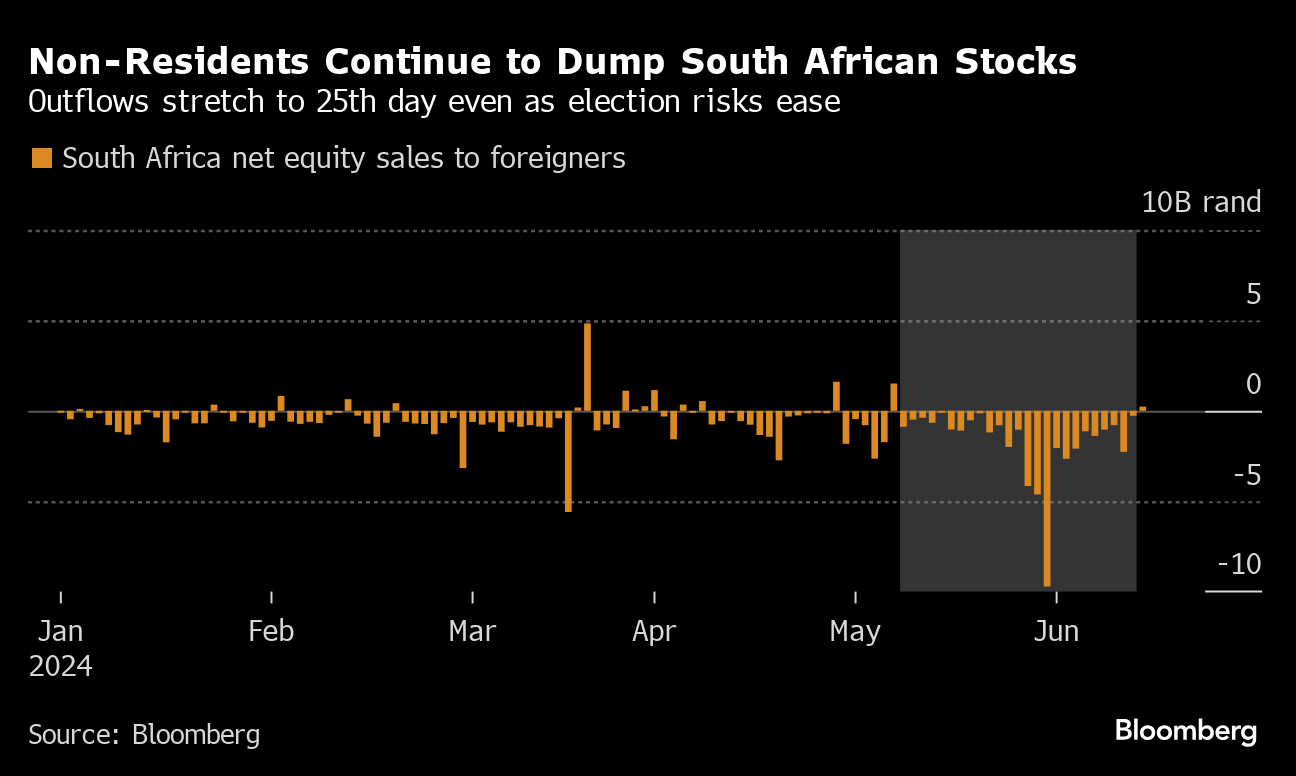

Given the prolonged period of foreign capital leaving South Africa and the significant decrease in domestic institutional investors’ holdings of local stocks, markets are likely to see substantial inflows into equities in the near future.

Combine that with non-resident outflows, who sold a net 42.6 billion rand ($2.3 billion) of Johannesburg stocks in the 25-day period before the election, bringing outflows this year to $4.7 billion.

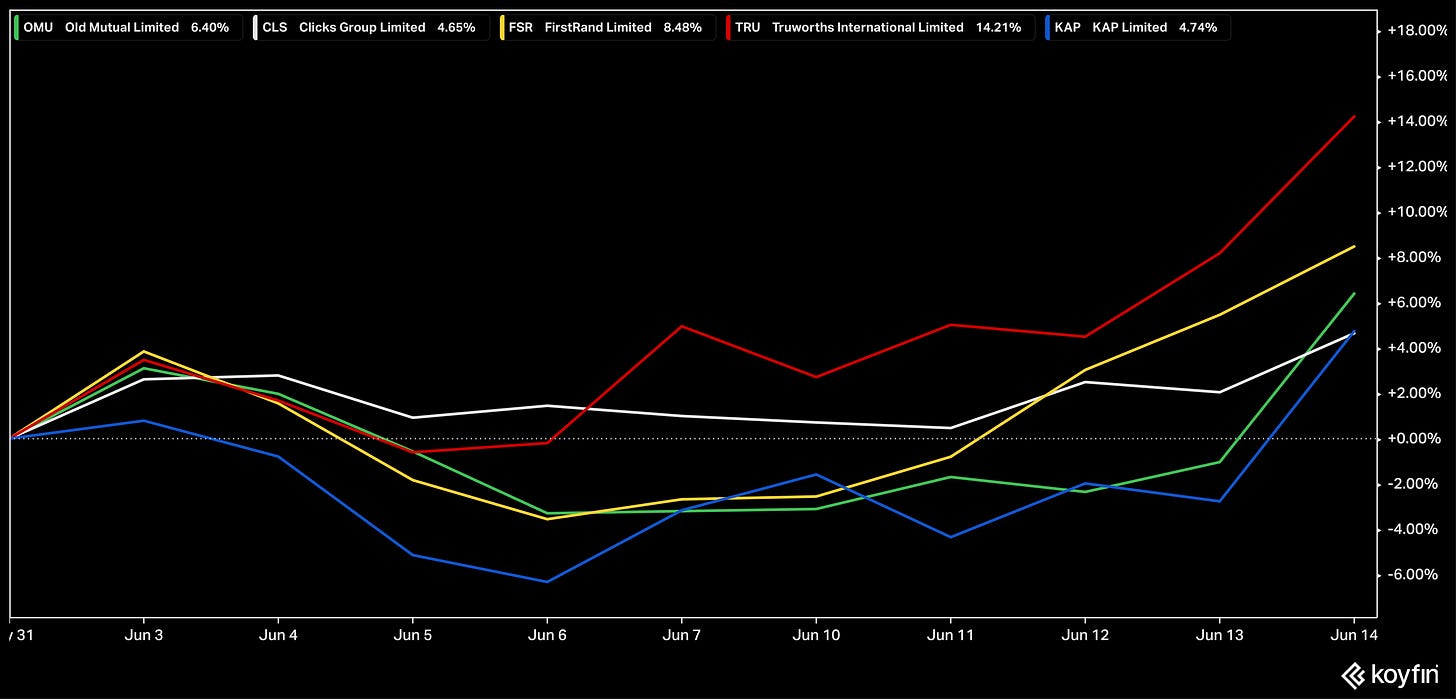

Insurers, banks and retailers look set to outperform (more on some specific trades later). Some of the best performers this week were Old Mutual, Clicks Group, FirstRand, Truworths and KAP.