A Copper Super-Cycle

The world's next key commodity?

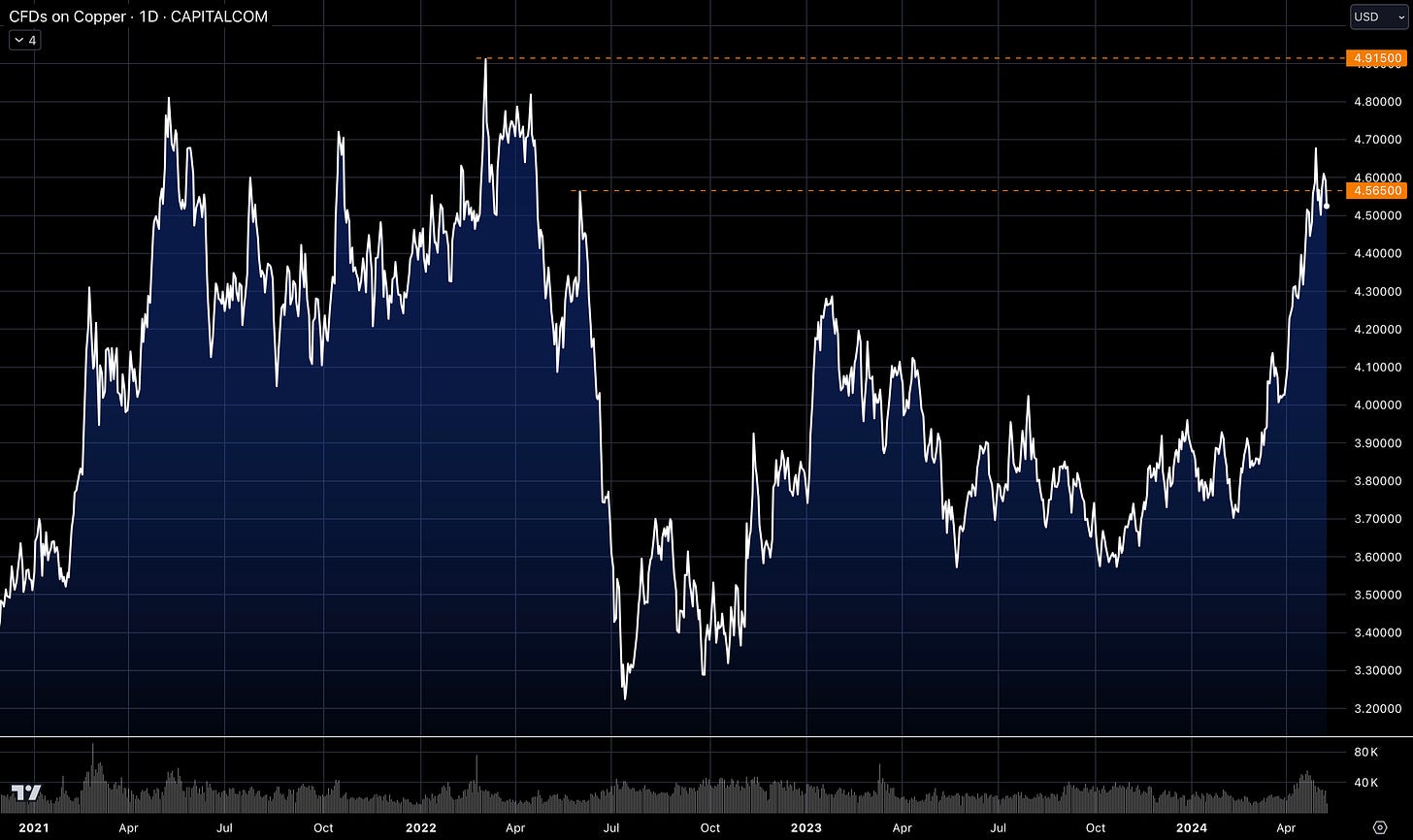

Copper prices briefly surged past the $10,000 per tonne mark as investors raised bets on Federal Reserve rate cuts. The rally in metals was part of a broader surge in risk assets triggered by the soft US jobs data.

The potential for the Federal Reserve to further ease rates is a key factor supporting the upward trend in copper prices. Industry experts are predicting further gains. The world’s copper mines are grappling with significant challenges in meeting the growing demand, which is adding to the supply stress. In light of these factors, Goldman Sachs recently revised its year-end price target to $12,000 per tonne from $10,000 earlier.

Although copper has been on a recent rally, this may be the start of a much bigger move.

A bright future

Investors looking to potentially make a return from copper do so for a number of reasons. For example, a key attraction of investing in companies concerned with the mining or production of copper is the metal’s importance in a range of industrial processes. Copper’s malleability, conductivity and ductility mean it is used by many industries, ranging from automotive manufacturing to consumer electricals to construction.

There is structural long-term demand for copper as a key component in electric vehicles and renewable energy infrastructure including hydroelectricity, wind turbines and solar panels. The increasing adoption of clean energy technologies and advancements in electrical infrastructure are expected to drive a substantial surge in demand over the next few decades.

Interestingly, it’s estimated that renewable energy systems use more than five times more copper than traditional energy plants, and considerably more copper is used in electric vehicles than in conventional petrol or diesel cars.

The following chart provides a comparative analysis of the increased demand for copper (as well as other essential metals) in an electric vehicle in contrast to a gasoline or diesel-powered car:

Based on current projections, the demand for copper is expected to rise from 25 million metric tons (MMt) to a record high of 50 MMt by 2035. Given that copper is a finite resource, this increase in demand could potentially create a shortage in the future.

Increase in demand. Decrease in supply.

The mid-term

The transition to clean energy will be a big tailwind for copper in the long term. However, the ongoing weakness in worldwide manufacturing output and the slowdown of the global economy could lead to a decrease in demand in the upcoming years.

China’s position as the largest consumer of copper in the world has been impacted by the slowdown in its property market over the past year. The main downside risk to copper demand in the country remains the continued slowdown in the sector. However, the rising number of completions (which are the primary source of copper consumption) despite a more than 20% drop in housing starts last year could provide additional support for copper prices in the future.

The property sector is expected to remain a prolonged drag on growth, and the revival of the struggling property sector in China will be crucial in driving copper's next move higher.

Despite this, copper prices are predicted to stay between $8,600 and $9,100 for the next two years.

Thereafter, it forecasts that demand is likely to exceed supply, which could potentially have a positive impact on prices and, thus, on the value of the shares of companies involved in the sector.