A Currency Struggle in a Tariff Storm

An evolving landscape for Switzerland's economy amid recent pressures.

In the grand theatre of international trade, Switzerland has found itself thrust into the spotlight, but not in the way it would have hoped. While the country has long prided itself on its neutrality and strategic independence, recent events (chiefly the US’s bombshell 39% tariff on Swiss exports) are shaking that foundation. Switzerland, the small but wealthy nation nestled in the heart of Europe, is now facing a stark reality: the elephants are dancing, and the mouse is getting trampled.

The national debate that has emerged is no longer just about trade agreements or currency intervention, but about Switzerland’s place in a world where economic and geopolitical giants set the rules, and the small players must either adapt or risk being sidelined.

SNB’s Dilemma

USD/CHF surged in the immediate aftermath of the tariff announcement, but don’t count on this momentum to last. The Swissie is likely to regain its footing in the medium term, particularly if global tariff tensions escalate, prompting a broader risk-off environment. However, if the Swiss are left with unfavourable tariffs while others secure better deals, the franc might not appreciate as a safe haven, since its appeal would be undermined by Switzerland’s weaker position in global trade.

The SNB has limited tools at its disposal to curb this shift. Historically, the SNB has relied on currency interventions to mitigate excessive CHF appreciation, particularly when the currency threatens to disrupt the Swiss export-driven economy. However, its options are now much more constrained. The political dynamics at play (primarily the need to avoid irritating the US government further) make intervention a politically fraught move. With Trump’s economic approach becoming increasingly unpredictable, the SNB will be hesitant to cross a line that could damage already strained relations. More than ever, the SNB’s actions will be dictated by a fine balance between managing currency stability and safeguarding political ties.

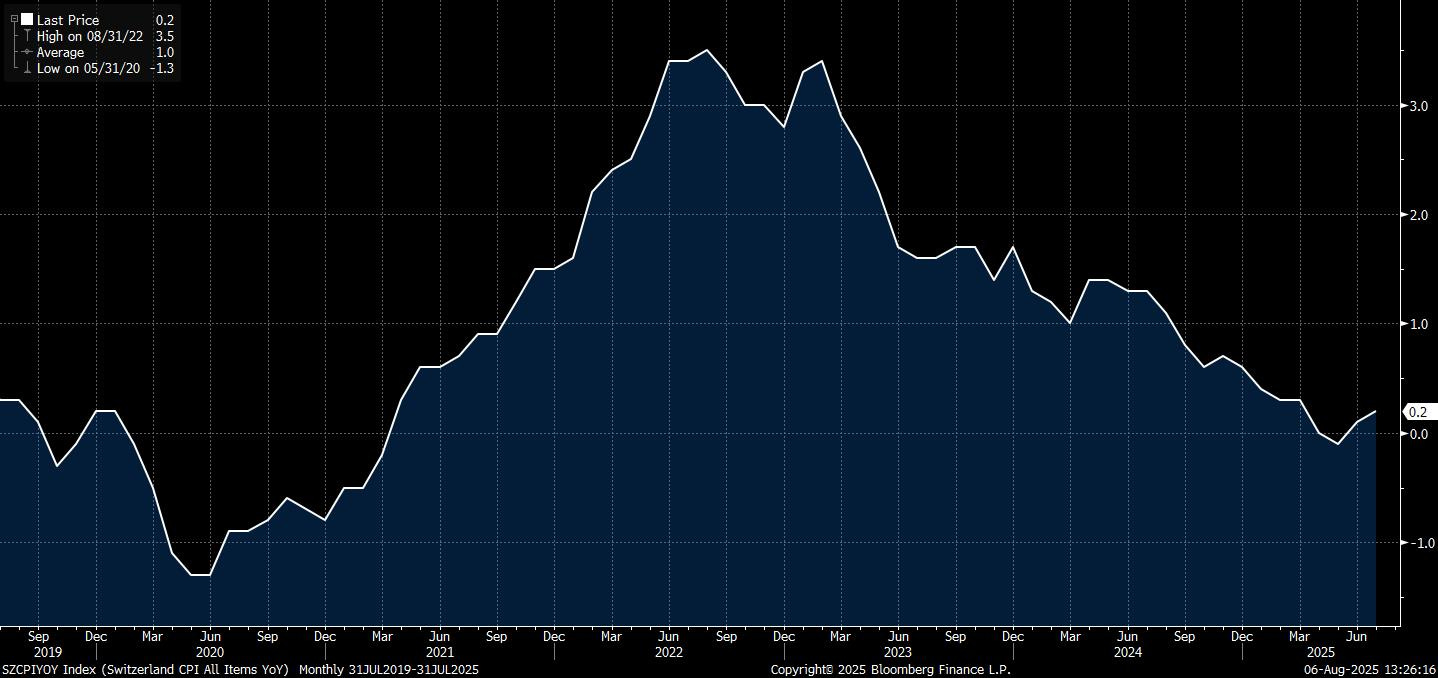

Rate cuts also remain on the table, but any move further into negative territory is unlikely to have a long-lasting effect on the franc’s trajectory. The latest inflation data shows a healthy uptick in prices, meaning there’s little room for the SNB to justify a sustained policy of negative rates. The medium-term trend will largely depend on the direction the franc takes as tariff impacts play out, and whether those impacts spill over into broader economic performance.

To access all of our research, manage your account here.

A 1% Blow to the Swiss Economy

The 39% reciprocal tariff rate imposed by the US on Swiss goods represents a tariff shock of unprecedented proportions. In comparison, the previous 10% rate was a nuisance, and even the 31% rate first threatened in April seemed manageable. But now, the Swiss economy faces a jarring shock threatening to wipe out around 1% of Swiss GDP in the medium term.

It gets worse. The Swiss economy is highly exposed to pharmaceutical exports, and the potential for a 25% tariff on drugs introduces a new layer of downside risk. We estimate that the pharma sector alone could push the total tariff shock beyond 32 percentage points, which would exacerbate the economic blow, forcing the SNB to consider a rate cut deeper into negative territory by year’s end.

Some Swiss industries, particularly aircraft manufacturing and high-precision medical devices, are highly vulnerable to these tariffs. Coffee, optical instruments, and watchmaking, once cornerstones of the Swiss export market, are also feeling the sting. The impact of this tariff on Swiss businesses is already being reflected in the equity market. Major sectors, including industrials and luxury goods, saw significant sell-offs after the tariff announcement.

A New Look at Neutrality

The tariff crisis has put Switzerland’s delicate balancing act with the EU into sharp focus. For years, Switzerland has maintained a fine line of neutrality, opting out of full EU membership but still remaining closely tied through various agreements and trade deals. But now, with the US imposing tariffs that are damaging to key sectors, the Swiss government faces a growing argument from pro-EU voices who are advocating for closer integration with the EU.