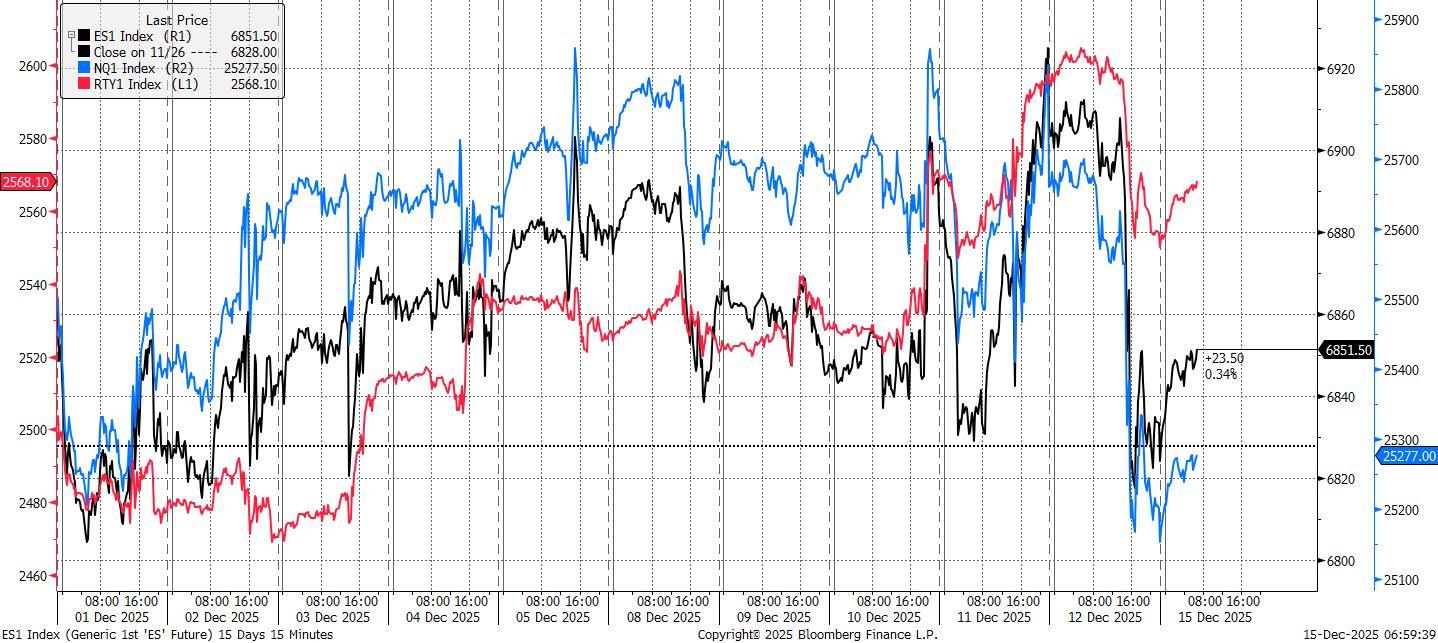

US equities finished the week near their lowest levels since November, as disappointment over late-cycle tech earnings outweighed optimism over another Federal Reserve rate cut. A post-FOMC rally in futures following Wednesday’s third consecutive reduction quickly faded during Asian trading as investors digested Oracle’s results, before Broadcom added further pressure in the cash session on Friday. By the end of the week, the S&P 500 had fallen 1.1% on Friday alone, with the selloff concentrated in megacap and AI-linked names.

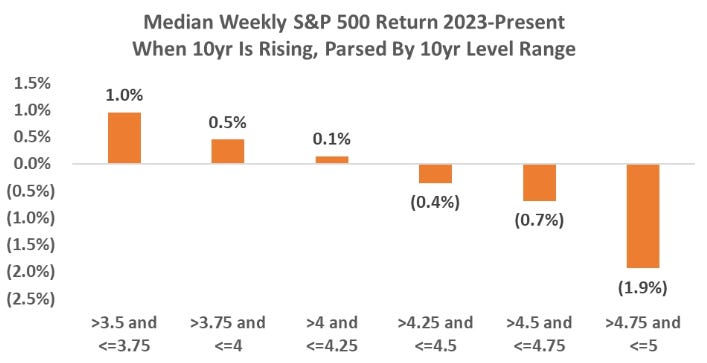

Into year-end, investor focus is shifting decisively toward the shape of the rates curve. The US 10-year yield is now within roughly 6bp of the 4.25% level, which Piper Sandler’s Michael Kantrowitz flags as a potential inflexion point for equity returns.

The Warner Bros. saga escalated sharply. After agreeing last week to sell its studios, streaming and HBO businesses to Netflix in a $72bn equity deal, Warner now faces a hostile counterbid from Paramount Skydance valuing the company at $108.4bn, including debt. Jared Kushner’s Affinity Partners is participating in the Paramount bid, alongside backing from several Middle Eastern funds. There ain’t no business like show business.

Oracle shares plunged 11% after the company escalated AI-related capex far beyond expectations, with spending now projected to reach $50bn by fiscal 2026, $15bn higher than its September guidance. Investors baulked at the widening gap between infrastructure build-out and cloud revenue realisation, reigniting concerns around capital intensity and returns in the AI ecosystem.

Broadcom followed with its own disappointment. Despite flagging a $73bn AI backlog to be delivered over six quarters, the outlook failed to clear the bar set by investors. Shares dropped 11% as markets reassessed whether order visibility alone is sufficient without clearer acceleration in revenue realisation.

Policymakers also announced monthly purchases of $40bn in Treasury bills starting Dec. 12, citing the need to maintain ample reserves. Chicago Fed President Goolsbee and Kansas City Fed President Schmid confirmed their dissents to cutting rates. Goolsbee cited the data vacuum caused by the shutdown, while reiterating optimism on cuts next year. Schmid maintained that inflation remains too elevated to justify further easing. OIS pricing now reflects just 5bp of cuts for January, with a full 25bp move not priced until June 2026. Markets remain highly sensitive to the forthcoming Fed chair announcement, which could rapidly reprice the curve.

The USD ended the week near its lows, retracing back toward September levels as Fed policy divergence came back into focus. One-month risk reversals flipped bearish for the first time since early October, with seasonality reinforcing downside pressure. EUR/USD is now firmly above 1.17, and Morgan Stanley sees scope toward 1.30 by mid-2026 should the ECB hold steady while the Fed continues easing.

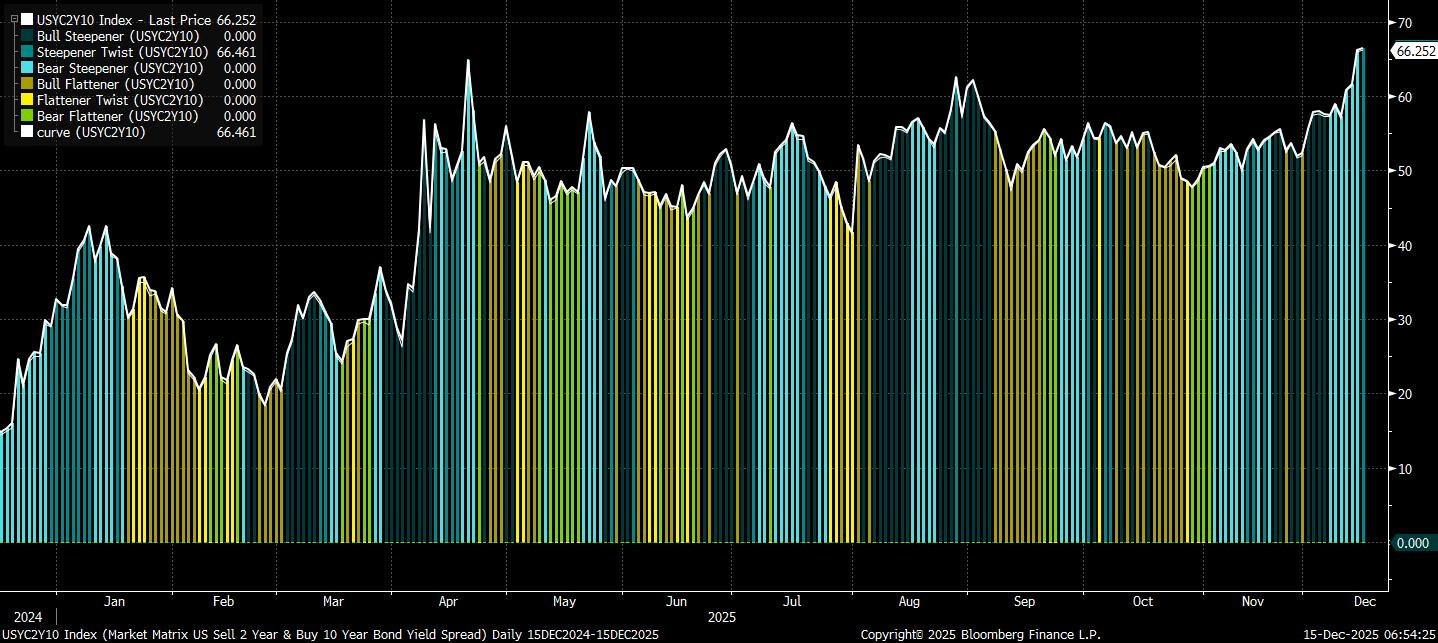

Rate markets were dominated by front-end dynamics. While 10-year yields rose a modest 5bp on the week, the short end absorbed the impact of the rate cut and the announcement of bill purchases. The SOFR–fed funds basis trade saw record volume as traders positioned for reserve stabilisation and marginally lower repo rates. Further out the curve, auctions were absorbed smoothly, though liquidation in 10-year futures continued, with open interest falling in nine of the last ten sessions.

The Week Ahead

Let’s start with our thoughts on the AI-led selloff on Friday, what it means for the wider complex, and which areas we think offer opportunities.