A Real Jay Or A June Mockingbird? (US Fed Preview)

We feel a pause in rates will be seen, but discuss why a 27.6% probability of a hike is on the table.

Market pricing shows that some are factoring in the strong NFP print and actions of other central banks (eg. Bank of Canada).

However, broad consensus remains for a pause this month and a hike in July, which we agree with.

We present trade ideas for both sides of the argument.

Next Wednesday at 2pm EST we get the latest US Fed announcement, with the interest rate news ahead of the usual press conference with Chair Jay Powell.

Last month, despite another 25bps rate hike (the 10th monthly move higher in a row), the language around pausing was more pronounced. Although not explicitly mentioned, certain hawkish parts of the text were removed, with Powell commenting that:

“If you add up all the tightening that’s going on through various channels, we feel like we’re getting close or are maybe even there” - Jay Powell (May FOMC)

Yet with the events and data points since then, could we have an tail risk of a Mockingbird and a surprise 25bps hike instead?

Where we stand right now

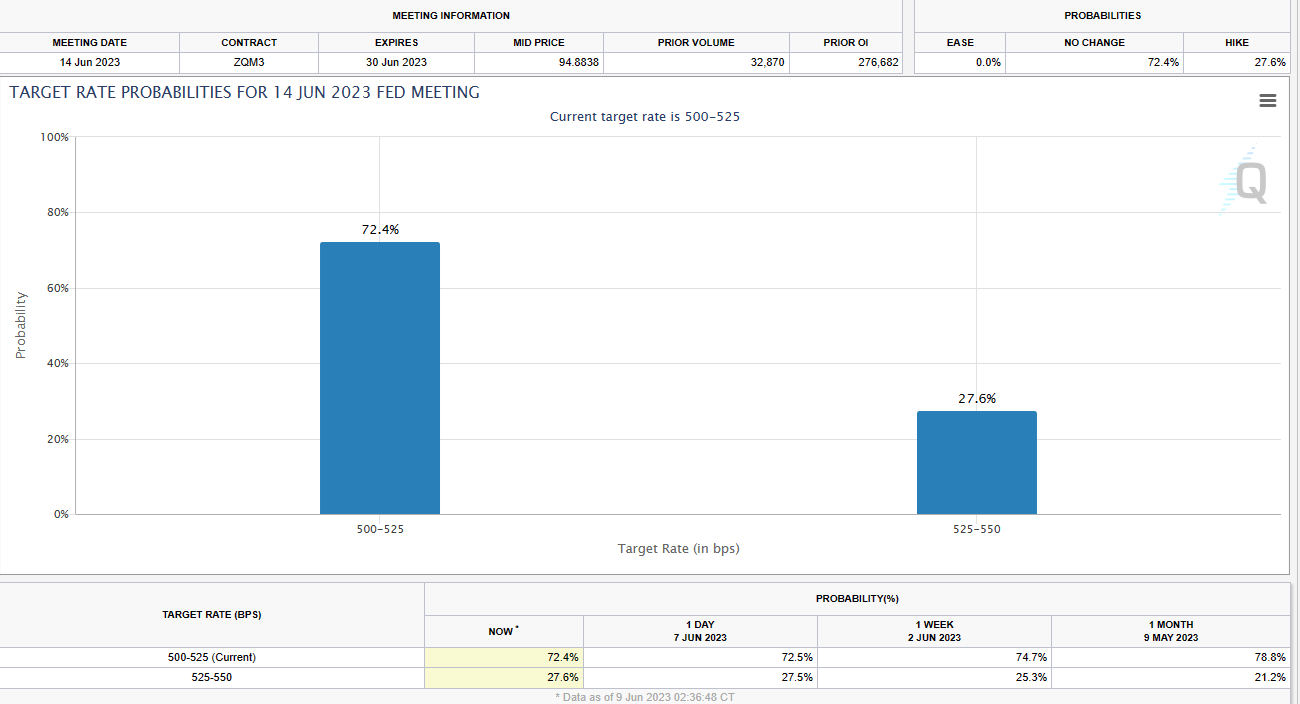

Firstly, let’s assess current market pricing. As shown below, there’s currently just over a 1-in-4 chance that we get a 25bps move higher, with the consensus view being of a no-hike.

The case for no-hike (72.4%)

At the risk of sounding rather obvious, the Fed have guided us to expect a pause from the last meeting.

As a data-dependant central bank, there are indications that a pause could be warranted.

For example, consider the latest US Jobless Claims figure, released earlier this week. It came in at 261k, above forecasts and the highest figure since October 2021.

We also flag up the tick higher in the unemployment rate that came out this time last week. It rose from 3.4% last month to 3.7%, matching the highest figure from the past year.

Aside from the labour market, there will be less of a case to hike if inflation continues to moderate. This is going to be a last-minute call for the Fed, given that the CPI inflation print for May is due just as the FOMC meeting begins next Tuesday.

Expectations are for a further fall from 4.9% previous to 4.1%. Importantly, core inflation is also surveyed to drop from 5.5% to 5.3%.

If realised, this signals a continued easing of price pressures. In this case, Jay’s comments from last month would appear to still ring true about being close to finishing policy tightening.

The case for a hike (27.6%)

The markets have been wrong footed by the Fed in the past, and this could happen again next week.

After all, during the meeting last month, there was no guarantee that rates will remain on hold. There were plenty of references to the fact that inflation remains elevated and more work is needed to get it under control.

Also, don’t forget that Powell said that he believes it’s more likely than not that the US won’t enter a recession this year. That being the case, there is less of an argument to be made that further hikes can’t be done due to the health of the economy.

There could be a preference to front-load the final couple of rate increases sooner rather than later. At the moment, there’s a 65.7% chance of an increase in the July meeting, so this could be brought forward, to allow a pause to begin next month instead.

Data to support this view can be seen from the bumper NFP print last Friday of 339k vs 190k expected.

We also flagged up in more detail here about the surprise 25bps hike from the Bank of Canada this week, and how the correlated rate path (shown below) from the two central banks over the past five years could be an indication of something to come from the Fed…

Trade ideas

We present an idea for both sides of the argument.

Given the relative lack of certainty on a hike, those that feel we could see a hike can potentially get a larger market reaction in their favour. We like;

TRADE IDEA - FED HIKE - LONG USD/CHF

Buy a 1 week USD/CHF call 0.9050 strike for 0.27%

Targeting a move to 0.9200 for a 5:1 risk/reward

On the other side, confirmation of a pause in the rhetoric from Powell and concerns around the labour market or glee about a low inflation print would be supportive of a bump higher in gold:

TRADE IDEA - NO HIKE AND DOVISH POWELL - LONG GOLD

Limit Order: $1,940

Take Profit: $2,000

Stop Loss: $1,920

We hope you enjoyed this investing article written by us, AlphaPicks. Feel free to reach out if you have any questions or feedback. Subscribing, sharing and liking this article is greatly appreciated as it helps us grow as a page. The more people reading our articles, the greater the compounding effect.

Enjoyed the article