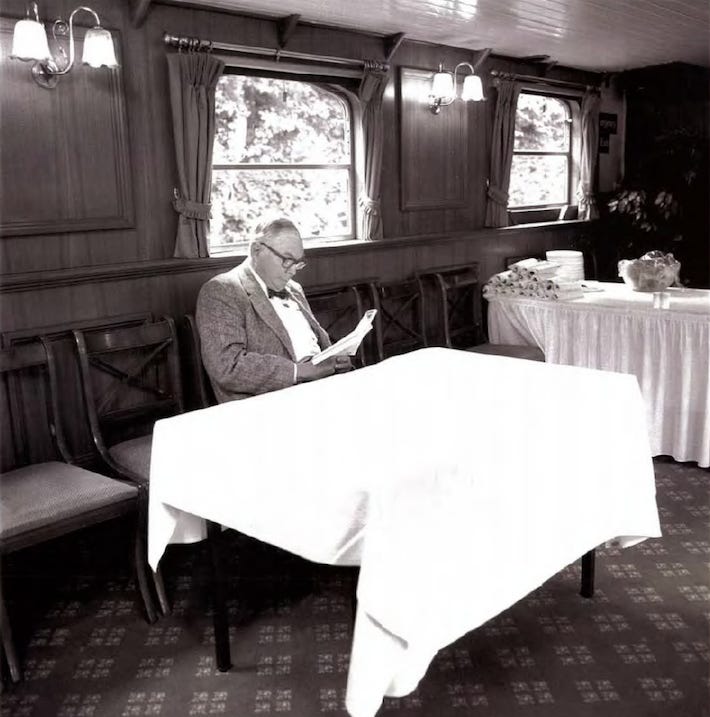

A Tribute To Charlie Munger

“Berkshire Hathaway could not have been built to its present status without Charlie’s inspiration, wisdom and participation.” - Warren Buffett

Charlie Munger, the vice-chair of Berkshire Hathaway, died at the age of 99 on Tuesday morning at a California hospital, the US investment conglomerate announced.

Munger was the alter ego, sidekick and foil to Warren Buffett for almost 60 years as they transformed Berkshire Hathaway from a failing textile maker into an empire.

A lawyer by training, Charlie helped Warren, who was seven years his junior, craft a philosophy of investing in companies for the long term. Under their management, Berkshire averaged an annual gain of 20% from 1965 through 2022 — roughly twice the pace of the S&P 500 Index. Decades of compounded returns made the pair billionaires and folk heroes to adoring investors.

We thought today would be appropriate to ignore our article and instead pay tribute to Charlie Munger, who has given countless wisdom over the years.

Charlie’s Wisdom

Buffett credited Munger with broadening his approach to investing beyond mentor Benjamin Graham’s insistence on buying stocks at a fraction of the value of their underlying assets. With Munger’s help, he began assembling the insurance, railroad, manufacturing and consumer goods conglomerate.

“Charlie has always emphasised, ‘Let’s buy truly wonderful businesses,’” Buffett told the Omaha World-Herald in 1999.

That meant businesses with strong brands and pricing power. Munger nudged Buffett into acquiring California confectioner See’s Candies Inc. in 1972. The success of that deal — Buffett came to view See’s as “the prototype of a dream business” — inspired Berkshire’s $1 billion investment in Coca-Cola Co. stock 15 years later.

A Great Thinker

Charlie Munger was also well known for his thinking ability, often excelling due to his mental models.

Visual credit to CMQ Investing

“Charlie has the best 30-second mind in the world,” said Warren Buffett.

But alongside his short-term sharpness, his long-term thinking helped him succeed.

1. Circle of Competence - Focus on areas within your expertise and understanding. Expand that circle, but avoid venturing into unfamiliar territories.

2. Inversion - Instead of solving problems directly, consider them in reverse. Identify what could cause failure to navigate better and mitigate risks.

3. First Principles Thinking - Break down complex problems into fundamental principles. Solve them from the ground up rather than relying on conventional wisdom or assumptions.

4. Margin of Safety - Employ a margin of safety by making conservative estimates and allowing for a buffer against uncertainties or errors when making (investment) decisions.

5. Psychology of Misjudgment - Recognise and understand common biases and psychological tendencies that can lead to faulty decision-making.

6. Checklist Manifesto - Use checklists to consider critical factors systematically.

7. Paradox of Tolerance - Acknowledge the importance of being open-minded yet understand when and where to draw the line by not tolerating intolerable behaviours or ideas.

8. Complex Adaptive Systems - Consider systems as interconnected and evolving entities, understanding that changes in one part can profoundly affect the whole.

9. Network Effects - Recognise the value of networks and how they can amplify the value of a product or service as more people adopt it.

10. Comp. Advantages & Moats - Understand and invest in companies with durable competitive advantages that protect them from competitors.

11. Redundancy - Employ redundancy and backup systems to reduce the risk of catastrophic failure.

12. Second-Order Thinking - Think beyond the immediate consequences of an action. Consider secondary and long-term effects that might follow.

13. Lollapalooza Effect - Apply mental models from various disciplines to form a comprehensive understanding of complex issues.

Quotes From The Great Charlie Munger

1. “Lifelong learning is paramount to long-term success.”

2. “If I can be optimistic when I'm nearly dead, surely the rest of you can handle a little inflation” - drawn from the 2010 annual Berkshire Hathaway meeting.

3. “Every time you hear EBITDA, just substitute it with bulls*.”

4. “If you're not willing to react with equanimity to a market price decline of 50% two or three times a century, you're not fit to be a common shareholder, and you deserve the mediocre result you're going to get.”

5. Or this one clip which lays out Munger's formula for success: “It's so simple. You spend less than you earn. Invest shrewdly, avoid toxic people and toxic activities, and try and keep learning all your life, etcetera, etcetera. And do a lot of deferred gratification because you prefer life that way. And if you do all those things, you are almost certain to succeed. And if you don't, you're gonna need a lot of luck.”

6. Or as Buffett wrote in 2015: “From my perspective, though, Charlie's most important architectural feat was the design of today's Berkshire. The blueprint he gave me was simple: ‘Forget what you know about buying fair businesses at wonderful prices; instead, buy wonderful businesses at fair prices.’”

7. “The best thing a human being can do is to help another human being know more.”

8. “The world is not driven by greed. It's driven by envy,” he said last year while speaking at the annual meeting of the Daily Journal, the newspaper company where he is a director. “I have conquered envy in my own life. I don't envy anybody. I don't give a damn what someone else has. But other people are driven crazy by it.”

9. “People calculate too much and think too little.”

10. “The best armour of old age is a well-spent life preceding it.”

A 5-Minute Video

Here is an amazing 5-minute video of Charlie Munger’s greatest moments.

A legend