Acting Contrary To The Herd

Rationality is often lost in the crowd.

Herd Behaviour is a phenomenon in which individuals in a group act collectively without centralised direction. It is deeply rooted in human psychology and is instinctive at times. If everyone else starts running from something, you probably run, too.

In modern times, this instinct manifests in multiple facets of our lives, especially in the realm of financial markets. When investors observe others buying a specific stock, they frequently emulate the behaviour due to a fear of missing out on potential profits—a phenomenon popularly known as “FOMO”.

Conversely, during times of panic when selling activity prevails, individual investors often participate, driven by the fear of holding onto a sinking ship.

Rationality is often lost in the herd.

Market Observations

The stock market provides a plethora of examples to observe herd behaviour. During times of market stress, correlation among stocks increases. In simpler terms, they tend to move together more than usual.

This phenomenon was evident during the Great Financial Crisis. According to one study, stocks in the S&P 500 had an average correlation of 0.74 during the crisis, compared to just 0.44 in calmer times.

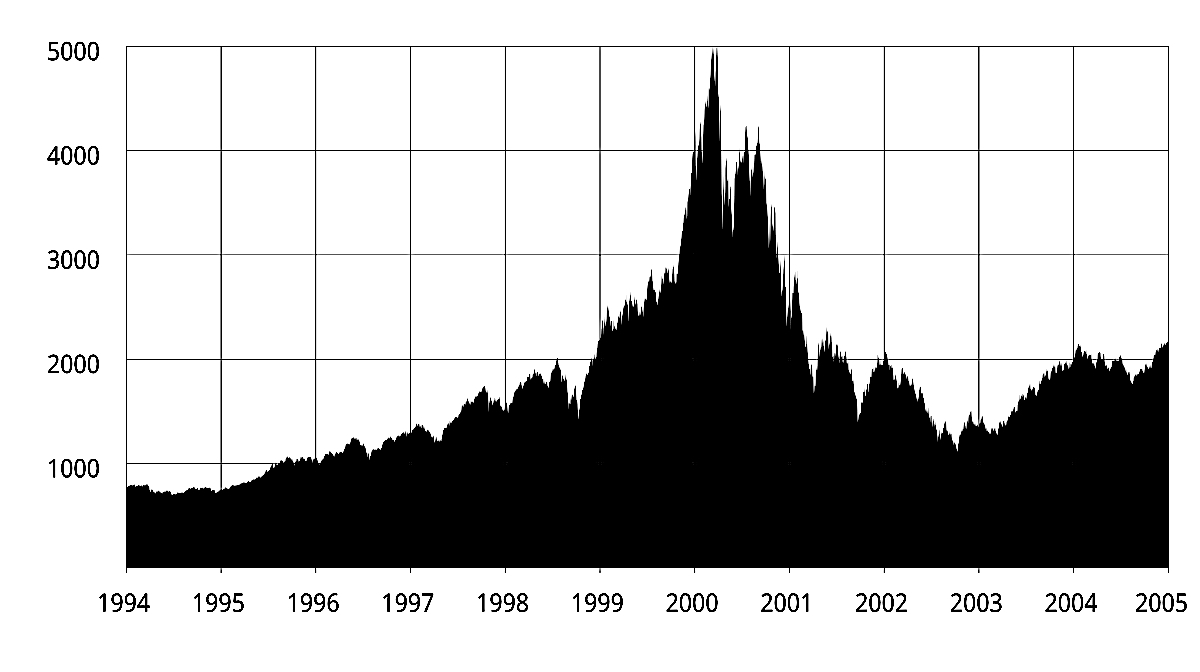

Similar actions can be observed as stocks rise, not just when they fall. In the late 1990s, investors flocked to tech stocks, inflating their prices. When the bubble burst in 2000, the Nasdaq, which had risen five-fold from 1995 to 2000, plummeted by nearly 78% by October 2002.

Many who followed the herd saw their investments evaporate.

Other manias in history include the tulip frenzy and, more recently, the GameStop frenzy in 2021.

Factors At Play

To comprehend the occurrence of herd behaviour, it is necessary to examine the psychological and structural factors contributing to it.

Social Proof is when uncertain people look to others for cues on how to act. For instance, if everyone else is buying a stock, the implicit assumption is that they must know something you don’t.

Information Cascade is another factor at play. Essentially, this occurs when a small number of individuals initiate actions based on private or exclusive information. As a result, others follow suit without knowing the true driving factors behind these actions.

These followers, lacking the same insights, assume that the initial movers must have valid reasons for their decisions. As more individuals join in, the cascade effect gains momentum, leading to price movements based on collective actions rather than thorough analysis.

This phenomenon can result in significant mispricing of assets, as decisions are made under the assumption that “everyone else must know something,” when in reality, most participants are simply following the crowd without fully comprehending the underlying basis for the actions.

The availability heuristic is why investors tend to give undue weight to recent information. If a stock has been rising, it’s easy to find news and opinions supporting further rises, reinforcing the herd behaviour.

Finally, one that we have all heard many times is Fear and Greed. Emotions play a significant role in influencing our decisions. Greed drives people to buy into rising markets, while fear prompts them to sell during downturns.

Be “fearful when others are greedy, and greedy when others are fearful.” It might be hard to do in the moment, but applying this thinking before making decisions can help investors to survive in the long term.

Herd In Numbers

A study conducted by Barber, Odean, and Zhu in 2009 discovered that individual investors who engaged in frequent trading, often driven by herd behaviour, tended to achieve lower returns compared to those who traded less.

Research by Bikhchandani and Sharma in 2000 demonstrated that herd behaviour could lead to significant mispricings in financial markets, contributing to bubbles and crashes.

A 2017 study by the CFA Institute revealed that investors influenced by herd behaviour during market downturns were more likely to engage in panic selling, resulting in poorer long-term performance compared to those who adhered to a disciplined investment strategy.

Avoid The Herd (Mentality)

Although you can easily observe that the herd is not rational in its thinking, that doesn’t, in itself, make it easy to avoid the traps of the mentality in the moment.

Understanding the psychology behind herd behaviour and employing disciplined investment strategies are essential in navigating the complexities of investing.

Act swiftly, but don’t act irrationally. There is a huge benefit to being early in a move. Your margin of safety broadens as others join the trade. This allows you to exit the trade with strong returns and avoid holding into highly speculative levels when the herd mentality is at play.

While it may seem safe to follow the crowd, the perceived abundance of opportunity may not always align with reality. Deviating from the herd and conducting a thorough assessment of investment opportunities increases one’s chances of achieving superior financial outcomes.

Therefore, it is crucial to avoid blindly following the crowd and to evaluate the true value of an opportunity before making investment decisions.

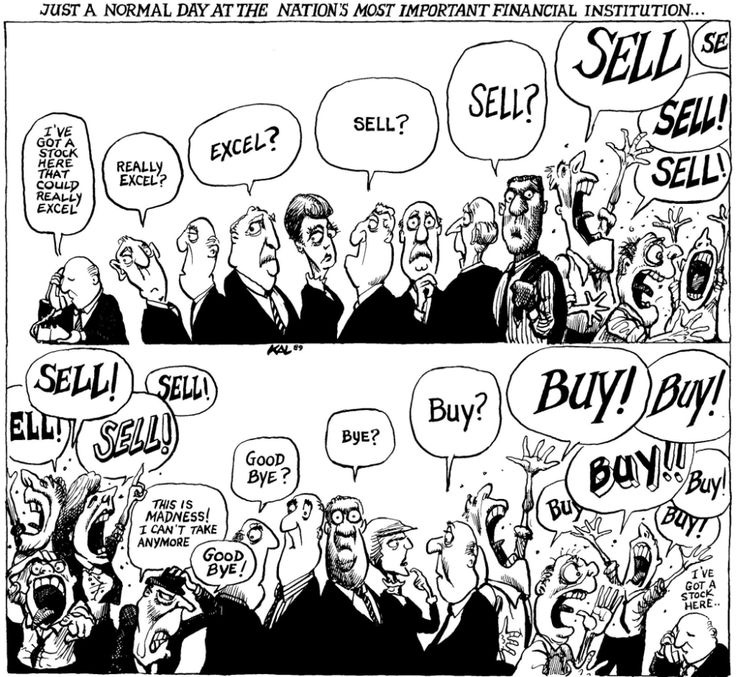

We leave you with a funny but extremely important visual for consideration…

Great thoughts. It reminds me of the social experiments people record on camera, like when one person is looking up into the sky it causes everyone walking by to look up too.

Reminds me of a comment attributed to Sir Bacon "knowledge is power" Great piece, well formulated and interesting coffee read!