The S&P 500 set fresh records midweek but ultimately closed lower as momentum faded. Monday brought another loss, the sixth in seven sessions, as optimism over rate cuts gave way to renewed scrutiny of earnings. Nvidia’s results loomed large, helping the index reclaim highs by Wednesday. But the world’s most valuable company disappointed with a softer revenue outlook, and Friday’s sticky inflation print ensured the week ended in the red. Energy led the way higher on firmer crude, while defensives lagged.

The bigger story was politics bleeding into monetary policy. Trump escalated his campaign against the Fed, seeking to oust Governor Lisa Cook over fraud allegations. Cook countered with a lawsuit, setting up an unprecedented clash over central bank independence. Markets worry the White House is looking to bend the Fed to its fiscal agenda, a theme amplified by Powell’s silence during the dispute. The fight underscores why investors are quick to fade rate-cut euphoria. Credibility at the Fed is suddenly up for grabs.

On the macro side, Q2 GDP was revised higher to 3.3%, while Core PCE held at 2.9% YoY, stubbornly high but not hotter than expected. Futures welcomed both, though the jobs market remains the swing factor. Waller reiterated his call for a September rate cut, noting that NFP could influence the size.

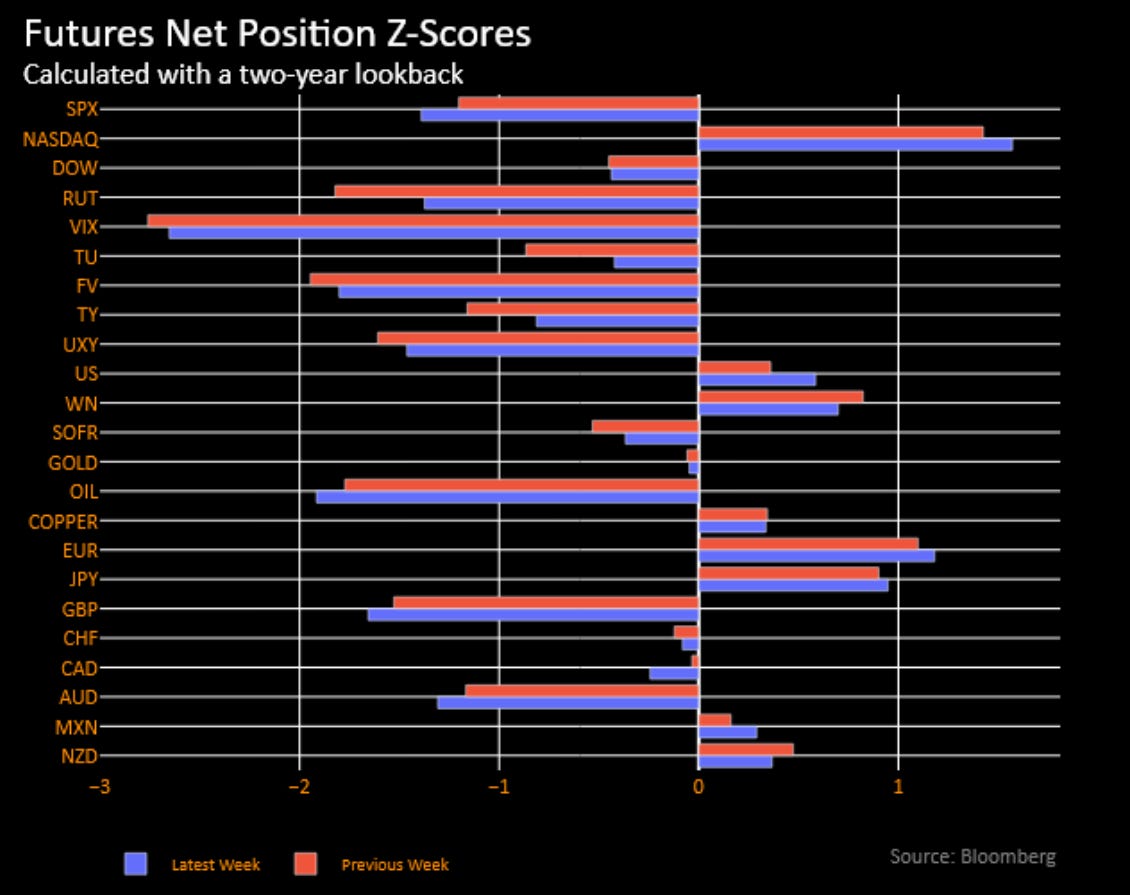

The dollar was whipsawed by data and flows, rallying on GDP revisions before month-end selling erased gains. In Treasuries, the long end softened, with 30y yields drifting higher amid concerns that political meddling at the Fed could stoke inflation risks over time. The streak of auction tails continued, reflecting a market hesitant to absorb duration just as politics clouds the Fed’s path.

The Week Ahead

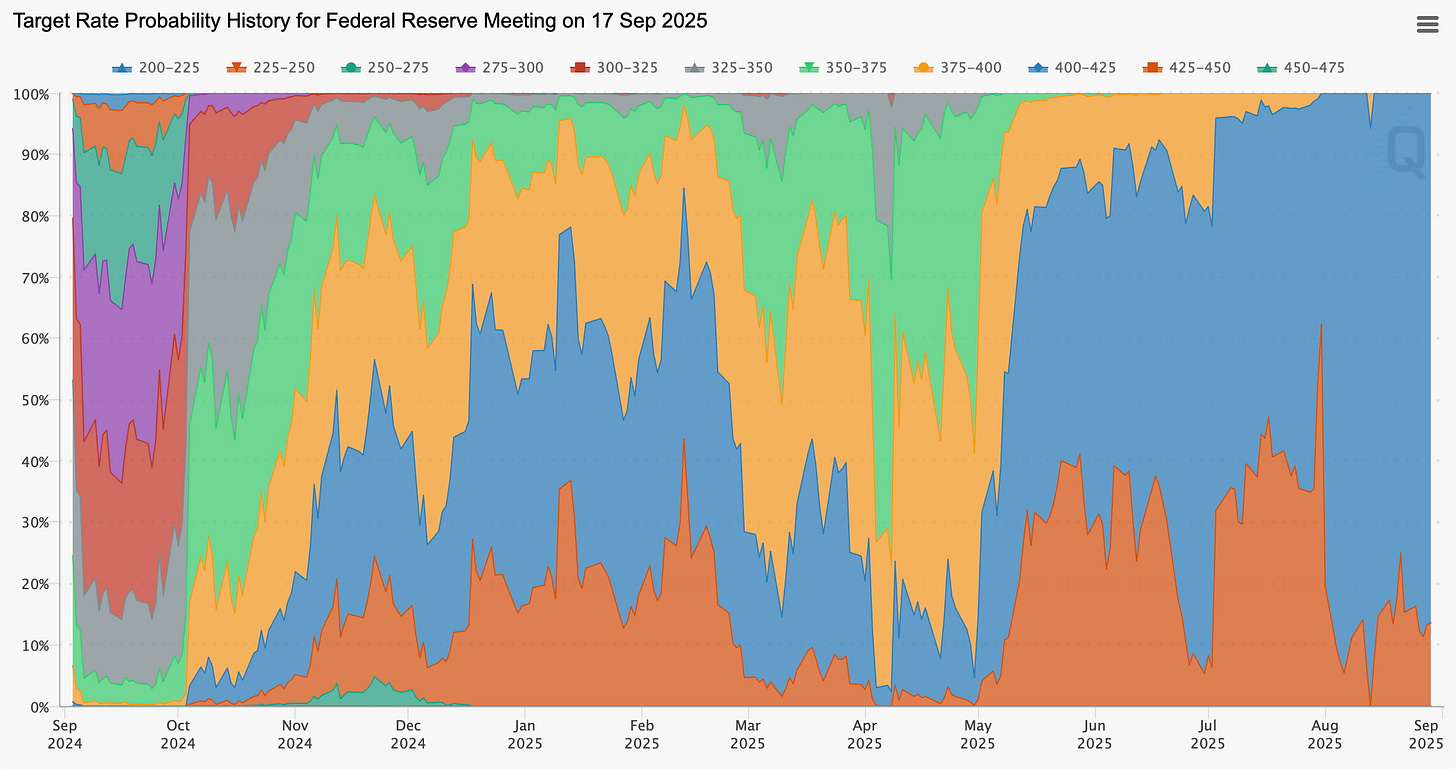

The first week of September will be dominated by US jobs data, which investors see as pivotal in confirming expectations for a Federal Reserve rate cut on September 17. Markets currently price an 84% chance of a 25bp reduction, but the outcome of Friday’s nonfarm payrolls report will be decisive. Weakness would cement the case for easing, while a strong surprise could complicate the outlook. Ahead of the release, labour-market signals from JOLTS openings, ADP payrolls, and weekly jobless claims will be closely watched. ISM manufacturing and services surveys will also provide a timely gauge of how the economy is coping with tariff-related pressures. U.S. markets will be closed on Monday for Labor Day.

In Canada, Friday’s employment data will also be in focus, following recent signs of softer growth that have raised expectations for further Bank of Canada easing. Trade data on Thursday will provide an additional read on the effect of US tariffs.

In Europe, the highlight will be Tuesday’s flash inflation data for August, with particular attention on services inflation, which the ECB views as a key signal of persistence. Final PMI readings for manufacturing and services are due on Monday and Wednesday, respectively, while eurozone retail sales, Q2 GDP, and employment data round out the week. Supply will be heavy, with Germany auctioning short- and long-dated debt midweek, followed by sales from Spain and France on Thursday.

The UK has a quieter calendar, though delayed retail sales data for July on Friday will be closely monitored for signs of consumer resilience. Mortgage lending and approvals, as well as house-price surveys, will be released earlier in the week. Several Bank of England policymakers are scheduled to speak on Wednesday, while the gilt market faces both a syndicated 2035 launch and an index-linked auction on Thursday.

In Asia, Japan will see remarks from BOJ Deputy Governor Himino on Tuesday, which could shed light on the pace of policy normalisation. Data on auto sales and household spending will help gauge momentum, while long-end JGB supply is due with a 30-year auction on Thursday. China will release private PMI surveys of manufacturing and services, offering fresh insight into whether tariff stress and policy support are filtering into activity.

Australia will be in focus on Wednesday, with the release of the second-quarter GDP and a speech from RBA Governor Bullock in Perth. Investors expect her to strike a cautious tone after the recent CPI uptick, balancing the prospect of rate cuts against persistent inflation risks.

Across the rest of Asia, a wave of data and central-bank meetings will shape regional sentiment. South Korea releases trade and inflation data early in the week, which could reinforce expectations of the BOK easing later this year. Malaysia’s central bank is expected to hold steady on Thursday after cutting in July. Indonesia will publish trade and CPI data, with inflation still leaving scope for further BI cuts. The Philippines reports CPI on Friday, Thailand releases inflation data, likely still in deflation, and Taiwan publishes CPI, expected to remain subdued. Regional PMIs from South Korea, India, and Taiwan on Monday will provide an additional test of tariff-related pressures.

Elsewhere, Switzerland releases August CPI on Thursday, an important lead-in to the SNB’s late-September meeting. In Poland, the central bank is expected to cut rates by another 25bp to 4.75% on Wednesday, extending its easing cycle.

Let’s start the week’s market thoughts in FX.

FX

EUR/NZD Eyeing a Break:

After testing out 2.000 back in April, it had another run in August. This time around, the correction has been much less severe, with the uptrend intact. We feel it’s only a matter of time before 2.000 gives way, with a likely fast move higher beyond that, with stops being triggered.

From a fundamental view, the recent RBNZ cut and the weak labour market (unemployment back to pandemic levels) spell trouble for the coming months, so we like to play a short here.

EUR remains our favourite outright long currency to hold, with the greenback still not a compelling buy in the short term.

Buy a one-month 2.000 strike Call option costing 49bps.

Musings on USD Data Plays:

Friday’s NFP and employment data are clearly one of the defining events for the coming week. With a 78k headline number expected and a lot of recent chat around overall labour market weakness, we feel the risk is actually skewed towards a big figure with decent AHE.

Although we haven’t decided if we’ll run risk over the figure, to us it makes more sense to have a long USD position on, as a large beat likely sees some fast money shorts unwound, versus holding a short USD position on a weak print, which really just confirms what Powell was saying at Jackson Hole.

In terms of isolating a pair, the technical picture appears promising for AUD/USD.

Entry: 0.6540

Take Profit: 0.6425

Stop Loss: 0.6590