All Eyes On Today's Event... And We're Not Talking About The Fed Meeting

Today, we take a look at the Treasury quarterly refunding statement as well as an FOMC preview.

Bank of Japan Meeting.

Treasury Refunding Statement.

Federal Open Market Committee Meeting.

Bank of England Meeting.

Apple Earnings.

Non-Farm Payrolls.

One down. Five to go.

Many market participants are eagerly waiting for today’s Fed meeting. The FOMC will release their latest rate decision (2pm ET), and Chair Powell will give comments 30 minutes later. But the event before it, the Treasury Refunding Statement, will have a more significant market impact today.

If you’re reading this later in the day, this event has already happened. It is scheduled for 8:30am ET.

Today, we will run through an FOMC preview and then look at the refunding event.

FOMC Preview

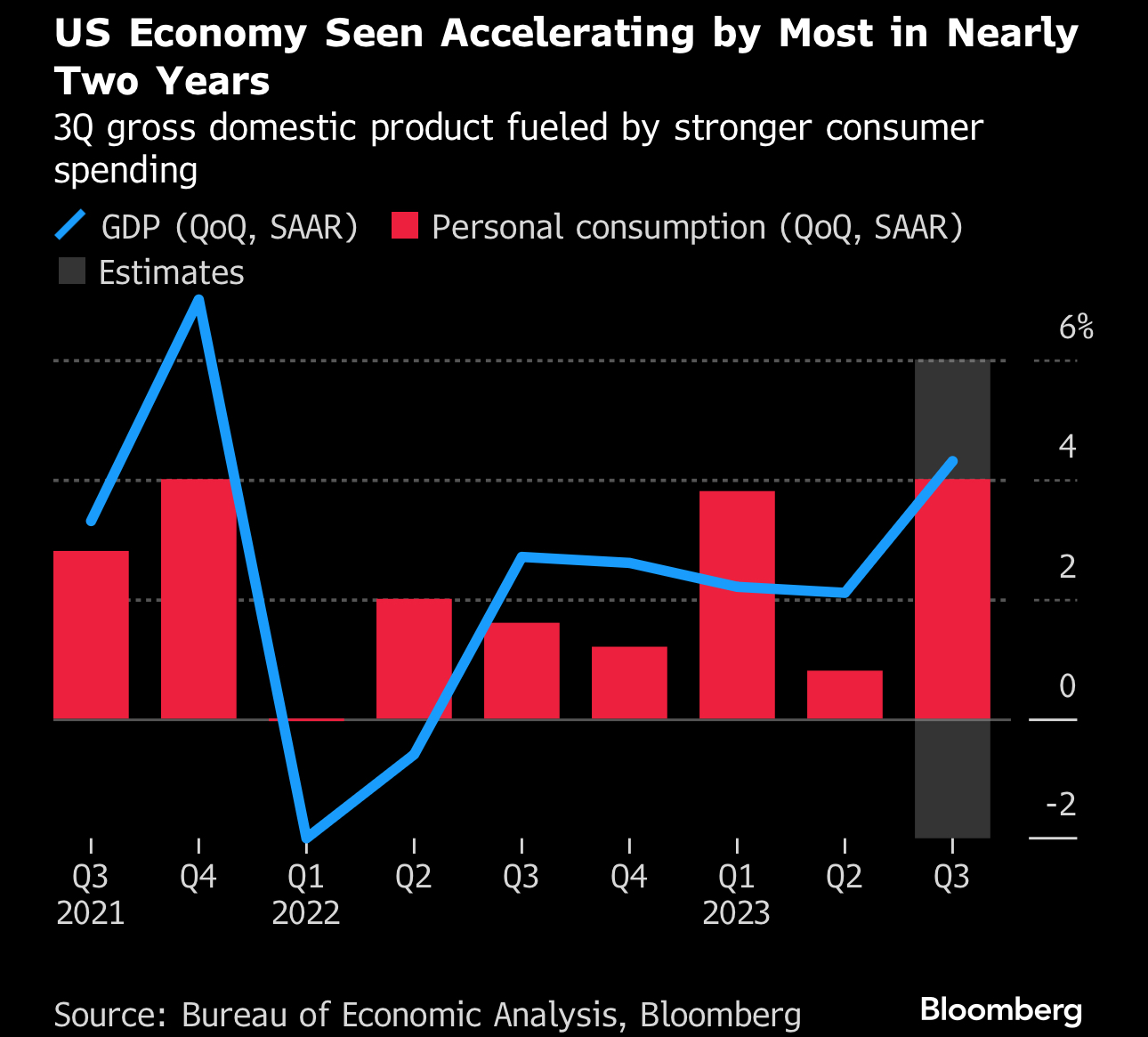

The surprising resilience of American consumers is about to be tested over the coming months, as rising delinquencies, growing debt payments and dwindling cash piles put pressure on household balance sheets.

Whether consumers pull back or power through is a big question facing Federal Reserve officials today, where they’re expected to hold interest rates steady.

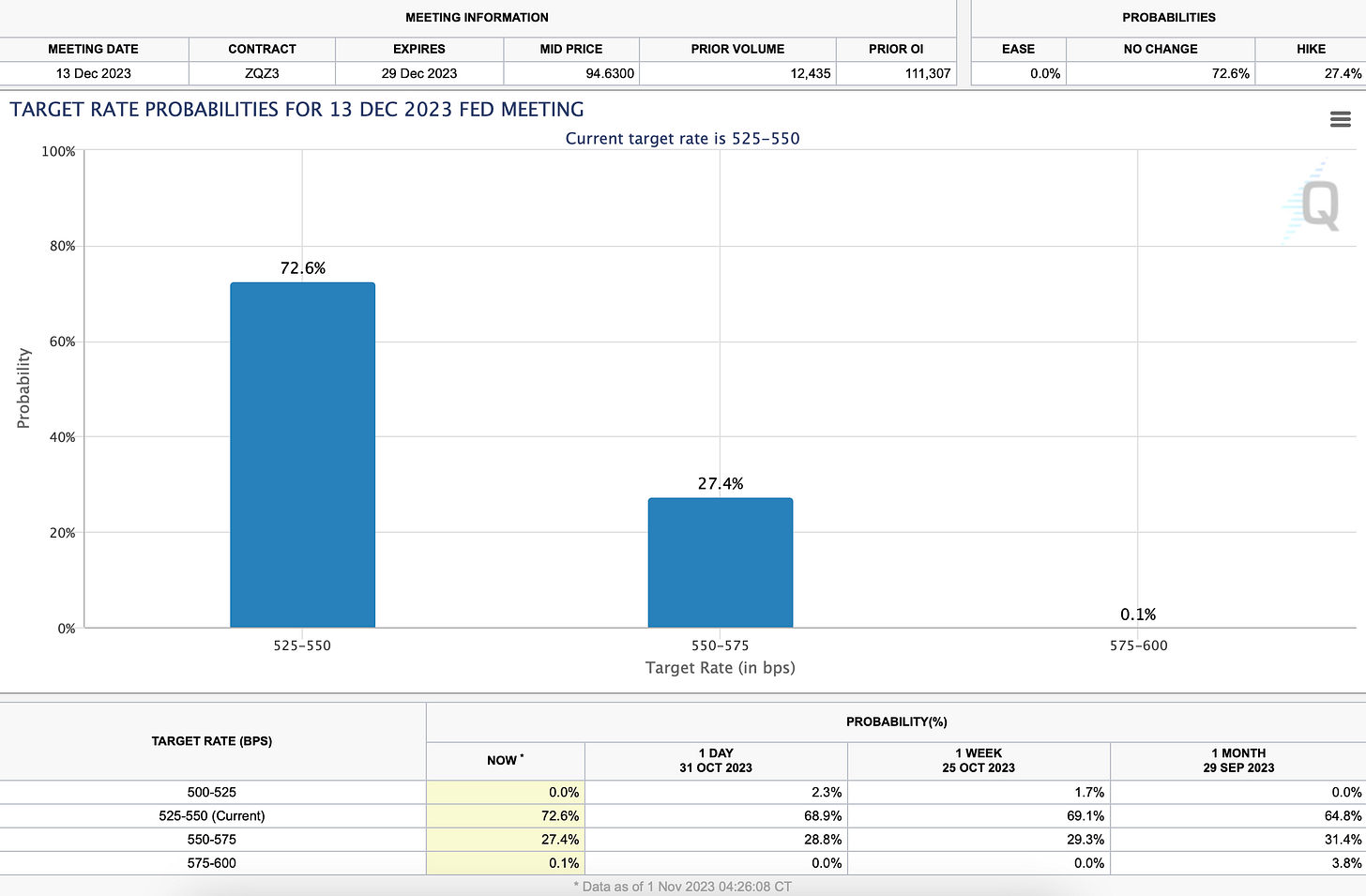

In short, high yields are doing the Fed’s job for them. Therefore, markets are pricing in a 99.7% that rates stay at current levels this month.

They’ll also debate whether another rate hike is needed at a future gathering, weighing the data on blockbuster growth against expectations for a slowdown.

This is where markets will be more attentive. FedWatch has December’s meeting split. There is now a 0% chance of a cut (just a few days ago it was still 3.5% for one), probabilities are nearly 3 to 1 for another hold. But the likelihood of that hike is much higher for the next meeting than the current one.

Treasury Refunding

The US Treasury Department sells a lot of bonds to keep up with the federal government’s borrowing needs. To prepare investors, the Treasury has for decades published a “quarterly refunding” statement that spells out its near-term plans for note and bond sales.

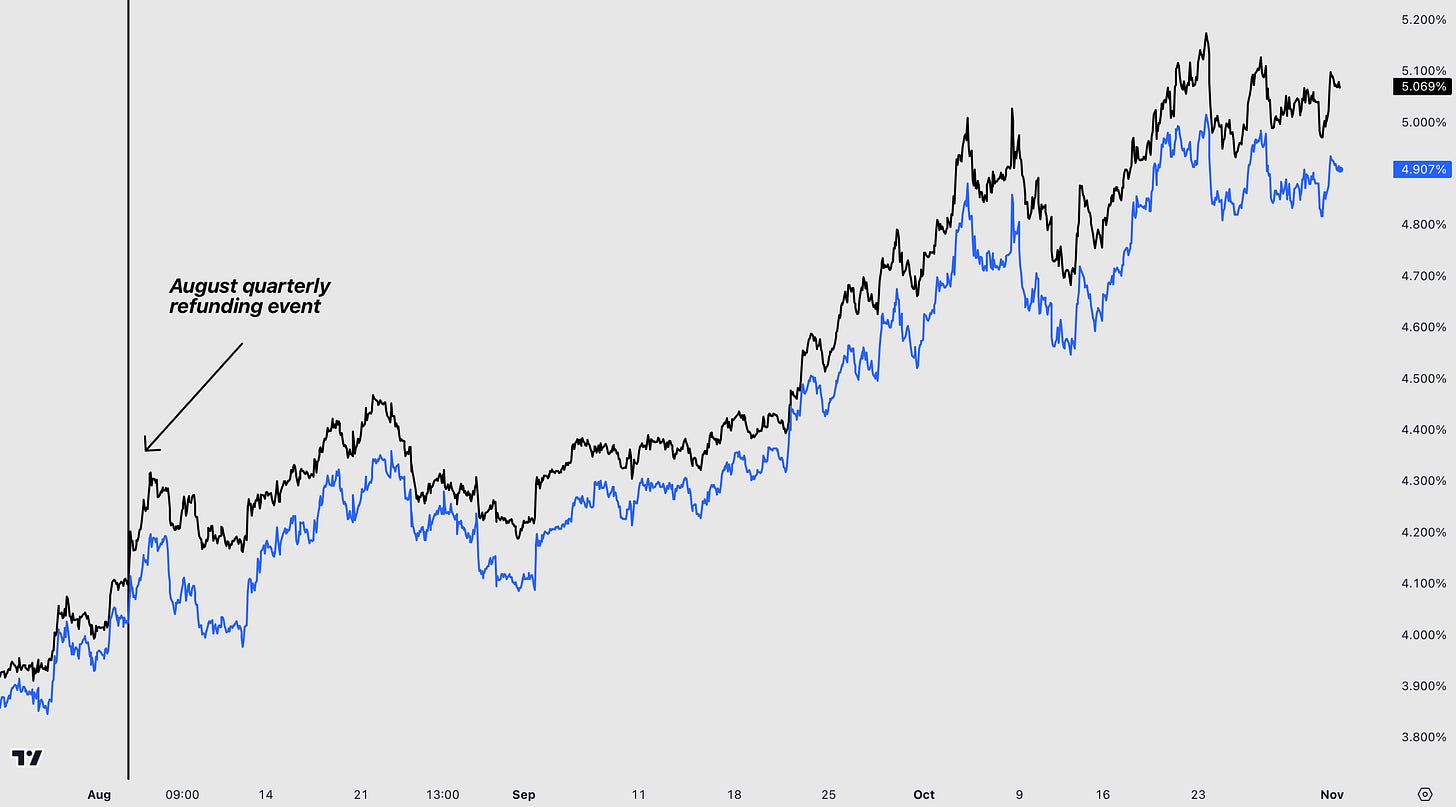

In August, the Treasury said it would have to ramp up sales for the first time in 2.5 years and predicted further increases. All this, along with market forces shaking up the Treasuries market, has created heightened interest in today’s report.

Bonds have been tumbling for weeks, even amid signals from Fed officials they’re “at or near” the end of rate hikes, sending yields to their highest level since the global financial crisis. This, in turn, has made longer-term Treasuries more costly for the government.

Treasury yields have risen since the previous quarterly announcement, the result building even more anticipation for today’s meeting.