America's LNG Boom Reshapes Global Energy

When it comes to LNG, the U.S. is calling the shots.

Guest contributions from Alyosha.

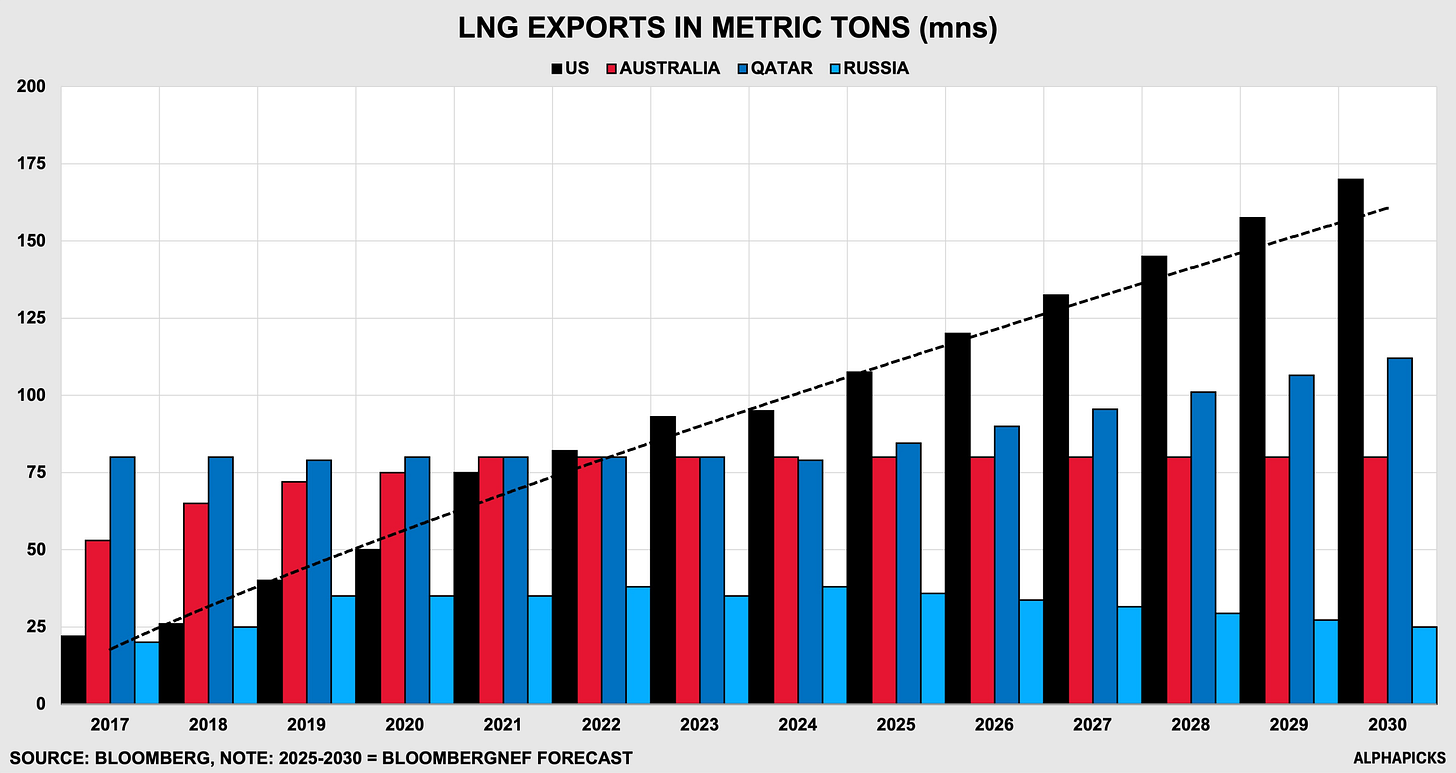

Two decades ago, America was scrambling for natural gas. Now, the world is scrambling for America’s. The shale revolution flipped the script, turning the U.S. from a desperate importer into the world’s top supplier of liquefied natural gas (LNG). With global demand surging, the industry is gearing up for another massive expansion—one that could cement the U.S. as the dominant force in global energy markets for years to come.

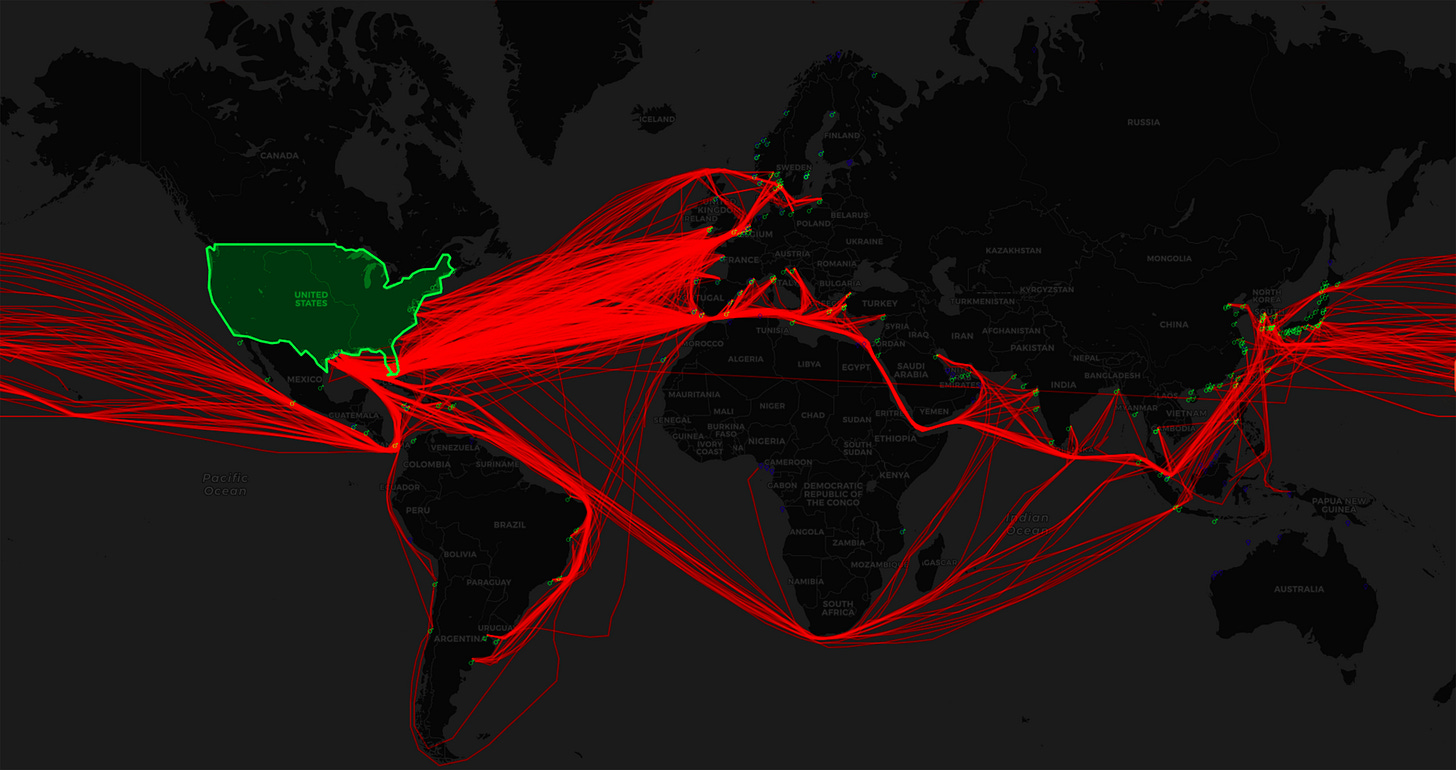

Over the next five years, U.S. LNG production capacity is set to jump 60%, with nearly one in every three tankers carrying the superchilled fuel departing from American shores. European utilities searching for a Russian alternative, Asia’s fast-growing economies, and developed economies welcoming an AI expansion are all in a bidding war for supply. In an era where energy security is paramount, natural gas has become Washington’s most powerful diplomatic tool, and the White House—regardless of who’s in charge—knows it.

From Afterthought to Global Kingpin

Not long ago, the idea that American gas would shape global geopolitics seemed far-fetched. At the turn of the millennium, U.S. reserves dwindled, and natural gas powered less than 15% of the country’s electricity. Industry experts feared an energy crisis. Then came fracking.

Advancements in horizontal drilling and hydraulic fracturing unlocked vast reserves, from the Permian Basin to the Marcellus Shale, unlocking previously inaccessible oil and gas reserves. Production soared, surpassing 100 billion cubic feet per day. Today, natural gas fuels 41% of America’s power grid, outpacing coal and nuclear. More importantly, it far exceeds domestic demand—meaning exports are the name of the game.

American LNG is now a global commodity, and energy firms are racing to expand infrastructure. Cheniere Energy and Venture Global lead the charge, constructing multibillion-dollar liquefaction plants along the Gulf Coast. These complex facilities supercool gas to -256°F (-160°C), condensing it into liquid form for overseas transport. Eight plants are already operational, three more are under construction, and several others are nearing final investment decisions. Even a long-dormant project in Alaska is back on the table.

To access full articles and research, manage your account here.

Washington’s Power Move

International buyers are lining up for long-term LNG contracts, keen to secure supply before markets tighten. Still reeling from its divorce from Russian energy, Europe is the biggest customer. Since 2022, the Netherlands, France, and the UK have ramped up purchases of American LNG to replace lost pipeline flows from Moscow. Germany, which once relied on Russia for over half its gas needs, is scrambling to lock in U.S. deals to keep its industrial sector afloat.

Asia isn’t far behind. China, Japan, South Korea, and India are all ramping up imports. Tokyo and Seoul are particularly vulnerable to energy price swings, and both have hinted at increasing LNG purchases to hedge against potential market shocks. Even India, under threat of U.S. tariffs, has pledged to facilitate LNG imports to maintain trade ties.

The global LNG boom gives Washington a major strategic advantage. Unlike crude oil, which is still dominated by OPEC and subject to cartel politics, natural gas exports allow the U.S. to dictate terms in key international negotiations.

In his second term, President Trump has wielded LNG as a bargaining chip. He’s pursued a Ukraine peace deal without key allies such as Europe (or even Ukraine for that matter), slapped tariffs on major trade partners, and even floated a dramatic Middle East restructuring (remember the bizarre AI-generated video of a Trump Gaza he posted a few weeks ago?). He’s done this all while watching LNG orders roll in. European leaders may bristle at his unconventional diplomacy, but they’re still signing gas contracts.