An Impressive Rally, But Enough To Change The Tide?

The mood is still cautious. There's much to be done to undo the crypto mess of 2022.

The recovery over the past three months has been impressive. However, Bitcoin still feels like a shadow of what it was before.

Prices are now trading at the same levels from June 2022. In fact, Bitcoin closed Q1 as one of the top performers across major indices and commodities. But the heavy weight of controversies still seems to be hanging over the crypto market.

Three Arrows’ collapse, Voyager Digital, Celsius, FTX, Blockfi, Genesis Global, and other formerly high-flying startups. It was one bad headline after another last year.

What effect has this had on the overall crypto space?

It is clear that the mood is still cautious. A strong Bitcoin start to 2023 will not mend the damage from 2022.

Institutions

Big money makes assets really move. Unfortunately, retail crypto enthusiasts alone will not be able to take Bitcoin anywhere near the significant prices it once boasted.

According to a Citigroup estimate, by 2030, up to $5 trillion might permanently switch to new types of money, including stablecoins and digital currencies issued by central banks. According to the group, the tokenisation of an additional $5 trillion in conventional financial assets might accelerate the widespread use of blockchain technologies.

However, given that the place that cryptocurrencies are supposed to take in a portfolio is a shifting target, Tallbacken Capital Advisors CEO Michael Purves believes that the "'show me' threshold" for institutional investors will be greater this time around.

It was once hailed as an inflation hedge and compared to "Internet-age gold," but it plummeted during the greatest consumer price increase since the 1980s.

In a recent email to customers, he stated that "Institutions started to take Bitcoin seriously after Bitcoin broke $20,000 in 2020 and played a key role in the subsequent rally to $69,000. However, this time around, its longer-term history of not providing portfolio diversification will heavily weigh on institutions, which probably have bigger headaches to worry about."

Alts slow

The performance of Bitcoin has not been matched by newer coins.

The last rally saw a plethora of different coins rise several hundred, if not thousands, of per cent over the course of a few months. This time around, Bitcoin leads the way.

Ethereum trails Bitcoin, rising (only) 50% this year.

The Bloomberg Galaxy DeFi Index, which tracks the largest decentralised finance protocols, has recouped only about one-tenth of last year’s 2,000-point drop.

Where do the technicals take us?

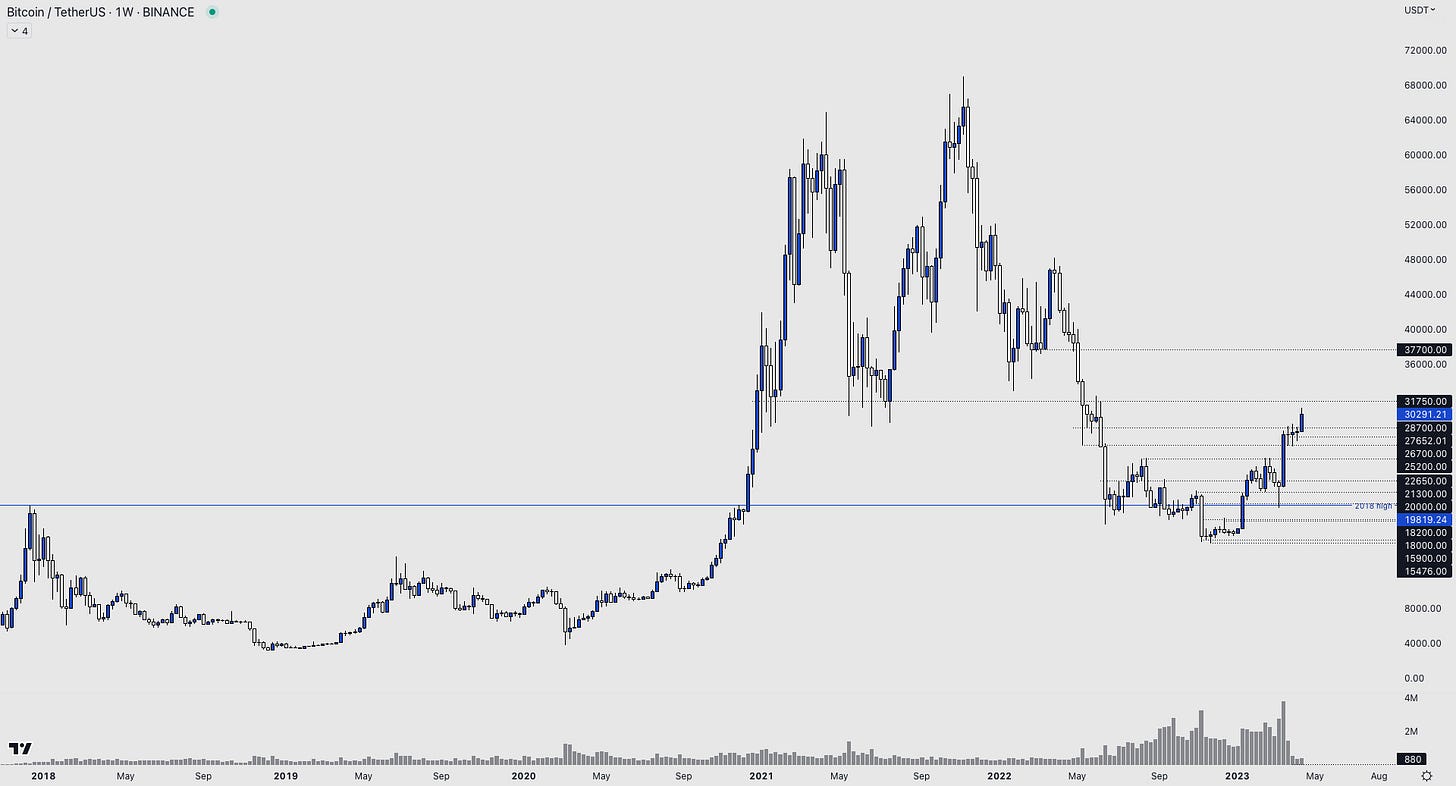

As seen in the image in the intro, volume was very strong when the price pulled back to $20,000. This demand is positive.

However, heavy resistance is just above. $31,750 has been a key pivot level for both bulls and bears. Over the past two weeks, the volume has been much lower. Even on Monday, when the price broke to YTD highs, it was not confirmed with heavy buying. Something to take note of.

For now, don’t fight the trend

It’s been a good start. Possibly better than crypto investors could have hoped for. Things are on the up.

A key resistance sits above, and maybe institutions will step in above there to help price higher.

Bitcoin could be in for a good 2023 overall, which may just be enough to change the sentiment on small coins and especially crypto startups again…

We have our next release out on Monday, sharing charts that we will be keeping our eye on over next week’s trading. Be sure not to miss out by subscribing below.