An Interview With Compounding Quality

From a successful career in asset management to launching his own portfolio, we sat down with CompoundingQuality.

What led to the beginning of Compounding Quality?

I worked in the industry as a Professional Investor. I loved my job, but I absolutely hated the short-term mindset of the industry.

As Warren Buffett said: “Wall Street is the only place that people ride to in a Rolls Royce to get advice from those who take the subway.” There are so many commercial incentives in the industry, and Professionals focus on filling their own pockets instead of the ones of their clients. Furthermore, it’s way more important to sound interesting than to be interesting in the industry. That’s why all professionals focus on quarterly results and why less than 10% of all funds outperform the S&P500 over time.

That’s not the way I wanted to live my life, and why I created Compounding Quality in June 2022. Via Compounding Quality, I genuinely want to help investors along their investment journey. It’s a true honour to help others full-time today. With the newsletter, I combine my two passions: teaching and investing.

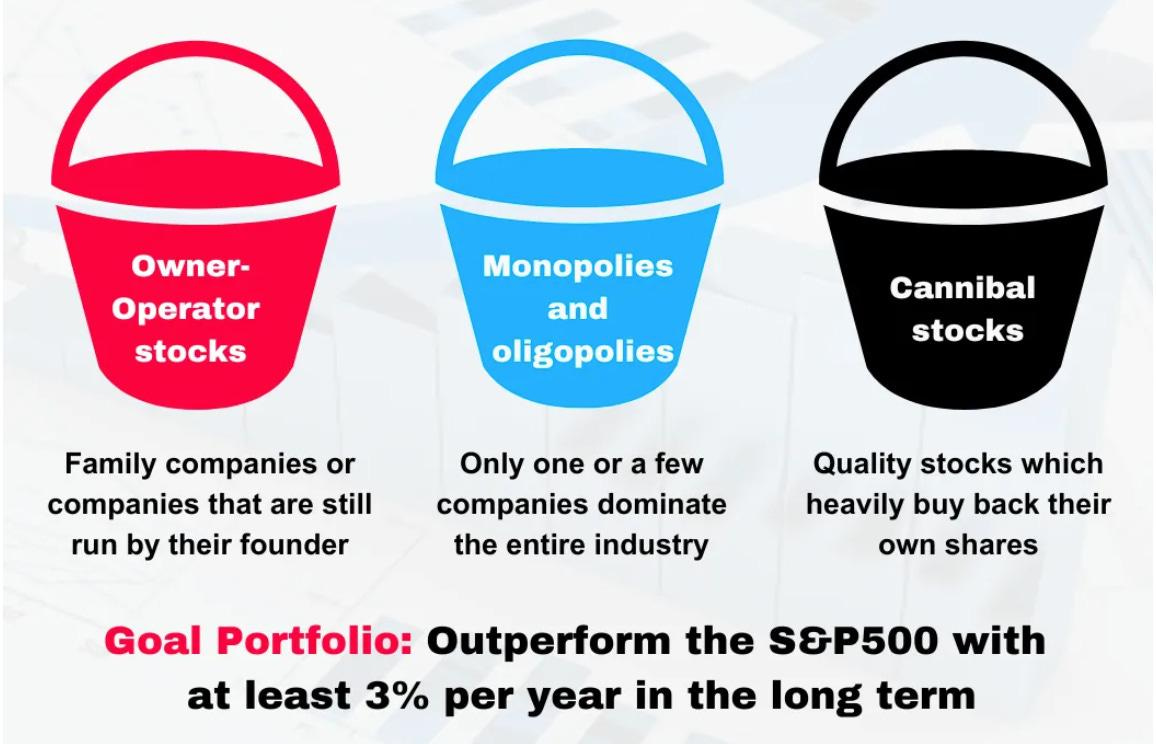

The Compounding Quality portfolio consists of three baskets - ‘Owner Operator’, ‘Monopolies and Oligopolies’ and ‘Cannibal’ stocks. What was the reason behind the selection of this group?

The essence of Compounding Quality is very simple:

Buy wonderful companies

Led by outstanding managers

Trading at a fair valuation

It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.

Here’s the reasoning behind every bucket:

Owner-operator stocks:

Owner-operator stocks are companies that are still run by their founder

Academic studies found that family companies and founder-led companies outperform the S&P 500 with 3.7% per year and 3.9% per year, respectively

“Some of our key managers are independently wealthy. They work because they love what they do and relish the thrill of outstanding performance. They unfailingly think like owners. They are the best kind of managers we can wish for.” - Warren Buffett

Monopolies and oligopolies

Only one or a few companies dominate the entire industry

Monopolies and oligopolies are usually great investments because they are able to operate at attractive conditions due to the lack of competition

“Over the years, Buffett followed his philosophy of buying into industries with little competition. If he can’t buy a monopoly, he’ll buy a duopoly. And if he can’t buy a duopoly, he’ll settle for an oligopoly.” - The Myth of Capitalism (Book)

Cannibal stocks

Quality stocks which heavily buy back their own shares

When outstanding shares decrease, your stake in the company increases

“Pay close attention to the cannibals.” - Charlie Munger

Most of the portfolio will be invested in owner-operator stocks.

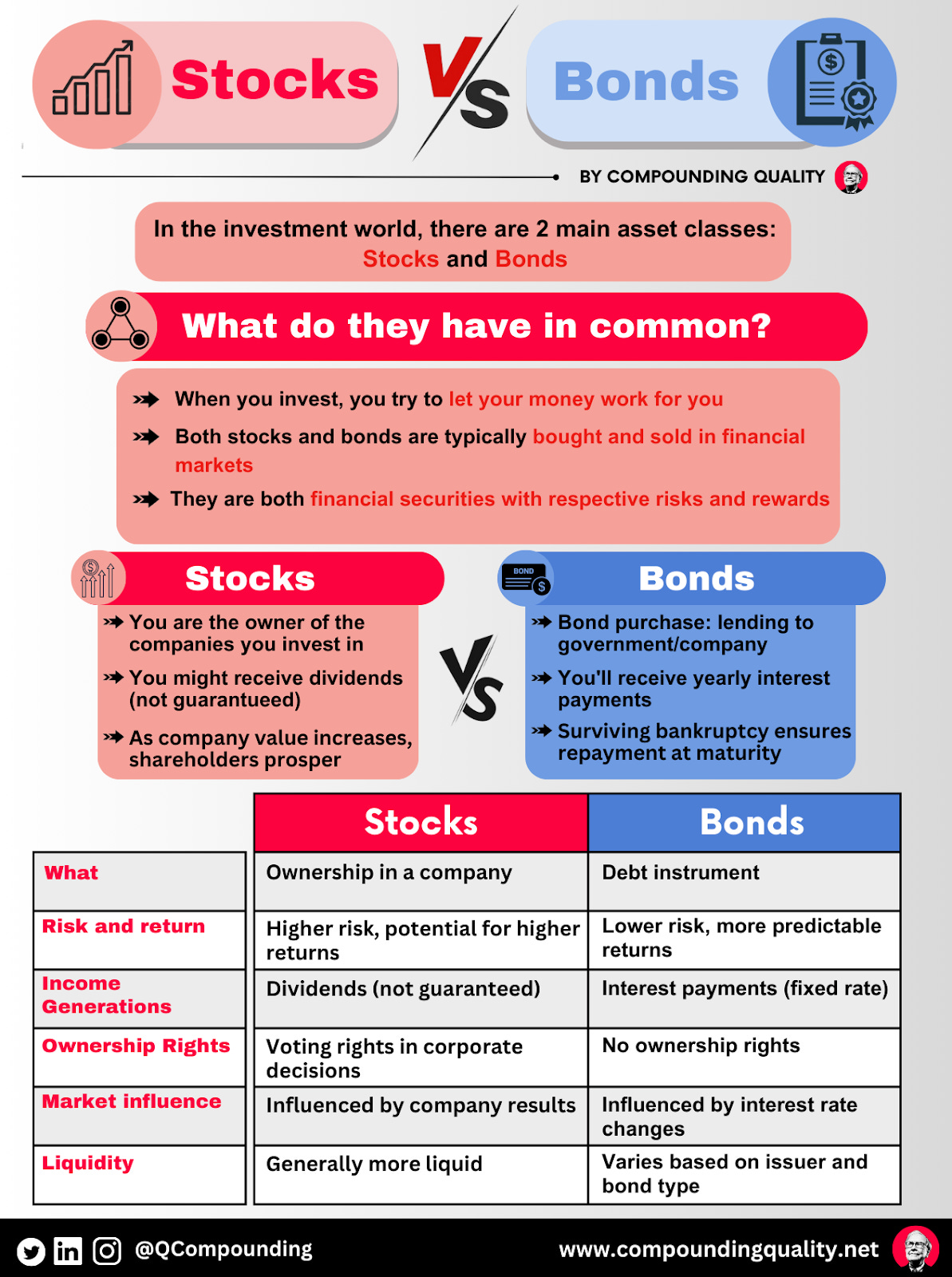

Why do you only include equities?

Good question. For me personally, it's quite simple in the sense that in the short term, it can be risky to invest in stocks. If you are investing in stocks, you should only do it with money that you don't need for the next 5 to 10 years.

There’s a book called ‘Stocks For The Long Run’ by Jeremy Siegel. In his book, he shows that since 1870, stocks have never underperformed bonds over a 20-year time period.

So, in the short term, investing is risky, while in the long term, not investing is risky.

In the long term, stocks are always better investments than bonds. Why? Because you're the owner of these companies, and those assets are generating cash flow for you every single day.

When you invest in equities, you’re making money while you sleep. That’s not the case with bonds or commodities like gold or cryptocurrencies.

Given the time horizons that you look to, do you use market events (such as a Fed meeting) to buy for the long term? Or do you avoid the noise?

I’m really a bottom-up stock picker.

For example, at the company I used to work for as a Professional Investor, people made predictions about interest rate hikes, what the VIX (volatility index) and certain currencies would do…. it doesn’t matter at all, and it will only harm you as an investor. Peter Lynch used to say, “If you spend 13 minutes a year on economics, you’ve wasted 10 minutes.”

All investing is, is trying to buy companies for less than what they’re worth. That’s why you should look at the fundamentals. You want to buy wonderful companies at a fair price.

I also think that, especially in the US, some stocks and some sectors are trading at quite lofty valuation levels. But that doesn’t mean that you can’t find attractive investment opportunities in the market today.

To add one more point, I don't think the next fifty years will be as good as the previous fifty years for stocks. Why? It's quite simple. The main driver for the earnings growth of companies is economic growth. Economic growth is driven by two main factors: productivity growth and the growth of the working population.

When you look at the situation in the United States, but also in Europe, you see that the working population will stagnate or decrease a bit over the next decades. That will make it harder for the economy to grow.

However, this doesn’t mean that you shouldn’t invest in stocks. You should. Investing is the best protection against inflation, and in the long term, stocks will outperform all other asset classes.

Have you noticed any changes in the industry in your time?

From my personal experience, I can spot one clear bubble. It’s everything related to ESG.

Environmental, Social, and Governance. Some stocks are blindly bought just because they score very well on ESG metrics. Professionals don’t care about the valuation. They just buy the company to greenwash their portfolio.

To give you another example, at the company I worked for, you weren't allowed to own Berkshire Hathaway. What's the reason for that? Because Berkshire Hathaway owns BNSF, and BNSF transports coal. That’s just ridiculous if you ask me.

Have you ever been a contrarian?

I'm probably not increasing the reputation of Professional Investors here. But you have the saying, “When you're a professional investor, it's way better to fail conventionally than to succeed unconventionally. Nobody gets fired for buying IBM or Apple.” It’s 100% true.

Recently, I released an article called ‘Foolish Wall Street.’ It talks about what I think is wrong with Wall Street, what you can learn from it as an investor, and what you should do differently as an investor to outperform markets.

In the long term, less than 10% of all professional funds outperform the S&P 500. But there are many great and straightforward strategies which outperform the market. Just think about quality investing or buying low P/E stocks, for example.

It’s the main reason why I created Compound Quality. I wanted to genuinely do the right thing. You really want to use the Buffett-like approach and think in the long term. That’s what really makes the difference.

Regarding a contrarian investment, the fact that Facebook (Meta Platforms) was my second largest position at the end of 2022 is probably a good example.

Do you believe in having an edge in the market?

An investor can have three kinds of advantages.

An informational advantage

An analytical advantage

A behavioural advantage

An informational advantage means that you know something that other investors don’t.

An analytical advantage is being able to do your homework better than others. This one is hard to achieve, especially for large caps such as Apple and Microsoft, … the market is quite efficient for companies like this.

A behavioural advantage means that you can think and act more rationally than other people. This is by far the most interesting one and the most durable. Successful investing is 10% intellect and 90% behavioural.

What advice would you give to your younger self?

Try to become a bit wiser every single day. You can do this by reading as much as you possibly can.

Most people work a 9 to 5. When they get home, they have dinner, watch TV, sports, etc.

But if you just take one hour a day to work on yourself, you will achieve a lot in the long term. If you are passionate about something and are willing to work very hard, you’ll succeed.

We hope you enjoyed the interview. Please be sure to check out and subscribe to Quality Compounding here, and you can subscribe for free below to AlphaPicks.

Thanks for the great interview! It was very nice talking to you guys.

Love what he stands for!