Annual Outlook 2024

Here's the summary of our key views and how to access the full version for free.

Over the course of the past six weeks, we’ve been busy writing up our key views on the main asset classes for 2024.

We dropped the Outlook over on X on Friday. You can read the full 26-page version by clicking here.

But what if you don’t have the time to read it all and just want a clean summary of some of our key views? Don’t worry, we’ve got you…

Stocks

US Large Caps

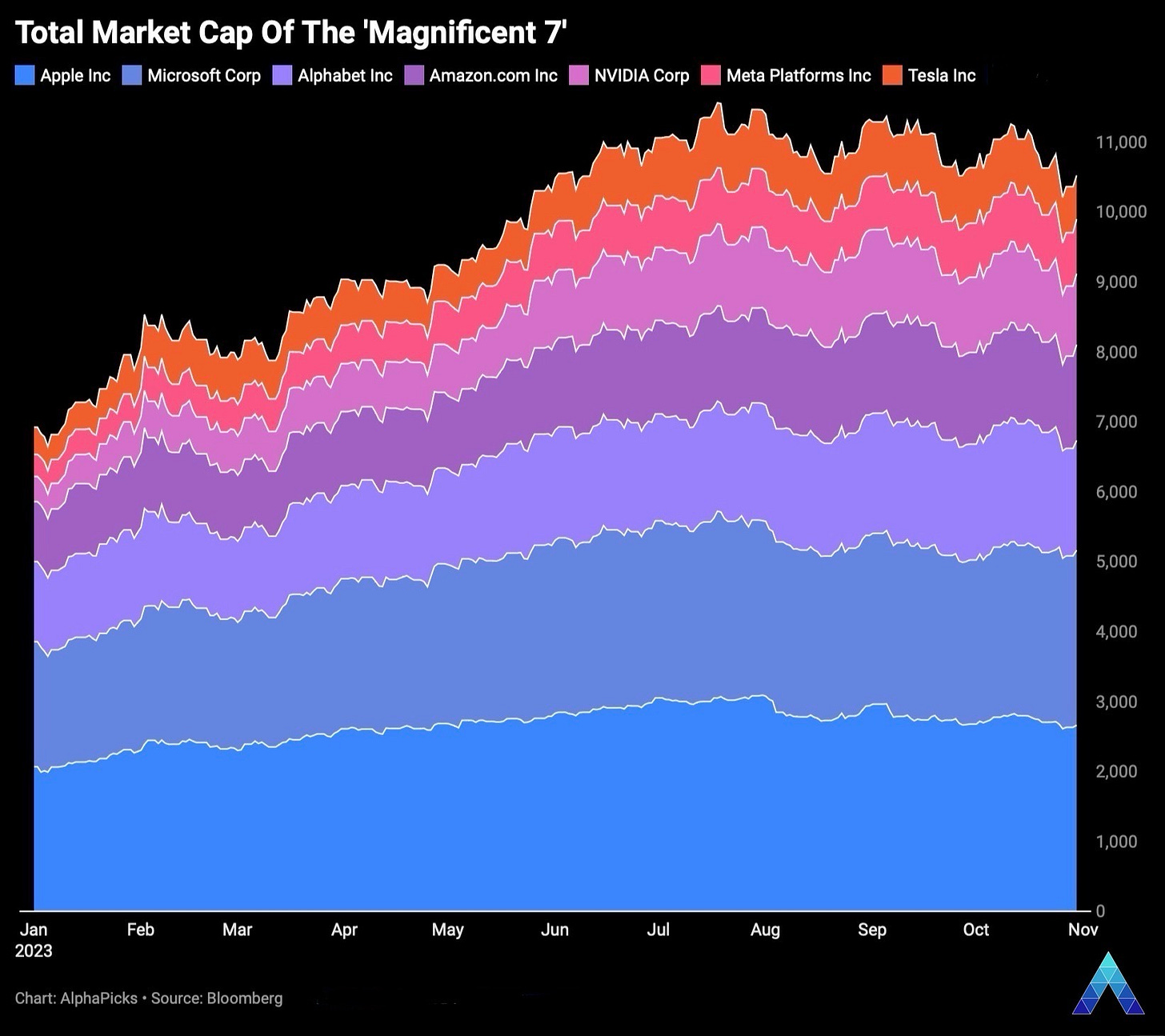

For much of 2023, the focus remained on the Magnificent 7, with the club now including Nvidia following the surge following the quarterly earning call related to sales outperformance driven by AI demand.

Gains have been trimmed (see chart) in Q4, and we forecast that 2024 could be one of much more muted returns for this group. This is based on current valuations and an increase in risk-off sentiment, seeing flows into more defensive sectors.

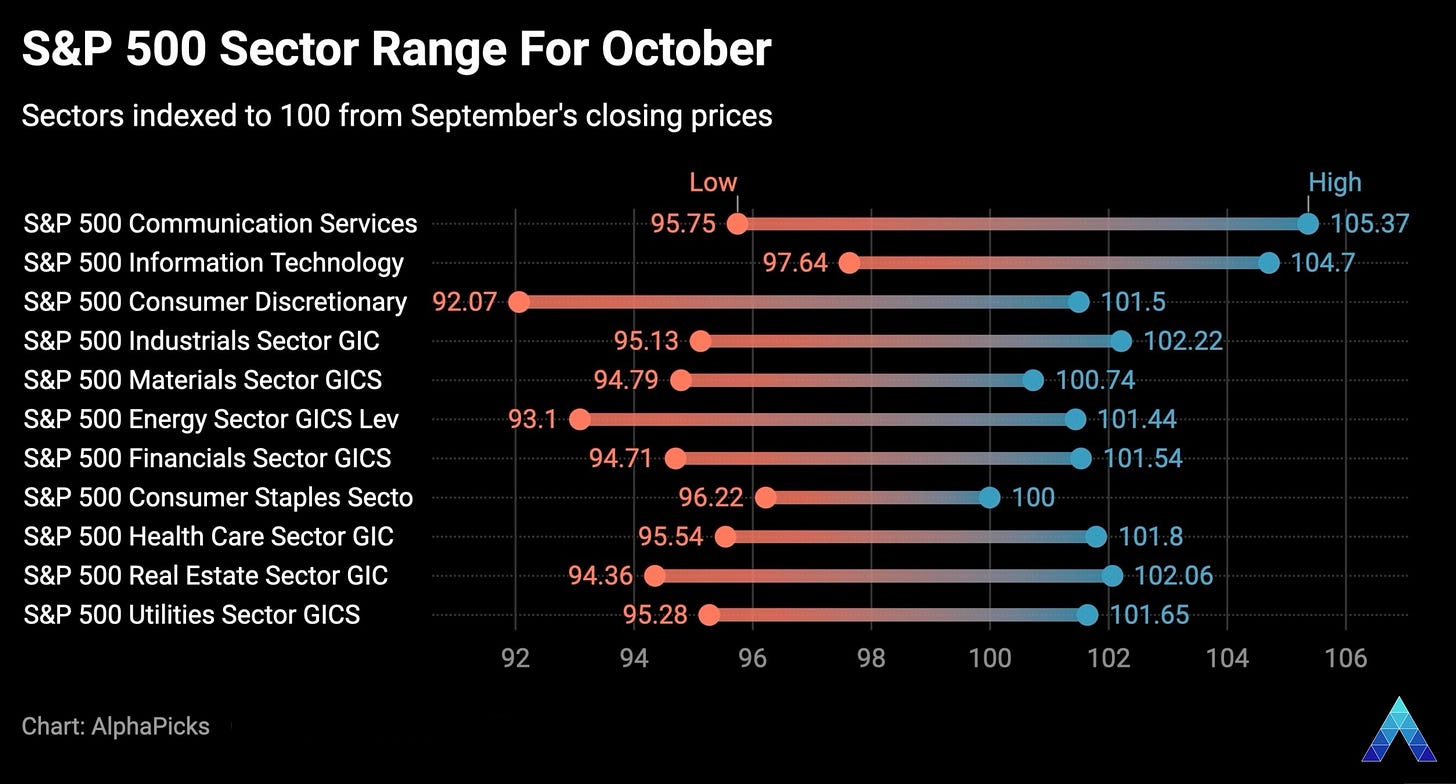

In terms of areas in the large-cap space that we are most bullish on, we like names from the Consumer Staples and the Utilities Sector of the S&P 500. Despite the volatility in the index during October, these were two areas with the lowest drawdown.

The uncertain nature of the market as we go into 2024 makes these sectors our favourites. Low price elasticity of demand and necessity of the goods/services provided should keep revenue stable for these firms.

European stocks

Europe is home to some of the largest luxury stocks in the world, including LVMH and Kering SA. H2 2023 hasn’t proved to be easygoing, with investors concerned about the growth prospects in 2024.

We’d agree with this and feel the large-cap European luxury names could struggle. With it looking likely that Germany will enter a recession, domestic stocks around Europe are probably not going to offer a solid return.

The DAX 40 could escape some of the pessimism due to the international scope of operations. A lot will depend on trade with China and, ultimately, how well China recovers next year.

For those not wanting direct exposure to China, being long a basket of European stocks that trade extensively with the country is one of our favourite thematic ideas for 2024. Our cautiously optimistic outlook on China means that this could offer gains, and if Europe itself shakes off stagflation fears, then it could offer a win-win play.

FX

US Dollar

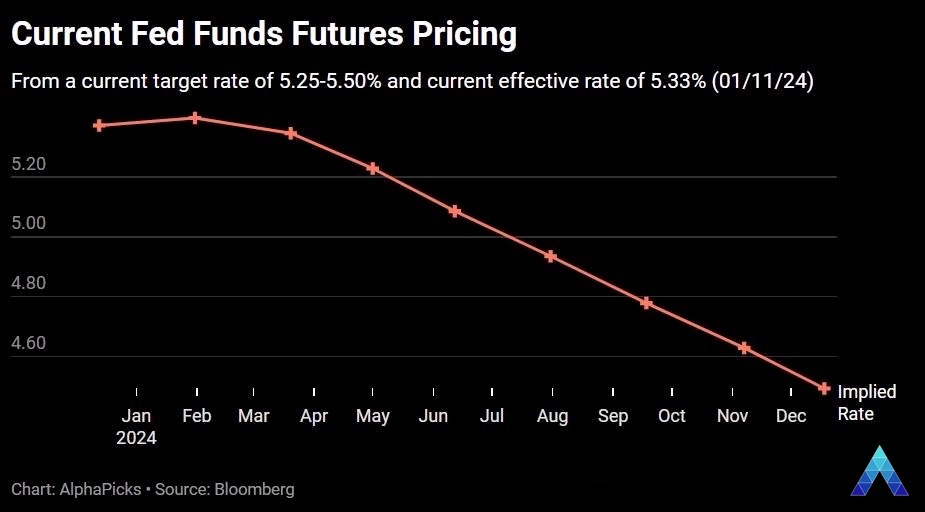

The US Dollar ranked as the third-best performer in the G10 space last year. The elevated yield, thanks to multiple Fed rate hikes and haven demand, should keep it strong in 2024.

With no end in sight for conflicts in Ukraine and Israel, as well as the potential for escalation elsewhere, buying USD remains the favoured play to hide from risk.

Markets still aren’t heeding the ‘higher for longer’ rhetoric. If cuts get priced out next year, further USD strength could be seen.

Another key driver will be the state of the US economy. We argue that the US won’t go into a recession next year. This is based on strong underlying data points from the labour market and PMI surveys.

Add into the mix disinflation, and we feel that the economy will be able to have a soft landing. As a result, the dollar should remain well bid, particularly if other areas (e.g EU, UK) have much weaker economic growth in 2024.

Rest of G10 FX

We admit that we were wrong in thinking that the Japanese Yen would materially strengthen in 2023, as the central bank continued to push back on calls to abandon yield curve control.

However, we feel the situation in Japan will change. The measure from the October meeting to remove the hard fix on 10Ys was just the beginning to let the market regulate itself. Given the severe negative carry versus USD and other peers, finding an attractive way to trade USD/JPY lower isn’t easy.

The other currency we like for 2024 is the Swiss Franc (CHF). It was the best performer in the G10 space in 2023, despite offering a relatively low yield.

The safe-haven appeal at a global level, with a Swiss economy that’s showing remarkable resilience, makes it a solid contender to do well next year.

Combining our bearish EUR view, we like short EUR/CHF as a risk-off hedge to add to a portfolio.

Bonds

US Treasuries

Arguably the closest-watched asset in 2023, US Treasuries helped to provide investors with market expectations of both Fed policy and economic health.

We don’t see any change to the importance in 2024, but the shift will be in seeing if yields buy the ‘higher for longer’ rhetoric. We are Treasury bulls in the short-end of the curve and see yields falling. Looking out to the long-end, we believe the 30Y can climb above 5% as more bull steepening takes place.

The issuance of Treasuries in 2024 is another key point to watch out for. Even for those not directly investing in this space, 2024 will be key to follow as the spillover impact of Treasury sale days is coming into the stock market.

This is shown below, with the main US equity markets exhibiting bigger absolute moves on those selected days than historically.

UK Debt

We are bullish on UK debt (mostly Gilts) in 2024. Even though we feel yields will remain elevated in the short term (helping to be a pillar for GBP carry trades), we expect further rate cuts to get priced in, particularly in H2.

This stems from our view of UK economic underperformance, with some forecasts suggesting a recession. Given the sell-off in the bond market over the past year, there looks to be a good amount of upside to be had here.

We like taking on this trade either in the short-end of the curve or going very far out. For example, the 30Y convexity could mean that a 1% move lower in the base rate would correspond to a significant move higher in the bond price.

Such volatility isn’t suitable for everyone, which is why the short-end could appeal.

The risks to our view include a market flooded with Gilts (see below) and UK surprise economic performance.

Commodities

Gold

Gold is one of the assets we’re the most bullish on for 2024. It appeals to us in multiple different scenarios in how the global economy plays out. If interest rates fall, the opportunity cost of owning gold decreases, likely boosting the price. If rates stay high, but economic conditions worsen, gold likely benefits as a safe haven.

As for the technicals, if we get a break above the triple top around the $2060-2075 region, momentum could propel us significantly higher.

In terms of the risks to our view, a soft (or even no) landing in the US and a peaceful resolution to the conflicts in Ukraine and Gaza both could see XAU/USD fall as investors cycle out of havens and go into risk assets.

Oil

In comparison to the large (Russia-induced) price swings of 2022, Brent and WTI oil have both been relatively non-volatile in 2023.

We hold to a bullish view for 2024, based on continued production cuts from OPEC and higher demand from a stronger China. This ties in with our broader optimistic view of China, who happens to be the largest importer of oil in the world (and keeps demanding more).

In a similar way to our risk for gold, a de-escalation of geopolitical tensions could cause the oil price to fall. This would be a very valid factor for oil, given the production levels of Russia and the Middle East.

Another factor is the decisions of OPEC, the governing body. On occasion, they have surprised in their decision making, and boosting supply could be one of them.