Are Nvidia Shares Overvalued?

Despite a new all-time high this week, the company is better valued than ever.

It’s a great week for Nvidia. An even better one for Nvidia investors.

Why The Rally?

Nvidia has just unveiled a new plan, and investors are ecstatic about it, driving shares up over 6% in the final minutes of Monday's trading session following the news. While much has been made of Nvidia's ambitions to reopen the Chinese market, another plan has been quietly accelerated: the domestic market.

Nvidia is hard at work on a new line of processors aimed at the average consumer end-user, bringing artificial intelligence (AI) directly to the house. Whether you're playing games, changing the backgrounds for video calls or creating your own pictures, the new line of chips will assist you. The prospect of broad AI deployment is both exciting and alarming, with the potential to destabilise a wide range of economies.

This is a big step for Nvidia and AI in general. Much of the news over the last year has been about AI disrupting corporate worlds. But this latest move emphasises the potential of AI for everyone.

But Is It Overvalued?

Despite continuing its insane rally and hitting a new all-time high this week, we wouldn’t say Nvidia is overvalued. In fact, we could argue the stock is the most undervalued it has been in several years.

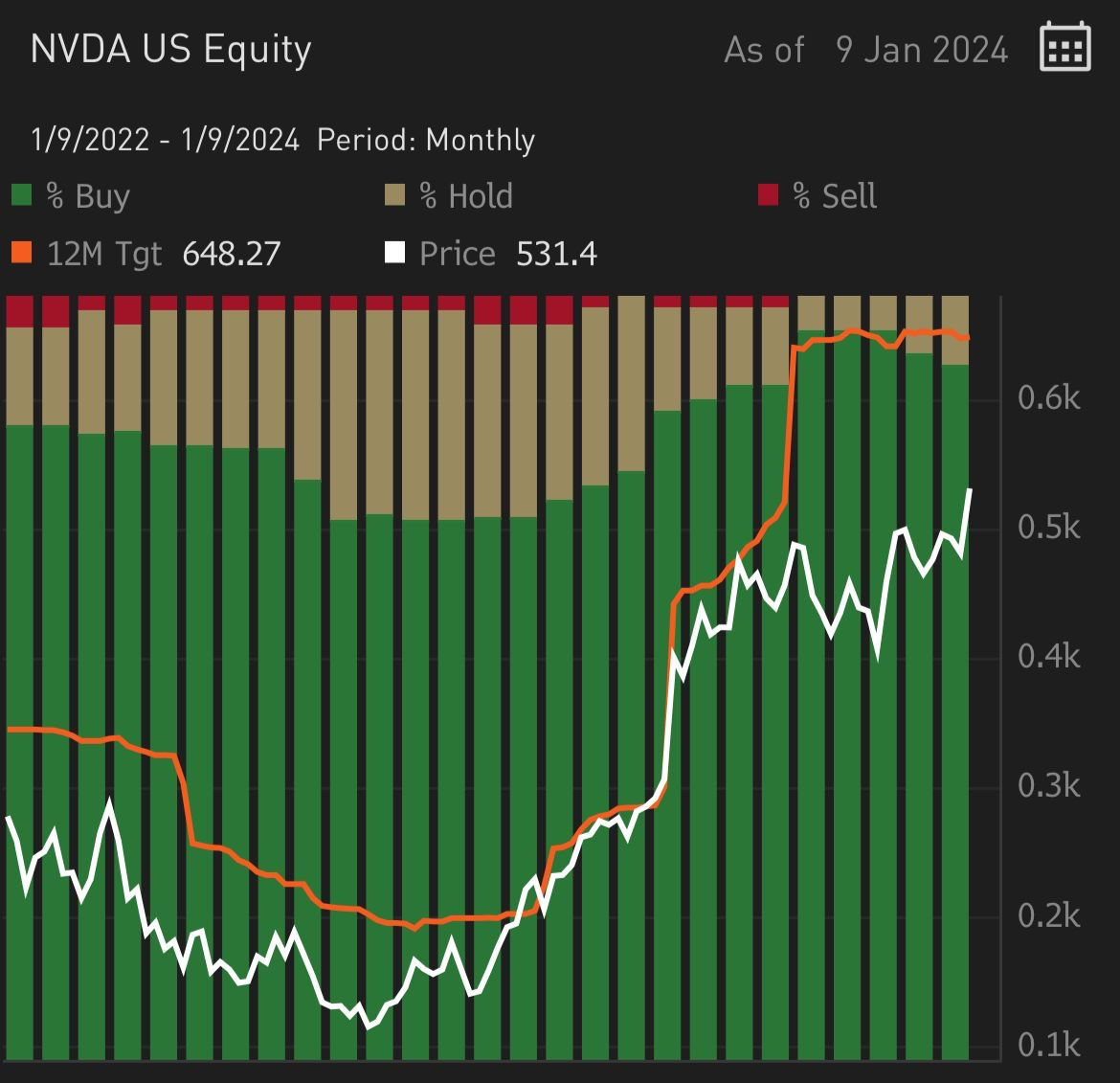

Up $55.7 (11.7%) in just the past four trading days, Nvidia closed at $531.40 yesterday. Of the current 65 analysts that cover the stock, 59 have a current buy rating, with 6 holds and no sells. The average 12-month target share price is $648.27. So, on the analyst front, there is still much more to come from this move.

But the reason for being able to make the statement that Nvidia is still cheap is that even with the sharp rally, the stock still trades with a blended forward price-to-earnings ratio of 26.2. This isn’t that expensive, given that AMD is at 38.0 and Marvell Technology is at 32.3.

In fact, the chart below goes some way to showing how the stock could actually be noted as good value to buy right now. The current blended forward P/E ratio is shown as the white line, which is close to 2-year lows. This is far below the orange horizontal line, showing the 2-year average of 39.3 and well off the highs of 60+ seen in Q2 last year.

For more value stocks, you can check out our screener here, which was updated this week.

According to UBS analysts, the AI business will produce $420 billion in yearly revenue in 2027, a considerable increase over the previous prediction of $300 billion. This equates to a staggering compound annual growth rate (CAGR) of 72% until 2027. UBS forecasts that the market for GPUs and AI processors will increase at a 60% annual pace during the forecast period, rising from $16 billion in 2022 to a whopping $165 billion in 2027.