Are We Near A USDJPY Reversal?

Almost.

Lots of talk has been made about a yen reversal. Many think that it is inevitable that the Bank of Japan will intervene at some point. And many more have been caught on the wrong ends of trades trying to time a bottom on the yen. But there may be more to consider for a yen reversal than just BoJ intervention.

Not long after the dollar-yen ticked past year-to-date highs on Monday, the yen caught a bid, and the pair made a swift 0.45% move lower.

However, it was nothing more than a technical move. The same level that the yen saw some strength on October 21, 2022, and also on June 15, 1989. Alongside the frequently mentioned 150.00, 151.90 has been a key pivot for the dollar-yen.

There will be a turning point, opening up an opportunity many have anticipated (albeit overly).

Weak, Even Against Sterling

The currency has been fragile for an extremely long time. Its strength (or lack thereof) against the dollar has halved in roughly a decade, now at a level not seen since the early 90s.

A case can be presented about the pound also being a weak currency. Since 2020, it has lost a third of its purchasing power due to inflation. It is an outstanding decline that would be worthy of a complete article. Against gold, sterling has lost 90% of its purchasing power since 1999.

But when we look at the pound-yen, it is at eight-year highs. It goes to show how weak the yen has become.

The yen is the world’s third most important currency behind the dollar and the euro, as the latest triennial survey of turnover in the currency markets shows (survey taken in April 2022)—the 17% accounts for $ 7.5 trillion, estimating about $ 1.3 trillion of daily trading volume.

Why So Weak?

The primary cause of weakness is that the Bank of Japan (BoJ) has not hiked rates in contrast to other central banks, particularly the US Federal Reserve. It has disregarded growing inflation (perhaps due to Japan's protracted struggles with deflation). To cap rates, the BoJ has been printing digital money and using it to purchase astronomical amounts of government bonds.

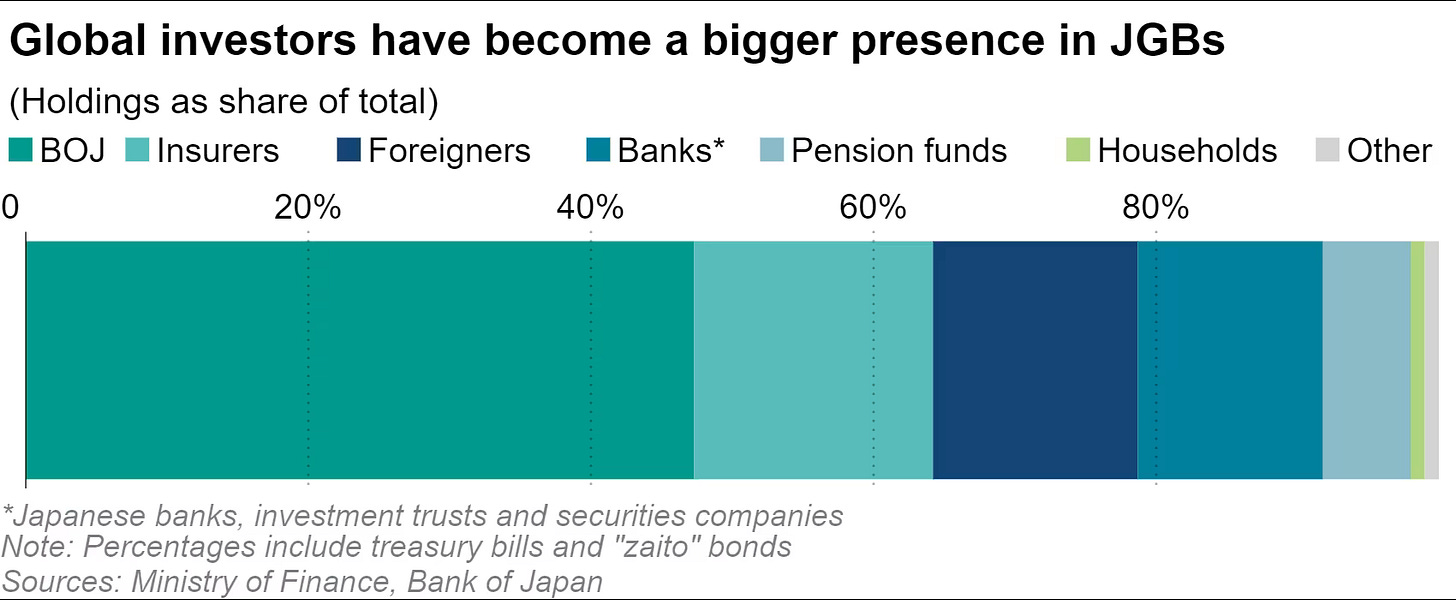

Over half of Japan's national debt is currently owned by the BoJ. Stats like that stand out. How is it feasible to purchase so much debt and print so much money without apparent repercussions?

The yen carry trade results from suppressed rates, which involves borrowing yen at a low cost and holding foreign currencies that produce higher returns. However, the carry trade tends to reverse swiftly, as it did in 2007 and 2008. When there is panic, the carry trade unwinds. So, the yen can act as a safe haven asset.

(For a further explanation of a carry trade, use this link)

The dollar-yen is not a stranger to big price swings. As mentioned, the yen has lost 50% of its value since the start of the last decade. But we can note some large dollar slumps, too.

Between April ‘90 and April ‘95, it declined over 50%.

Between August ‘98 and November ‘99, it declined over 30%.

Between June ‘07 and October ‘11, it declined nearly 40%.

Between June ‘15 and June ‘16, it declined over 20%.

An Even More Volatile Pair

The same cycles as the dollar pairing, but with more of a punch: The sterling-yen. Two swings brought more than 50% reversals, and two got nearly 40%.

Given the significant reliance of the British economy on finance, a robust financial sector is typically accompanied by a strong pound. When there is a market panic, money runs to the yen, and sterling sells off. The pound and the yen have an inverse relationship as a result.

This pairing will likely be where the yen reversal trade lies.

Japanese Government Bonds

The weak yen has boosted overseas demand for currency-hedged Japanese government bond investment. Due to overseas buyers taking advantage of Japan's low borrowing costs, the proportion of JGBs held by foreign investors has surpassed that of Japanese banks for the first time.

Foreigners held 14.5% of JGBs and other government debt at the end of March, more than the 13.1% held by domestic banks, investment trusts and securities companies, Finance Ministry data shows.

Distortions created by the central bank's policies have contributed to the changes in the market. “The BOJ's continued large-scale JGB purchases led to the reversal” between domestic banks and overseas investors, said Kazuhiko Sano of Tokai Tokyo Securities.

Policy

It can be tempting for US investors to overlook the influence of other monetary authorities with all of the focus on the US Federal Reserve. Thanks to the policies of the BoJ, which have allowed investors to borrow cheaply in yen and then invest in other nations that provide higher returns, Japan has been able to become a major source of finance for investments for more than ten years. But that may be changing.

In the rest of this article, we highlight one more key reason that will contribute to a yen reversal and how to trade the move.