"Are You Buying The Dip?"

Why that's the wrong question to be asking.

Wednesday saw the NASDAQ record the worst day since 2022. The headlines focused on the sharp drop in the index, combined with the loss from the S&P 500 and Russell 2000 of over 1%.

It might have only taken one session, but the most asked question we had in conversation was the one we framed in the title of this piece.

Let’s be straight, some will see this as a dip to buy. Others will see it as a start of a longer term move lower. Yet amongst all of this, we feel there’s a better question to be asking. Namely, how are you rotating sector exposure?

Sure, this doesn’t sound as sexy. But the move we are seeing is less about buying the overall dip, and more about a pivot out of tech and AI and into other sectors.

Today, we run through some views from the Street about the moves over the past couple of days, along with adding our own thoughts on where to be positioned.

Before we get into the article, you can become a premium subscriber with us for just $20 a month. This provides you full access to our weekly articles without a paywall, including our flagship Monday trade ideas and full access to what we are buying and selling in our Global Asset Portfolio.

Goldman Aren’t Convinced

Scott Rubner, a strategist at Goldman Sachs, put out a note citing why he won’t be buying the dip in US equities.

He has the view that the S&P 500 could continue to correct lower, based on factors including weak seasonality, stretched positioning and the subjective view that all the good news for H2 is priced in.

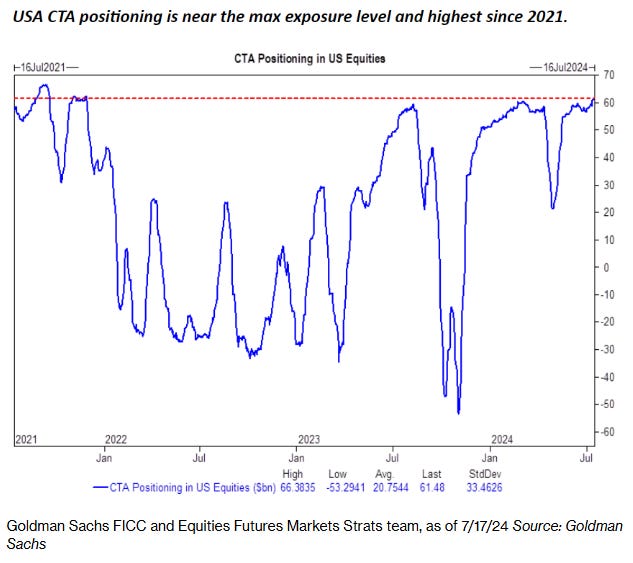

In terms of stretched positioning, the reference is to the below CTA positioning model:

As for takeaway trades, he advises buying Nasdaq 100 and The S&P 500 December lookback put options.

EXPLAINER: What Are Lookback Put Options?

Vanilla put options give the holder the right but not the obligation to sell an asset at a pre-determined strike level at a future date.

Adding a lookback feature changes this. The lookback means that the holder has the right to sell the underlying asset at its highest price during the option's life.

In effect, on expiry you can look back over the life of the option and pick the place to sell.

Naturally, these type of options are very expensive versus buying a normal put option. Usually they are traded if you feel a very large price movement is due, or sometimes for a specific hedging requirement.

What caught our eye more than this note was one put out by another Goldman colleague, Jim Covello.

He was talking about AI more broadly in his comments that:

“Most technology transitions in history, particularly the ones that have been transformational, have seen us replace very expensive solutions with very cheap solutions, potentially replacing jobs with tremendously costly technology is basically the polar opposite.”

One of the most important lessons I’ve learned over the past three decades is that bubbles can take a long time to burst.”

Although Covello isn’t outright bearish on AI or US equities in general right now, it’s a real pause for thought that a lot of investor cash has piled in to the sector on the assumption of commercial use cases. They will need to continue to see this become a reality in order to rationalise their investments (especially during any drawdown period like we might be at the start of now).

Talking About Rotation

One of the best lines we saw following the rout on Wednesday was that this was the first time since 2001 where the Nasdaq dropped by at least 2.5% and the Dow Jones recorded a gain.

We think this speaks volumes about how the move we are seeing isn’t just a ‘sell everything’ move, but rather a sector rotation. So let’s run through it, using as a benchmark the performance from midday Wednesday:

Rotating out of…

Information Technology

This was the area hit hardest by outflows, which is why the tech heavy Nasdaq took the brunt of the pain. Within this sector, semi conductors were the big loser.

Part of the reason for the rotation out of IT came from TSMC, with the stock down heavily following Trump’s comments that “I think Taiwan should pay us for defence” as well as stating “they did take about 100 percent of our chip business.”

Another factor at play was the rumours circling from the Biden administration that they are considering using the more trade restrictions available if companies continue giving China access to advanced semiconductor technology.