Back to Petroleum

How BP became the mess everyone wants to fix... or own.

Once upon a time, BP stood for “Beyond Petroleum.” Today, it feels more like “Back to Panic.” The once-proud British oil major is now stuck in a corporate identity crisis, wedged between the ghosts of ESG past and the hard cash logic of today’s energy markets. The share price says it all: down a quarter since 2019, underperforming U.S. peers, and firmly out of favour. But where there’s dysfunction, there’s opportunity.

This is a trade about pressure. About a company so compromised by strategic whiplash, scandal, and investor revolt that it will either have to reinvent itself or sell itself. And that’s exactly what interests us.

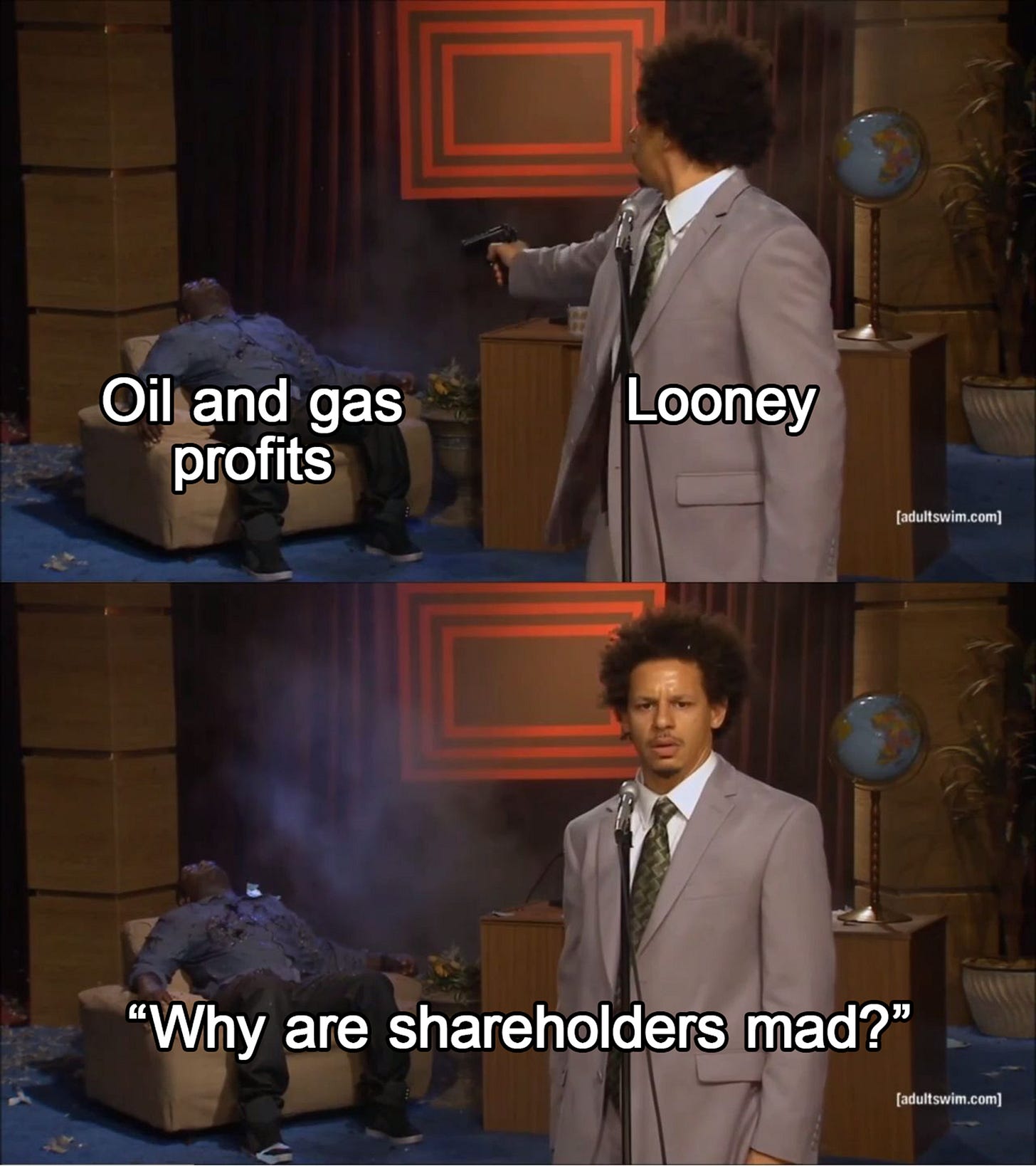

Looney Tunes

BP has spent the last five years attempting to ride two horses: decarbonisation and dividend discipline. In the end, it fell between them. The company made a headline-grabbing pledge to slash oil production by 40% by 2030, only to later walk it back to a 25% cut. Then it decided the future was fossil fuels again, just with a little more PR.

This wasn’t a pivot. It was a U-turn. The architect of the net-zero crusade, Bernard Looney, flamed out in 2023 amid the kind of HR scandal that would be banal if it weren’t so on brand: he failed to disclose relationships with colleagues. You’d think the CEO of a global oil major would be clear on disclosure rules.

Enter Murray Auchincloss, who described BP’s ESG era as having gone “too far, too fast.” His February 2025 “reset” involved a reversion to hydrocarbons, characterised by increased oil and gas capital expenditures, deep cuts to renewables, and a plan to offload $20bn in assets by 2027. It was supposed to be a bold new chapter. Instead, investors gave it a collective shrug.

The Revolt Has Begun

That shrug is turning into a shove. Elliott Management has quietly taken a 5% stake in BP and is now agitating for change. This is not a friendly suggestion. Elliott doesn’t do friendly. They do exits, restructurings, and C-suite reshuffles.

BP has already begun cleaning house. Helge Lund, the outgoing chairman and loyalist to the ESG era, squeaked through his re-election with a protest vote from 24% of shareholders. Not exactly a mandate. Giulia Chierchia, EVP of strategy and sustainability, is out. The boardroom is under siege. And rightly so.

Because here’s the uncomfortable truth: BP’s debt has been falling but is still high, its daily production has been dropping for some time now, cash flow is middling, and it’s trailing every major competitor on both sides of the Atlantic. This is Exxon and Chevron’s world now. BP is just living in it… until someone decides they shouldn’t be.