Back To The Cocoa Futures

In every sustained commodity price rally, there’s a moment when fundamentals — supply, demand, inventories — no longer matter.

This week, the spotlight isn't on altcoins or AI-related stocks. Instead, all eyes are on cocoa futures.

Cocoa futures surged past $10,000 per metric ton on Tuesday, marking an unprecedented milestone and representing a remarkable 140% increase for the year. During Monday’s trading alone, futures prices escalated by $710 per metric ton, establishing a new record for the largest one-day change.

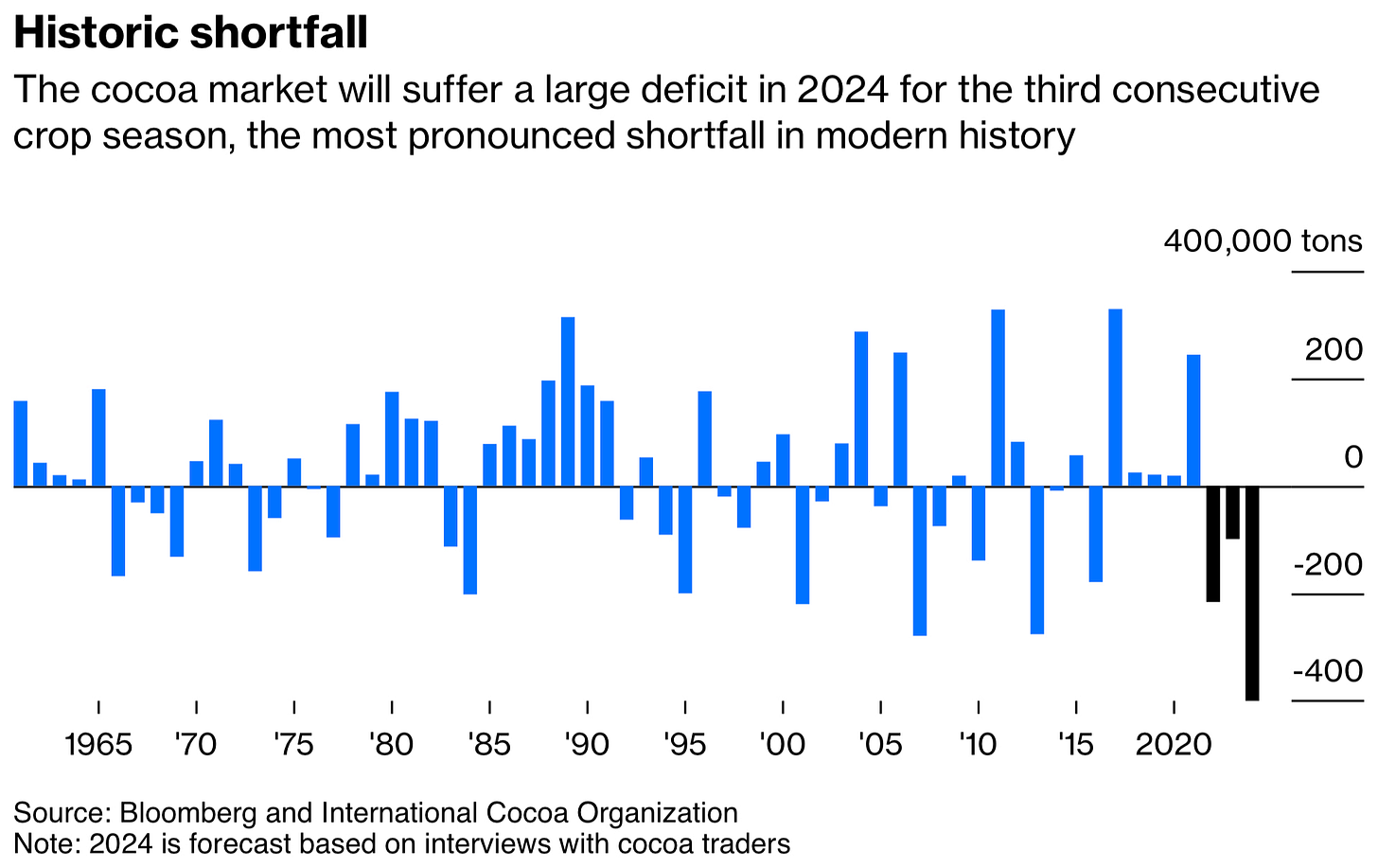

This remarkable surge in prices is attributed to underwhelming harvests in major West African cocoa-producing countries such as Ghana and Ivory Coast, which have been adversely affected by unfavourable weather conditions and crop disease.

And unsurprisingly, hedge funds have been right in the mix in this price surge.

Not the cause but the driving force

Adverse weather conditions and diseases affecting cocoa trees initially triggered the surge in cocoa prices. However, the momentum has been further intensified by the influx of hedge fund activity.

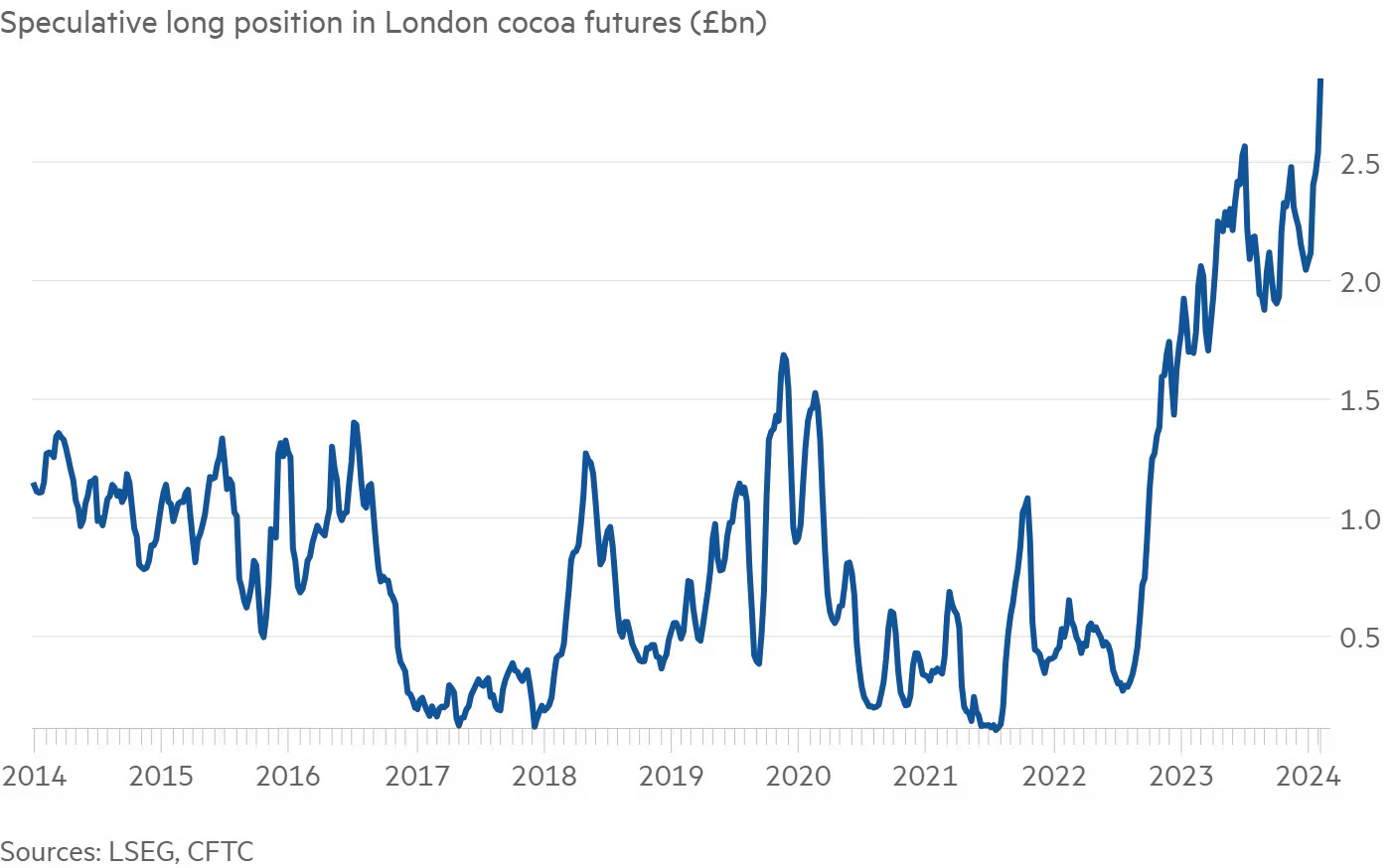

Speculative traders have recently built up a substantial $8.7 billion position in London and New York cocoa futures contracts, indicating their belief in continued price increases. This is the largest position ever recorded in dollar terms, based on data from the Commodity Futures Trading Commission.

The resulting profits for trend-following hedge funds in 2024 have been significant. As a result of this activity, the price of cocoa in London reached a historic high of £4,757 per ton last Friday, more than doubling from the previous year. Similarly, New York cocoa futures have also seen a surge, reaching an all-time high of $5,888.00 per ton.

Cocoa has been the single biggest contributor to profits at algorithmic funds this year, according to a portfolio compiled by Société Générale.

It’s tough for companies to operate as usual. Major cocoa processors, who transform cocoa beans into cocoa butter, are struggling to secure an adequate supply to meet the demand from chocolate makers, according to analysts and traders. The high concentration of hedge fund investments and the resulting market volatility have made it more challenging for processors to hedge their exposure to price fluctuations.

Impact on the broader market

The current imbalance between supply and demand in the cocoa market is expected to continue in the near future, putting upward pressure on prices. Adverse weather conditions and disease outbreaks are unlikely to be resolved quickly, and global demand for cocoa remains strong. As a result, consumers will face higher cocoa prices as chocolate companies pass on the increased costs to maintain their profitability.

Though the large chocolate companies were well-hedged last year and did not have to immediately pass on high prices to consumers, there is only so much the industry can do to absorb costs.

Continued cocoa prices at current levels will keep eating into chocolatiers’ profits. It would be impossible to inflate prices on the consumer to match the increased costs. It’s not a good outlook for a major name like The Hershey Company (NYSE: HSY).

Here's a crazy stat for you: Cocoa is now more expensive than copper.

Oh, and here’s a crazy deal for you: 14 days free, so you can read all the alpha we publish along with our weekly trade plans (and access the release of our portfolio, but don’t tell anyone else that yet. Full announcement soon)

Interesting dynamics for the cocoa trading houses

A trading house is a business that specialises in facilitating transactions between a home country and foreign countries. It is an exporter, importer, and trader that purchases and sells products for other businesses. Trading houses provide a service for businesses that want international trade experts to receive or deliver goods or services.

A trading house may also refer to a firm that buys and sells both commodity futures and physical commodities on behalf of customers and for their own accounts. Prominent commodity trading houses include Cargill, Vitol and Glencore.

Here are some of the major players in the cocoa markets:

There’s an interesting dynamic going on as these companies need to hedge themselves… and avoid getting margin called.