Basis Trade Blowouts

Why the growing Treasury market presents problems for the Fed.

We read with interest the different takes this week to the release of a Brookings Institution paper entitled “Treasury market dysfunction and the role of the central bank” by Anil Kashyap, Jeremy Stein, Jonathan Wallen and Joshua Younger.

The paper spoke about the fragility of the U.S. Treasury market and proposed strategies for the Federal Reserve to mitigate future disruptions. Part of any potential disruptions comes from hedge funds playing the basis trade, where funds try to profit from small price differences between the Treasury and the corresponding futures contract.

We wanted to run through some of our own musings on the topic to end the working week.

Key report takeaways

There are three main points that should be taken from the report:

Increased Treasury Supply Heightens Market Fragility: The authors highlight that the U.S. Treasury debt held by the public reached $28.3 trillion (96% of GDP) by the third quarter of 2024 and continues to grow rapidly. This escalating supply of Treasury securities may exacerbate market fragility as the capacity of traditional market participants to absorb and intermediate this debt becomes increasingly strained.

Diverse Market Participants Contribute to Instability: The authors focus on the roles of three key types of institutions in the Treasury market: asset managers, broker-dealers, and hedge funds. The interactions among these entities, each with distinct incentives and constraints, can lead to episodes of market dysfunction, particularly during periods of stress. This is where the basis trade problem comes in…

Central Bank Interventions Are Essential Yet Complex: The authors discuss the Federal Reserve's interventions during the March 2020 market turmoil, where it purchased over $4 trillion of Treasuries and government-backed mortgage securities to stabilise the market. They suggest that as the Treasury market expands, the Fed may need to play a more active role in ensuring market stability. But are such interventions going to be a moral hazard?

The basis trade

Let’s rewind quickly to talk through a strategy that’s used by some hedge funds to make money from the Treasury market. It’s usually contained within the ‘relative value’ camp or under more general arbitrage trading.

It hinges on the fact that the actual cash Treasury bonds can have a different price to the futures market that is supposed to track it. Treasury futures can (and do) trade at a slight premium or discount to the price of the actual cash Treasury bonds. This difference arises due to factors like funding costs, supply/demand imbalances, and periods of time with low market liquidity.

So, for example, let’s say the futures contract price is 115, but the cash bond is at 114. A fund would short the futures contract and buy the cash bond, expecting prices to converge. If correct, this would bank the difference (115-114) as a profit.

It’s only a small arbitrage, but as it’s perceived as being a relatively safe trade, funds like to get involved. Because of the small price differences, it needs to be put on in large size in order to make any kind of serious money.

With the futures contracts, leverage is already there based on initial margin requirements, so the notional can be beefed up. Then often they use repo agreements to finance the cash Treasury purchase as well.

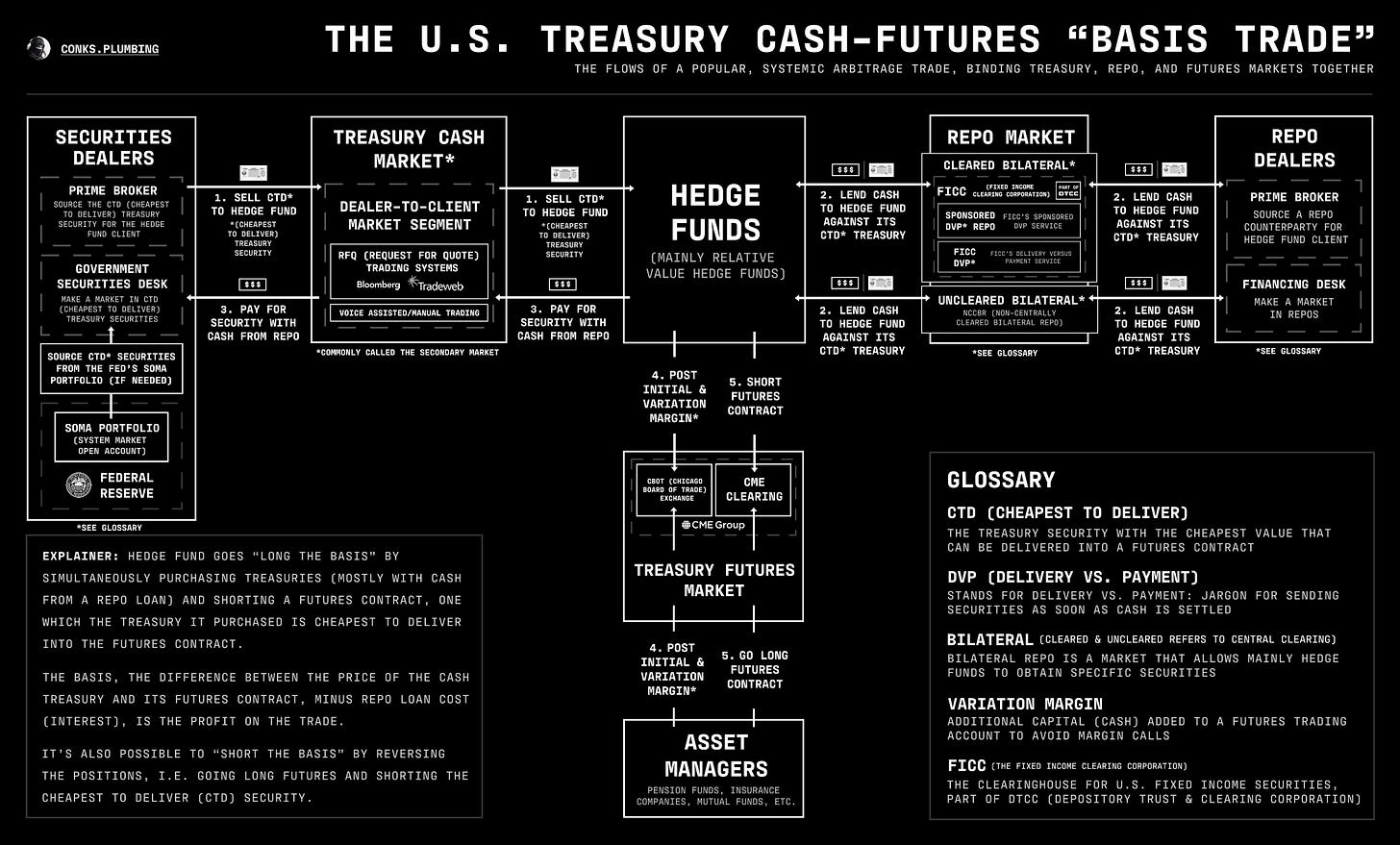

For a more complete visual, see the below from a good friend of ours, Conks Plumbing. His infographics are exceptionally well put together:

Now, let’s circle back to the report…

One strand of the reasoning from it revolves around the risks posed to the Fed and the market in general around concentrated positions in basis trading.

We’ve already seen this get twitchy back in March 2020.