Bear-ly Still Credible

Mike Wilson’s outlook change highlights why analyst forecasts are immaterial.

We didn’t have this one on our bingo cards for the week. Mike Wilson, one of Wall Street’s most prominent bears, has just turned positive about the outlook for US stocks.

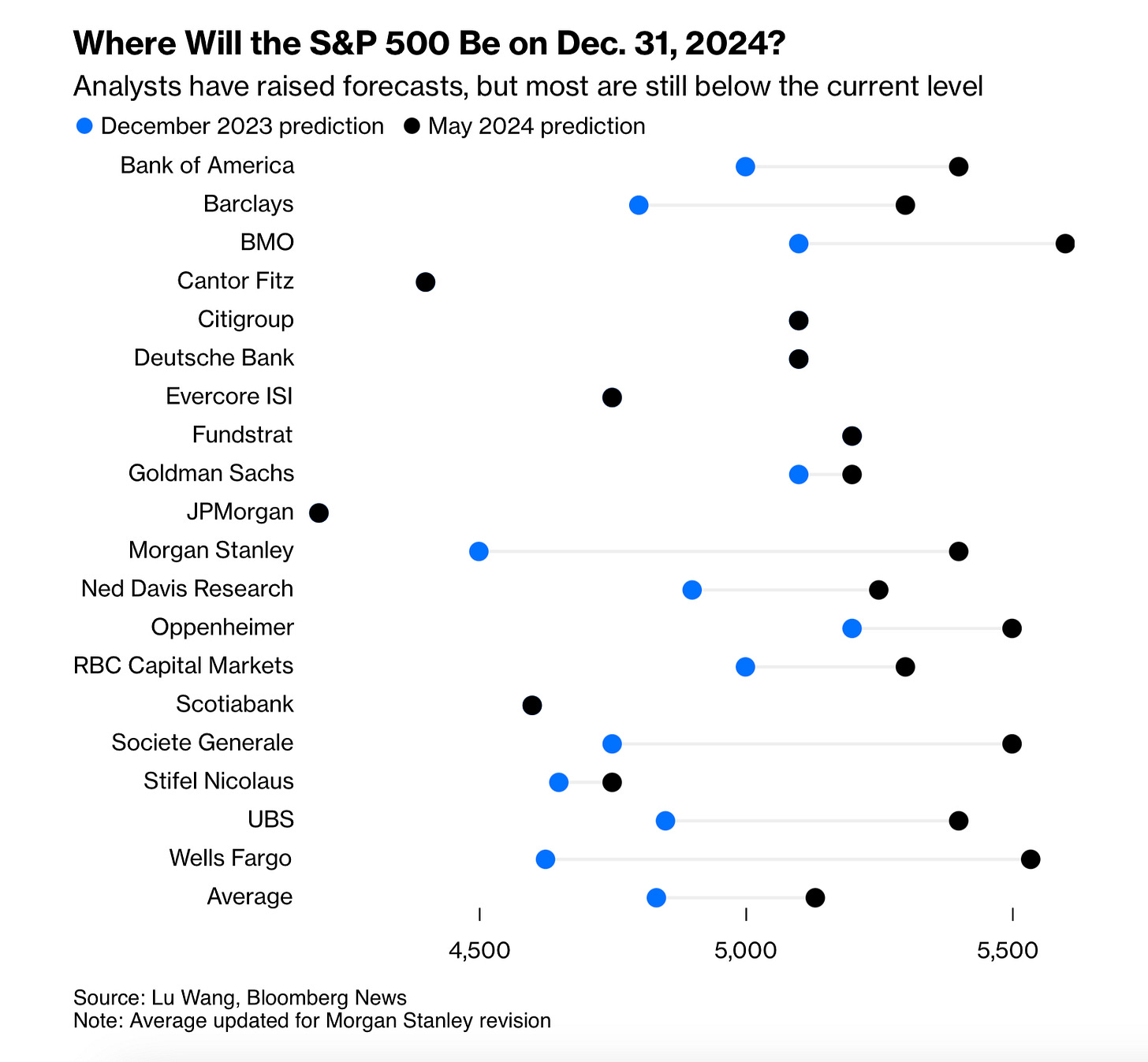

Morgan Stanley’s Mike Wilson has revised his forecast for the S&P 500, anticipating a 2% increase by June 2025. This marks a significant shift from his previous prediction of a 15% decline by December. Despite his bearish outlook in 2023, which did not align with the market’s continued upward trend, he has now adjusted his target for the S&P 500 to 5,400 points from 4,500. Consequently, his forecast, which previously ranked among the lowest on Wall Street, now anticipates a new record for the index.

Should you pay attention to analysts?

The short answer: Probably not.

The forecasts made by individuals, even those working for influential firms like Morgan Stanley, about where an index will be more than seven months from now should not be given much weight. These predictions are based on models with inherent assumptions that are inevitably imprecise and unable to account for future events.

If anyone ever knew exactly where the markets would be at a future point in time, they would not tell anyone. Also, keep in mind that 80% of managers will not tell the general public what they’re actually thinking. Why would they?

Let’s examine the reason for Morgan Stanley’s change of heart, the last bear standing on Wall Street, and some lessons for traders/investors.

Why the change?

An important reason behind the change in outlook is the dispersion of macroeconomic views, which have undergone numerous shifts since the start of 2024. This has led forecasters to converge more closely, resulting in fewer outliers on certain key perspectives. Additionally, macro investors have placed greater trust in the Federal Reserve, while stock investors have relied more heavily on corporate guidance.

The weekend note also cites a base case for earnings growth of 8% in 2024 and 13% in 2025, helped by top-line growth and margin expansion. By Q2 2025, the 12-month forward price/earnings multiple for the S&P 500 will be 19 times on aggregate earnings for June 2026 of $283, equating to 5,400.

Wilson also wrote, “Truth be told, our ability to forecast the P/E over the last year has been poor, and while we are confident valuations are too high, we have little confidence in our ability to predict the exact timing or magnitude of this normalization.”

The forecast provides a base case scenario with a bullish target of 6,350 for the S&P 500 index in the next 12 months, as well as a bearish target of 4,200. Wilson still seems to have a strong inclination towards the bearish scenario.

Below are December 2023 predictions compared to the most recent forecasts. Some analysts are unchanged at this moment, but no analysts have revised their forecasts negatively.

Wilson also discusses the ongoing undervaluation of recession risks, emphasising Morgan Stanley’s long-standing recession probability indicator based on financial markets and the New York Fed's measure using the Treasury yield curve. There is a significant and tangible risk of a hard landing:

One bear left

There is one prominent bear still standing. JPMorgan’s Marko Kolanovic.

In a note to clients late Monday, Kolanovic advised clients not to buy stocks, citing high valuations, prolonged restrictive rates, elevated inflation, consumer stress, and geopolitical uncertainty.

“A negative stance on equities has hurt the performance of our multi-asset portfolio over the past year,” he acknowledged while adding, “We do not see equities as attractive investments at the moment, and we don’t see a reason to change our stance.”

Among the big Wall Street banks, JPMorgan has the lowest year-end target for the S&P 500 at 4,200, implying a drop of more than 20% from Monday’s closing level.

Citigroup and Goldman Sachs have year-end projections at 5,100 and 5,200, respectively, suggesting limited upside from current levels. However, neither Citigroup’s top equity strategist, Scott Chronert, nor Goldman Sachs’s David Kostin, have issued warnings of an imminent market downturn similar to those from the JPMorgan team.

The strategist restated his recommendation for a defensive portfolio stance, advising investors to allocate less to equities and credit and more to commodities and cash.