Bill Ackman Is Right But For The Wrong Reasons

His latest short bond trade might be profitable, but we're not sure his reasoning is 100% correct.

Pershing Square co-founder Bill Ackman might not have the acclaim or legendary status of a Warren Buffett, but people do still sit up and listen when he talks through his latest big idea.

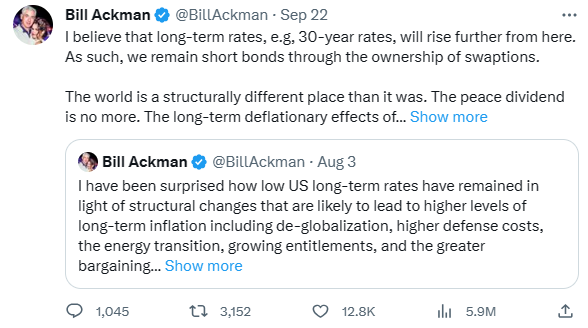

The latest one came last month, when he posted on Twitter that he was shorting 30yr Treasury bonds:

The tweet itself was fairly long and detailed his reasonings on his trade. Late last week, he felt the need to flag up his continued view on this trade:

Before we get into the details of why we feel he’s right for the wrong reasons, let’s briefly run through the trade.

Ackman and the 30yr

Ackman has the view that he believes US long-dated yields will rise. Or put another way, that the bond price will fall. To express this view he has purchased interest rate swaptions.

Swaptions are a derivative that combine a swap and an option (hence the name). When bought, it gives the buyer the right (but not the obligation) to enter into an interest rate swap.

For Ackman, he’d be a payer on the swap, in the sense that he would pay the fixed rate and swap for floating. If the floating leg (the US 30yr yield) rises, he would profit.

How’s the trade going?

When Ackman posted the tweet, the 30yr was at 4.10%. It’s currently at 4.67%. Given the nature of the leverage on swaptions, this move has been very profitable for him.

We don’t know exactly when he entered the trade, or the notional size, but imagine this will get disclosed in the future (and cue the inevitable gushing headlines).

He mentioned a target of 5.5% in his initial tweet, so see scope for him to hold this trade for the time being.

In the rest of this article, we’ll discuss:

Why Ackman entered into this trade based on inflation

Why we think the 30yr yield has risen due to a higher real rate

How retail investors can get a piece of the action