Blackout Before Lift-off

The Fed can’t see, but it knows where it’s going.

The calendar for Fed speakers this week has been stacked ahead of the blackout period beginning this weekend. Despite some of the rhetoric being overlooked by some in favour of surging precious metal prices and President Trump’s twitchy typing fingers, we got the clear vision from Powell and Co about what to expect for the upcoming October FOMC meeting.

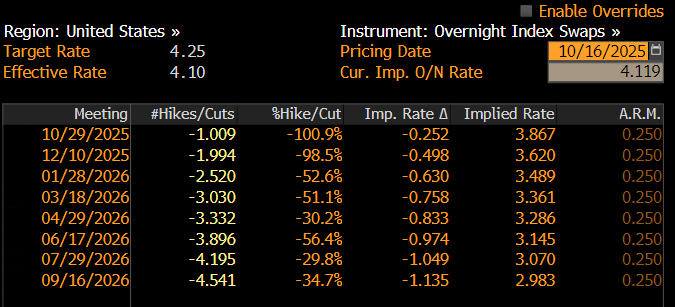

Sure, they’re flying blind when it comes to data prints due to the ongoing government shutdown, which has led us to look at short October SOFR futures heading into the week, with a skewed risk/reward from implied rate pricing tightening.

However, the messaging on the labour market, inflation and the balance sheet was clear, leading us to see a clear rates trade to implement.

Powell Reinforces October Cut, Focuses on Balance Sheet

Powell’s Tuesday speech struck a careful balance between acknowledging progress on inflation and recognising growing risks to the labour market. Yet in reading between the lines, the overall tone clearly points toward a 25bps cut for October, consistent with market pricing.

Speaking at the National Association for Business Economics conference, he highlighted the Fed’s dual challenge: the economy has held up better than expected, but hiring momentum is clearly fading. Powell described “tension” in the data (growth looks firm, yet labour demand is softening) and made clear that the Fed will remain data-dependent and cautious in adjusting policy.

On inflation, Powell noted that price pressures have moderated, with core PCE running below 3% and long-term expectations still anchored around 2%. He downplayed the risk of renewed inflation acceleration, attributing recent stickiness to tariffs and supply-side noise rather than overheating demand. That gives the Fed more room to focus on employment risks, which he said “have moved higher” as job openings narrow and private payroll data weaken.

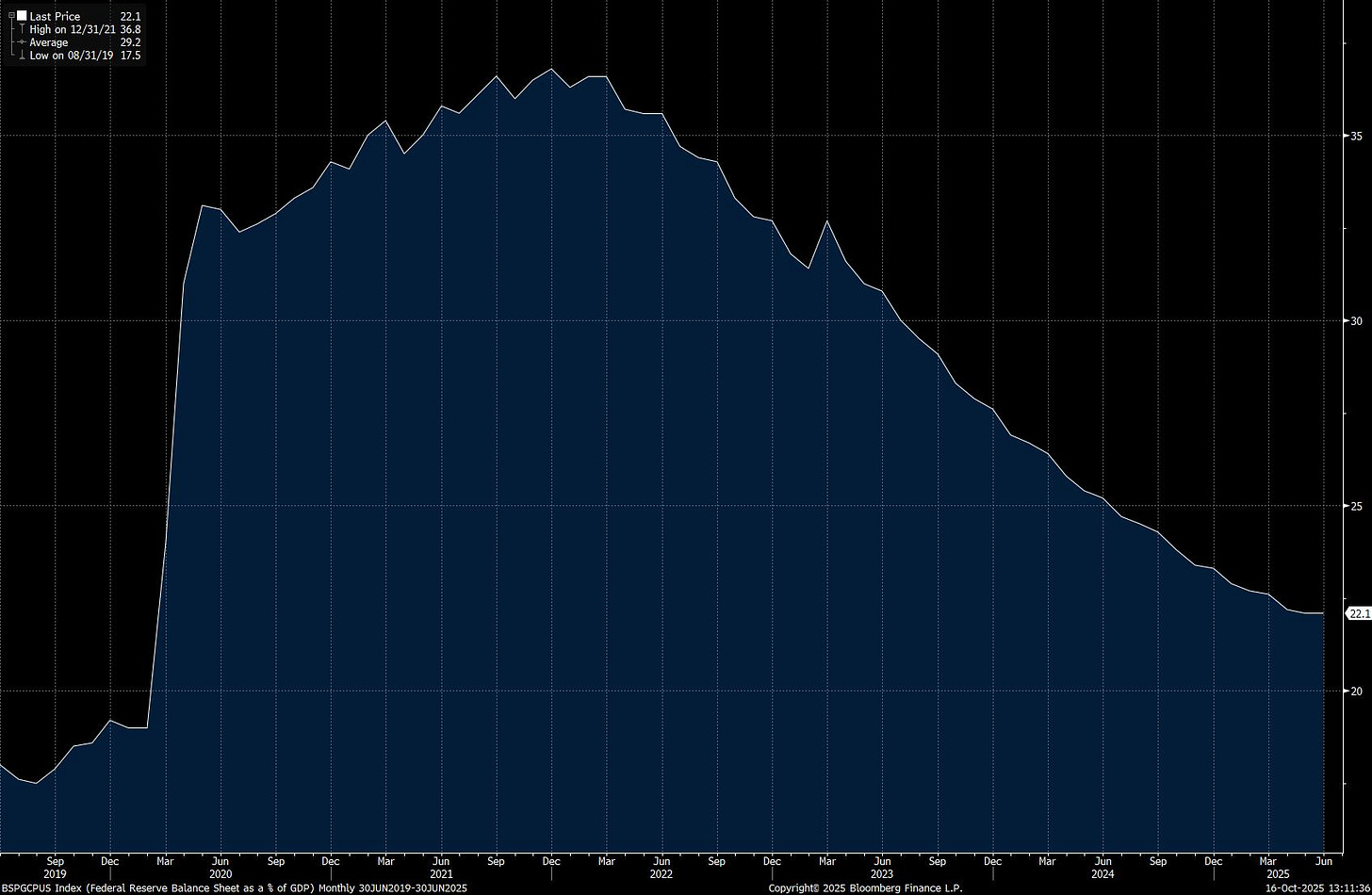

The most notable section of the speech focused on the balance sheet. Powell reaffirmed that the Fed intends to end quantitative tightening before reserves become scarce, effectively signalling that the pace of runoff could slow or pause in the coming months. His comments on maintaining an “ample reserves” framework were aimed at stabilising market expectations around liquidity management—a subtle hint that the Fed is preparing to shift from contraction to neutral footing.

Key Implications:

Powell keeps the door open for multiple cuts into 2026, while pretty much nailing on an October move.

A controlled easing cycle is his push, cushioning downside risks without reigniting inflation or signalling panic.

Watch for a potential QT end date to be given, or a preferred balance sheet notional size.

Beige Book Confirms Narrative

The Fed’s beige book provided some thoughts on Wednesday in a finger-on-the-pulse view that has survived the government shutdown. It painted a picture of an economy that’s largely flat, with muted growth and emerging downside risks. Across the twelve districts, three reported modest expansion, five were essentially unchanged, and four noted slight declines in activity. Consumer spending is softening, manufacturing remains sluggish, and real estate continues to show signs of stress. The tone overall: stability on the surface, but clear fatigue underneath.

With regards to the finer details of the report, along with the thoughts of multiple other Fed speakers, we’ve bucketed comments in key focus areas, then distilled them all into trade ideas.

Data Blackout

Powell called government data the Fed’s “gold standard,” warning that the shutdown threatens to blind policymakers just when clarity is most needed. With official releases on hold, the Fed is leaning on private-sector proxies — credit card spending, payroll processors, and freight data — but Powell admitted the substitutes won’t cut it: “We don’t expect we’d be able to replace the data we’re not getting.” If the blackout drags on, October’s figures might never be collected, although this doesn’t appear to be a major concern for voting members ahead of the October meeting.

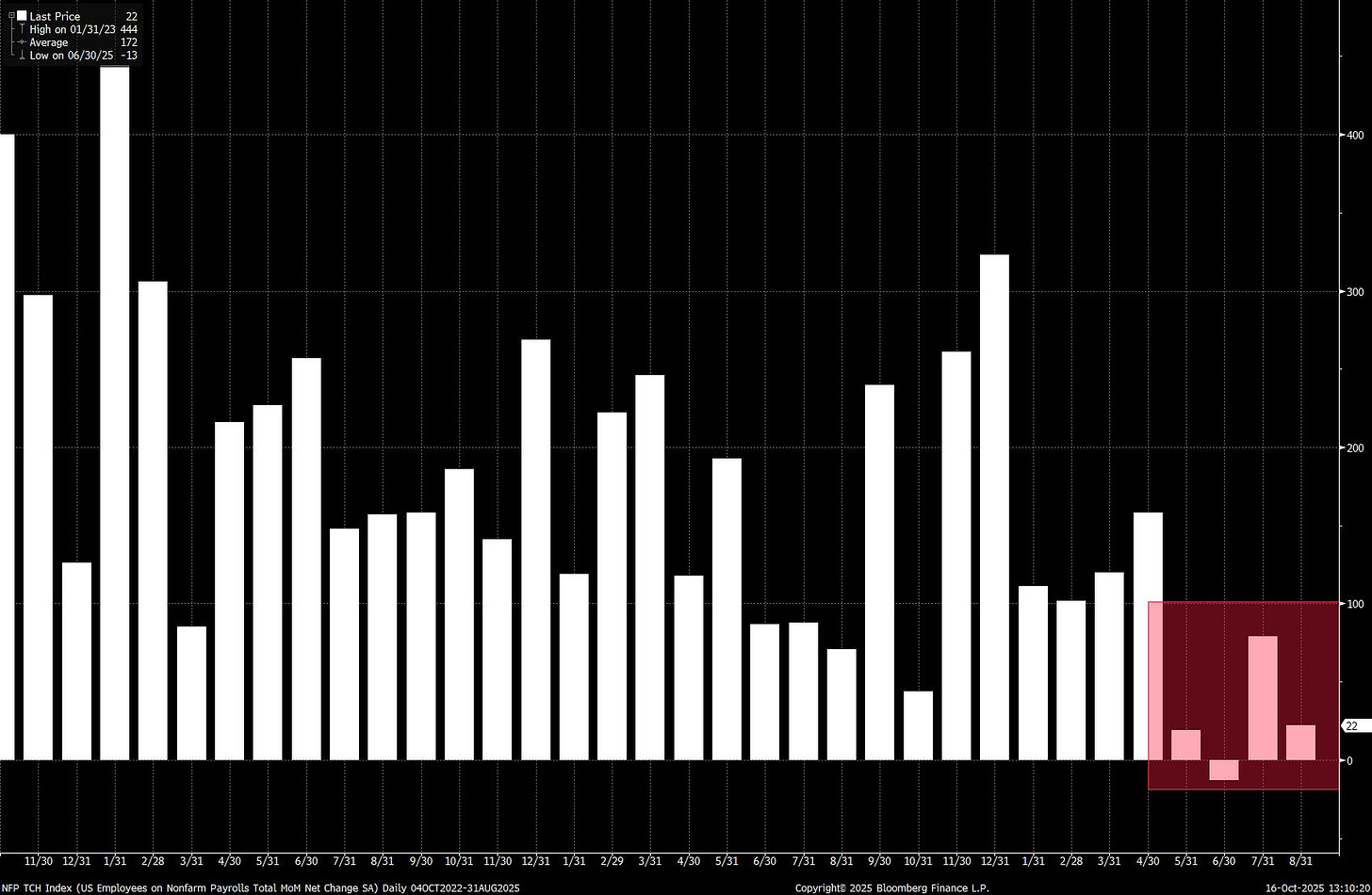

The Labour Market

Fed Governor Waller didn’t sugarcoat it: “Job growth has probably been negative the last few months.” The Beige Book echoed that tone. Demand for labour is fading, even as firms resist large-scale layoffs. Attrition is doing the heavy lifting. Wages are growing only at the margins, mostly where skills are scarce.

The broader read is that the labour market has stopped fueling inflation and is now cushioning it. St. Louis Federal Reserve President Alberto Musalem expects a gradual cooling, but flagged the risk of a sharper slowdown if hiring freezes turn into firings.

Balance Sheet Runoff

Powell signalled the Fed’s balance sheet runoff may soon pause—a quiet but meaningful pivot. “We may approach that point in the coming months,” he said, hinting reserves are nearing the level consistent with “ample conditions.”

Translation: liquidity is tightening faster than desired, and the Fed doesn’t want a repeat of 2019’s repo crunch. Fed official Miran backed that view, saying further runoff offers “little marginal benefit.” With labour data weakening and easing expectations rising, Powell’s message reinforced the shift from tightening to preservation.

The size of the Fed’s balance sheet as a % of GDP is getting close to pre-pandemic levels:

Inflation

Musalem estimated tariffs now account for roughly 10% of current inflation but expects those effects to fade by mid-2026. Still, the Beige Book shows pricing pressure hasn’t gone away. Input costs are rising faster than selling prices, squeezing margins across sectors.