Bonds are the Scorekeeper

Musings on Musk and the 10-year, growth scares in the U.S., China tensions, Germany elections, and the PCE print.

As much as Elon Musk wants to take a win from his seemingly informal stint in government, ultimately, Wall Street will decide the success of his efforts.

10-year yields rallied from 3.6% in the run-up to the election (as Trump’s odds were rapidly increasing) and continued their incline through to the start of this year. The message to the new administration was loud and clear: the bond market was sceptical, calling for stronger proof that the budget cuts were effectively contributing to reducing the overwhelming budget deficit and tackling the rising national debt.

As is usually the case with Elon, he voiced his thoughts. “The bond markets do not currently reflect the savings that I’m confident we can achieve,” he said. “If you’re shorting bonds, I think you’re on the wrong side of the bet.”

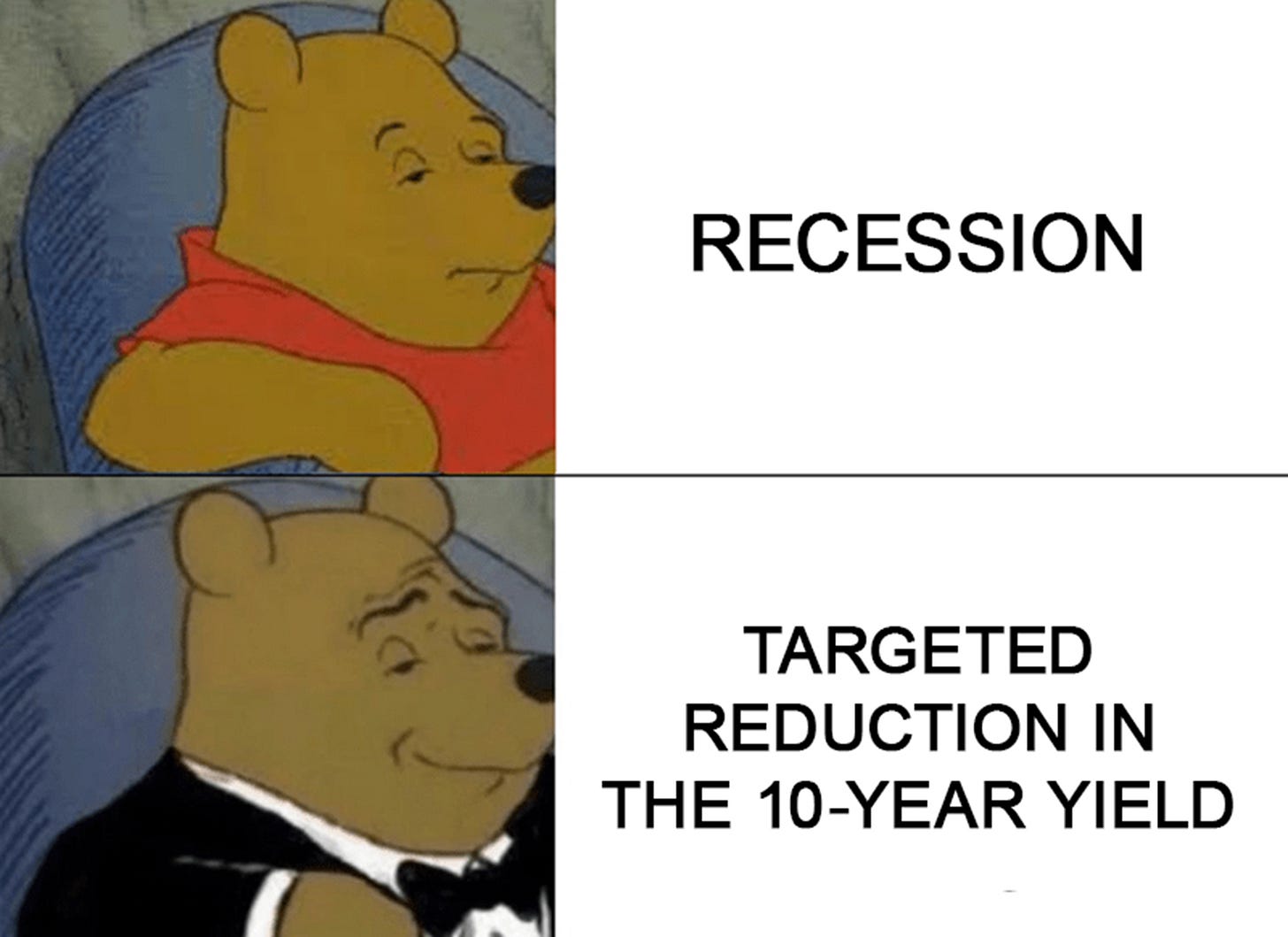

While Elon may not hold the same level of influence on Wall Street as someone like Warren Buffett has done in the past, his expressed opinions could indicate a shift in Trump’s underlying stance. The success of Trump 1.0 was self-signalled by the continuing new highs in the Dow Jones (a quick search on ChatGPT suggests he tweeted about the market over 200 times). With Musk and Treasury Secretary Scott Bessent advising him as he embarks on his second term, the spotlight has now turned to a different key indicator—the yield on the 10-year Treasury bond.

With good reason, though. The Federal Reserve wields significant power through its control of short-term interest rates and influence on stock market sentiment. However, the 10-year Treasury rate primarily dictates borrowing costs for both homebuyers and major U.S. corporations. If this rate were to decline, the shift could also spark quicker economic growth and help rein in the troubling rise in the government’s annual interest expenses.

That leads us to the next topic.

The Growth Scare

U.S. markets are signalling a classic growth scare. Key sectors like industrials (white), financials, and materials have seen notable breakdowns, while defensives, utilities, and staples (yellow) are catching a bid. At the same time, bond yields have compressed—a clear risk-off shift. The economic data backs this up: weak retail sales, a significant miss in services PMI, soft housing numbers, and cautious consumer commentary all paint a concerning picture to end Q1, but not one that currently calls for doom and gloom.

The services PMI laid out the core issue—businesses are increasingly citing political uncertainty as a drag on activity and new orders. Federal spending cuts and policy risks are weighing on economic confidence, which in turn is shaping inflation and growth expectations.

Last week’s abrupt reversal in high-beta trades—think growth, meme stocks, momentum names—tells the same story. February saw persistent retail buying in U.S. equities, but with seasonality effects, tax-loss considerations, and diminishing liquidity into March, there’s reason to tread carefully.

Adding to the pressure, reports emerged (and were later confirmed by at least one sell-side shop) that Microsoft has started cancelling leases with certain data centre operators. This is an interesting story in itself, and maybe the next AI race is how quickly megacaps can cut committed AI capex spending. We might dive into this story more on Friday. This appears to have had ripple effects across the AI infrastructure chain, amplifying last week’s moves. In the near term, Nvidia’s upcoming earnings will be key—the market likely expects a strong print, which could offer a short-term boost to sentiment in the space.

In Europe, positioning looks much fuller than before, raising the question of whether investors will “travel and arrive” around the German elections once hedges unwind. The broader thesis remains intact—capital is shifting away from the Mag7 and into other global opportunities. Meanwhile, meme stocks and retail-favorite names in the U.S. still appear vulnerable. That said, there’s a short-term trading opportunity in momentum… buying the dip might make sense here.

Big picture: U.S. data suggests quality remains the best bet. One final thought linking back to the intro: can the largest employer in the U.S. cut payroll without triggering a slowdown? Someone ask Mr. Musk.

We move onto a few notes that we’ve made on China, Germany, PCE and buying bonds.