Buffett And Berkshire Back To Their Best

Berkshire Hathaway is a microcosm of the broader market, highlighting the breadth and depth of this rally.

Berkshire Hathaway jumped to a record high after its Saturday earnings report showed an operating profit for Q2 that exceeded Wall Street expectations.

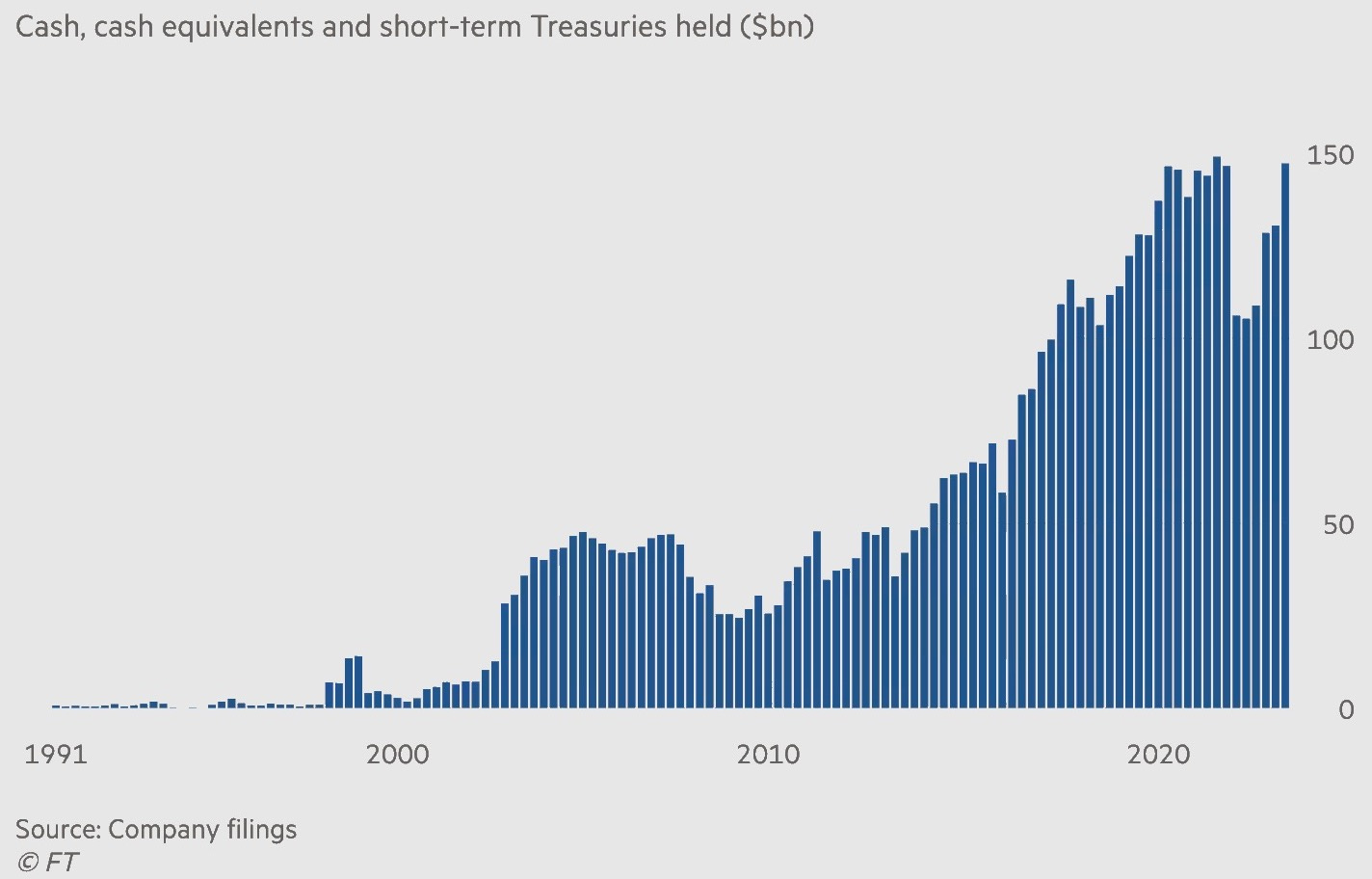

Shares closed 3.6% up on Monday’s trading and edged higher again on Tuesday. The 17.3% rise YTD has been mainly due to the earnings outlook improving over the last 9 to 12 months as interest rates have increased and cash balances are back to approaching record levels for the company.

Before we get into the rest of the article, please leave a like on this post if you enjoy it. The engagement really helps us out.

Earnings

Berkshire Hathaway’s operating earnings after taxes rose 6% to $10 billion in the second quarter, the company reported Saturday, marking a new quarterly record, while overall results swung to a profit of $35.9 billion from a loss of $43.6 billion in the year-earlier period due to gains in the company’s equity portfolio.

Insurance underwriting earnings recorded a 74% increase to $1.25 billion, benefiting from higher interest rates and lower catastrophe losses. The solid performance in insurance helped offset the softness in railroad due to lower volumes.

The railroad unit, BNSF, saw profits fall 24% as freight volumes dipped, and an increase in headcount and wage inflation contributed to higher costs for compensation and benefits.

Buffett’s investment income from the cash it stockpiles in short-dated US Treasuries also contributed towards the quarter’s income.

Berkshire’s stock repurchases totalled $1.4 billion in the second quarter, compared with $4.4 billion in the first quarter and $1 billion for the year-earlier period.

In the rest of this article, we’ll take a look at:

How the company benefits from its heavy cash reserve

Why Berkshire is a microcosm of the broader market illustrating the depth of this rally

The part Apple has played this year for the stock price

Takeaways from the report

Berkshire Hathaway's cash pile surges towards a record

Berkshire’s massive cash pile grew to $147.38 billion at the end of June, near a record and much higher than the $130.62 billion in the first quarter. Now that interest rates are higher, Berkshire can profit significantly from its cash.