Bulls Ignore Geopolitics, For Now

A weekly look at what matters and how to trade it. (January 12th)

The first full trading week of 2026 delivered a familiar outcome. Equity markets powered to fresh highs, but on politics, not data, this time.

Price action was dominated by a flurry of White House interventions that cut cleanly across sectors. Energy stocks led from the opening bell after President Trump signalled US oil companies would be central to reviving Venezuela’s energy industry, a move reinforced by a late-week rally in crude. Materials and industrials followed, while defence names rebounded sharply as the administration floated a $1.5 trillion security spending proposal ($500 billion above current levels), reversing an earlier selloff tied to threats of limits on dividends and buybacks.

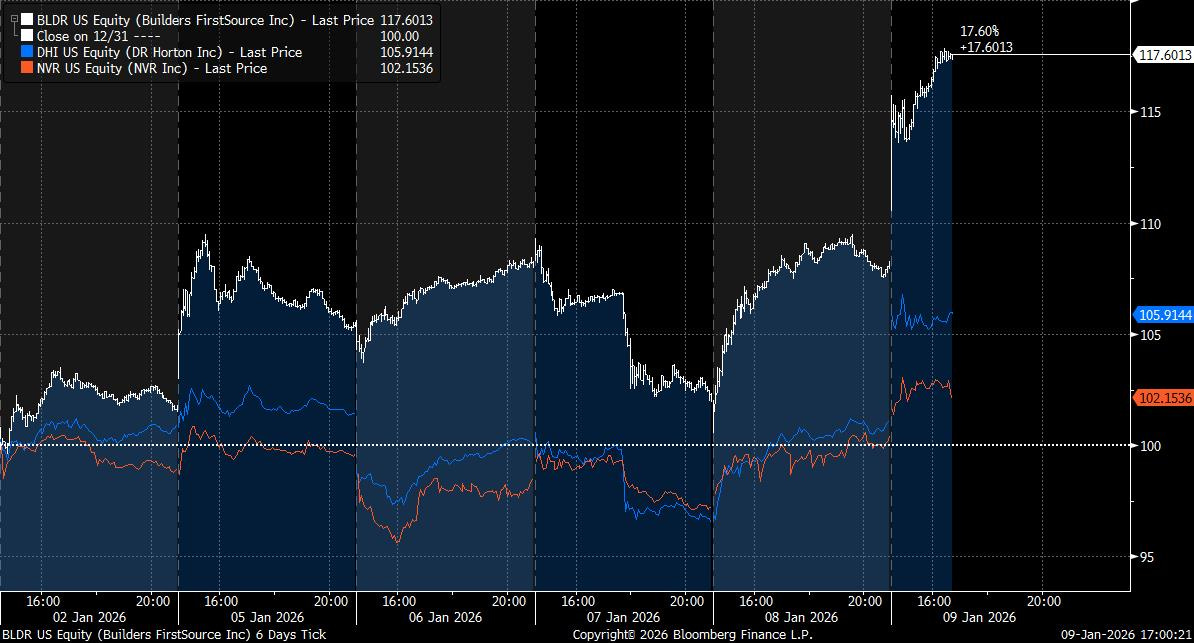

Housing policy was the other major accelerant. Trump’s directive for Fannie Mae and Freddie Mac to purchase $200 billion of mortgage-backed securities lit up homebuilders and consumer discretionary stocks, with analysts estimating a meaningful compression in MBS risk premiums if the buying scales toward earlier projections. That upside came with threats to bar Wall Street firms from buying single-family homes punished private-equity-linked real estate plays, most notably Blackstone. This is the latest leg of a focus on “juicing” the US economy ahead of the midterm elections.

Our homebuilding exposure, first included in our Year Ahead note, is up a healthy amount from this development.

Information technology barely moved on the week, utilities lagged, and gains were driven by policy-sensitive cyclicals. Markets responded positively to direction, even as the macro backdrop stayed unresolved. The data feed through from the shutdown is still murky.

That leaves equities entering earnings season with optimism intact but increasingly dependent on follow-through. Bank results and inflation data this week will test whether policy-driven enthusiasm can transition into something more durable, or whether this was simply the first reminder of how headline-sensitive markets remain at the start of a new year.

The Week Ahead

A quick rundown of what we’re focusing on in this week’s report:

“Domestic Beta For Tariff Announcements”

The Supreme Court holds the say over whether Trump’s tariffs stay or go. Markets have already shown their hand.

“A Short Note on Oil”

Iran is coming into the spotlight as a major source of supply disruption following the fall of Venezuela.

“AUDNZD Keeps Pushing”

Aussie data and an update on the divergence play.

“Wham! Index Outperformance”

White House Asset Management continues in 2026 (to no one’s surprise).

“JGBs”

Maybe flying under the radar, but Japan deserves attention with Takaichi tailwinds at play for equities.

For full access to each weekly note, see subscription pricing here.

Domestic Beta For Tariff Announcements

The Russell 2000 (RTY) pushed to fresh highs to close out the week, with domestic exposure looking increasingly attractive amid the pending Supreme Court ruling on Trump’s legality of tariff impositions.