Buying The Dip On...Whisky?

Holiday season alts.

We’ve no doubt that the majority of our readers have enjoyed a tipple over the past week. While everyone has their own preference, and some argue about the proper way to spell it, the general theme is that whisky remains as popular a drink now as it has been in the past.

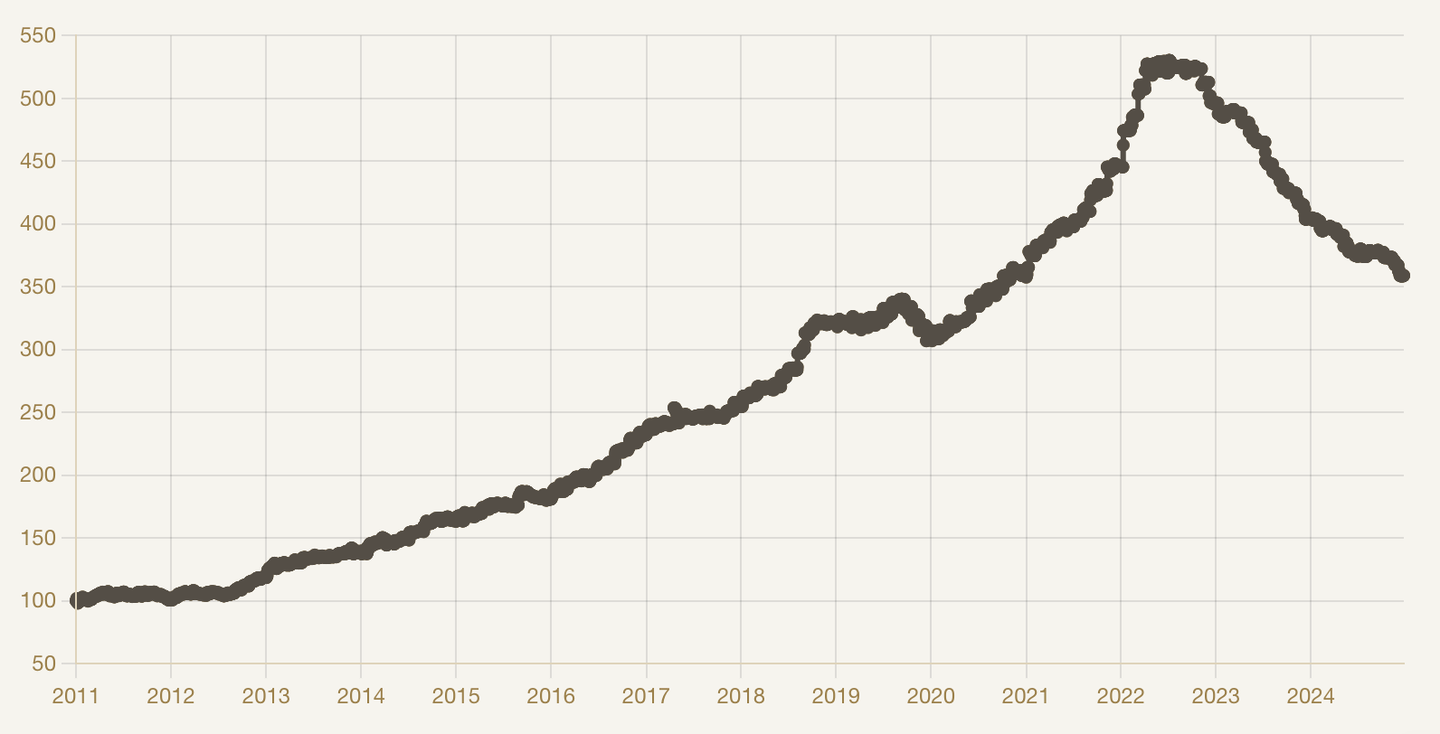

Yet there’s a difference in buying whisky to drink and purchasing bottles as an investment. Interestingly, there’s an index that tracks the 999 most traded bottles on the market, known as the Mark Littler 999 Index. Each January, the index is rebalanced to reflect the most traded bottles. Below shows the performance for 2024:

With the index down 11%, it contrasts heavily to the strong gains in equities, commodities and other more traditional asset classes. Obviously, the world of alternative assets is just that - alternative. The returns are much less correlated.

But it got us musing at to whether it’s time to splurge on some bottles within the index in order to buy the dip. So pour a Macallan 15, sit by the fire and enjoy.

Why Whisky Has Underperformed

Elevated Retail Prices

One factor has been higher retail pricing from whisky brands, in an odd paradox which has been observed in other markets in the past.

Brands noted the strong demand for products in recent years and reacted by increasing the retail price for bottles. Yet this has negatively impacted resale values for collectable whisky.

When brands set higher retail prices for new releases, it reduces the potential profit margin for resellers. Buyers in the secondary market are less willing to pay significant markups if the initial retail price is already high.

If newer releases are priced high, the appeal of older bottles—often priced competitively relative to their rarity—can diminish, lowering resale values across the board.

Broader Supply Availability

Another factor has been the ramp up in supply. This was originally designed to keep up with the higher demand from the past few years, but with demand slowing down and more supply coming online, the natural result is lower prices.

We’re not just talking about cheap blends. Take a look at the recent expansion projects, with some big and reputable names on the list:

As the capacity increases, so does the potential for special editions and other limited runs that are classic collectables that should increase in value. Even though these will still be limited edition (and thus limited supply), there will likely be more of the editions in general, increasing the overall supply of them from the industry in general.

Investor Caution

At the high end of the market (bottles priced £1000+), sales have been very slow this year. This is shown below:

Some flag that this is due to investor caution, with interest rates this year remaining higher for longer. In terms of choosing where to deploy cash, a non-income paying alternative asset like whisky hasn’t been high on the list. Yet in contrast to another non-interest bearing asset, gold, whisky isn’t seen as a safe haven asset to own.

Further, in a market right now where being nimble and liquid is desired, locking money up in very expensive whisky simply doesn’t appeal to some, who would rather look to more liquid alternative investments for that portion of allocation.

The Bigger Picture

Before you swig your Macallan down and start listing your favourite bottle on eBay to cut your losses, let’s look at this year in context:

Sure, 2024 has been a bad year. But the trend over the past decade has been very constructive for whisky as an asset.

Just like any melt-up, the price spikes from 2022/23 wasn’t sustainable. Ironically, it was during this period that a bottle of the Macallan 1926 single malt smashed the world auction record for any bottle of wine or spirits when it sold for nearly £2.2m at Sotheby’s in London.

A nice bottle, for sure, but with hindsight the bidding likely signalled the top of the market.

Another example of the exuberance in 2022 can be seen from that July when a cask of Ardbeg Islay single malt distilled in 1975 was bought by a private collector in Asia for £16m. The stat that caught our eye on why this might have signalled the market was dislocating was that it was more than twice what the distillery's owner, The Glenmorangie Company, paid for the entire distillery and all its stocks in 1997.

So if we’re being honest, there were signs that a correction was coming. We’ve now seen 18 months of price correction, with some citing that we’re getting close to where it makes sense to start dipping a toe back in the water.

Where To Target

Don’t get things confused, we’re not whisky investment experts. But Mark Littler complied an article earlier this month of six bottles that specialists recommend as their picks for 2025:

The Macallan Anniversary Malts

Picked by Beau Wallace, Director at The Grand Whisky Auctions

“The Macallan remains some of the most valuable and sought after whiskies in the primary and secondary markets. The Anniversary Malt Series marked the start of Macallan’s foray into high age statement single malts and represents a really interesting story for fans of scotch whisky.”

Brora Special Releases

Picked by Joe Wilson, Head Curator & Spirits Specialist at Whisky Auctioneer

“While by no means cheap, these original bottlings had a sense of accessibility—being both competitively priced at £150, and familiarly presented in utilising the same bottle shape and similar label designs to sister brand, Clynelish. While the value of these bottles is now considerably higher, they still represent one of the best avenues for new collectors to enter the market for Brora.

Considering the ultra-prestige style of releases currently favoured by Diageo for Brora single malt and the still lengthy wait for its newly produced stock to mature, this is likely to be the case for a long time to come - if not indefinitely.”

Macallan Private Eye

Picked by Yuri Bronzina, Managing Director from Just Whisky Auctions

“Macallan remains one of the most sought after distilleries with collectors, and Private Eye with its eye-catching design and stated limited edition number makes it likely to stay a popular choice. Like many bottles in the market the current value has softened since its peak, but it has just corrected to pre-pandemic levels, and for patient investors it offers a great entry point.”

Lagavulin Fèis Ìle

Picked by Thomas Gardiner, director and owner of Scotch Whisky Auctions

“However at auction some of the older bottles are down at the moment, while newer releases can actually go under retail. The Fèis Ìle bottles from some of the best known and most collectable distilleries, such as Lagavulin, present a good opportunity for those with time for a long-term hold.”

Macallan 18 year old 1970s Vintages

Picked by Jonny Fowle, Global Head of Whisky & Spirits at Sotheby’s

“The Macallan 18 year old series is arguably the longest running single malt scotch series. If you are after something to start building at a cost effective point the current release years are still available, but if you are after something a bit older and rarer then the vintage statements go back to 1962. Release years for bottles are from the 1980s with 1960s vintages, which tend to be the most expensive.

For me the 1970s vintages, released from the late 80s onward are my selection for 2025 as they are fantastic whisky for drinking and collecting, plus if you’re after something special these vintages would make an unbeatable gift for that person you know approaching a half century this decade.”

The Springbank Millennium Collection

Daniel Milne, managing director at specialist online auction Whisky Hammer

“The Springbank Millennium Collection consists of six high-age statement whiskies from 25 to 50 years old. It was originally released by the sought after distillery between 1998 and 2001 in celebration of the new millennium.

Any bottle from the series represent good value in today’s market as they tick ‘all the boxes’— incredibly rare, discontinued, super quality spirit and desirable age statements as well as being from a distillery that has sensibly kept the ‘small batch’ ethos despite significant surges in demand over the years.”

So there we have it. The case presented as to why fine whisky has fallen in value and where could be the right spots to pick up something at good value right now.

Normal service relating to more traditional asset classes will be resumed shortly…

Enjoy the weekend.

AlphaPicks

Great read! It feels like there are some real gems for patient investors