BYD Motors - Big Year Deliveries

The BYD delivery numbers are impressive and highlight the lacklustre legacy manufacturers, plus a key area where Tesla can thrive.

Electric vehicle sales have been a popular topic this week. First, let's quickly breeze past the headlines that we’ve seen one hundred times this week: “BYD Overtakes Tesla As Biggest EV Maker.”

On Monday, BYD reported record sales of battery-only vehicles of 526,000 in Q4. Tesla announced on Tuesday that over 484,000 cars were delivered for the same period.

BYD are bigger than Tesla as far as deliveries in Q4 of 2023. We will have to see if this outperformance can become a trend. But if we were to compare market cap, Tesla’s $788 billion dwarfs the $80 billion of BYD.

BYD is showing up the legacy market

BYD growing as fast as it has and being the first name to compete with Tesla on a delivery basis underlines to us how slow the legacy car manufacturers are at adapting to the new preference for electric vehicles. While many of the headlines this week are focusing on the rivalry between BYD and Tesla, the real losers of these new delivery figures are the oldest carmakers.

Daniel Roeska, an auto analyst with Bernstein, said, “Many incumbent OEMs rushed into electric vehicles without appreciating the far-reaching technological and design difference between combustion and electric vehicles.”

There is a higher premium paid for shares of electric vehicle companies. BYD now rank as the fourth largest manufacturer by market cap, closely behind Porsche in third. As far as revenue goes, BYD has $82.09 billion over the last 12 months compared to Tesla’s $95.92 billion (for Q4 2022 to Q3 2023).

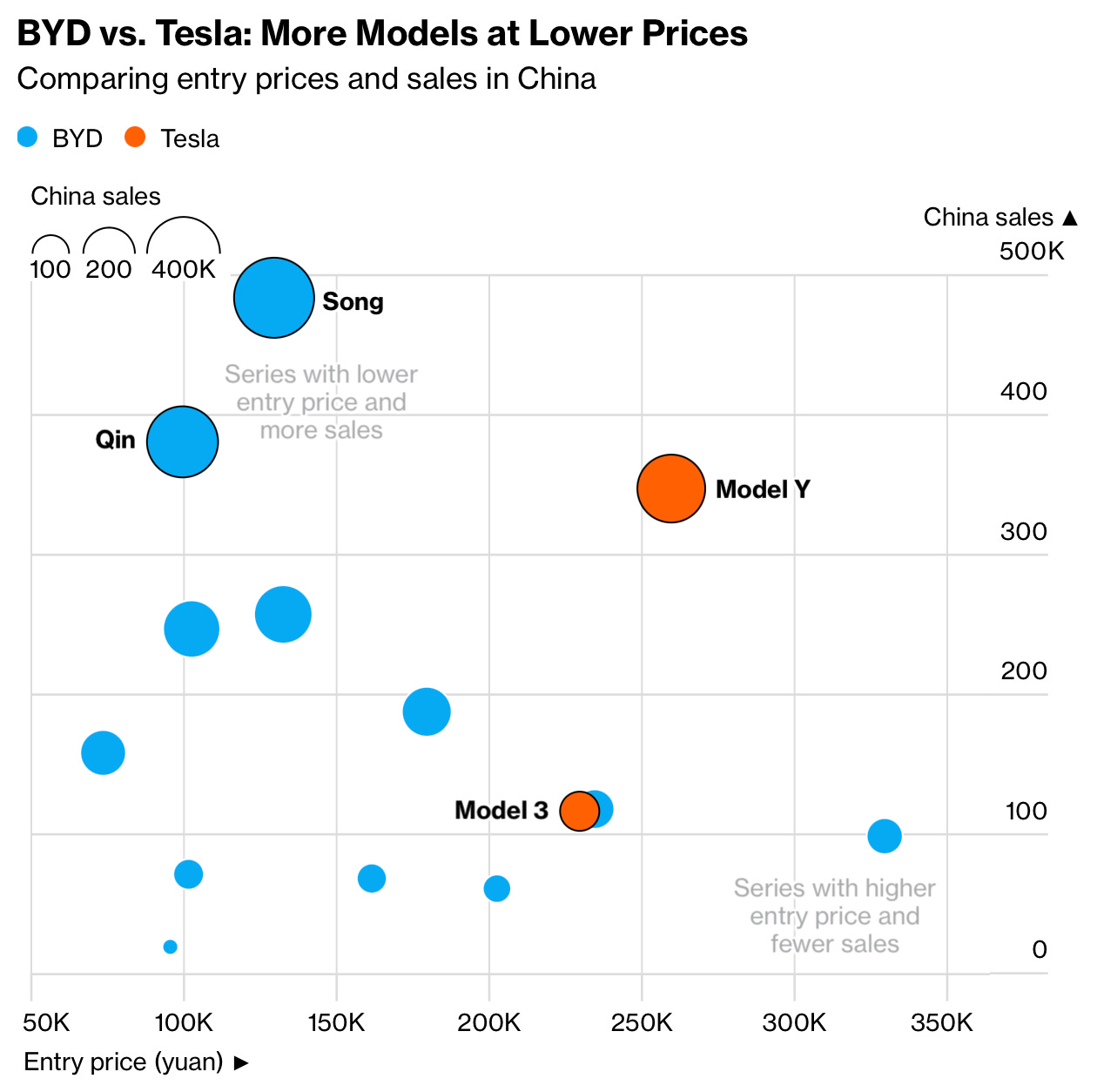

BYD did it by going affordable. Its vehicles sell for below $30,000, on average. Tesla vehicles still average north of $40,000, even after all the price cuts of 2023.

What to say about Tesla

The headlines may suggest that Tesla has been de-throned, but there is a lot to look forward to and a lot to admire about the 2023 results, regardless of BYD’s outperformance in Q4. Tesla’s sale of 1.8 million was a major achievement in a choppy macroeconomic environment for the electric vehicles sector.

This week, Elon Musk will be doing a company talk for both SpaceX and Tesla. He commented that he would speak on “plans for 2024 and beyond” via X (formerly Twitter). January is setting up to be a big month for Tesla as their earnings are also scheduled for Jan. 24th.

The Model Y has been a huge hit. BYD’s growth shows that Tesla’s next model should be a lower-priced BEV. That is what the company has planned, but when the car will hit the roads is still a mystery. Winning over the everyday buyers will be the next stage of growth for Tesla and would likely be the factor that sees them continue the outstanding growth seen over the last few years.

In the rest of this article, we look at the technicals and some trade ideas for Tesla, along with an early 2024 takeaway for the markets.