Cathie Wood - The Innovative Stock Picker

Disruptive growth led Cathie Wood and Ark Invest to the spotlight, but recent years have taken a tumble.

Cathie Wood often gets a lot of media attention. Initially, it was for the terrific growth of her fund, Ark Invest. But recently, the attention has leant more towards scrutiny about her performance.

Here is a rundown of her career and the investing principles she follows.

Career

Wood secured a position as an assistant economist at Capital Group in 1977 through her mentor Arthur Laffer, where she worked for three years. She relocated to New York City in 1980 to work as managing director, chief economist, analyst, and portfolio manager at Jennison Associates. She spent 18 years there at that job.

Wood co-founded Tupelo Capital Management, a New York City-based hedge fund, in 1998 with Lulu C. Wang.

In 2001, she began working at AllianceBernstein as the chief investment officer of global theme strategies. During her 12-year tenure there, she managed $5 billion. She received criticism for performing worse than the market as a whole in the 2007-2008 financial crisis.

In 2014, Wood quit the company and started ARK Invest. AllianceBernstein had rejected her idea for actively managed exchange-traded funds (ETFs) based on disruptive innovation as they thought it would be too risky. Bill Hwang of Archegos Capital provided the first funding for the first four ETFs offered by ARK.

Wood was named the best stock picker of 2020 by Bloomberg News editor-in-chief emeritus Matthew A. Winkler.

However, her flagship ARK Innovation fund experienced a 24% decline in 2021, and it had the poorest performance among Morningstar’s recognised equities funds in the first quarter of 2022. Eight additional Wood-managed funds, including ones devoted to financial technology and space, were launched in early 2022.

Investing Principles

Wood's investment approach centres on identifying high-impact innovations. The high-level areas of focus are artificial intelligence, DNA sequencing, robotics, energy storage, and blockchain technology. These are five platforms Wood predicts will be prominent areas of growth and change for the global economy.

Two key concepts underpin Wood's strategy. The first is that not all innovation produces the same opportunity. To Wood, investable innovation: cuts costs, spans sectors and geographies, and fosters more innovation. The second is that identifying appropriate investments takes both big-picture and granular research.

1. Investable innovation

The cost-cutting component is essential because it encourages quick adoption. New solutions that create large-scale efficiencies often generate their own momentum and demand.

The breadth of impact defines the size of the growth opportunity for investors, and innovations that launch follow-on disruptions create longer-lasting growth cycles.

You can see these qualities in play with Teladoc Health (TDOC 1.71%), an Ark investment. Teladoc provides virtual healthcare around the world. In 2020, Teladoc acquired Livongo, which offers remote monitoring for chronically ill patients.

At the highest level, employers, health plans, and hospitals use Teladoc's platform to extend the reach of care cost-effectively. Livongo adds to the efficiency story since chronic patients are very costly to healthcare payers.

The virtual healthcare market potential is massive, as well. Grand View Research valued the global telehealth market size at $83.5 billion in 2022. The researcher also predicts that value will grow 24% annually from 2023 to 2030.

2. Top-down and bottom-up research

The Ark team finds specific investment opportunities with two layers of research. First, researchers look at big-picture trends to identify innovation platforms and quantify the affected market size. Then they dive into granular data to identify companies that will either lead or benefit from disruptions.

Potential investments are scored individually on factors such as culture, execution, barriers to entry, product leadership, valuation outlook, and risk. Researchers also gather company data from social media and crowdsourcing, as well as traditional sources such as company reports.

Wood's investment timeline is five years. In her view, that duration maximises investor returns on these disruptive innovators. In fewer than five years, these stocks can be volatile. Beyond five years, the growth potential slows down.

When projecting a stock's potential over the five-year horizon, Wood looks for a minimum average annual return of 15%.

Criticism

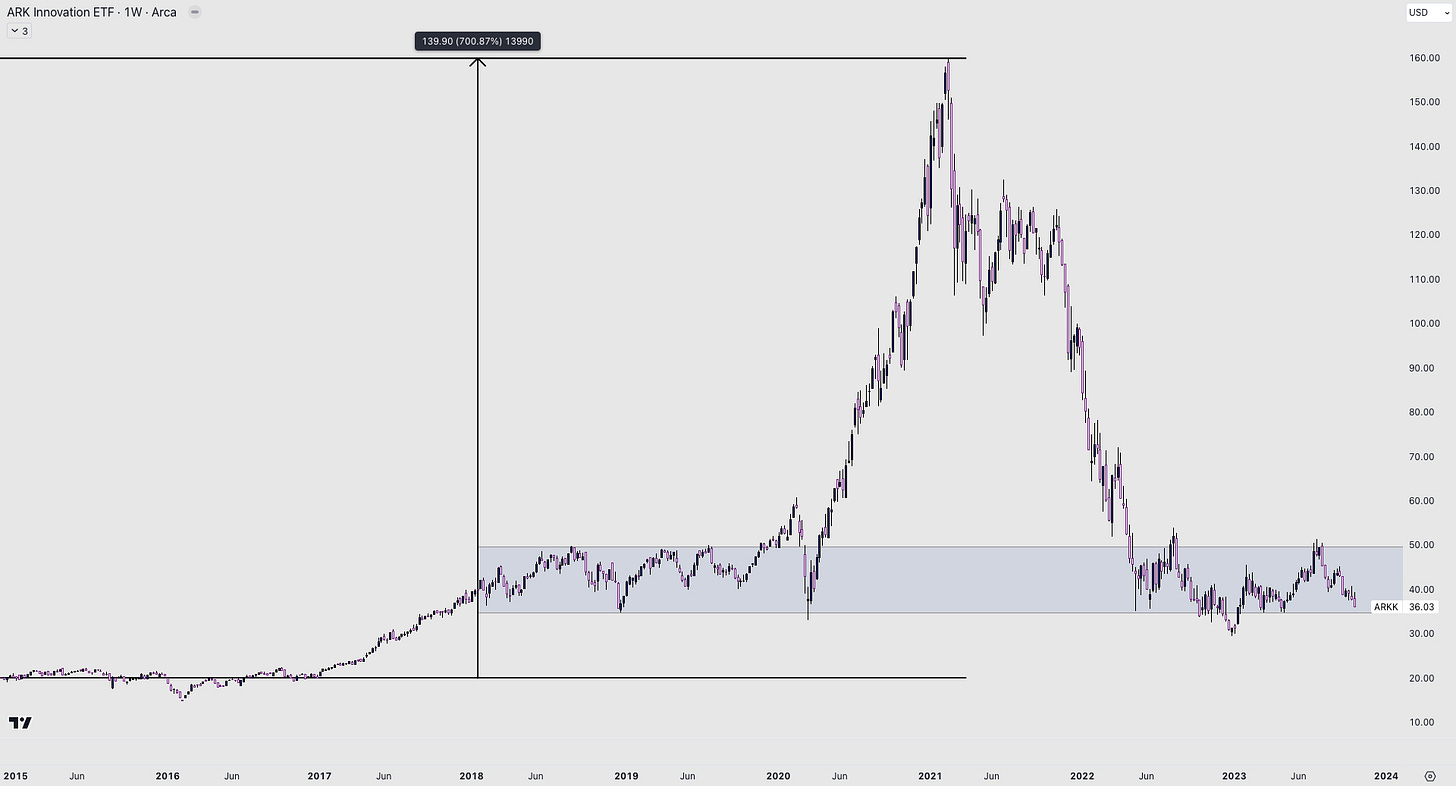

Wood has severely underperformed the market since the beginning of 2021. The company is down 77% from all-time highs.

One criticism she gets is how frequently she manages her funds, often selling stocks (such as Nvidia) just before huge rallies in price and buying other names just before quick sell-offs.

But her initial record with Ark Invest cannot be forgotten, returning 700% between November 2014 and February 2021.

A Quality Portfolio

You can access a quality portfolio run by a professional money manager below.

The Compounding Quality Investment Portfolio.

The goal of this portfolio? Outperform the S&P 500 by at least 3% per year in the long term by investing in:

Owner-operated stocks (family companies or companies that their founders still run).

Monopolies and oligopolies (Only one or a few companies dominate the entire industry).

Cannibal stocks (Quality stocks which heavily buy back their own shares).

Access to this portfolio also brings you the benefits of investment courses, company research, investment resources, and weekly news.

Since 2011, Compounding Quality’s investable universe has increased by 1100% (CAGR of 21.0%) compared to 184% for the MSCI World (CAGR of 8.4%).

This is an annual outperformance of 12.6%! You can sign up for this portfolio via this link.

Great read. We humans are really bad when it comes to judgment, even so called "experts" as Cathie Wood. We all fall for biases.