China Tech: From Buyer to Builder

The rise of self-reliance.

There was a time when China could buy growth off the shelf. Silicon came from Nvidia, software from Microsoft, algorithms from the open-source commons. Factories churned, consumers spent, and the geopolitical weather seemed permanently calm.

That world is gone.

In its place stands a country that no longer trusts the scaffolding it once climbed. The air is different now, thicker with caution, louder with ambition. The old comfort of importing innovation has been replaced by something sharper: a resolve and a necessity to build it, own it, and defend it.

China has always had an uncomfortable dependence on foreign technology. It tolerated this as long as growth continued to compound and access to Western hardware seemed assured.

Alibaba and Baidu are quietly rewriting the script. Both are now training parts of their AI models on homegrown chips, no longer solely on Nvidia silicon. Alibaba has been using its internally designed chips for smaller models since early this year. Baidu is trialling its Kunlun P800 to train new versions of its Ernie AI model.

This goes beyond cost-saving and is a matter of survival. Each round of US export restrictions forces Chinese firms deeper into self-reliance. And Beijing is nudging them along, making it clear that technological sovereignty is now a matter of national security.

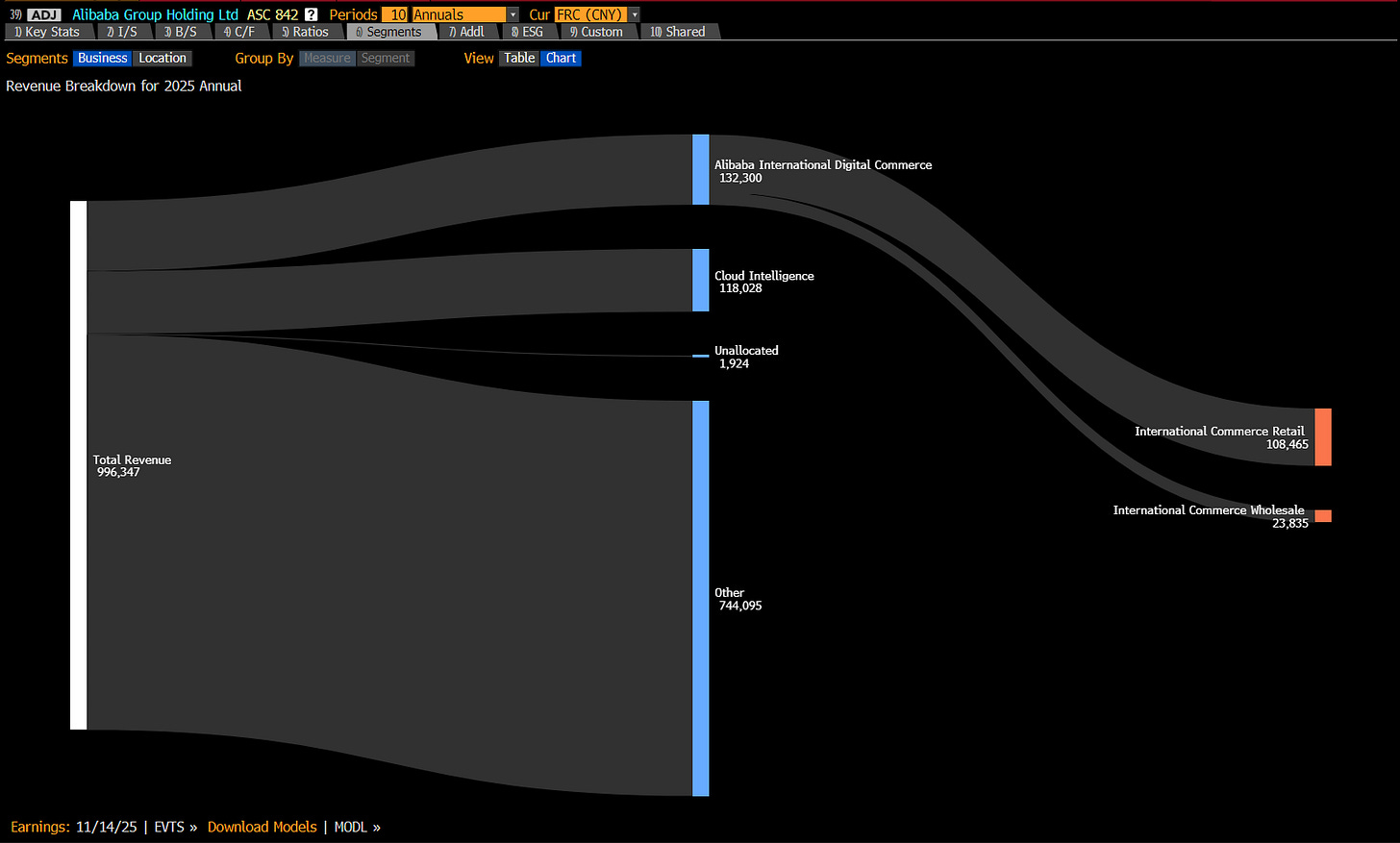

Nvidia’s H20 (the fastest chip it’s still allowed to sell into China) remains superior to Chinese alternatives on raw performance. But Alibaba’s newest chip is reportedly on par with the H20, and that matters. It signals that China’s tech firms are no longer just customers of US innovation, but they’re becoming competitors, with AI and Cloud Intelligence divisions becoming a larger contributor to revenue.

The message is clear: future growth depends on domestic technology. Beijing won’t let another country hold the keys. Beijing is catalysing an ecosystem shift—China’s largest tech firms are now strategic national champions, not just private enterprises.

Beijing’s push for technological sovereignty isn’t happening in a vacuum. Successive rounds of US export controls on AI chips and semiconductor tooling have shown how exposed China’s supply chain remains to geopolitical pressure. Each new restriction accelerates the state’s drive to plug chokepoints with local alternatives, and now, to channel domestic capital into funding them. Markets are no longer just venues for profit; they’ve become instruments of national security.

Alibaba’s Return to the Arena

Alibaba is having its AI moment. After the boom lifted names from Nvidia to Oracle, TSMC and Cambricon, the Chinese e-commerce giant has surged to its highest level in nearly four years.

Investors are buying into a full-spectrum AI push. Alibaba raised billions via a convertible bond sale to fund its infrastructure buildout, unveiled new large language models, and began training them on its own chips. It’s now one of the standout names in a region-wide tech rally that has also lifted chipmakers like SK Hynix and Samsung, propelling the MSCI Asia Pacific Index toward record highs.

Alibaba’s rebound marks a striking reversal after years of regulatory pressure blunted its internet empire. It’s even defying fears of margin erosion as it pours cash into a fierce price war with JD.com and Meituan—stocks that are down year-to-date, while Alibaba has rallied almost 100%.

Alibaba has re-entered the tech arms race with real firepower, and markets are finally rewarding it.

The Tariff Shield

China’s Ministry of Commerce has opened an anti-dumping investigation into certain US-made analogue semiconductors that serve as the low-profile building blocks of every electronic device.

Markets got the message. Shares of SG Micro Corp., Suzhou Novosense Microelectronics Co., and 3Peak Inc. surged by their daily 20% limit. Analysts at Citi said the probe could accelerate market share gains for local suppliers if the anti-dumping probe by China’s Ministry of Commerce relates to certain American-made analog IC chips—the sort of products sold by Texas Instruments (TSN.US) and Analog Devices (ADI.US).

At first glance, this looks like tit-for-tat geopolitics ahead of trade talks. But beneath it is something larger: industrial policy by other means. Beijing is building a protective tariff shield to nurture its chip sector, just as it once did for steel, solar panels, and EV batteries.