Climbing a Wall of Disbelief

A weekly look at what matters and how to trade it. (October 27th)

In this week’s report:

A week ahead focused on the FOMC and US heavyweight earnings

Milei’s success in the Argentine midterms

Global equities into year-end

Fading the oil bid

BoJ thoughts

US equity markets continued their relentless grind higher, brushing off trade headlines, sanctions, and the lingering government shutdown. The S&P 500 rose for another week, setting fresh records as investors doubled down on the path of least resistance: buying every dip. Energy led the advance after President Trump imposed sanctions on Russia’s largest oil companies, sending crude up more than 4% on Thursday, its biggest one-day gain in four months. The sector rotation underscored how immune risk sentiment has become to geopolitical and political noise.

Volatility remained pinned near year-lows. The delayed September CPI report (cooler than expected at 3.0% y/y) extended the narrative that inflation is soft enough for the Fed to cut again in October. The White House later confirmed that October’s CPI release would likely be postponed due to the ongoing shutdown, now stretching into its fourth week. For now, traders are content to trade momentum while data uncertainty stays conveniently invisible.

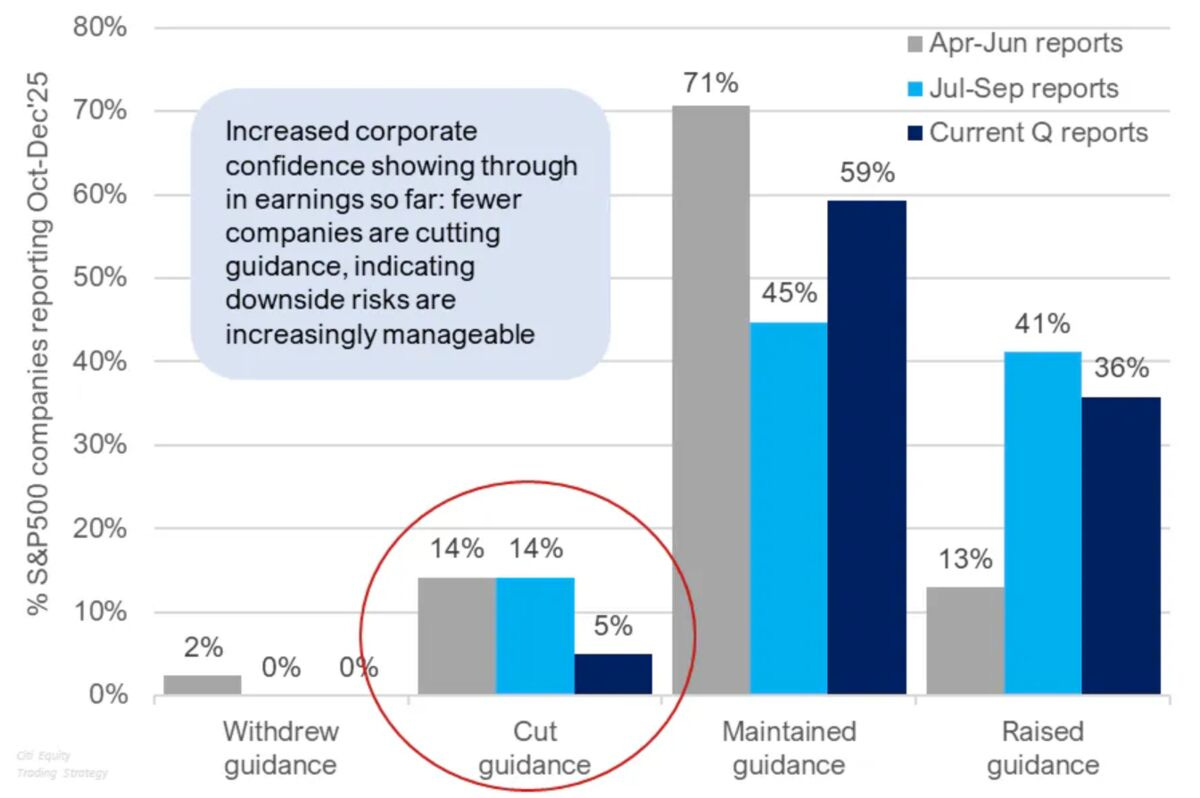

Corporate results continued to reinforce the bullish tone. Tesla and GM both delivered upbeat earnings, giving the consumer discretionary sector a lift, while AI-linked optimism kept tech firmly in charge. Citi pointed out that only 5% of S&P 500 firms have cut forward guidance so far this quarter, well below the 14% average of recent seasons, suggesting earnings resilience is extending the cycle.

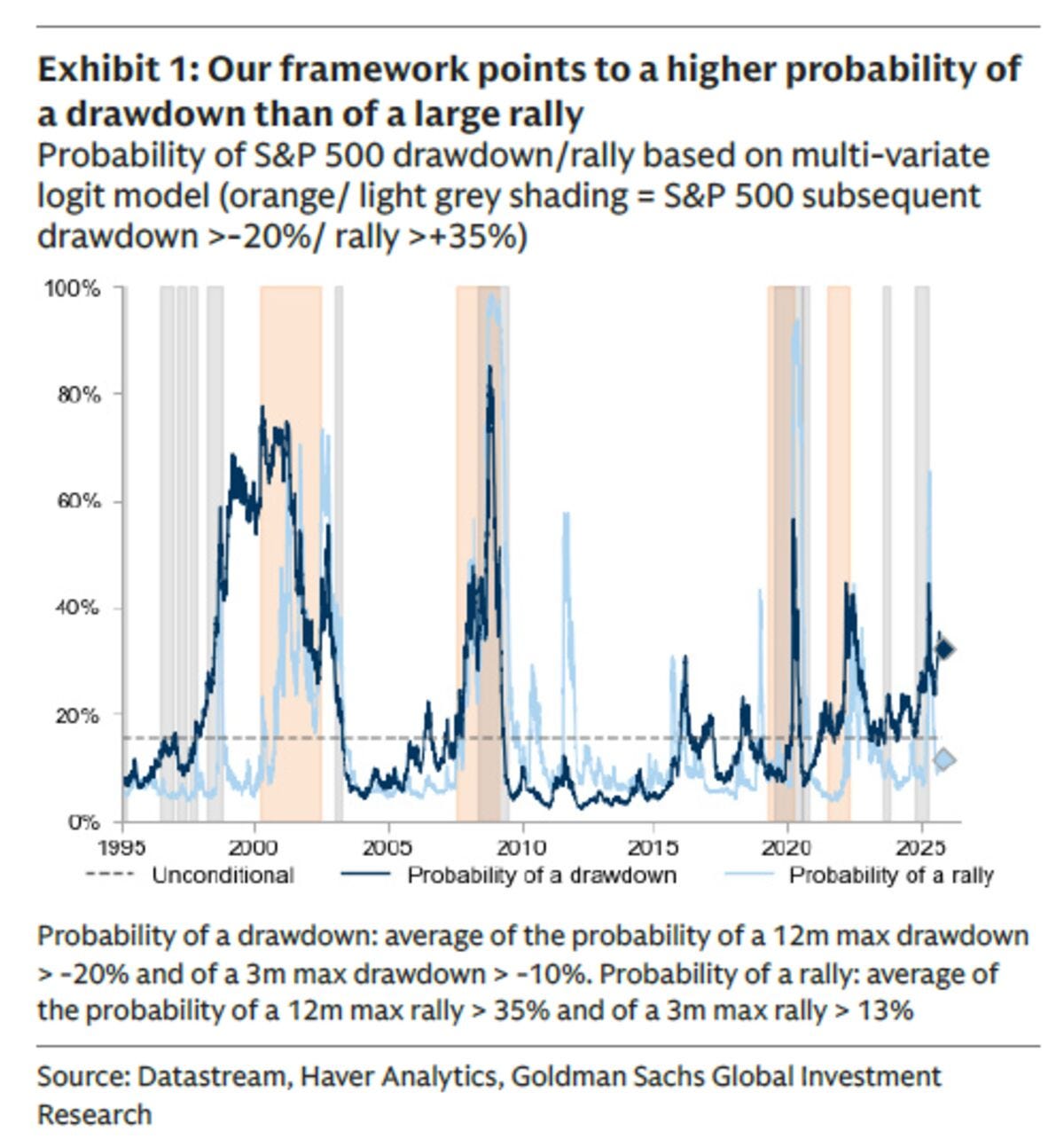

Beneath the surface, however, there’s unease. Goldman Sachs strategists noted that the risk of a short-term pullback now outweighs the potential for another leg higher, with positioning and valuation asymmetry at extremes.

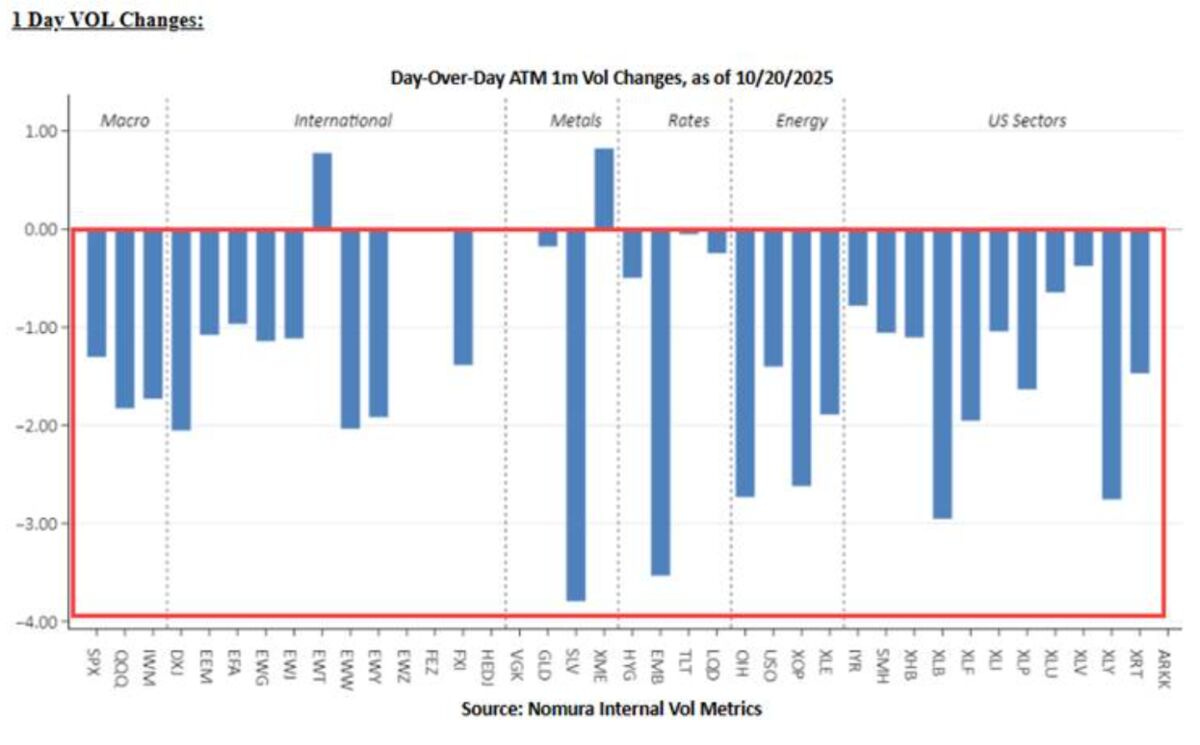

The macro backdrop remained muted with the Fed in blackout and the shutdown freezing official data releases. Markets instead defaulted to sentiment and positioning. Nomura noted that the surge in short volatility trades has acted as a shock absorber, muting any downside pressure.

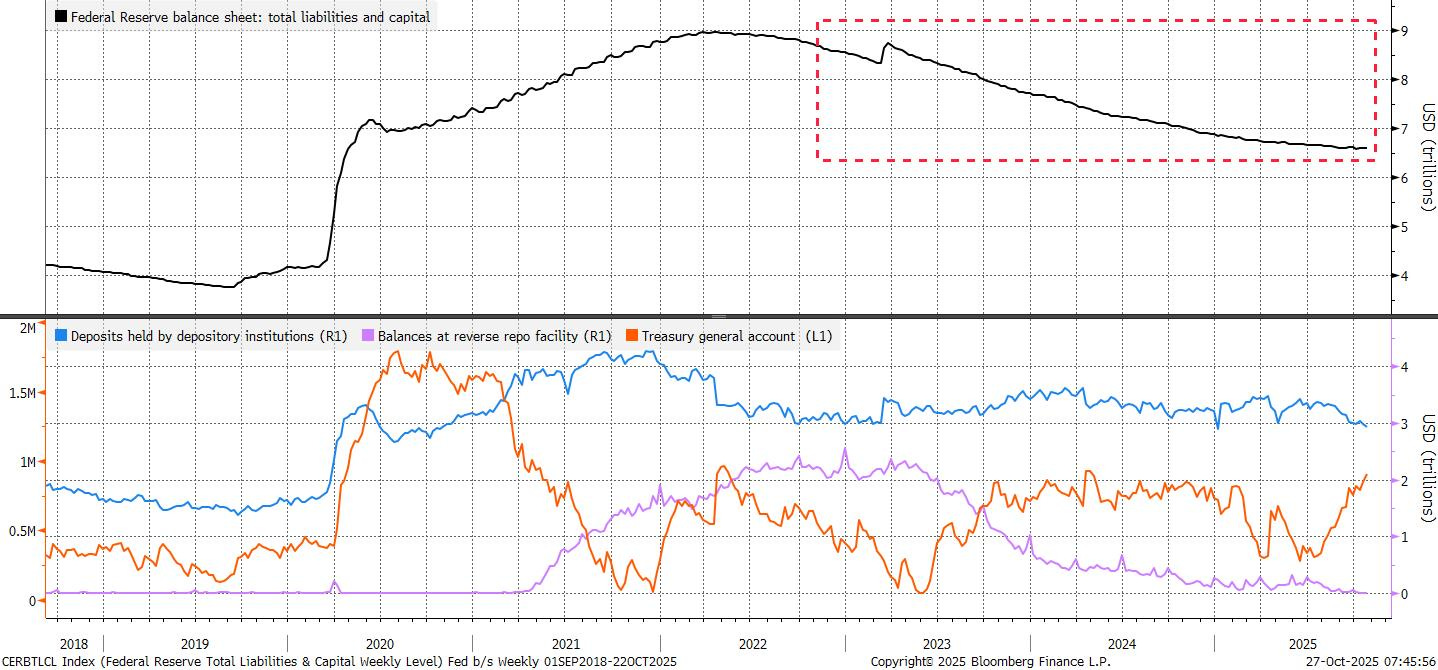

The dollar drifted slightly higher, though price action was subdued given the absence of data catalysts. There was chatter of intervention by the SNB amid CHF strength, while CAD underperformed after Trump’s rupture in tariff talks. In fixed income, Treasuries were flat with a marginal bull bias as quarter-end funding stress kept traders focused on liquidity conditions. The rise in the Fed Effective Rate continues to hint at mild tightening beneath the surface, adding pressure on policymakers to clarify their quantitative tightening strategy at the upcoming meeting. Swap spreads widened further, reflecting cautious positioning into what could be a policy recalibration moment for the Fed.

Equities continue to climb a wall of disbelief. The shutdown, trade skirmishes, and sanction headlines barely registered as markets priced in easier policy and clean earnings. With volatility crushed and megacap momentum back in charge, the rally now hinges on one assumption: that the Fed cuts cleanly and doesn’t blink. For now, the absence of bad news has become the best catalyst of all.

The Week Ahead

Earnings season hits full stride with the Magnificent Seven headlining. Alphabet, Meta, Microsoft, Apple, and Amazon all report, alongside heavyweights like Boeing, Caterpillar, and UnitedHealth. Consensus looks for another round of AI-driven beats, and if that materialises, it could fuel one final melt-up ahead of the October Fed meeting, where a 25bps cut is already fully priced in.

Elsewhere, focus in the week ahead will remain on US monetary policy, where the Federal Reserve is expected to deliver another 25bp rate cut. The market’s attention will be on how the Fed frames the path forward rather than the cut itself.

In Europe, the ECB meets with inflation still moderating and policymakers balancing the case for caution against weak growth. In Asia, the planned meeting between President Trump and President Xi will be watched for any sign of easing trade tensions, while Trump’s discussions with Japan’s new prime minister come just as the Bank of Japan delivers its first policy decision under the new leadership. Canada will also announce its latest rate decision, rounding out a week defined by central bank signalling rather than economic releases.

Turning towards our outlook and commentary for the week, we’ll start with…

Milei, Milei, Milei

We’ve been vocal on Argentina over the past month. To us, the US stepping in with what was effectively a $40bn backstop always looked like bailing out a sinking ship, not stabilising one. We avoided taking directional exposure into the vote (the political risk was binary enough), but we had highlighted EDN/YPF spreads as ways to express the asymmetry without having to guess the winner.

Sunday’s midterms change the calculus. Milei’s coalition secured roughly 41% of the vote, a far stronger showing than expected and enough to reshape Congress. Crucially, his party is now positioned to block veto overrides, the dynamic that had repeatedly hamstrung his reform agenda. While he still lacks a true majority, the ability to prevent Congress from unwinding his decrees gives him durability, and momentum likely means coalition support shifts in his direction, not away from it. The other message from the vote is just as important: Peronism collapsed, pulling barely 25% nationally. The market will read this as an ideological inflexion point. Populism is no longer the default equilibrium.