Coinbase. Binance. The SEC.

The charges from the SEC towards BinanceUS and Coinbase throw more trials ahead of crypto companies, but the Bitcoin reaction tells another story.

The SEC has a new target: Cryptocurrency exchange platforms.

Maybe the lawsuit was not exactly a shock for the crypto exchanges. As far as the Coinbase story goes, when the company filed with the US Securities and Exchange Commission to start publicly trading its shares, it said there was a “high degree of uncertainty” regarding the legality of its operations, warning that “regulators may disagree” with the company’s view that it wasn’t covered by their rules.

The reality of these concerns started this week.

In a lawsuit filed Monday, the SEC alleged Binance and CEO Changpeng Zhao misled investors and regulators, mishandled customer funds and broke securities rules. Zhao, 46, co-founded the exchange in 2017 and grew it into a global giant. His net worth grew, reaching a high of $96.9 billion in January 2022, but his wealth shrank by $1.4 billion to $26 billion on Monday.

The SEC then sued Coinbase on Tuesday, sending its stock down 12%. In the 101-page complaint, the SEC didn’t accuse Brian Armstrong, CEO of Coinbase, of any wrongdoing but alleged that the company evaded SEC rules by letting users trade tokens that were actually unregistered securities.

The SEC’s push is particularly fraught for Coinbase, which generated over 80% of its revenue in the US last year and is now facing a near-existential threat to its business model.

On Twitter, Brian Armstrong responded to the lawsuit and expressed his pride in standing up for the sector in court. In support of his claims, he reiterated that the SEC had examined Coinbase's operations and approved its conversion to a public corporation when it registered the stock. However, the regulator made it abundantly clear in its complaint that approving the company's intention to go public did not entail endorsing its underlying business model: “Declaring effective a Form S-1 registration statement does not constitute an SEC or staff opinion on or endorsement of, the legality of an issuer's underlying business.”

A long fight

The company will likely operate normally in the short term. However, the potential reputational damage caused by the SEC’s claims could lead users to pull their money from the platform.

“If it takes going to the Supreme Court, that’s what we’re prepared to do,” Coinbase’s top lawyer, Paul Grewal, said in an interview, adding that he believes the company will prevail. “I think that every court that looks at this issue is going to conclude the SEC has fundamentally gotten this wrong.”

Expect a long legal battle.

During the first quarter, Coinbase’s revenue was already less than a third of its late 2021 peak. This scare over what may happen on crypto exchanges could lead to more customer withdrawals and lower revenue for Coinbase going forward.

The longer-term worry is that the SEC will force the company to stop providing custody and trading of coins considered securities. How much more pressure on revenue can Coinbase face?

The Crypto reaction

What is interesting is the opposite reaction from Bitcoin to both SEC charges.

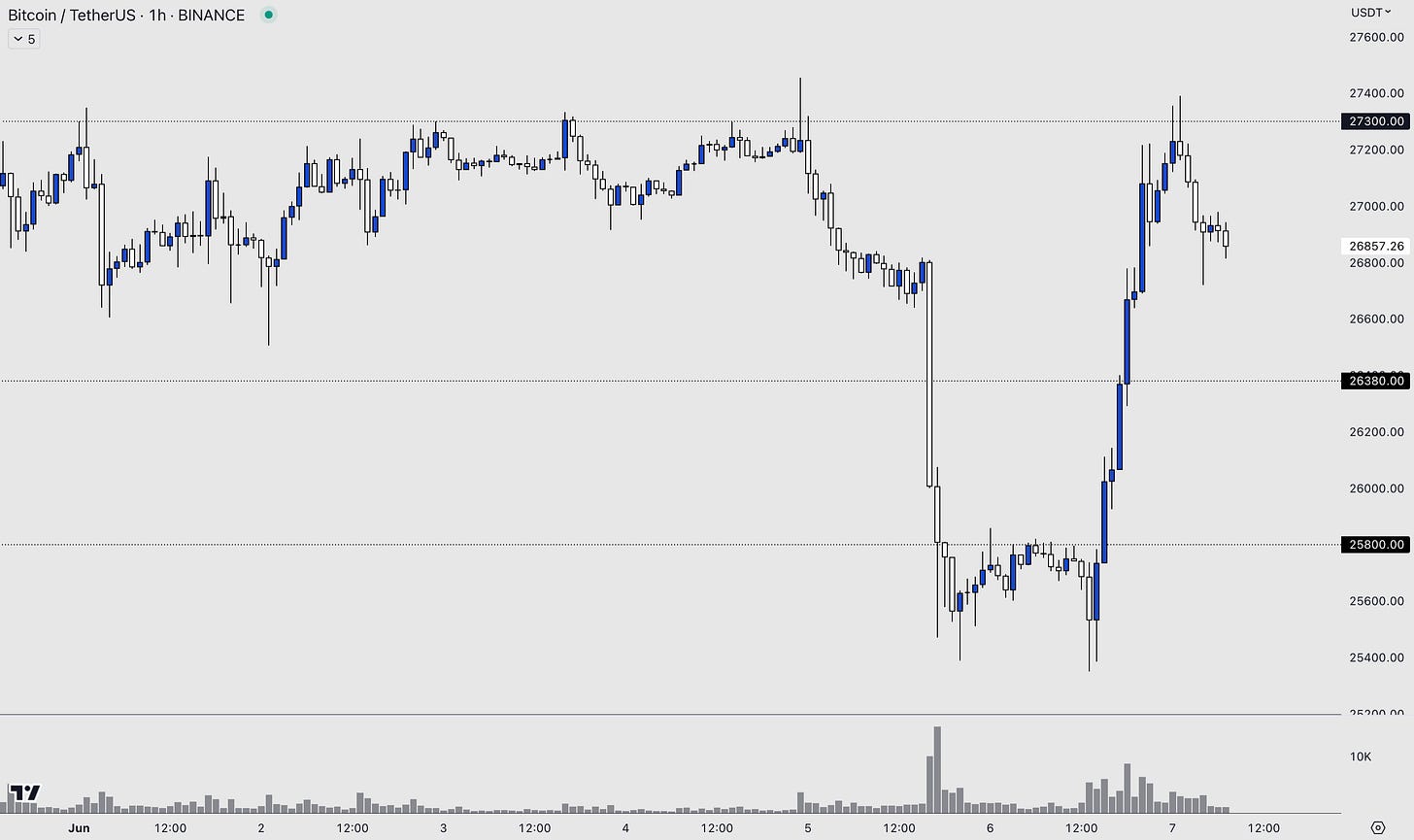

Firstly, Bitcoin sold quickly off the back of the Binance lawsuit, falling from $26,800 to $25,400. But the opposite happened when the Coinbase lawsuit was announced. Bitcoin rose from the lows and recovered losses from the previous day.

This may be because the Coinbase lawsuit was already priced in before this week. So, in this case, it was “Sell the rumour, buy the news.”

The concern for the main crypto asset is that the SEC has asked a Federal court to grant a temporary restraining order to freeze assets tied to Binance.US.

Binance is by far the world’s largest digital-asset trading venue, representing a pillar of the crypto universe whose continued operations and financial health is a matter of existential importance to prices. The immediate risk is that fears over Binance create the crypto equivalent of a run on the bank, which could threaten the operations of this systemically important player.

But we cannot ignore the positive reaction from the main crypto asset. Strong buying off bad news is something to keep note of. Maybe the latest development in the crypto world will throw more doubt on crypto exchanges, but it will be positive for Bitcoin itself. The digital asset's price is currently 33% higher than before the FTX failure. Why could this be?

The concern lies more with the crypto exchanges and smaller coins than with Bitcoin. So, despite there being $800 million withdrawn from Binance this week, there has been a $415 million inflow into Bitcoin, driving the price higher.

We hope you enjoyed this investing article written by us, AlphaPicks. Feel free to reach out if you have any questions or feedback. Subscribing, sharing and liking this article is greatly appreciated as it helps us grow as a page. The more people reading our articles, the greater the compounding effect.