Dalio's Debt Spiral

The U.S. economy's "heart attack", currency devaluation, and this week's selloff.

The first headline coming across the desk (promptly on Monday at 9 am) was from a pod. This time, it was not from a pod shop “blowing up” as the phrase goes, but Ray Dalio’s appearance on the Odd Lots podcast.

A podcast is usually recommended as a must-listen but is rarely accompanied by headlines from major news outlets. But this time, it was the case as Dalio’s so-called “economic heart attack” is a trouble for the U.S. economy. The billionaire founder of hedge fund Bridgewater Associates warned the Trump administration to commit right now to reducing the deficit or risk a major debt crisis within three years.

Dalio likened the increasing fiscal deficits to “plaque” accumulating in the American economy’s cardiovascular system, warning that a disastrous “heart attack” might be on the horizon without proper intervention.

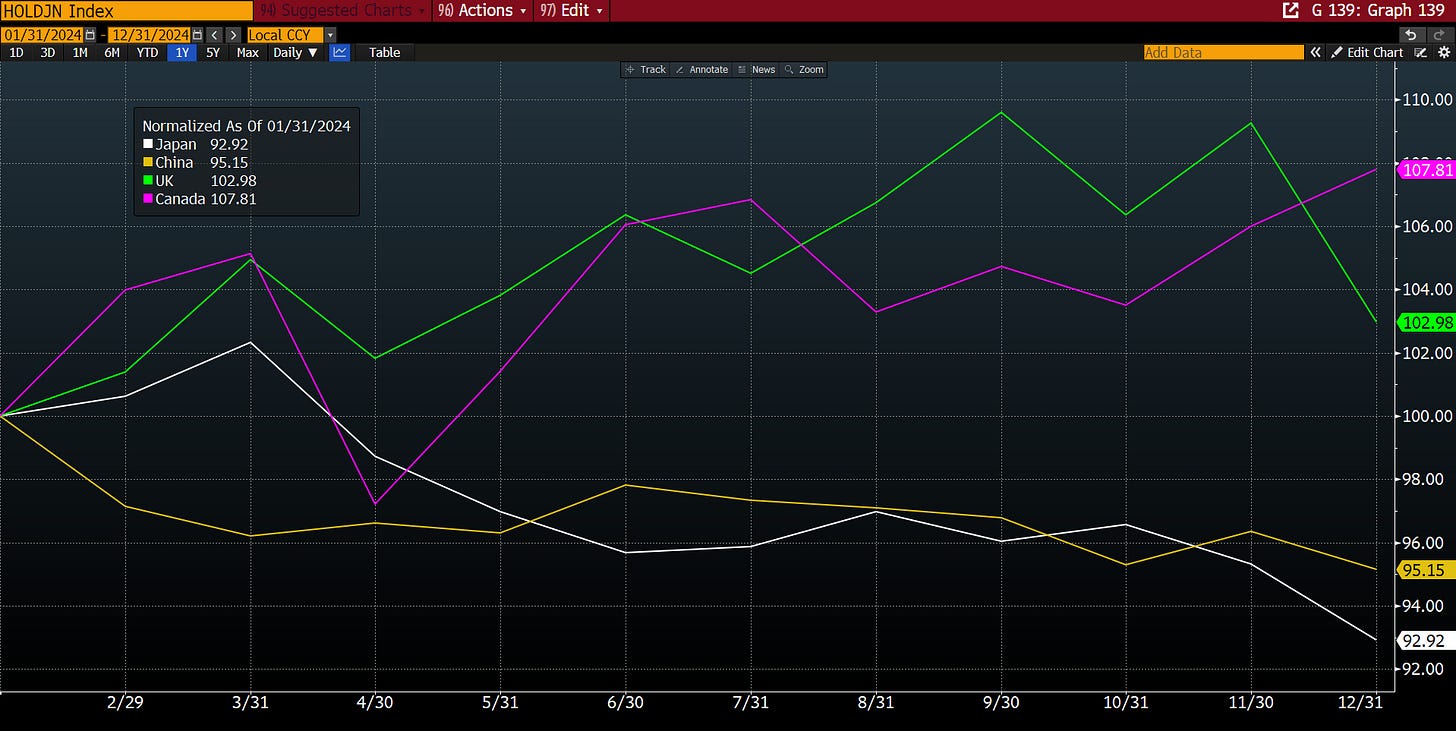

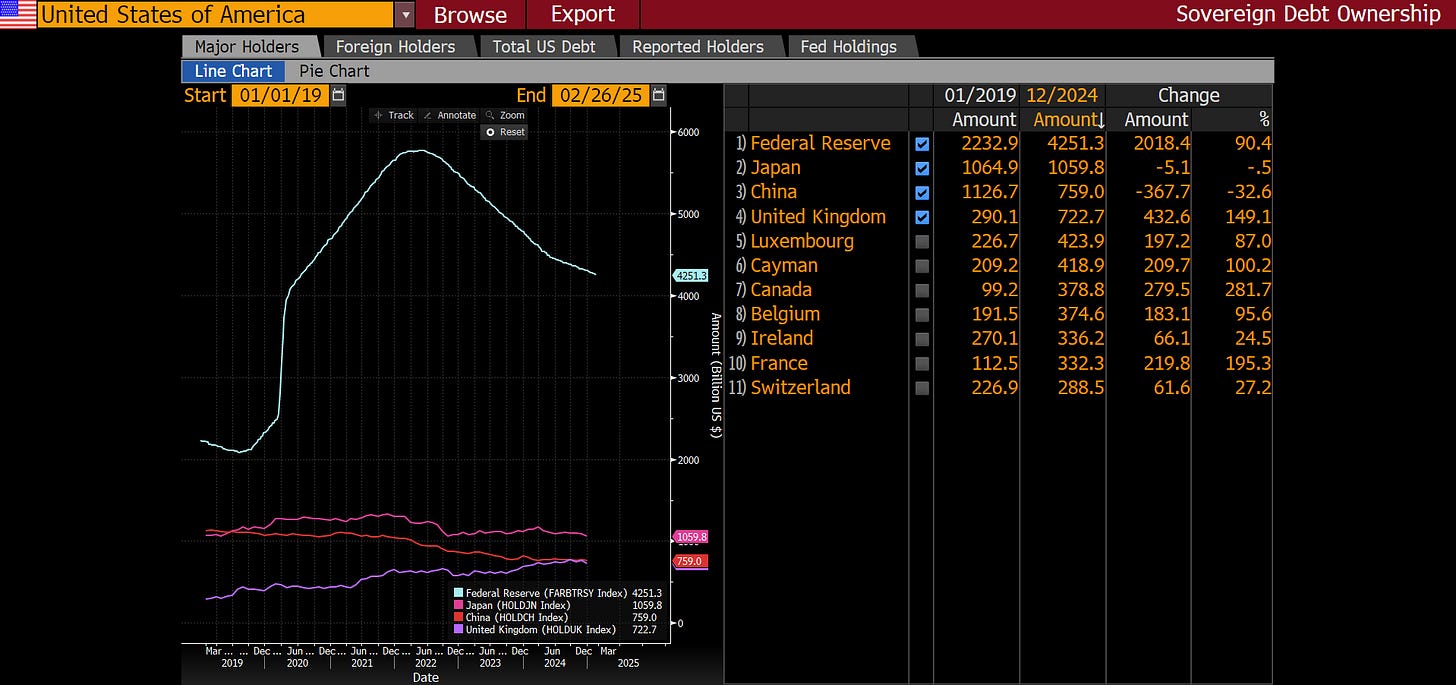

He also emphasised the critical role of foreign investors in purchasing U.S. debt, cautioning that declining foreign demand for U.S. bonds (two charts below) could lead to soaring bond yields and potentially trigger a recession. To mitigate this risk, Dalio advocated for the government to commit to reducing the deficit to 3% of GDP. He warned that failure to address the deficit could result in political fallout and voter dissatisfaction, as the burden of the debt crisis would fall on the administration in power at the time.

The attention to Dalio’s comments comes from his extended success on Wall Street. His understanding of history and the mechanics of long-run debt cycles has been key to his successful career creating Bridgewater. It helped him navigate the 2008 financial crisis and make money during the euro-zone debt crisis soon after. So, his words come with some weight.

However, we might argue that, although the “heart attack” is an excellent simile for the economic situation, some people manage to live unhealthy lives and get away without a heart attack. The U.S. has had a centralised conversation about deficits for decades, but has so far evaded any material disaster.

“When you’re putting a lot more debt on top of that pile of debt, so it’s not just existing debt that’s a problem, but you have to add more debt sales. You’ve got to sell those, you have to sell those to people or institutions or central banks and sovereign wealth funds. Nowadays with sanctions and too many bonds and so on, when I calculate who are the buyers and how much do we have to sell, I find a big imbalance and I know how that works.”

Currency Devaluation

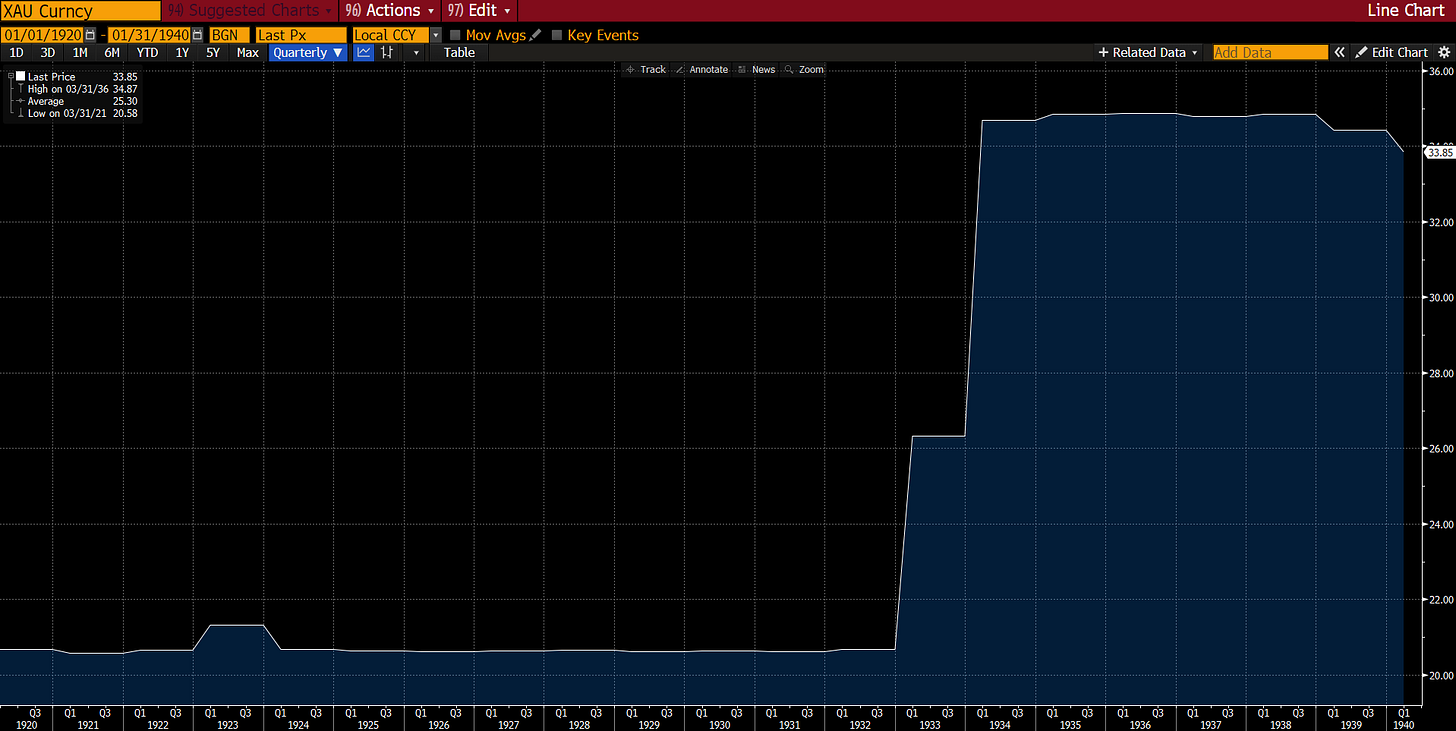

Dalio expressed skepticism regarding the practicality of a “Mar-a-Lago Accord,” a hypothetical strategy aimed at enabling the U.S. to weaken the dollar while maintaining its status as the world’s reserve currency. He believes that rather than the dollar losing value against other currencies, it’s more likely that all major currencies would decline in tandem, leading to what he describes as an “ugly contest” among central banks. He drew parallels to the 1930s and 1970s, eras when currencies collectively depreciated in value compared to gold and other hard assets.

If currencies were to devalue, investors would turn to other forms of money with stable supplies. Notably, gold and bitcoin come to mind on that point. While we think the longer-term picture of bitcoin will be one of strength, the recent storm in U.S. equities and the following risk-off mode has been felt in the crypto space. A weekend Trump-Pump quickly led to a faster and harder Pump-Dump on Monday as the S&P 500 and Nasdaq had one of their worst days of the year. Maybe that is an indication that Bitcoin remains on the tactical element of a portfolio, whereas gold could fit a more stable core positioning.

The year to date comparison of the two highlights this.