DeepSeek for Dummies

The AI development disrupting U.S. tech.

“To see the DeepSeek new model, it’s super impressive in terms of both how they have really effectively done an open-source model that does this inference-time compute, and is super-compute efficient. We should take the developments out of China very, very seriously.”

Those were the words of Microsoft CEO Satya Nadella on Wednesday of last week in Davos. Maybe it fell on relatively deaf ears, as it was only speculation over the weekend that drove up concerns, resulting in Nasdaq futures falling more than 5% before the New York open on Monday.

The developments of DeepSeek raise several questions and have been the centre of many good and, even more so, bad takes. Firstly, what have DeepSeek achieved that is so groundbreaking? Secondly, what does this mean for the current tech companies leading U.S. indices higher over the last few years? And what opportunities does the “Phase 2” of AI present?

DeepSeek for Dummies

DeepSeek caught headlines because it was able to compete on performance against other large language models (LLMs) like OpenAI, the developer of the popular ChatGPT, and it is doing so at a fraction of the cost.

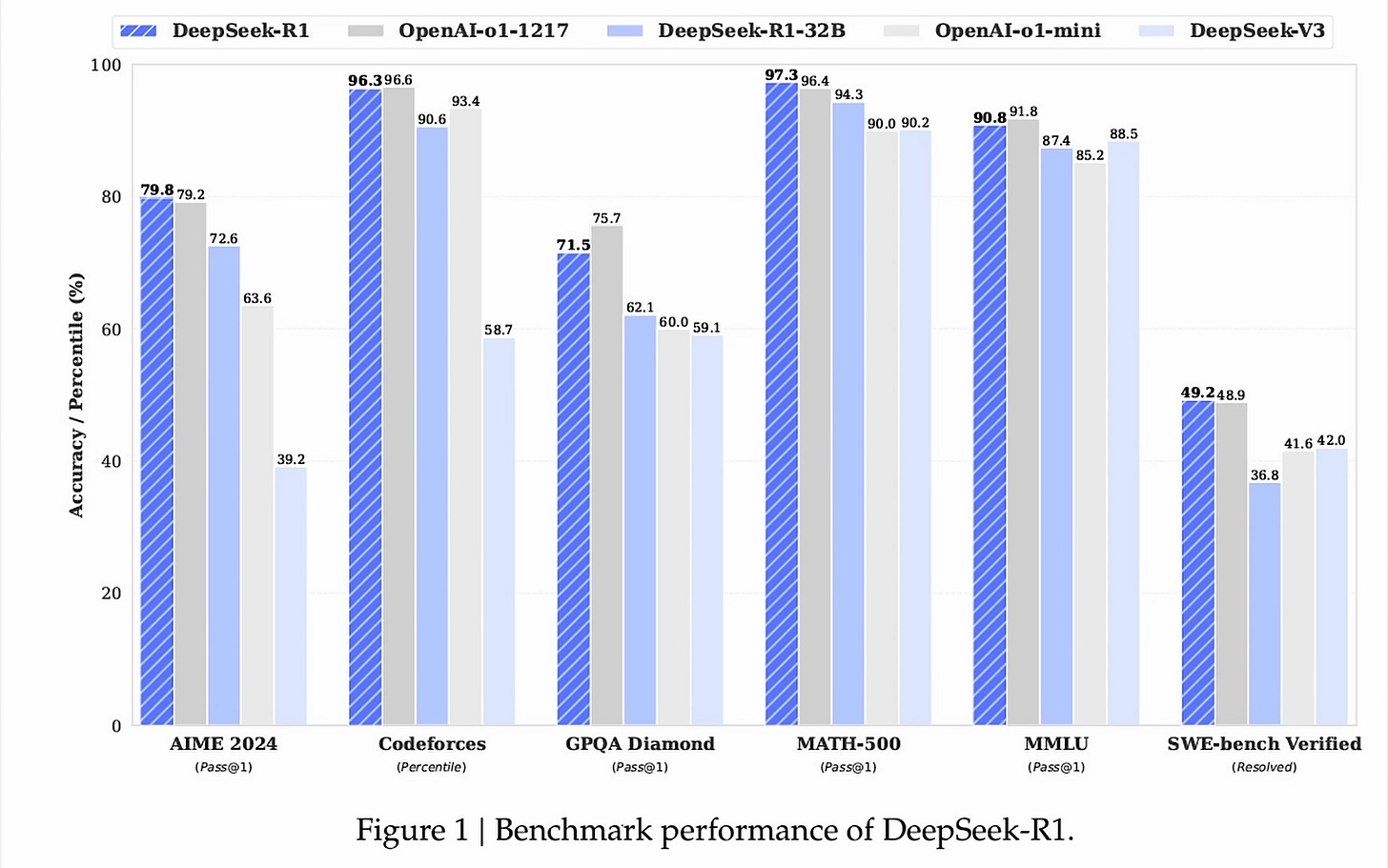

An LLM is a machine-learning model that analyses and understands text. The performance of these LLMs is benchmarked to compare accuracy across different areas, such as math problem-solving or coding.

The development of DeepSeek used a “chain of thought” model. That means the AI has to explain its reasoning when making a decision. That reasoning can be reviewed and adjusted, and the model is rewarded for being correct. This way, the model can learn on its own. Other LLMs were trained by being given the question and the answer.

The Q&A model results in static performance, as shown by the green and purple lines below. Reinforcement learning results in a gradually increased score, as shown by the blue and red lines, eventually outperforming the comparative model.

DeepSeek’s R1 model only cost $6m to train. However, it would have used more expensive models to learn from. So the total cost to get here is unknown. To compare, Open AI’s O1 model is rumoured to have cost around $500m to train.

While DeepSeek is the headline of this story, the big takeaway from a market perspective is the low-cost possibilities for LLMs going forward and what this means for the heavyweights investing billions into AI. It was only last week that Stargate was announced, the $500bn AI infrastructure project touted by Donald Trump.

The other point of interest in the story is the shift in the U.S.-China tech war. While the U.S. has been throwing billions into AI, Chinese tech has been labelled as falling behind. But maybe that was never the case…

The importance of leading the AI race may be equivalent to the development of the nuclear bomb or the race to be the first on the moon.

APFX, our latest venture, has just launched. You can read more about it here. For institutional readers, feel free to reach out to us at research@alphapicks.co.uk to discuss access.

Evaluating the Tech Selloff

Monday Meltdown

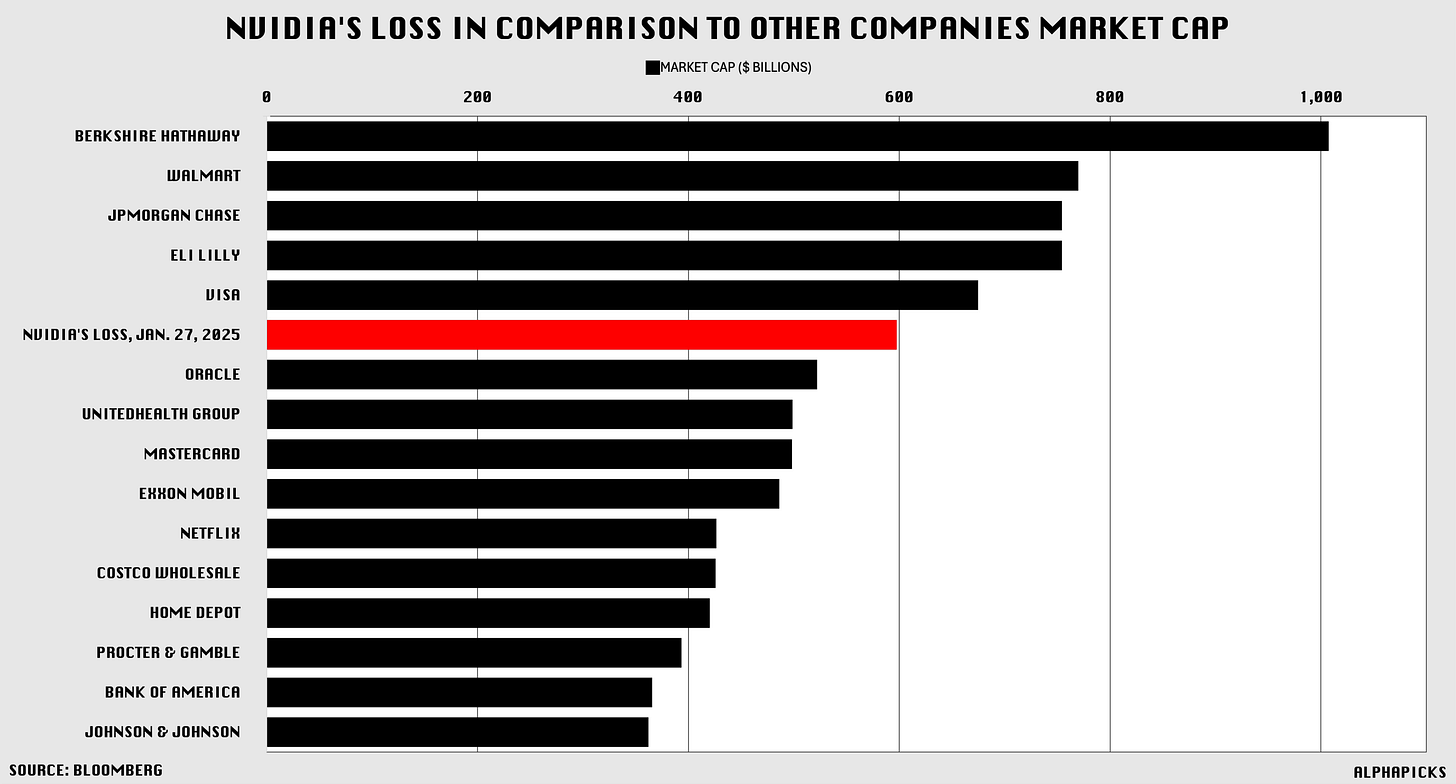

The 300bp move lower in the Nasdaq on Monday will have concerned a fair few investors. It can be narrowed down to a concentration risk in the major U.S. indices. A bet on America has really been a bet on a handful of companies, as has been well-documented over the rise of the Mag Seven. DeepSeek suddenly emptied the monopoly moat that has protected Nvidia’s domination of the AI landscape. NVDA, on its own, led to a 150bps decline in NDX. That relates to a $589bn loss in market capitalisation for the AI darling, the largest decline in valuation ever recorded.

The graph below adds some relativity to that figure.

However, NVDA has seen worse days.

One of the worst-hit areas of GenAI has been the power stocks. A 9.23 Z-score move was recorded. That doesn’t happen often. One of the big second-order effects relating to AI was the power demand needed to fuel any expansion. That thesis is now on its backside, with a quick unwind of any premiums that were being priced.

A final note on Monday’s chaos… yields across the curve fell. Does that make DeepSeek a macro issue?

Tuesday Turnaround

The following actions were a prime example of an overreaction catching a bid. The dip-buy mentality is still well and truly alive.

Investors poured $4.3bn into the tech-heavy QQQ—its biggest one-day haul since 2021. The same notion drove a record $1bn into the 2x Long NVDA ETF (NVDL) and almost $1.3bn into the 3x Semiconductors ETF (SOXL).

Interestingly, while tech bounced back, most shares in the U.S. equity benchmark actually fell, a reversion of the move in the previous session.

Software Safehaven

Areas of tech that investors found shelter in were software names. Last week’s developments signal the start of AI’s “Phase 2”. DeepSeek showed strong results despite lower costs and fewer performance chips than other models. That means improved capabilities at a lower cost—a bullish development for software. The lower cost should spur accelerated adoption of AI workflows, whereas, previously, companies shied away from higher computing tasks because of cost considerations.