A quarter-point cut. Bond and equity markets are happy. That’s the initial takeaway from yesterday’s FOMC decision and Chair Jerome Powell’s presser.

Beneath the surface, we can gather more detail. The quarter-point move went through over the objections not only of a few voters, but also of several regional presidents who weighed in despite not holding a vote this year. Markets are also pricing a different path than what the median dot plot says, and by one measure of where the neutral rate is, maybe the Federal Reserve won’t need to cut at all.

Silent Disenters

There were dissents, but maybe not as many as feared. Rumours leading up to the meeting were that as many as five voting members might dissent in a display of independence. But for now, a divided Fed is more together than expected. Schmid and Goolsbee voted to keep rates on hold. Miran, the most recent appointment from Trump, unsurprisingly voted to cut 50.

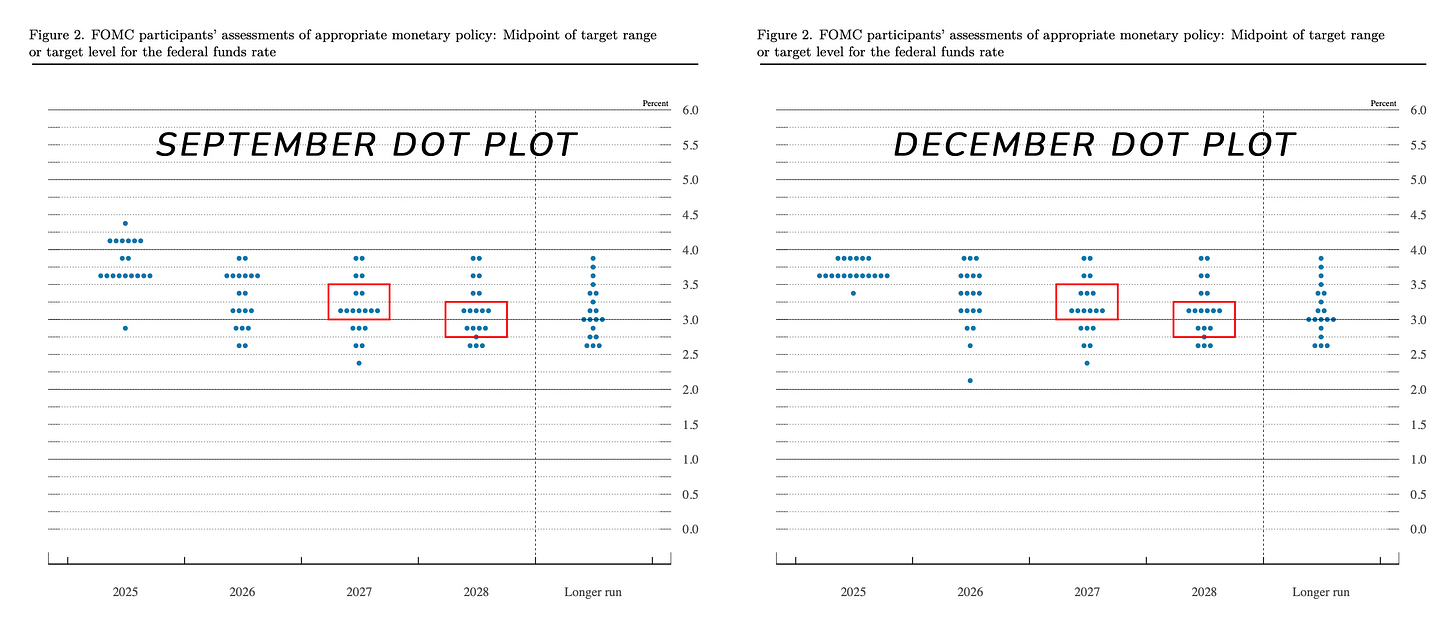

A quick look at the dots shows that not much has budged since September. For 2027, one lonely dot crept 25bps higher. For 2028, the same story—a single participant nudged their estimate up. Otherwise, stasis.

Officials still don’t see fed funds rising above 4% for the foreseeable future, and most of them don’t see it falling much below 3% either. The distribution has settled into a narrow corridor, reflecting a quiet consensus on what “normal” looks like in a world that keeps refusing to behave normally.

But there exist “silent dissenters.” These are the regional Fed presidents who joined the discussions but didn’t hold a vote this year, several of whom signalled they would have opposed the cut. Their dots imply a 2026 hike and, in some cases, no cuts at all over the next three years. They don’t have a formal say, but they do have a view, and it sits uncomfortably against the majority’s glide path.

The voting roster rotates in January. Cleveland’s Beth Hammack, Dallas’ Lorie Logan, Philadelphia’s Anna Paulson, and Minneapolis’ Neel Kashkari step in as Boston, Chicago, St. Louis, and Kansas City step out.

Hammack and Logan have leaned hawkish, arguing that inflation progress is still fragile. Paulson is new and focused on labour-market softening. Kashkari remains data-dependent but has cautioned that inflation may be harder to pin down than markets hope.

However, the Fed (and the market) seem to have an upbeat view of inflation next year.

Inflation

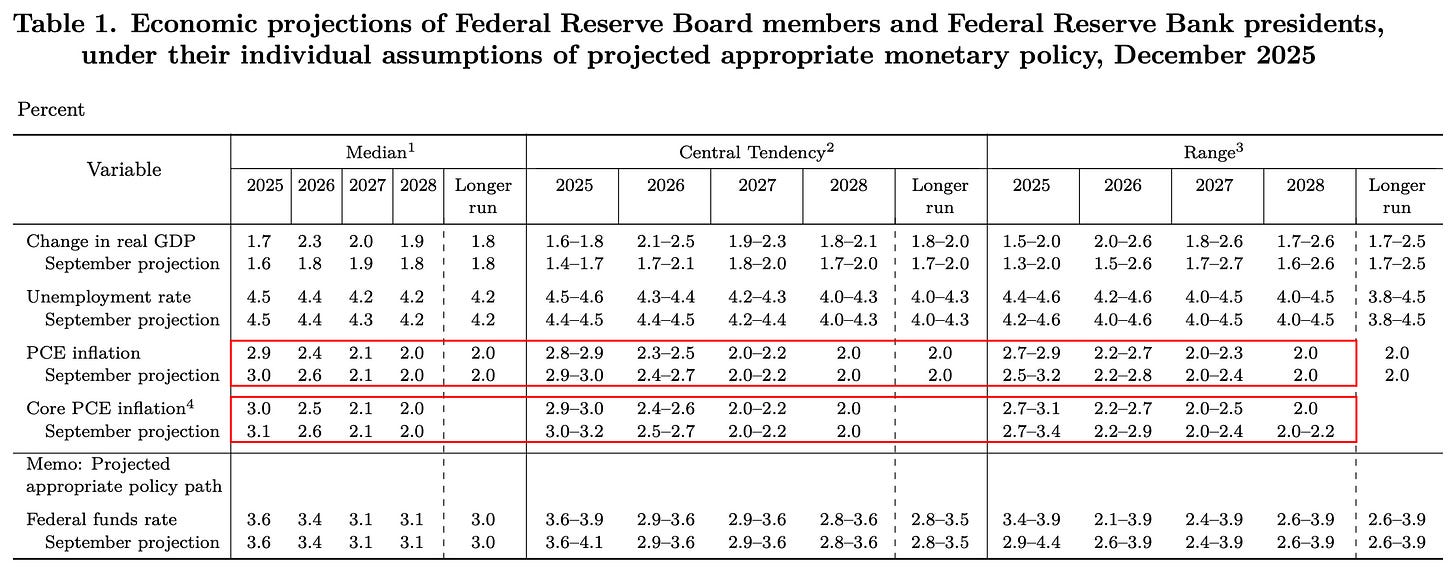

The statement still calls inflation “somewhat elevated,” but Powell avoided turning up the temperature in his press conference. Inflation estimates edge lower across the next three years, and everyone dutifully forecasts a clean return to 2% by 2028.

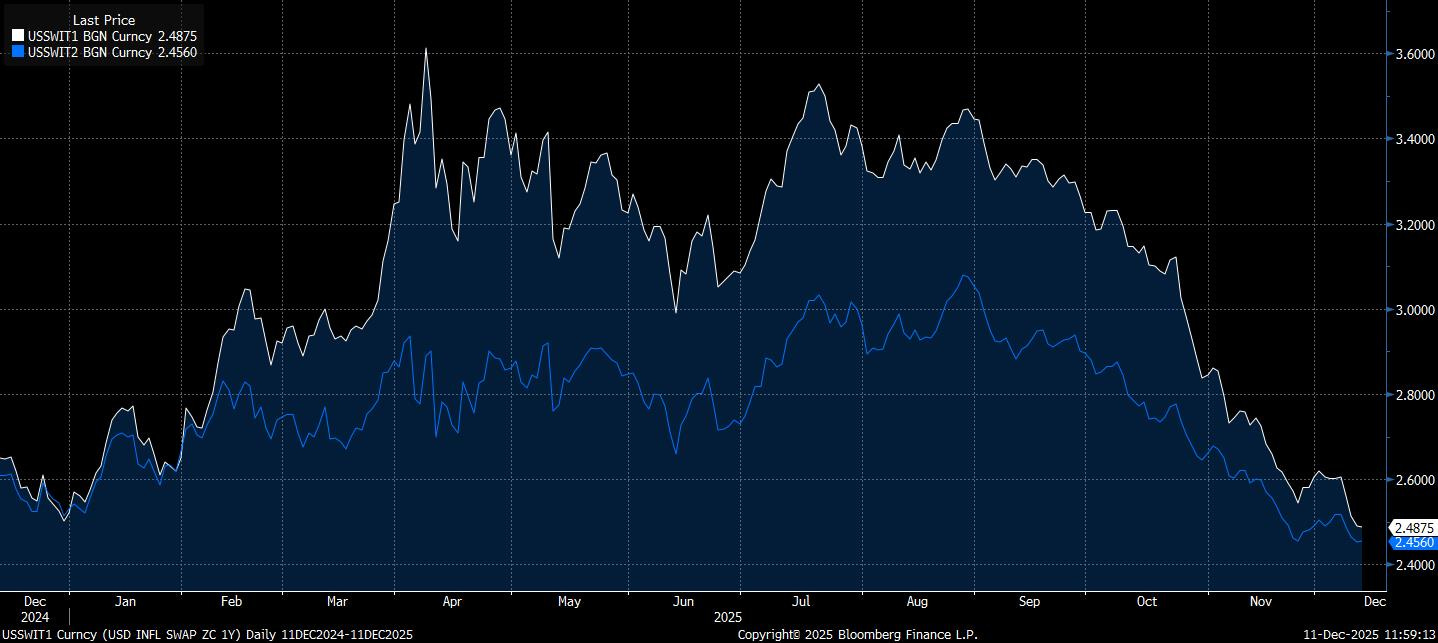

Markets seem even less bothered. One- and two-year inflation swaps have drifted back to pre-tariff levels. The gap between horizons has narrowed, effectively pricing the tariffs as a one-off shock that fades within a year.

For now, the Fed and the market are aligned. Both are acting as though inflation has been brought to heel.

But even with inflation viewed as comfortable or tolerable (even if elevated above the official “target”), we feel markets may be ahead of themselves with pricing rate cuts next year.

R*

The terminal rate has ticked up over the past month, despite Hassett being stated as the clear front-runner.

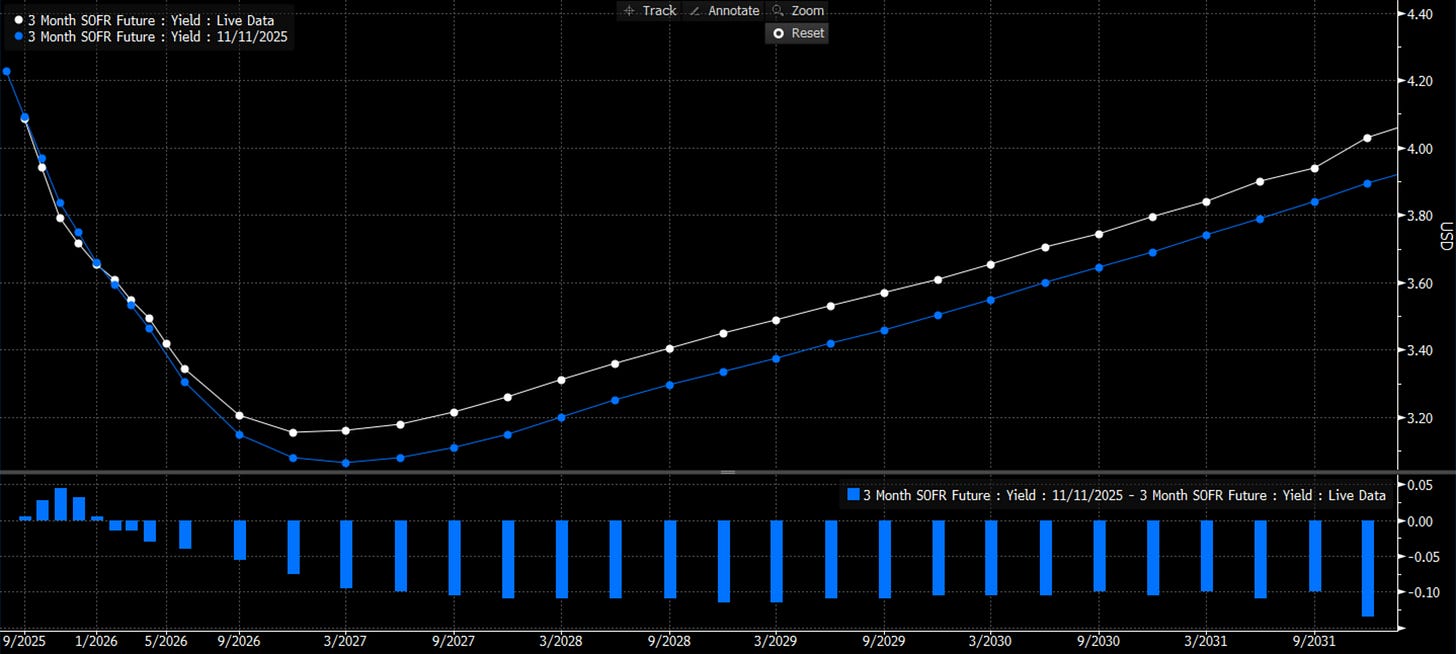

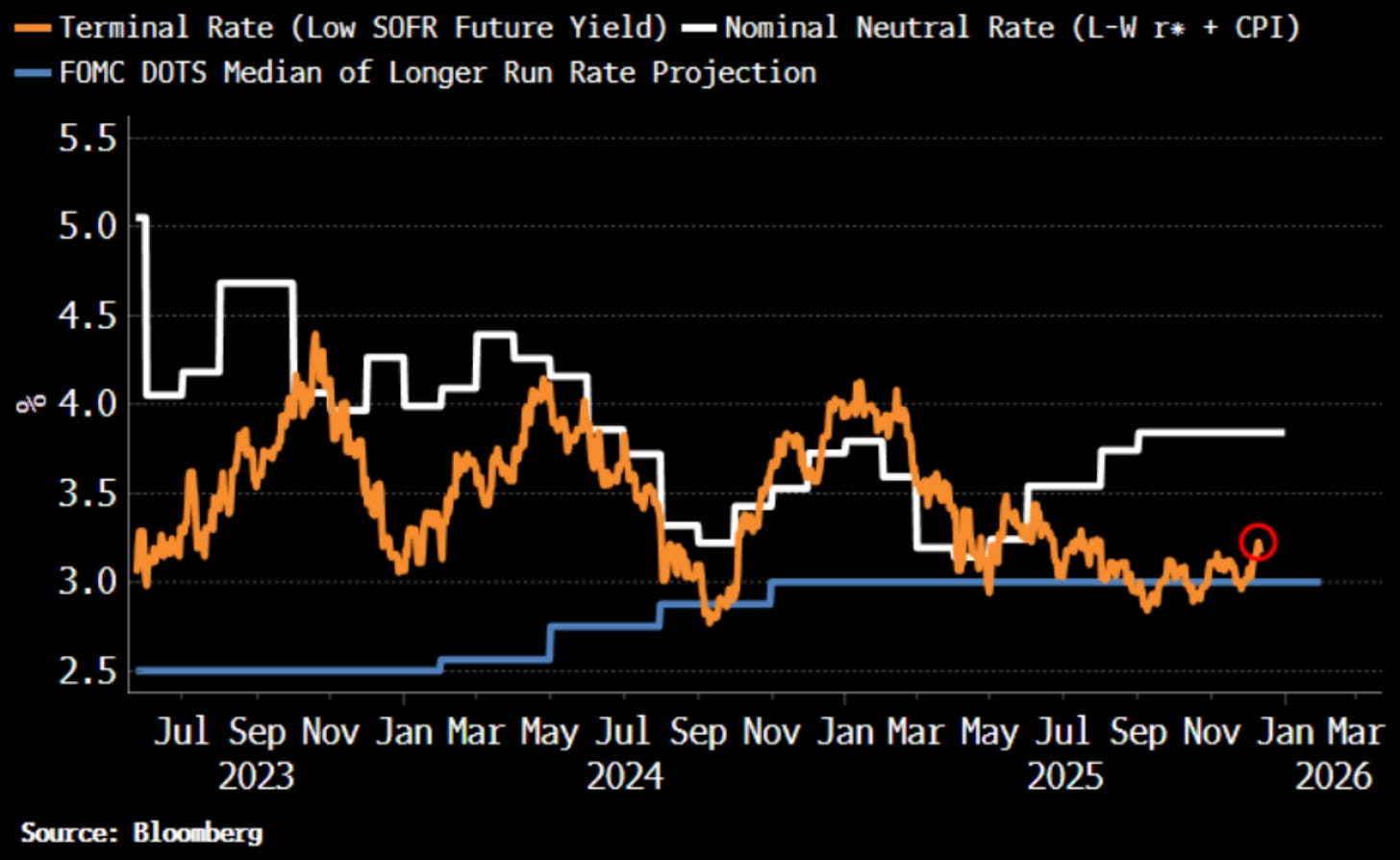

Theoretical economics offers its own guides to the neutral rate, such as the Laubach-Williams estimate, near 3.84% in nominal terms, or the Fed’s long-run dot plot, closer to 3%. At roughly 3.2%, the market’s expected terminal rate is parked near the bottom of that range.

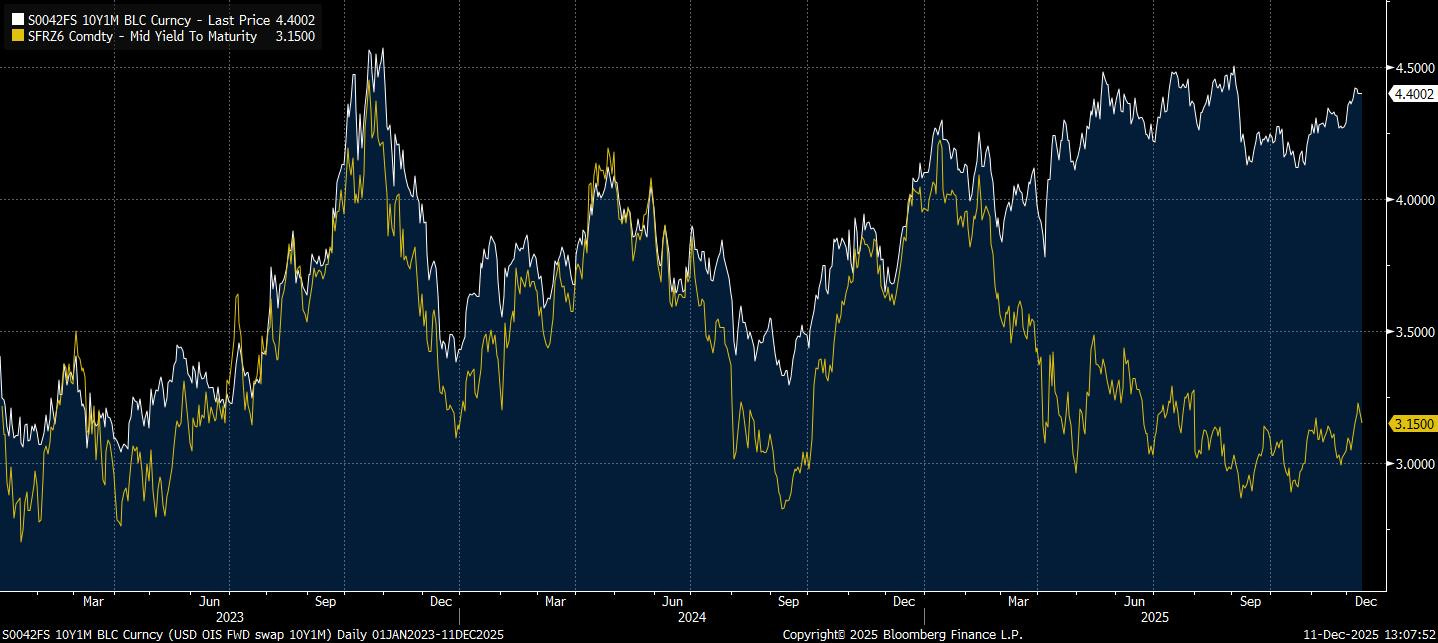

If you want a market-based read on the neutral rate, the 10y1m OIS is a measure.

The rate has been drifting upward for the better part of two years. It now sits comfortably above 4%, and more importantly, the gap between the 10y1m rate and the market’s expected terminal rate has widened. In other cycles, whenever the terminal rate traded too far below this forward neutral proxy, it eventually snapped back toward it, the market’s way of acknowledging that the Fed cannot sustainably run policy below neutral without re-igniting inflation pressures.

If the market’s estimate of neutral is rising while the expected policy rate a year out is falling, that’s a tension that usually resolves in one direction: fewer cuts, not more. A central bank that cuts into an upward-drifting neutral rate would be easing policy outright, not delivering an insurance cut or a calibration tweak.

Of course, the debate around the neutral rate is ongoing, and we are not here to say the 10y1m is the only benchmark. But it highlights our one concern for interest rates going into 2026.

For other areas of the markets, a recalibration of the terminal rate may not be detrimental. Equities have proved they can be driven by many other tailwinds, such as the ever-increasing AI narrative, which has become the cornerstone of returns over the last three years, despite the stop-start nature of this Fed cutting cycle.

Cutting Through the Noise

At AP, we hold the view that markets are overpricing rate cuts next year.

57bps are priced for next year.

The median dot plot (3.25-3.50%) is for just one quarter-point cut in 2026.

And by one measure, the Federal Reserve already have an accommodative rate.