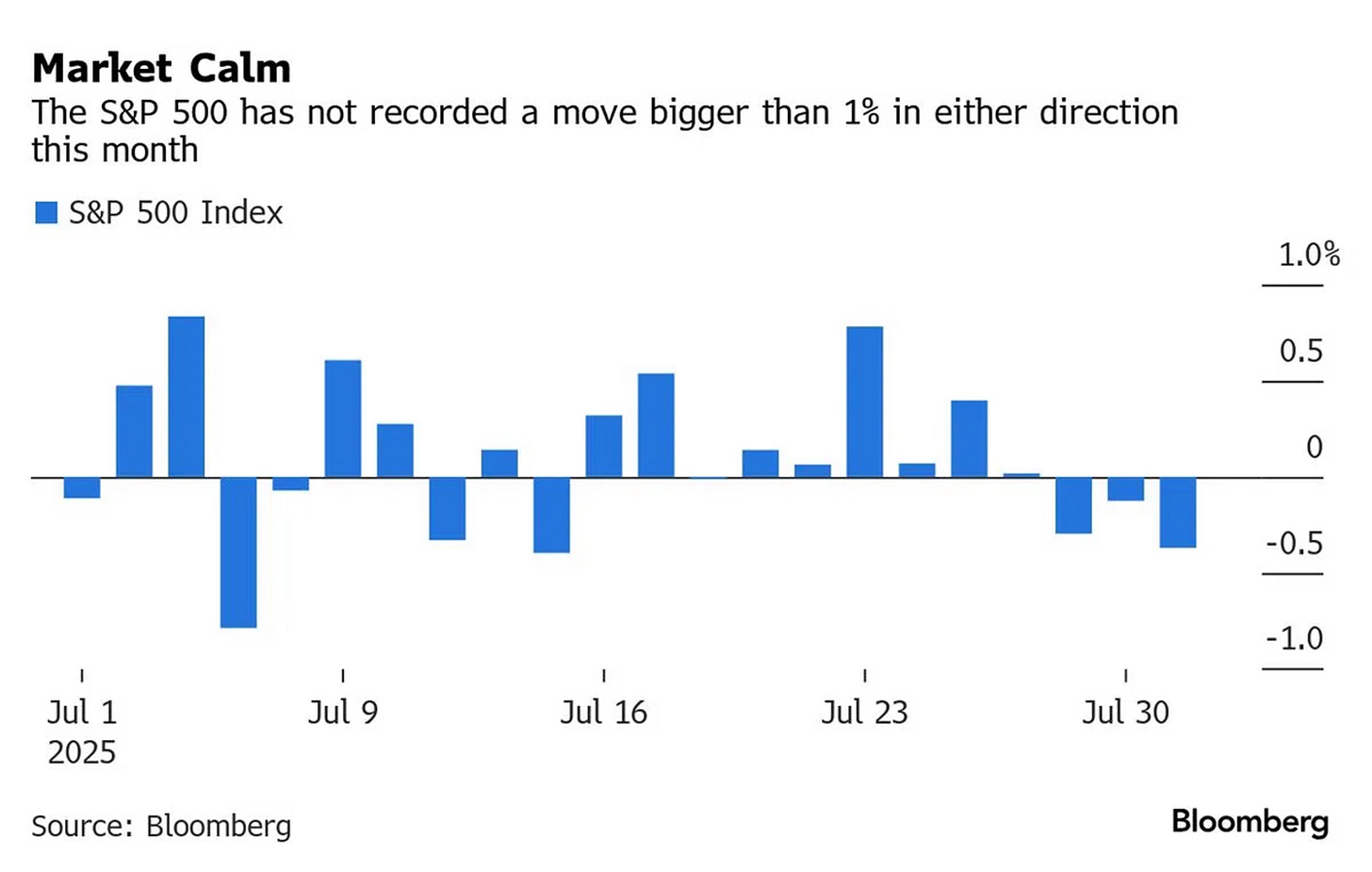

US equities marched higher in July, with the S&P 500 notching a 2.2% monthly gain and setting a string of daily records into month-end. A mix of strong earnings, resilient economic data, and visible progress on trade agreements with Japan and the European Union kept sentiment firm. The Nasdaq 100 outperformed (+2.4%), lifted by the Magnificent Seven, while volatility collapsed—not a single 1% move in the S&P 500 all month—marking the calmest stretch since October.

Tech led again, driven by robust results from AI-linked firms. Six of the Magnificent Seven reported in July. A quick rundown:

Nvidia (+13%) became the first company to hit a $4tn valuation. Government reassurances on AI chip exports to China added fuel.

Microsoft (+7.3%) disclosed $75bn in annual Azure revenue and joined Nvidia in the $4tn club.

Alphabet (+8.9%) beat estimates and signalled rising AI capex, pushing FY spending forecasts to $85bn.

Meta (+4.8%) topped expectations and raised guidance, betting big on AI infrastructure.

Apple (+1.2%) posted stronger China sales and iPhone strength.

Amazon (+6.7%) offered mixed guidance, worrying investors over AI-related costs.

Tesla (-3.0%) stood out for the wrong reasons. Musk warned of “a few rough quarters” as the firm absorbs the blow from Trump’s tax bill and shrinking EV subsidies.

The Fed held interest rates steady last week, voting 9-2 to maintain the benchmark federal funds rate at current levels. While no change was made to policy, officials downgraded their outlook for the US economy, an incremental but important shift that suggests the door to rate cuts may be opening. Dissenters Waller and Bowman argued for an immediate cut, though Fed Chair Jerome Powell struck a balanced tone, rejecting political pressure from the White House while acknowledging that uncertainty around tariffs still poses meaningful risks.

Inflation data offered a mixed picture. Core CPI rose just 0.2% month-over-month in June, below expectations and continuing a streak of softer-than-expected prints. Core PCE, the Fed’s preferred inflation gauge, increased 0.3% from May and 2.8% from a year earlier, showing that while inflation pressures are easing, they remain sticky. Meanwhile, second-quarter GDP rebounded modestly, supported by steady consumer spending and a notable drop in imports after earlier front-loading due to tariff concerns.

In currency markets, the US dollar staged a sharp reversal, logging its strongest month since President Trump returned to office. A softer European outlook also weighed on the euro, boosting the dollar’s relative appeal.

Treasury yields climbed across the curve, led by the policy-sensitive two-year yield, which rose over 20 basis points to 3.95%. July marked just the second negative month for Treasuries this year, as robust economic data and shifting policy expectations weighed on duration. Into month-end, hedge demand in long-end options rose noticeably, with traders positioning ahead of the Treasury’s refunding announcement, jobs data, and looming tariff deadlines in early August.

Strategist sentiment is beginning to show more caution. Bank of America warned that bubble risks are building as easier monetary policy meets a looser regulatory backdrop. JPMorgan flagged signs of complacency, pointing out that equities are rallying even as earnings revisions weaken. Meanwhile, Morgan Stanley’s Mike Wilson forecast a 5–10% equity pullback in Q3 as Trump’s trade policies begin to filter through balance sheets, but he views any correction as a buying opportunity ahead of stronger corporate earnings into year-end.

The Economic Week Ahead

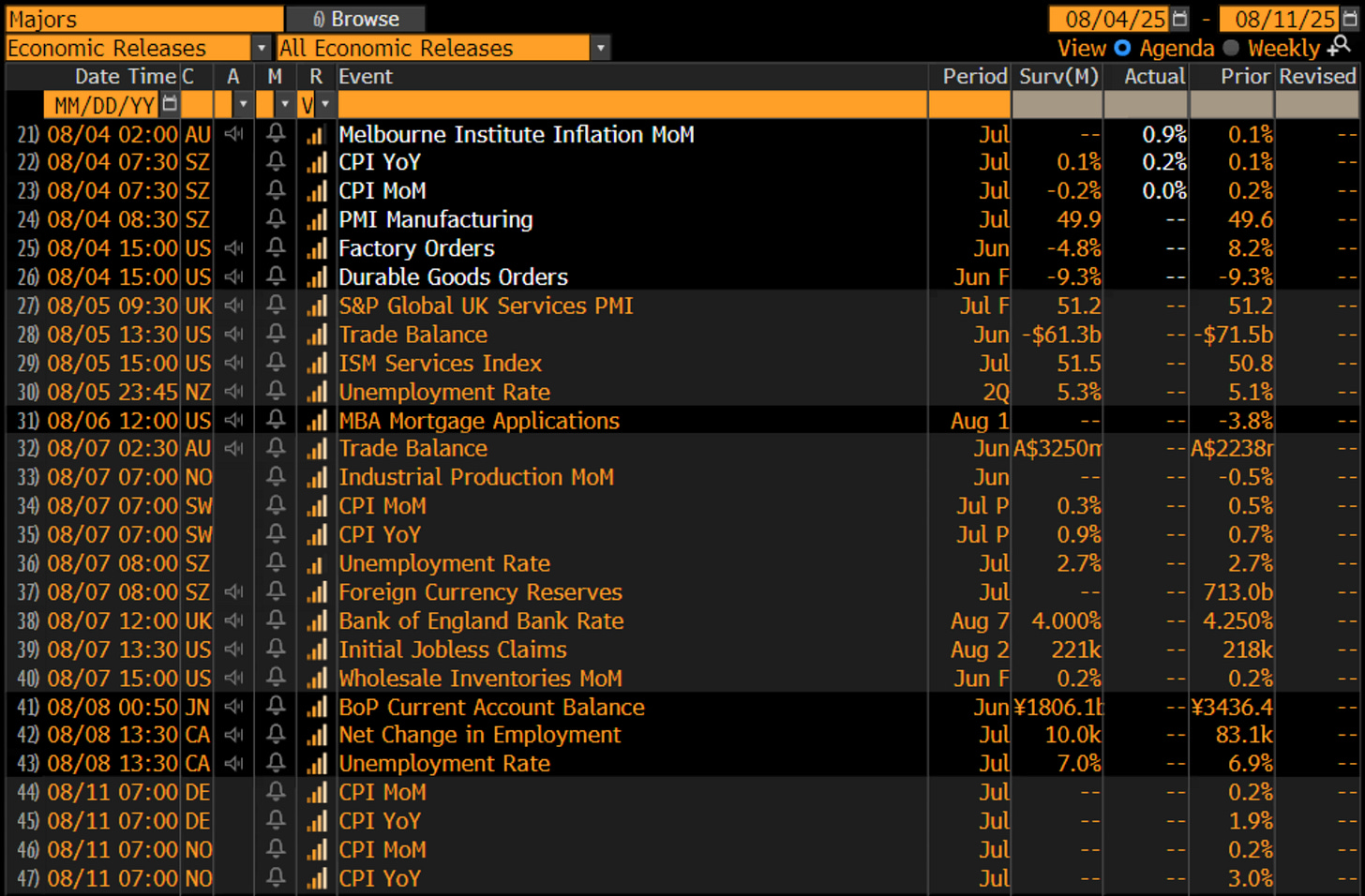

In the US, attention will centre on the ISM services index for July, due Tuesday. Following last week’s surprisingly weak nonfarm payrolls and a soft manufacturing ISM, this release is likely to carry outsized significance for market expectations around a potential Federal Reserve rate cut in September. Money markets now price in a 90% chance of a cut, up from 45% before the jobs data. Supporting evidence of economic softness, especially in the services sector, could solidify those odds. Also on the calendar is trade data on Tuesday and Q2 productivity numbers on Thursday, alongside weekly jobless claims. Treasury auctions will be closely watched, with $58bn in 3-year notes on Tuesday, $42bn in 10-year notes on Wednesday, and $25bn in 30-year bonds on Thursday.

In the UK, the Bank of England delivers its policy decision on Thursday and is widely expected to lower rates by 25 basis points to 4.00%. This move would align with recent dovish rhetoric, even as inflation remains sticky. Markets are pricing an 86% probability of a cut. Beyond the BOE, the final services PMI on Tuesday and Friday’s RICS house price survey will provide updates on activity and the housing market, respectively. Gilts supply will resume with a reopening of the March 2035 bond on Tuesday.

Across the euro area, final services PMIs for July will be published on Tuesday, offering insight into how consumer activity is holding up against the backdrop of recently finalised 15% US tariffs on European exports. Otherwise, the European calendar is largely backwards-looking, with June industrial production and factory order figures trickling in from Germany, France, Spain, and Italy. Germany will also conduct auctions across various maturities, including the 2027 Schatz on Tuesday and longer-dated Bunds on Wednesday. France, Spain, and Austria round out the week’s core European bond supply.

In Japan, the Bank of Japan will release the minutes from its June meeting on Tuesday and the summary of opinions from the late-July meeting on Friday. The latter is likely to draw more market attention, particularly for commentary on the recently concluded US-Japan trade deal and its implications for monetary policy and fiscal stimulus. On Wednesday, the BoJ will conduct JGB purchases across key maturities, while the Ministry of Finance auctions 10-year bonds on Tuesday and reopens the 30-year issue on Thursday. With the ruling coalition having lost its upper house majority, markets will be watching bond demand closely amid talk of additional fiscal issuance.

In Switzerland, the July CPI figures on Monday will be scrutinised for early signs of domestic inflation trends following President Trump’s unexpected announcement of 39% tariffs on Swiss exports. The shock move adds trade risk to an otherwise stable macro backdrop and could feed into the Swiss National Bank’s thinking later this quarter.

Let’s start with FX ideas this week:

FX

Bank of England Naysayers:

Investors were quick to offload USD in the wake of the disappointing set of data to end last week. We think it’s too early to call whether this is the start of the next leg lower in the greenback, so we prefer to steer clear of fresh USD exposure this week.

Instead, we turn to the Bank of England meeting, where a 25bps cut is expected and therefore shouldn’t move the needle much. However, we expect Bailey and Co to express concerns about the slowdown in economic growth, while tempering worries about inflation (which they had forecasted to spike to around this level).

We expect it to be an underwhelming meeting for GBP bulls and like to position for further downside in GBP crosses ahead of Thursday. GBP/CHF, playing on CHF remaining bid on global worries even with the dodgy tariffs from Trump, looks likely to test April lows, and could even push beyond.

Entry: 1.0675

Stop Loss: 1.0825

Take Profit: 1.0375

Rolling short AUD/USD into long EUR/AUD

Last week we went short AUD/USD at 0.6566, which paid off well, triggering our extension take profit at 0.6450. However, we cycle out of the USD leg and roll this into a long EUR/AUD.