Economics: Central Bank and Tech Earnings Preview

Previews ahead of FOMC, the BOE interest rate decision and major tech earnings in what is expected to be a volatile few days ahead.

FOMC to likely see a 25-basis point hike and “ongoing increases”

BOE divided and a difficult choice, UK recession warnings rise

Earnings could extend move up with record amounts of cash on the sidelines

The Federal Open Market Committee (FOMC) is the primary monetary policy-making body of the Federal Reserve System. It holds eight regularly scheduled meetings per year to review economic and financial conditions and determine monetary policy. The outcome of these meetings can have a significant impact on financial markets and the economy.

The Bank of England (BoE) interest rate decision refers to the rate at which the BoE sets the benchmark interest rate for the United Kingdom. This rate, also known as the Bank Rate, serves as a benchmark for many other interest rates in the economy, including those on mortgages, loans, and savings accounts.

FOMC

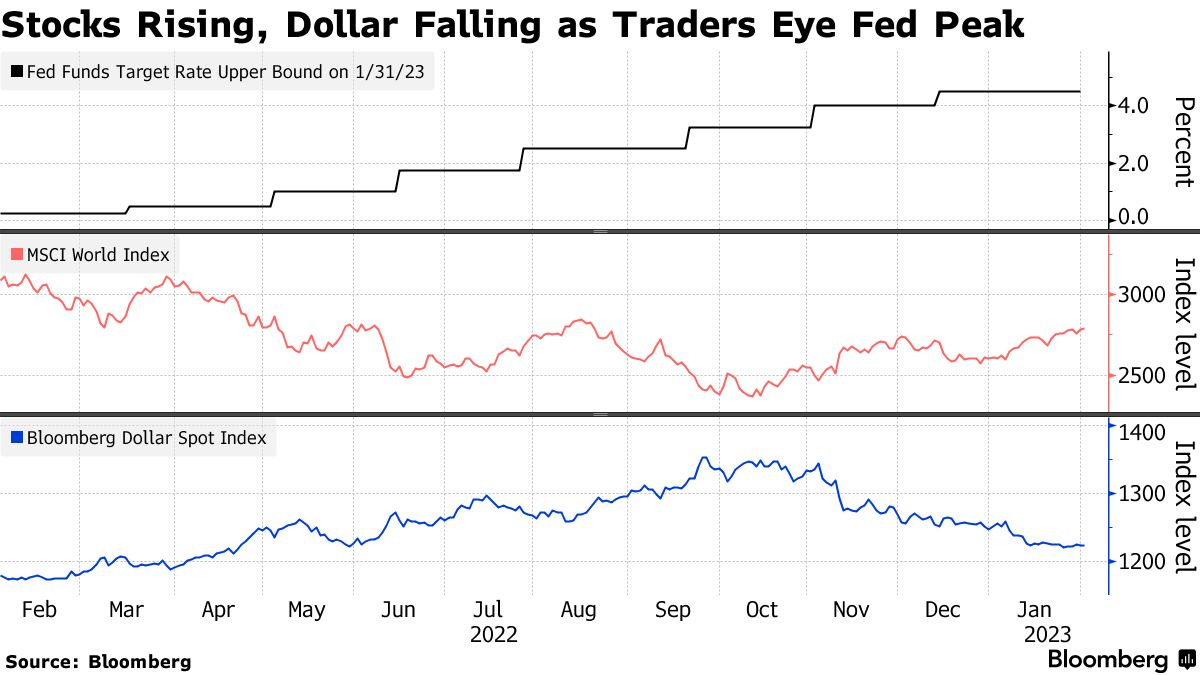

The main point to look out for in the FOMC meeting is the basis point increase. Most signals point to a 25-basis point hike, bringing its benchmark to a target range of 4.5% to 4.75%. There is little to signal any other decision. The market currently has this rate factored in.

The Feb 1st meeting is not accompanied by a summary of economic projections or a new set of dot plots, so the accompanying statement and Fed Chair Jerome Powell's post-meeting remarks will determine the market reaction more than the decision itself.

The statement's two most important components will determine the immediate mood of the market response. One that will be closely scrutinised is whether the phrase "ongoing increases" to the benchmark rate will change. For example, the Fed might change the wording to imply that additional tightening will happen in smaller steps.

“Where there is a market disconnect is that the Fed keeps saying over and over again — and these are doves and hawks alike — that the policy rate is likely to stay at peak for quite some time,” said Ellen Zentner, chief US economist for Morgan Stanley.

The decision will be announced on Feb 1st at 2 pm EST, and the Fed chair, Jerome Powell, will speak 30 minutes later.

BoE interest rate

The BoE was the first major central bank to increase rates and start reducing its quantitative-easing stimulus. As a result, it was also the first mover in actively selling its QE bond holdings back into the secondary market.

The nine-member Monetary Policy Committee is as divided as ever, so it will be a difficult choice. Three-way voting divides have occurred at the last three MPC meetings. While some policymakers are more concerned with preventing an overly steep economic downturn, others have stressed the potential of under-tightening, which might force the bank into a second round of hikes.

The bank's quarterly review will also be discussed during this week's BOE meeting. For the majority of the past year, there hasn't been much growth in the UK, but the bank's predictions that a recession began in late 2017 may now be rectified to reflect some growth.

However, multiple red flags are present in the UK economy. The property market is struggling to tread water, manufacturing and services PMIs are disappointing, and the IMF forecasts indicate the UK economy will perform the worst of the developed nations this year. The recession probabilities below, therefore, are not surprising:

The risk for the BoE is that they acknowledge the fragility of the economy and pause rate hikes or hike 50bps this meeting and pause from there. This would be positive for UK equities, but we could see sharp weakness in the British Pound as further rate increases get priced out.

The meeting will take place Feb 2nd at 12pm GMT.

Tech name earnings

This week has also included some major earning releases. SoFi, Exxon Mobil, General Motors, Spotify, AMD and Snap Inc have already released earnings. After close today, we see Meta release their earnings, with Thursday’s US market close seeing the release from Amazon and Apple.

Here is a quick rundown of the estimates for the names to come:

Meta Platforms: EPS 2.259, revenue $31.551B META 0.00%↑

Amazon: EPS 0.175, revenue 145.698B AMZN 0.00%↑

Apple: EPS 1.938, revenue 121.498B AAPL 0.00%↑

Meta Platforms will be assessed for their revenues and expenditure on the continued pursuit of virtual reality. Analysts have slashed their average expectations for adjusted earnings per share by 27% and revenue by 15% over the last six months. The company may need to offer investors more clarity, including its strategy to tackle competition from social media rivals such as TikTok. However, Meta is currently leading its FAANG competitors since the November low.

Apple will have investors intrigued by iPhone sale numbers as the demand for their flagship product has softened in recent months.

Overview

What is almost guaranteed this week is volatility. SPY SPY 0.00%↑ will see big moves on the initial data release and the following speech. European SPXX 0.00%↑ and UK UK 0.00%↑ markets will see movement on Thursday. Individual US names will also see large volume in the build-up and reaction to earning releases. This implied volatility is increasing the costs of options across the board.

We expect that US markets will finish higher at the end of this week. With investors already anticipating a particular decision, we don’t see markets falling lower unless a shock result is announced.

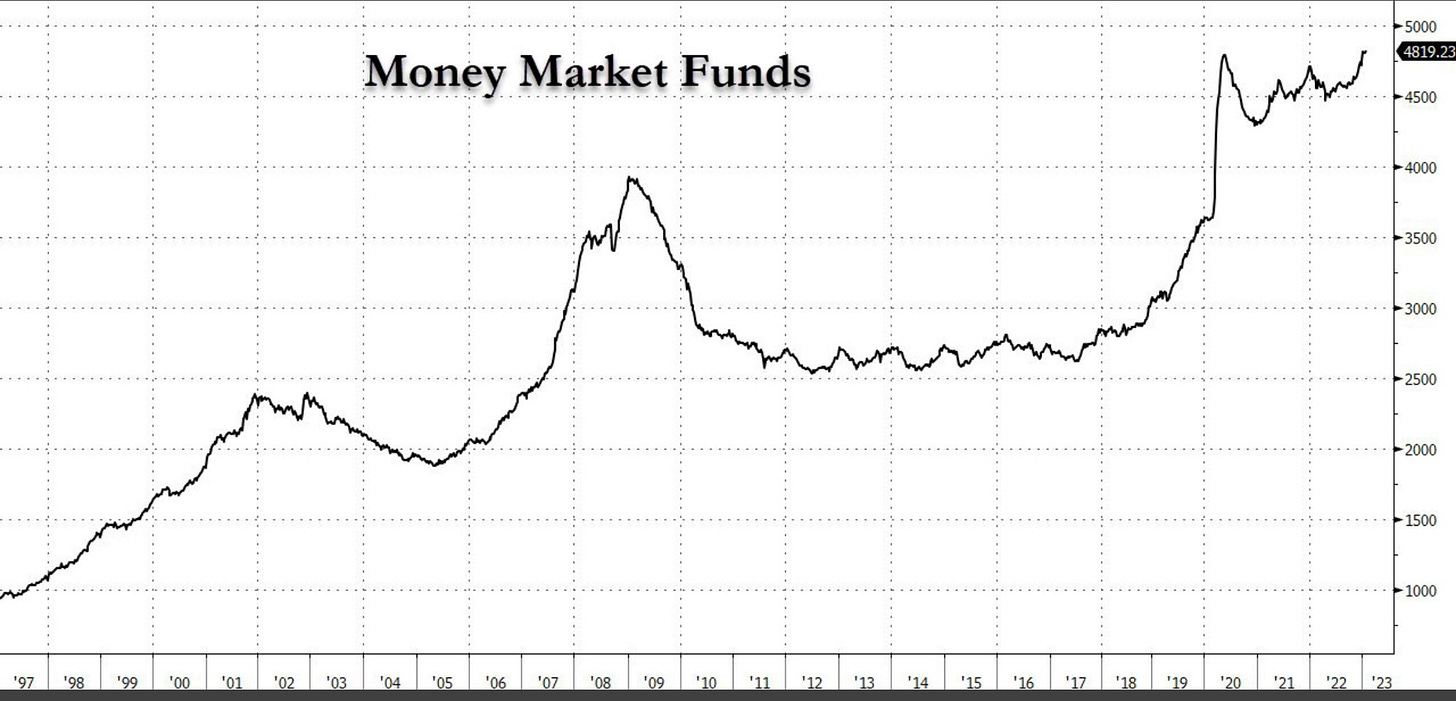

What is interesting to note is the amount of cash currently on the sidelines. Money market cash is at a record high of $4.8 trillion, even higher than the 2008-2009 period. However, all that money may come back into stocks soon, coinciding with the future economic outlook becoming slightly more transparent by the end of this week.

If you enjoyed this preview for the events ahead, please drop a like on this article and share it with others.

Also, you can subscribe for free below to stay up to date with articles released twice a week.

Looks like today could be choppy! Time to keep eyes peeled. Thank you for an informative and realistic read