Economics: Hotter-Than-Expected CPI Leaves Markets Mixed

CPI came in lower YoY but higher than expected, leaving the S&P 500 flat, the Dollar up and volatility down.

CPI data above expectations

Stocks flat, dollar up

UK inflation slows for the third month

CPI data came in at 6.4% in January compared with a year earlier. Estimates expected a more considerable decline, with the average consensus at 6.2%. This data will surely increase the concern about persistently high figures across the US economy.

When energy and food costs are excluded, the "core" CPI measure increased at an annual rate of 5.6% in January, which was also somewhat less than the 5.7% increase in December. However, a 5.5% increase in the year-over-year metric was what economists had predicted.

As crucial information for investors, economists, and US central bankers, the January inflation report was being eagerly studied. In addition, expectations that the Federal Reserve might need to be more proactive in tightening monetary policy to slow the economy was fuelled by an unexpectedly strong jobs report for last month.

The outcome

Following the hotter-than-expected CPI announcement, Wall Street was volatile. US stocks and government bonds bounced between gains and losses.

On Tuesday, the Nasdaq Composite, which is heavily weighted towards technology, rose 0.6%, while the S&P 500 finished unchanged.

The two-year Treasury yield reflected a price decrease, which closely tracks interest rate forecasts. It increased by 0.08 percentage points to 4.62 percent.

Those moves came as pricing in the futures market indicated that investors were expecting US interest rates to peak around 5.27 percent in July before falling to almost 5.07 percent by December — implying no interest rate cut before the end of the year.

Earlier in February, markets had priced in a peak of about 5 percent in May, with two interest rate cuts by the end of 2023.

Is Vix broken?

Given everything going on, the index, which financial journalists seem constitutionally obligated to refer to as "Wall Street's fear barometer," does appear to be relatively low. It now stands at under 20%.

CPI comes in higher. The S&P 500 closes flat. The dollar rises. VIX drops 7%. Something doesn’t seem right.

However, despite being designed to capture what investors think the S&P 500’s volatility will be over the next 30 days, as implied by the prices of options, the index has always been a better measure of the mood in markets right now. And right now, the moderate Vix reflects that markets have started the year in decent shape.

UK inflation

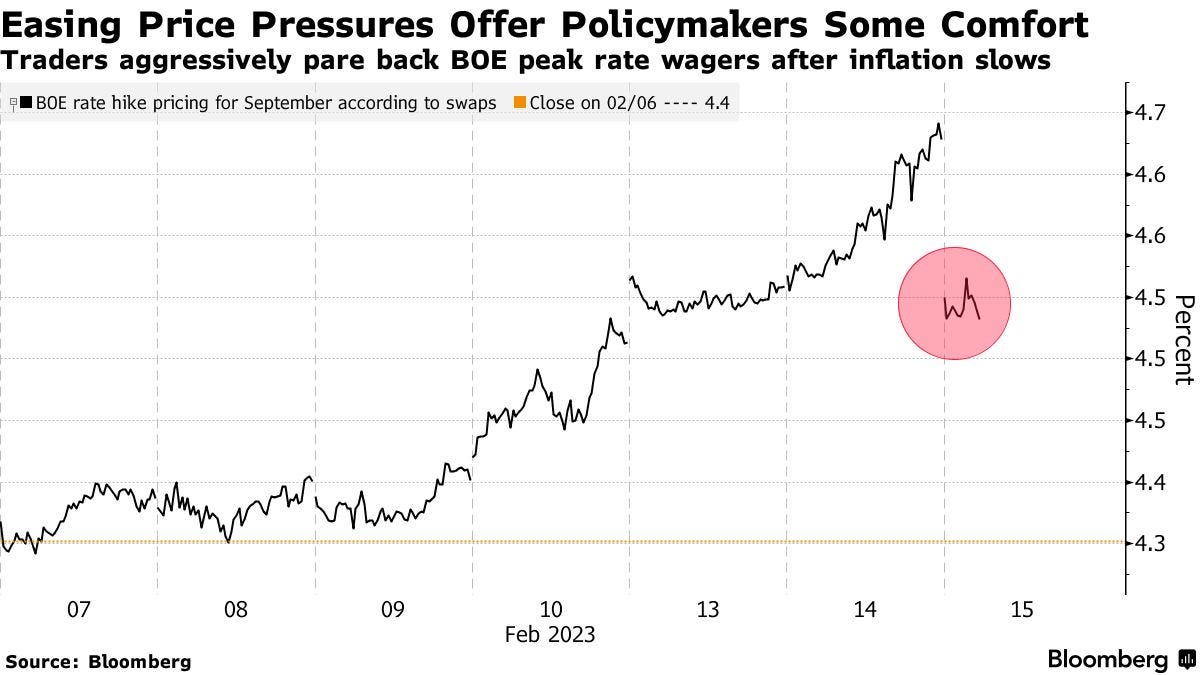

According to data released on Wednesday, the inflation rate slowed for a third month, which led traders to reduce their predictions on future BOE rate hikes. The current bet is that interest rates will increase to 4.53% in September instead of the 4.69% projected on Tuesday.

Falling petrol prices helped to slow UK inflation in January, and an ongoing drop in energy prices could offer further support to UK government bonds.

It’s a strange world when a 10%+ inflation print sees interest rate expectations fall