Economics: The Destination Not The Speed (Fed Preview)

In our US Fed Preview, we run over the tightrope between financial stability and inflation control that Powell and Co. need to walk today

25bps hike is most likely, but tail risk of a no-hike is present

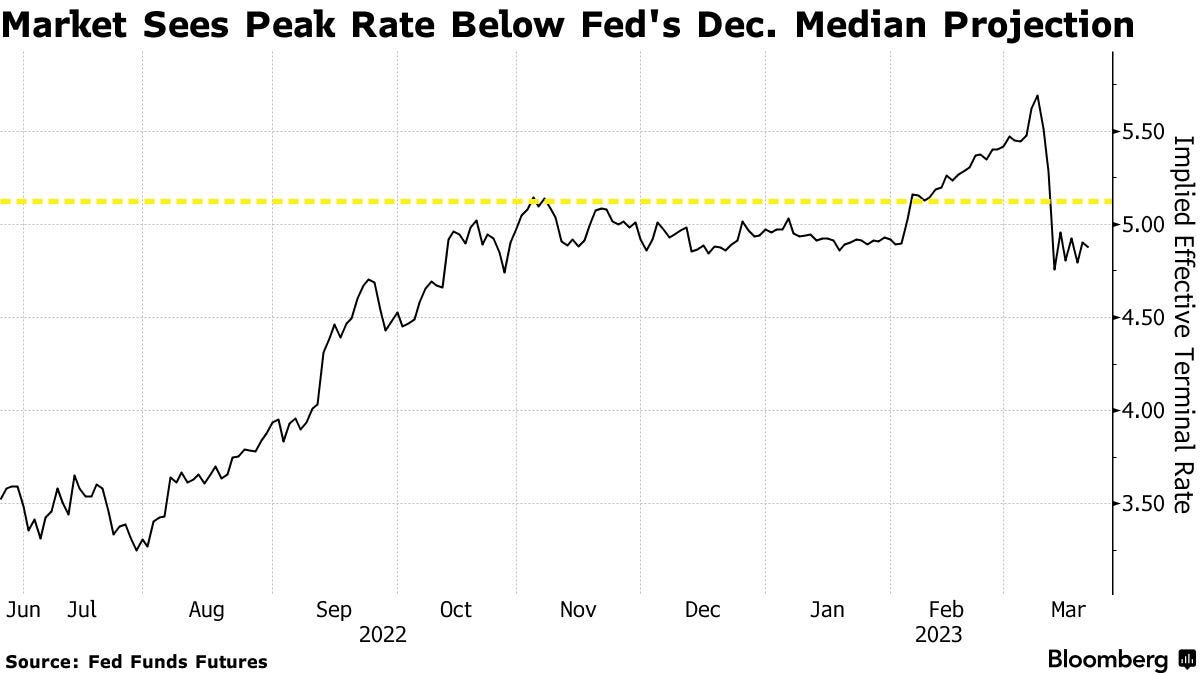

We feel the end destination of a 5.50% terminal rate is still there

Slowing down to the speed of hikes due to financial stability makes sense

Tonight at 6pm GMT we get the latest policy decision from the US Fed. Market consensus is for a 25bps hike, taking the upper bound to 5.00%. Even though this is expected, there’s a small (but very valid) chance for both a no-hike and a 50bps hike, which would see an outsized reaction in markets.

Here’s what you need to know.

Size of the hike

A no-hike situation would be driven primarily by the Fed being concerned about the recent issues in the banking sector. Regardless of how you want to spin it, one of the causes of the SVB demise and other regional banks in the US was the low rate, ease of lending environment. The sharp increase in rates has exposed this, so increasing rates further could act to put more stress on financial stability.

It would therefore seem counter intuitive for the Fed to hike aggressively when it also has a mandate to look after the economy as a whole. There’s a 10.7% probability of no hike this evening:

On the other hand, a 50bps hike would send a clear signal to the markets that it’s still committed to the cause of bringing down inflation. It was less than a month ago when Powell testified before Congress and boldly stuck to his guns (we enjoyed the showdown between him and Warren) that the Fed would continue to use tools to get inflation under control.

Despite this scenario tonight being the least probable, if the Fed did want to push the rhetoric of inflation being the main aim, a 50bps would certainly do this.

Finally, a 25bps hike is our preference, in line with most in the market. This is the best of both worlds. It shows that the Fed aren’t blinking in the face of tightening financial conditions, yet at the same time shows that they acknowledge the impact of what higher rates can do to the banking sector.

As far as the initial stage of walking the tightrope goes, 25bps seems to fit.

More hikes, just further down the line

We expect the Fed to note that they still see a terminal rate in the 5.5-5.75% range, with all that has really changed is the speed of getting to that destination.

If they flag up the likelihood for hikes in the summer, there should be some re-pricing higher in the bond market, given where we’re currently at (see below).

Addressing the elephant in the room

It seems impossible for the Fed not to discuss the impact of SVB, First Republic and other banking situations that have developed in recent weeks.

The reaction from the market will stem from if this is going to materially distract the Fed from the previous monetary policy path they were on. After all, a gauge of sentiment on conditions isn’t currently that optimistic:

We argue that it won’t. Firstly, there are plenty of other tools to help deal with a troubled banking sector. We’ve already seen some of these in action, including FDIC protection, bail-ins, bail-outs, guarantees, backstops etc etc. Fundamentally, the Fed doesn’t need to get embroiled in all of this.

Second, US data has continued to run hot over the past month. This has always been critical (data dependency) on Fed policy. If the committee drop this and focus on financial stability, it will lose all credibility by market participants. Ironically, it also won’t help financial stability in global markets, as traders will second guess what to focus on when it comes to trying to predict Fed outcomes.

The risk to our view is that for once, the outcome of the Fed meeting could be overlooked if further banking problems arise in coming weeks. The Fed might come out and stress that inflation is still the main priority. Yet if we get issues blowing up in April, the market will probably assume the Fed will change tact depending on the severity of what happens.

How to trade the Fed tonight

Pulling everything together, we expect a 25bps hike, with Powell stressing that inflation control remains the priority. We feel this will be negative for stocks. We don’t think this materially shifts USD either way.

The big moves will come on either a no-hike or a dovish hike (25bps but stressing concern about the banks). In both scenarios, we see a strong spike in stocks, and a knee-jerk move lower in USD.

For those that want to play for a big move but don’t have a directional bias, a strangle option (buying a call and a put with a different strike level) is an option to consider. More details on that can be read here.

Our Twitter account posts quick, informative tweets and data throughout the week. We also join live trading spaces, which you can listen to. So please drop us a follow and turn notifications on to stay up to date.

Great write up, Team 🫡