Equity Concentration Concern?

We don't think so.

Talk in the markets of late has been concentrated on… equity concentration.

Nvidia alone has driven 45% of the S&P 500’s gain over the last two months. Other semiconductor names (such as Broadcom, Qualcomm, Micron, etc.) have been responsible for 17% of recent gains. The Fab Five have driven 11% of the rally.

What about the other companies and industries that comprise the equity benchmark? They’ve contributed a negative 2%.

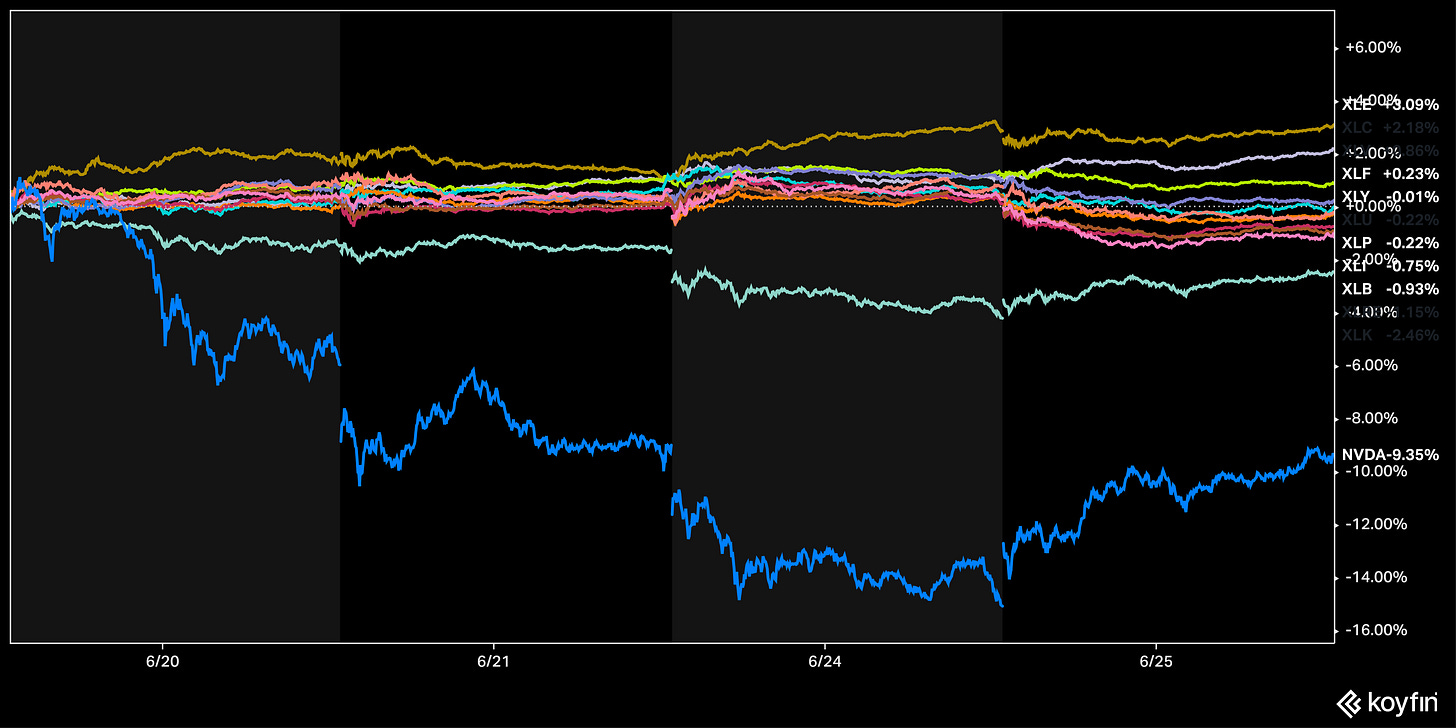

However, recent trading has seen Nvidia fall 15% in three trading days, and money has flowed into other sectors, notably energy, communication services, healthcare, and financials.

Time for more breadth in the market? Looking at a sectoral breakdown in Q2, the current rally is primarily centred on three sectors: information technology, communication services, and utilities. Sectors such as consumer discretionary and health care have seen modest single-digit gains, while industrials, materials, and the energy sector have encountered challenges. This stands in sharp contrast to Q1 when all sectors (except real estate) made progress.

We are a few days from the start of a new quarter. Maybe we’ll see more of a Q1 theme than Q2 in the coming months.

Concentration

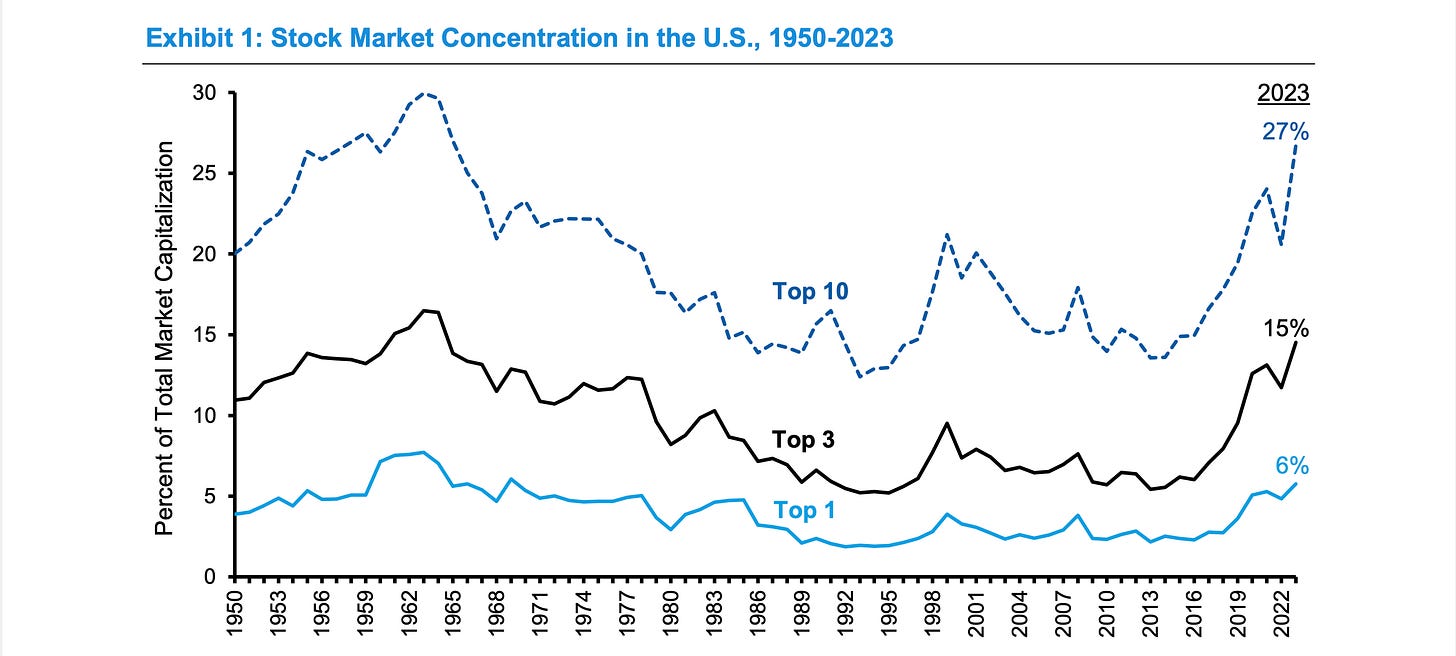

Throughout the decade ending in 2023, the US stock market saw a significant increase in concentration, with the top 10 stocks’ weighting nearly doubling from 14% to 27%. This means that a small number of stocks have had a substantial impact on the overall market’s return. To illustrate, the appreciation of MAG7 contributed to over half of the S&P 500’s gain of 26.3% in 2023.

It raises a question: What is a normal level of concentration in an index?

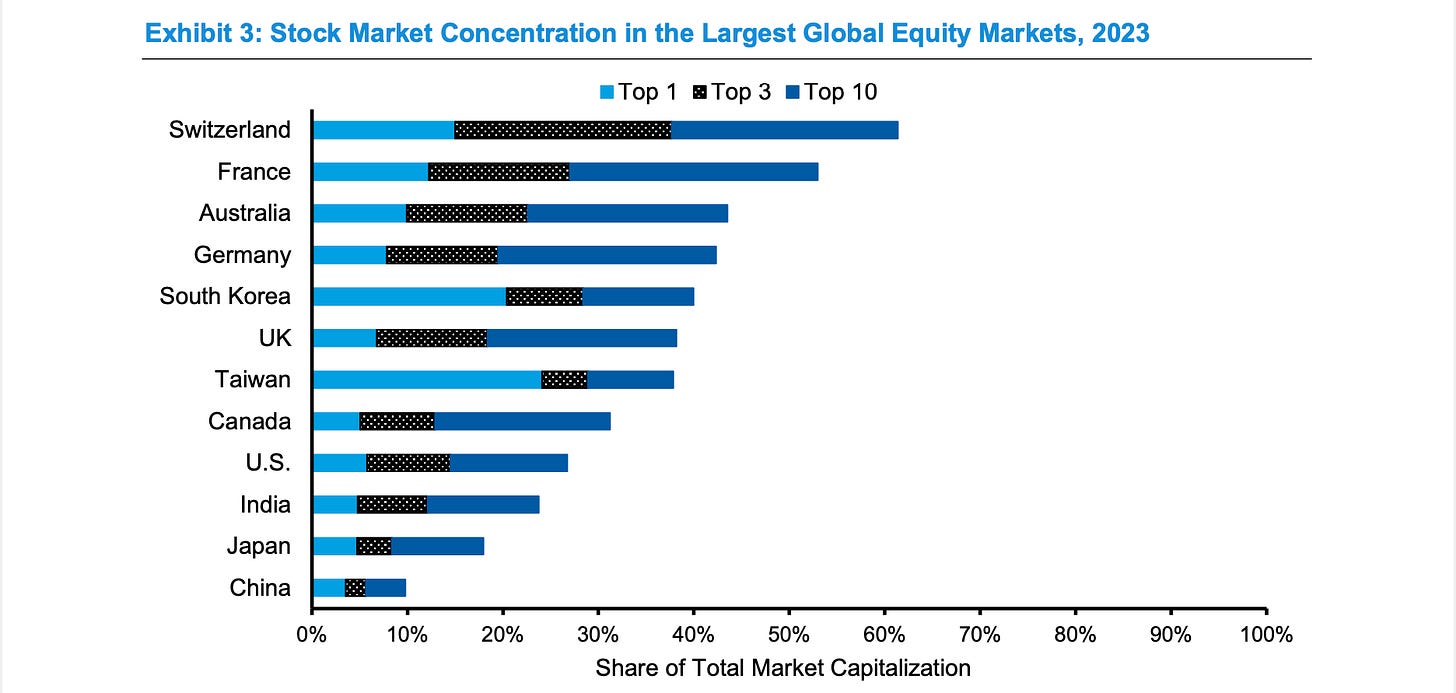

Let’s look at equity markets beyond the United States to gain insights. The below image visualises the market concentration of 12 major global markets at the end of 2023. Despite the recent rise in concentration, the US stands as the fourth most diversified market. With the US contributing around 60% of the total equity market capitalisation in 2023, changes in the US market composition significantly impact aggregate indices like the MSCI All Country World Index. A study covering 47 equity markets from 1989 to 2011 revealed that the average weighting of the top 10 positions was 48%. In 2001, Finland and Switzerland exhibited concentrations exceeding 80%. Notably, during the early 2000s peak, a single stock, Nokia, represented roughly two-thirds of the total market capitalisation of the Finnish market.

Is the current concentration in US equities unusual? The data suggest it is not.

Highlighting a US-to-US comparison over the past years, market concentration has been similar before.

Can calm last?

An increased concentration would usually see increased volatility. But markets have been on a very calm incline.

Market volatility has been at historic lows, causing unease among Wall Street investors. The S&P 500 has shown a consistent 14% increase in the first half of 2024, reaching 29 record highs. Notably, one-day index fluctuations of 1% in either direction have been infrequent, with only a single 2% move – the lowest occurrences since 2017 at this point in the year.

The Cboe Volatility Index (VIX) plummeted to below 12, marking a nearly five-year low. As a measure of traders’ expectations of stock price fluctuations, this index reflects the price of options used for hedging against market downturns.

Investors are feeling optimistic. The economy has proven to be more robust than initially anticipated following the Federal Reserve’s decision to increase interest rates. Corporate profits are on the rise once again. Inflation has decreased more than was anticipated in the recent consumer prices report, and the Fed has indicated that it anticipates reducing benchmark rates later in the year.

Additionally, the AI boom is contributing to substantial gains for market leaders such as Apple and Nvidia, further boosting investor confidence. However, it’s crucial to note that periods of extreme market stability seldom persist.

The VIX index remained at similar levels during most of 2005 to 2007, before abruptly surging above 80 during the 2008 financial crisis (not to sound like a “levels not seen since 2008” doomer). A strong economy and stable markets can lead to complacency among investors, prompting them to turn to riskier, more speculative investments in pursuit of higher returns.

This quote came up the other day:

“On a really calm day, it’s easy to blow bubbles. They can grow to humongous sizes. When the wind picks up, they pop.” - David Kelly, chief global strategist at J.P. Morgan Asset Management.

Is the concern justified or overstated?

We don’t see a “pop,” so to speak. The stocks making up the high concentration will go through slower periods in the future. As an example, following the earnings report in June 2023, which saw the stock rise 25% overnight, Nvidia spent six months in a $12.50 range last year before exploding higher at the start of this year. Granted, that $12.50 range was 25% of the market cap. Although there were big fluctuations, it was in range nonetheless.

Apple had a similar story in 2023. A strong H1, followed by a choppy H2.

Slower periods in these outperformers will happen, and money will flow into other areas of the market. On a broader horizon, the AI boom will start to take effect in other areas of the market. The concentration of growth will expand away from the initial boom, that being semiconductors and data.

Deutsche Bank AG: “Is Rising Index Concentration a Threat or an Opportunity” notes:

After spending this morning at the above event and considering the topic is very much in line with the thoughts already noted, we wanted to share our takeaways from this presentation.