Europe Prepares for a World Without Uncle Sam

It's a 'pay up or stand alone' situation in Europe.

It’s no secret what Trump’s view of NATO is. Within his first week back in the office, he resumed his browbeating of Europe to spend more on its own defence. Whatever EU members thought of the President’s criticism in his first term, Russia’s full-scale invasion of Ukraine in 2022 shifted the landscape dramatically. In response, many countries have been boosting their defence budgets, even before any U.S. pressure to do so was about.

Investors have picked up on the trend of defence spending. Among the four best-performing stocks in Europe over the past year are Germany’s Rheinmetall, known for manufacturing battle tanks, and Norway’s Kongsberg Gruppen, which specialises in missile production.

While this theme is underway, we believe further pressure from the U.S. has the potential to continue spending expansion into European defence names and also create a shift in the sector domestically.

The End of the Free Ride for Europe’s Defense

Europe has faced a shift in reality over the past few years as conflicts escalate between Russia and Ukraine, and concerns remain about Russia’s intentions if an invasion of Ukraine is successful. Commentary out of Davos last week also highlights this. Secretary General of NATO, Mark Rutte, spoke of the alliance needing a “war mindset” in an interview with Bloomberg, also noting that Europe should be paying more of the financial burden, regardless of Trump’s comments. More specific details may come in March, when Andrius Kubilius, the EU’s defence commissioner, will publish rearmament needs.

During his campaign, Trump said he would dial back U.S. security relationships with Europe and during a NATO summit in his first term, Trump threatened to leave the military alliance if allies didn’t boost spending.

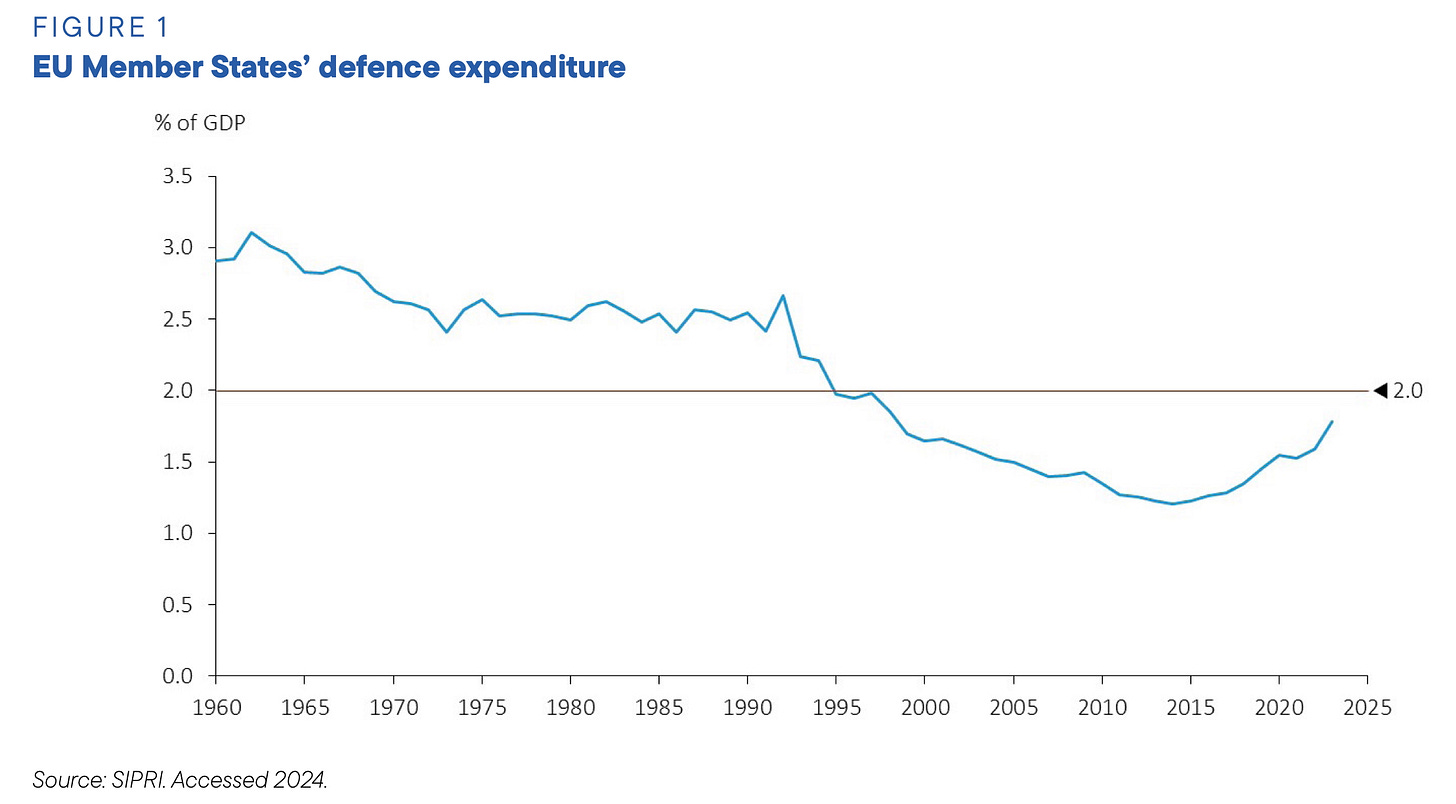

The exact scale that Europe can up its military spending is unclear. The Trump administration is pushing a 5% of GDP agenda, but something around 3% is a more likely outcome. 2024 figures came in at just 1.9%.

Europe is in a tough situation economically. The ECB cut rates again yesterday to help stimulate a stagnating economy. The only feasible way for Europe to meet this increase in spending over the next few years would be through debt sales. Any funding via tax increases or cuts in other areas will impact their economy further. But there is one silver lining to all of this.

Much of NATO’s spending goes overseas. Mario Draghi, former ECB President, estimated that 78% of purchases come from production outside the EU—and 63% from the U.S. alone. Increasing spending overseas leaves Europe out of the picture for any economic boosts.

If Europe instead focuses these expenditures on European defence contractors, there would be several benefits and incentivise more spending, helping to reach the 3% goal. A build-out of the European defence industry would also lead to job creation at a time when the heavy automobile industry is declining. The balance of a shrinking auto industry but a growing defence industry would also ease knock-on inflationary concerns of increasing labour market strength.