“When Investing, Less Is Often More”

Joel Greenblatt has annualised a return of 50% using his 'magic formula' investing method.

Joel Greenblatt, renowned for his expertise in value investing, holds a prominent position among Wall Street's notable investors. In 1985, he established Gotham Capital, a venture that yielded an impressive annualised return of 50% from 1985 to 1994. Recognising the need for progression, Greenblatt founded Gotham Asset Management in 2008 as a successor to his previous fund. Presently, he assumes the role of Managing Principle and Co-Chief Investment Officer.

AlphaPicks on Wall Street is a reader-supported publication. If you are a new reader, we would greatly appreciate you subscribing to our articles. We release a weekly watchlist on Monday, deep-dive articles on Wednesday and Friday, and then some light weekend reading on Sunday.

If you are already subscribed, please feel free to share our page with others or leave a like and tell us what you thought of Joel Greenblatt in the comments.

Early days

Greenblatt became curious about value investing while learning about the efficient market hypothesis. According to the hypothesis, all publicly available information is already priced in. In other words, value discovery is a futile exercise. Greenblatt felt that this could not be true, and in his search for answers, he discovered the teachings of Ben Graham.

Graham's lessons about Mr Market (an imaginary investor) and how he is extremely emotional in the short-term made a lot of sense to Greenblatt. He then started following Graham's teachings on value investing, leading him to Graham's student, Warren Buffett.

The Magic Formula

His written work includes the famous tome The Little Book That Beats the Market, published in 2005, which set out his ‘magic formula’ for private investors.

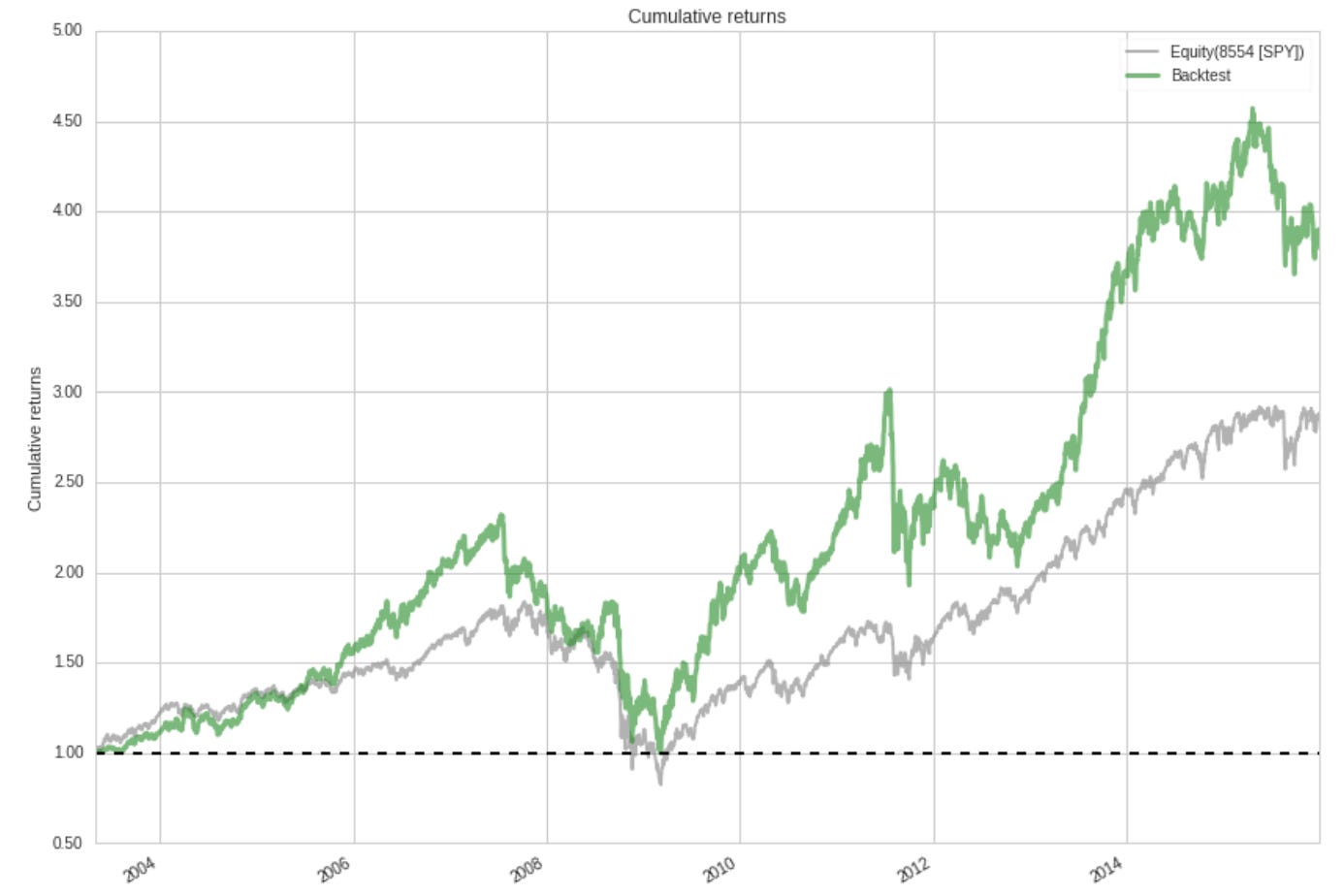

This book explains a systematic methodology that can be used to find and identify value stocks with growth potential. The Magic Formula, as explained by Joel Greenblatt in his book, involves ranking stocks based on two metrics: earnings yield (EBIT/enterprise value) and return on capital (EBIT/invested capital).

Greenblatt’s approach to investing can be called a combination of value and quality. It’s all about buying a high-quality company at an attractive price. Or, viewed from a different angle, buying a cheap company that isn’t a waste. As Greenblatt stated in a 2006 interview with Barrons, the Magic Formula is designed to help investors “buy good companies, on average, at cheap prices, on average.”

Gotham Asset Management

At the close of Q1 2023, Gotham Asset Management's portfolio value surpassed $4.125 billion, marking an increase from the previous quarter's $3.5 billion. The fund maintains a diverse investment strategy, with technology, services, healthcare, and finance sectors occupying significant positions within the portfolio. Noteworthy holdings of Greenblatt in Q1 include Alphabet, Microsoft, and Apple.

“Our process is to analyse financial statements from approximately the 3000 largest U.S. companies based on our assessment of value. We then buy the companies we believe are the cheapest and short the ones we believe are the most expensive. GONIX (Gotham Neutral Fund) generally holds more than 300 positions on each side.”

“We only use measures of value, so not momentum or other technical indicators. For example, we do extensive cash flow analysis, and we utilise measures of absolute relative value, including current and historical data. We ask ourselves, what do we believe is the fundamental valuation of each business, and how much is that worth?”

The secret to success?

Trying not to lose money was the primary objective of Greenblatt's fund. He stated, “We didn't take big positions in things where we thought we would make ten times your money or 20 times your money. Instead, we took big positions in things where we didn't think we would lose money.”

Further, he reiterated the importance of portfolio allocation. Quoting Charlie Munger, he said, “If you have the greatest position you've seen and you put two per cent of your money in it, and it quadruples or something, you didn't make a good investment but a stupid investment.”

I’m a believer, in fact I know you can because some of the worlds greatest fortunes have been made while the market actually was crashing. And good quality solid positions are far more valuable, as at the moment. I’m sure many are stupefied by the massive infusion of cash and looking at this crazy inverted Yield curve on the T-notes... It should not but there it is. Idk gov’t spending. It looks like a big bear. Like after ‘29 it took a decade to recover, now perhaps not as bad, and as long as we keep in the middle of the road under a 100mph, we’ll be ok. If the greenie weenie want to destroy the nation, well their on a beam. But with AI moving a decade ahead of itself... Breeches occurring at MGM and in places they should NOT occur. I’m going with layered security and those that spend the most on research. And provide the highest energy return. In my book that leaves only one company standing.