Flying Too Close to the Sun

A weekly look at what matters and how to trade it. (February 2nd)

Markets began the year priced for certainty and ended January reacquainted with doubt.

US equities finished January modestly higher, but the path there was anything but clean. Early-week risk appetite carried the S&P 500 through the symbolic 7,000 level, only for that enthusiasm to fade as two familiar forces reasserted control: the Federal Reserve and Big Tech earnings. By midweek, the rally had stalled as investors were forced to confront how much optimism was already priced in.

The Fed delivered a hold, steady language, and no urgency to restart cuts. Powell’s refusal to hint at near-term easing was enough to drain momentum from equities that had been leaning heavily on the idea of policy support.

Results from the Magnificent Seven were split. Meta bought time, convincing investors that ad-driven cash flows can still underwrite massive AI investment. Apple reminded markets that demand remains strong, even if margins are now the battleground. Microsoft, by contrast, became the release valve: record capex, slower Azure growth, and capacity constraints triggered the sharpest selloff since the early-DeepSeek shock. Tesla’s attempt to reframe itself as an AI-and-robotics platform landed flat, reinforcing the market’s growing impatience with capex promises untethered from near-term returns.

The week’s final turn came not from earnings, but from politics. President Trump’s selection of Kevin Warsh as the next Fed chair shifted expectations abruptly. Markets interpreted the move as hawkish, and the repricing rippled across assets. The dollar stabilised after a volatile stretch, front-end rate expectations firmed, and precious metals suffered their sharpest drawdown in years, dragging materials lower with them.

This wasn’t a breakdown, but it wasn’t a breakout either. January ended with equities still elevated, narratives still intact, but confidence more conditional. With policy uncertainty rising, AI returns under scrutiny, and liquidity no longer doing the heavy lifting, markets are being forced to earn the next leg higher, not assume it.

Let’s get into the guide to trades moving markets, where things stand and where they may be heading.

“Metal Speculators Flew Too Close to the Sun”

“Warsh, the Fed, and Inflation”

“FX Optionality Over Conviction”

“No Bids in Physical or Digital”

Metal Speculators Flew Too Close to the Sun

The timing of the precious metals shock felt almost too neat, arriving alongside the announcement of Kevin Warsh as President Donald Trump’s choice to lead the Federal Reserve. Warsh has long argued that market volatility is a feature of the system, not a bug.

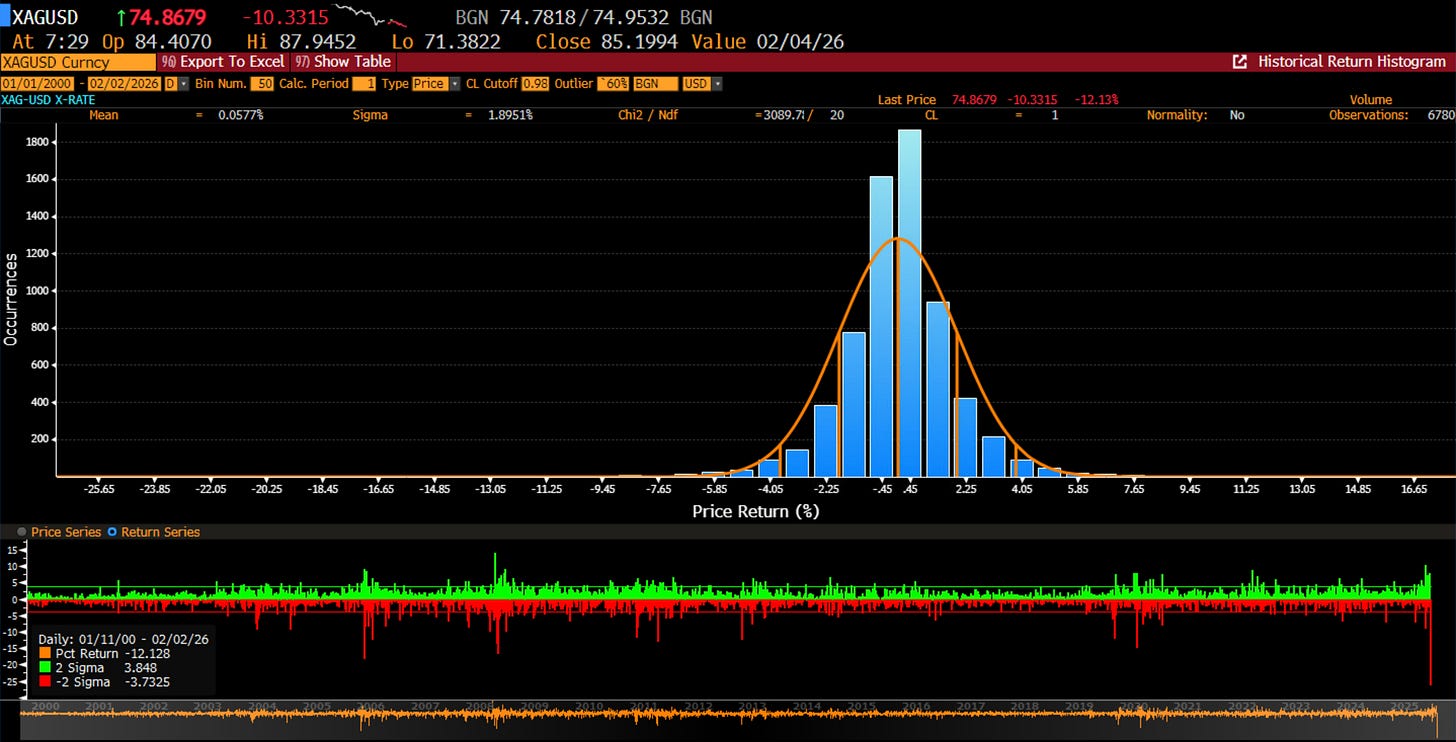

That view was put to the test as one of the most crowded and speculative trades of the past year unravelled. Gold and silver sold off sharply, with silver recording its largest intraday decline on record, falling as much as 36% at the lows.

The move had the familiar signature of a systematic capitulation. Precious metals had become a favoured expression across trend-following and momentum strategies, leaving positioning vulnerable to even a modest shock. Once prices began to gap lower, risk models took over. Exposure reductions were triggered mechanically, with little regard for fundamentals or longer-term conviction.

Deleveraging followed quickly. Futures were sold into thinning liquidity, accelerating the decline. As prices sliced through key moving averages and momentum thresholds, trend signals flipped from long to neutral and, for faster systems, outright short. Second-order effects compounded the pressure. Risk-parity and volatility-targeting funds cut exposure, options dealers hedged negative gamma, and margin calls pulled discretionary sellers into the move.

These episodes tend to be particularly destabilising for CTAs and vol-control frameworks. A one-day move of this magnitude forces rapid deleveraging as volatility spikes and cross-asset correlations reprice simultaneously. Tail-risk constraints are breached, emergency risk reduction kicks in, and selling pressure spreads well beyond the original market.

The end result was a violent unwind of what had become one of the more extreme speculative trades of the cycle, less a reassessment of value than a reminder of how quickly crowded positioning can turn disorderly when volatility reasserts itself.

While speculators are unwinding length in the West, the East remains the fundamental bid, the bid that started this rally. Whether the market stabilises from here will depend heavily on the response from Chinese buyers. Even as the Shanghai benchmark extended its decline after the open today, it continued to trade at a premium (bottom panel in the below chart) to international prices, suggesting domestic demand has yet to fully disengage.

Physical buying also picked up across major bullion hubs as retail demand resurfaced ahead of the Lunar New Year, with lower prices drawing buyers back into the market.

Near-term volatility is likely to continue encouraging traders to trim positions and reduce risk. But seasonality matters. In a peak buying period, price pullbacks tend to support physical demand in China, providing a potential offset to speculative unwinds elsewhere.

While volatility may be here to stay for the next few days, maybe weeks, any price balance will likely be seen as a buying opportunity over the medium term.