From $0 To $1T, Please Welcome Stephen Schwarzman

In our Sunday investor piece, we turn to asset management and run through the remarkable career and deals of the Blackstone co-founder.

Who is he?

Stephen Schwarzman, born on February 14, 1947, in Philadelphia, Pennsylvania, is a renowned American financier and philanthropist known for his deal-making and investing acumen.

Raised in a middle-class family, he setup his first business when he was 14, mowing lawns. Schwarzman's journey to success began with his education at Yale University, where he earned a bachelor's degree in economics. Later, he pursued an MBA from Harvard Business School, solidifying his academic foundation in finance.

After graduating in 1972, he spent several years in banking, including a stint at Lehman Brothers. He became MD at 31 and became Global Head of Mergers & Acquisitions.

In 1985, him and his boss decided to co-found their own private equity company, The Blackstone Group. The business did very well, going public in 2007 and growing assets under management since then.

As of Q2 2023, the company surpassed $1trn in AUM. Schwarzman’s net worth is estimated at $32.5bn.

The success of Blackstone

Even though Schwarzman setup the company firstly for M&A activity, the aim was always to build it out for other investment options over time.

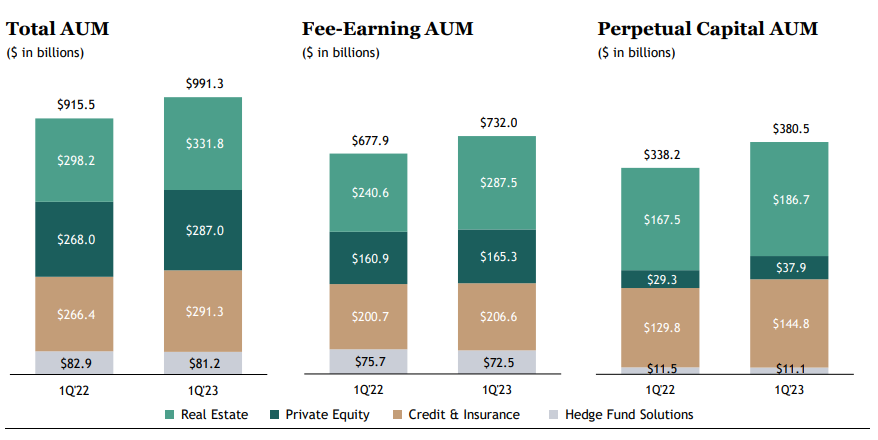

Below we show a breakdown of the main areas where the business invests, as of Q1 2023:

In terms of AUM split, real estate continues to be the largest area, with hedge fund solutions making up the smallest contributor to total assets.

A really powerful chart is the growth in AUM over time, which in a large part can be put down to the strong foundations that Schwarzman built up in the 1990’s.

Some of the best investments

Schwarzman reportedly holds a Monday morning meeting with all senior partners to discuss current and new deals and pipeline. In this way, he has a very active role and say in where the company should invest. Below are some of the best deals struck over the years:

The Hilton Hotels Deal (2007): In the same year as its IPO, Blackstone made an iconic deal by acquiring Hilton Hotels Corporation for approximately $26 billion. They purchased one of the world's largest hotel chains just before the financial crisis. Over the years, Blackstone has successfully managed and expanded Hilton's portfolio, making it a highly profitable venture.

The Equity Office Properties Trust Deal (2007): Blackstone made a strategic move in the real estate market by acquiring Equity Office Properties Trust for $39 billion. This deal, completed just before the financial crisis, allowed Blackstone to acquire a vast portfolio of office buildings across the United States. They subsequently sold off individual assets at significant profits.

The Refinitiv Deal (2018): Blackstone, along with co-investors, acquired a 55% stake in Refinitiv, a financial data and technology company, from Thomson Reuters for $17 billion. In 2020, Refinitiv merged with the London Stock Exchange Group (LSEG), creating a global financial data powerhouse. Blackstone's investment in Refinitiv has yielded substantial returns.

The Bumble IPO (2021): Although not a direct deal, Blackstone's venture capital arm, Blackstone Growth, invested in Bumble Inc., the parent company of the popular dating app Bumble. When Bumble went public in 2021, its valuation exceeded $13 billion, representing a significant return on Blackstone's investment.

These are just a few examples of Blackstone's successful deals. Many others could be included but are harder to pinpoint due to private valuations.

Schwarzman’s best quotes

On Risk and Opportunity: "The best opportunities often lie in areas that others have overlooked. Find those spots, the untouched markets, and make the most of them."

On Leadership and Decision-Making: "In business and in life, the most important decisions you make are the decisions about people. Never underestimate the power of great leadership."

On Adaptability: "In today's fast-paced world, the ability to adapt is essential. Don't be afraid to pivot, but do so with conviction and a clear plan."

On Persistence: "Success rarely comes overnight. It's the result of countless small actions, taken consistently over time."

On Risk Management: "Risk is an inherent part of investing. The key is to manage it intelligently, diversify your portfolio, and stay committed to your long-term goals."

On Innovation: "Innovation is the lifeblood of any successful business. Embrace change, encourage creativity, and be open to new ideas."

On the Value of Knowledge: "In the world of investing, knowledge is your most valuable asset. Never stop learning and seeking new information."

On Resilience: "Failure is not the end; it's a lesson on the path to success. Embrace setbacks as opportunities to learn and grow."

On Vision: "Having a clear vision for the future is essential for achieving your goals. Set ambitious targets and work tirelessly to bring them to life."