FX: Why a lot of traders were caught napping on EUR/USD last week

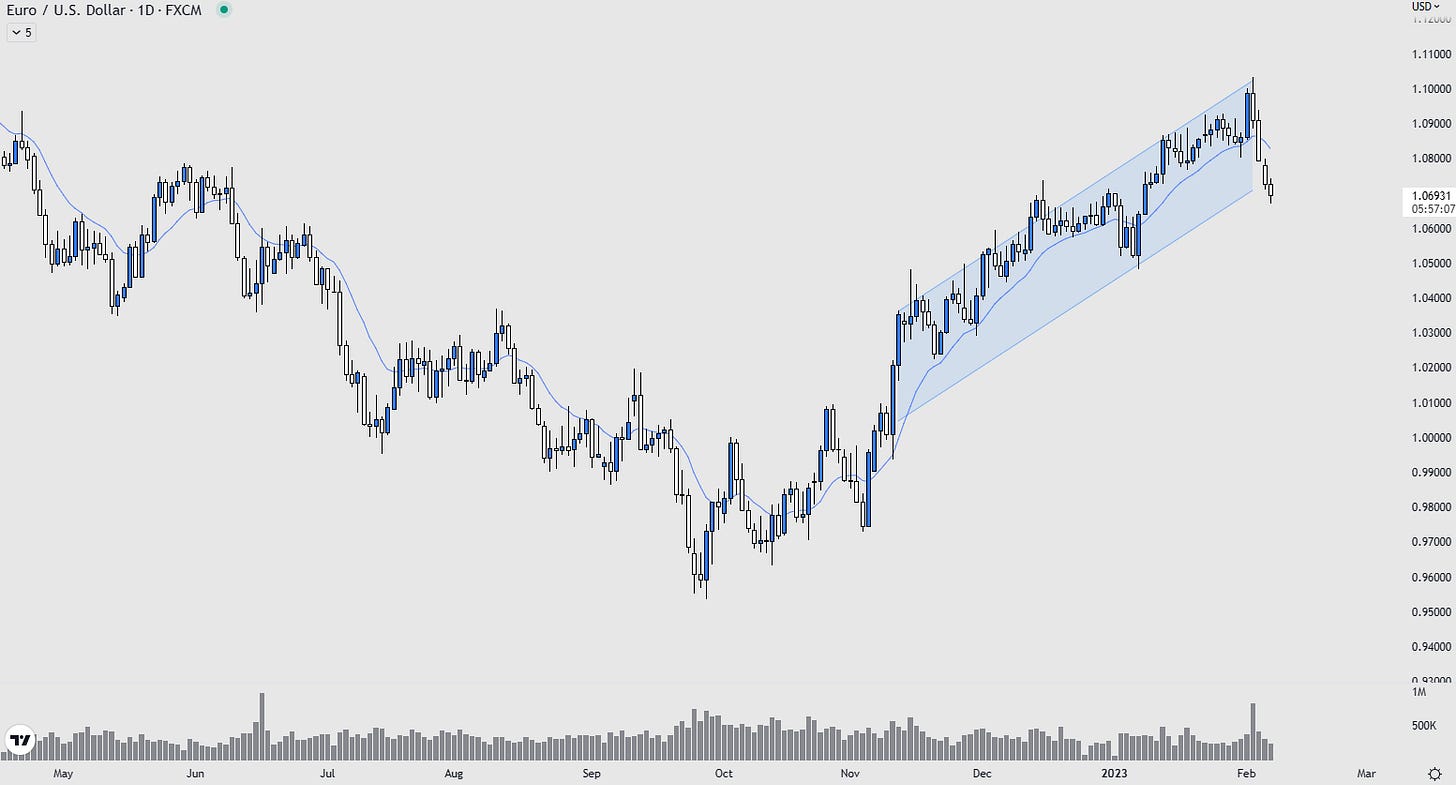

After rallying 12% since early November, a break above 1.10 last week seemed to indicate we were heading even higher for EUR/USD. Not correct.

Differentials between the US Fed and ECB saw a break of 1.1000 on Thursday

Bumper data releases saw investors flock back to the US Dollar on Friday

EUR/USD longs caught out badly, short-term correction lower could continue

A lot of traders were caught out last week. What makes this even more surprising is that the data calendar and events were all well prepared for. We knew that the Fed, ECB and BoE were meeting. We also knew that top tier data releases were also coming out. Yet in the markets (as in life), things never quite go to plan.

The past few months

Before we get into last week, it’s key to understand why things went badly wrong.

Many have been getting long EUR/USD since the back end of last year. This has accelerated into January, with the pair forming a steady uptrend on the charts.

This was driven by several fundamental reasons. Investors realised that the milder winter in Europe meant lower natural gas prices. This eased pressure on the Eurozone from the weaponizing of energy from Putin. Add this into the mix of better data prints and it led to some major investment banks forecasting that Europe would no longer have a recession this year.

As for the US Dollar, demand was fading. Some of this was profit taking last November, after the historic USD bull run. It was also softening as inflation kept falling, easing pressure on the US Fed to raise rates as aggressively as initially forecast.

Putting that all together, we entered last week expecting more of the same from the Fed, along with a more upbeat ECB. With technical levels suggesting that a break above 1.10 could open up large upside, traders watched closely.

So far so good

The Fed stuck to the script, with a 25bps hike. While the commitment to do whatever is needed to bring inflation back under control was still there, there were some hints at the potential for an upcoming pause. Admittedly, we didn’t think Powell was that dovish, and had previously outlined our case as to why we wouldn’t be shorting the USD just yet.

However, the market heard what it thought it wanted to, and carried EUR/USD higher to 1.1000 as we walked in on Thursday morning. From here, things started to go wrong.

Problems compounding

The market couldn't hold 1.10, and slid lower as Lagarde and Co. came to the stage in the early afternoon. Even with the 50bps hike and a clear commitment for more of the same in coming months, EUR/USD continued to slide.

There was good support in the 1.0910-1.0930 region, which we feel led to those that jumped long at 1.10 doubling down on their positions. Or for those that were stopped out, the short rebound probably led to adding fresh long trades on Friday morning.

Then came the real kick in the guts. US Non-Farm Payrolls came out Friday afternoon at a huge surprise. 517k jobs added versus consensus of 189k and a previous reading of 223k shook everyone.

This was the clearest USD buying signal you could get, with bond markets hurriedly pricing in a higher likelihood of Fed hikes (confirming our earlier call that the Fed weren’t that dovish on Wednesday).

EUR/USD cratered lower, trading below 1.0800 as London left for the weekend. For a lot of those that had built up long positions in EUR/USD in recent weeks, they really were caught napping at the wheel.

Direction from here

The market has certainly carried through on the trajectory from last week, and is now firmly out of the multi-month trend. We think this could see us trade down to support around the 1.0475 level.

What did we do about it

We publish our favourite trades for the week ahead each Monday. We did have an active Option trade on for EUR/USD last week, but this was a play on volatility, not direction. This was closed for a profit.

To access our future ideas, please subscribe.