FX: Why The Fed Have Missed The Boat And How We Can Profit From It

The February 25bps hike came ahead of bumper employment, inflation and retail sales data. If the Fed now need to play catch up (again!), FX can offer some trading ideas.

Markets are currently pricing two further 25bps hikes from the US Fed in March and May, taking the terminal rate to 5.25%

This may underestimate the firepower needed to simmer down inflation, leading to a market adjustment

In this case, we like to be long USD vs low-yielders and also take on some longer-dated Option exposure

Since the last US Fed meeting, we’ve had several data points out that suggests the US economy is still running hot. First up we had the bonkers Non-Farm Payroll print of 517k vs estimates of 185k on the first Friday of the month.

Then this week we had the January CPI inflation print. At 6.4%, it did come in lower than the previous month of 6.5%, but was above the expectation of 6.2%.

Finally, retail sales surged +3% in January, compared to +1.8% expected, a huge outlier in comparison to the past year.

Putting this together, it’s clear that the economy is still doing well. Yet a tight labour market and higher consumer spending is going to fuel demand pull inflation. So the US Fed might be forced to hike more aggressively than the current timeline suggests.

Why The Fed Are In A Pickle

Simply put, there’s no good way the market can take a pivot from the Fed at this stage. If they come out and indicate that larger hikes are needed going forward and that the job is really not done, it shows they don’t have a grip on inflation. It highlights that their own projections from six months ago were wrong.

Not only that, but it shows to the markets that the so-called ‘soft landing’ for the US economy is firmly in the rubbish bin. There’s no way that a step up in rate hikes from here (talking a 6%+ terminal rate) is going to lead the US anywhere but to a hard bump (i.e recession).

Traders aren’t stupid, and so if the Fed do make this move, it’s going to be swiftly reflected in asset prices. At a general level, this would see USD strength, rising US yields, lower equity markets and lower gold.

In fact, we think there’s a strong likelihood that we’ll start to see the market front-run expectations here. The DXY index has done very well in recent days and has broken out of the doldrums (shown below), which leads us to believe that some are already having the same thoughts as we are.

How to action the theory

Talking through the problems with the Fed might be FT Weekend content, but how can we actually make money from this?

At a basic level, we like buying USD and selling lower yielding currencies. If rate expectations shift in favour of the US, the yield differential will grow between the two currencies. This naturally should see the USD appreciate in value.

Being long USD/CHF therefore is a good place to start.

Another avenue is to buy USD and sell a currency that is close to finishing the rate hiking process. In this way, even if the base rate in the other country is relatively high, the yield differential can still grow.

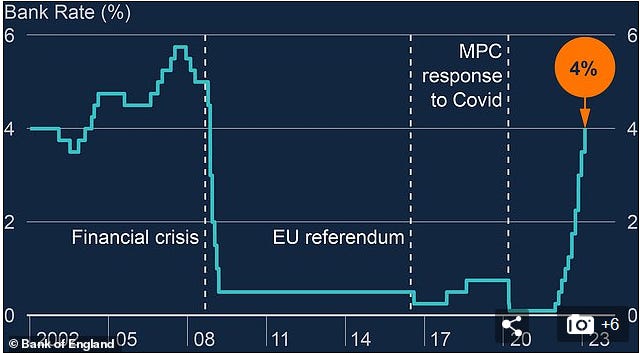

For example, being short GBP/USD. The Bank of England have signalled only one further rate move is coming. In fact, we think there’s a strong case for some rate cuts in the UK towards the end of this year, given the state of the economy.

The UK economy is a story for another day, yet the pair highlights the opportunity in taking advantage of a yield movement within the FX market.

Ideas in the Options space

Derivatives are a different ballgame, and the fully risks should be understood before entering into any Option contracts.

Given the timeframes involved, if the Fed are forced to move then it’ll likely be felt within the next three-to-six months. Sitting on an open spot trade for this long can be tedious, and open up the possibility of getting stopped out prematurely.

Options provide a cleaner way of expressing views, often with more attractive risk/reward levels.

For example, consider the below idea on GBP/USD.

Example Trade Idea

Sell a 6 month 1.2175 Call for 1.90%, Buy a 1.1700 Put for 1.92%

Zero Cost

Targeting A Move to ~1.1450

The Option strategy doesn’t cost anything to put on, has risk above 1.2175 and profit below 1.1700. Therefore, if we are wrong in our view and the market trades flat around the current spot of 1.1950, there’s no loss taken on.

We use American style options, meaning that these can be exited before expiry if needed. As a result, it provides a lot of flexibility to close if we see a move before the six month timeframe.